XLU trade ideas

How To Rotate SectorsJust compare each sector at the end of each quarter and rotate out weakening sectors and rotate in stronger sectors. Holding the top two or three through each quarter has beaten approx. 70% of the time (if memory serves me right). I can't currently site the numbers but many books have been written that demonstrate positive back-testing. This article explains how to do it using relative strength papers.ssrn.com

XLU uptrend struggles to gain strengthThis technical analysis was conducted using the Swing•Genie Cycles swing trading indicator on a 2-day chart. It typically takes between 1 and 10 days from the time the Swing•Genie Cycles indicator prints a dot on the chart for the trend to demonstrably change. A green dot is a bullish signal, a red dot is a bearish signal. Swing trades using this system typically last 2 to 6 weeks.

LEARN HOW TO USE SWING•GENIE

discord.gg

Join our Discord group of Swing•Genie users and learn a system that will improve your trading and increase your profits. Make friends, share information, get ideas, and learn from other growth oriented people. Let's get rich together!

WATCH OUR DAILY YOUTUBE VIDEOS

www.youtube.com

Our daily 2 minute video reveals the direction every major index is heading and the gains made since the last Swing•Genie Cycles indicator printed. Like, share, and subscribe!

SUPPORT US ON PATREON

www.patreon.com

Your tips help us make informative content.

GET SWING•GENIE

stockdotgenie.com

Swing•Genie provides novice traders the same abilities as experienced and professional traders - the first time they use it! These professional trading skills often take years for traders to develop. Swing•Genie quickly and accurately analyze stock charts even providing signals that anticipate where that stock will go next, with a very high level of confidence. I have no financial interest in Swing•Genie. I just think it's the best indicator on the planet.

OPENING (IRA): XLU JAN 17TH 52 SHORT PUT... for a .48 credit.

Notes: One of the underlyings on my IRA shopping list, pulling the trigger here on a "not a penny more"* short put at the 52 strike with a resulting cost basis of 51.52/share if assigned on the 52 shortie. The current yield is 3.06% with an annualized dividend of 1.85.

Will look to roll out "as is" at least quarterly for further cost basis reduction until assigned or that's no longer productive.

* -- See HYG "Not a Penny More" Short Put Post, Below.

Sell Safety StocksUtilities and Real Estate sectors (XLU XLRE) both are down big on an up day for the overall market which is a signal that portfolio managers are rotating out of "safe" stocks and into "risk" stocks. Utilities chart looks like it is about to break below the 50 day after hitting all time highs at the 1.618 fib extension. What I like about shorting Utilities is that they sell off big for a few days in a row when they break down.

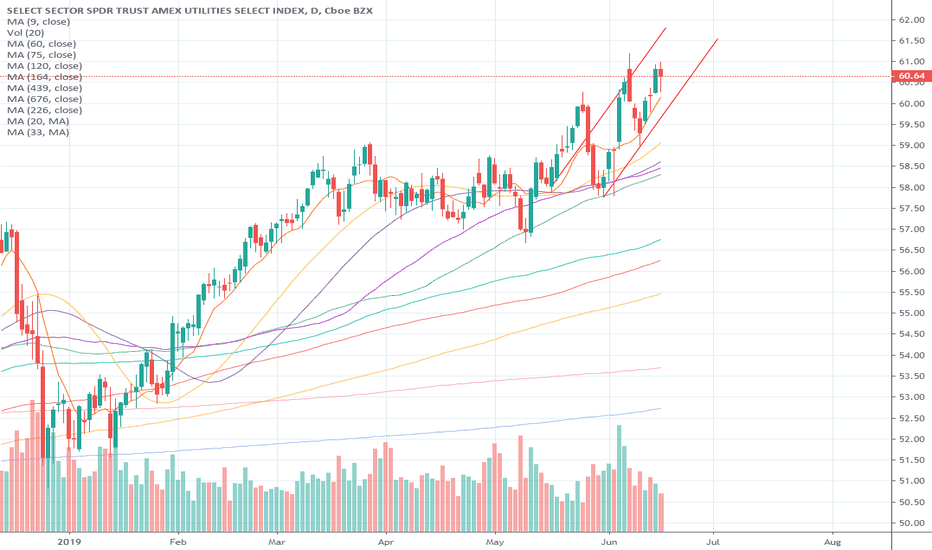

XLU - DAILY CHARTHi, today we are going to talk about XLU

We observe a D1, some important points. The details are highlighted above.

Thank you for reading and leave your comments if you like.

Join the Traders Heaven today, for more exclusive contents!

Link bellow!

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should use it as financial advice

XLU Buyers hopping in again?The defensive utilities sector has been on a strong uptrend since 2018 as markets trembled with uncertainty and bulls threatened to buck. After some profit-taking at 65 dollars, there is reason to believe that there may be another leg up as buyers seem to be returning with bullish price actions observed last trading session.

Interest Rate Sensitive UtilitiesThe amount of money pouring into utilities is no joke. In a world of slow growth, low interest rates, and trade uncertainty... utilities are a no-brainer with stable earnings and dividends. But like anything that can seem like a no-brainer, over-crowed pilling occurs and price extension of the underlying can cause unrealistic valuation to long term perspectives. If you believe interest rates could rebound from historical lows than rotational selling of utility stocks could occur as portfolio managers reduce their exposure and lock in profits.

XLU has good option liquidity and I recommend call credit spreads and debit put spreads into Oct/Nov.

US SECTOR SERIES FINALE 11/11: UTILITIES(XLU)+ESSENTIAL TA NOTESSERIES FINALE ; Episode 11/11 : US (SPX) Sectors Technical Analysis Series - 31st of July 2019 (4 Minute Read)

Since this is the Series Finale I will try to holistically summarize the whole series of 11 Episodes on all the US sectors.

The essential notes from this chart are the following(also included in the comments) :

1 . Compared to the previous expansion of 2002-2007 ; the current expansion of US Utilities has yielded a much slower growth . This can be seen from the chart as the current bullish channel is at the bottom range of the pitchfork. Despite this fact, the volume has kept growing continuously from which statement several indications can be derived. To keep it simple and as obviously as it can be, a good portion of the volume growth can be attributed to the funds flow from asset classes that are based on inflation( pension funds, real estate, fixed income securities etc etc ) into equities characterised as defensive as part of XLU, XLP, XLV .

2 . From the cycle lines it can be seen that we narrowly escaped a recession in 2015-2016 . However, I do not think that this will be the case come by the next drop in the cycle circa-2021. Fundamentally, due to the low global growth that dominated the 2015-2016 correction particularly in the emerging markets-in effect due to President Trump the cycle extended . Despite my disagreement with his absurd trade and tax policies , I have to give credit where credit is due. Now at the same time, I do not think that a cycle extension is necessarily good; in a way it means that the fundamental & structural issues that develop in the economy during an expansion continue to build up even more. The higher it tops= the lower it will bottom (% wise).

3 . Elections 2020 , US/China trade deal and Brexit will dominate the negative momentum in the upcoming months and years. Global growth has slowed down quite a bit and it's way overdue for a recession. In fact, past June 2019, we have been in the longest expansion on record, lasting more than 10 years(122 months now).

Regarding the key takeaways from the XLU chart are all labelled above: structural supports, channel supports and bullish targets . I do not see a need to continually repeat myself . Make sure to check out the comments for detailed indicator analysis.

This episode concludes the show . Hope you enjoyed it- I certainly did.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research. For any use of this show for references to any corporations or individuals that get inspired from my ideas, I'd appreciate it I am being given credit for my efforts .

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Step_Ahead_oftheMarket-

Make sure to check all the previous episodes on the US Sectors for more holistic understanding :

EPISODE 10 : US COMMUNICATIONS ( XLC )

EPISODE 9 : US REAL ESTATE ( XLRE )

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me through any of my channels.

XLU stock price forecast timing analysisStock investing strategies

Read more: www.pretiming.com

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

S&D strength Trend Analysis: In the midst of an upward trend of strong upward momentum stock price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.1% (HIGH) ~ -0.1% (LOW), 0.7% (CLOSE)

%AVG in case of rising: 0.8% (HIGH) ~ -0.4% (LOW), 0.6% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -0.8% (LOW), -0.4% (CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

LONG Idea - XLU Bouncing Off The Lower Trend LineUtilities are a good place to be with the current global slow down and a trade war here and there. Going long XLU should provide you with a good risk reward opportunity. XLU already bounced off the trend line turning up. A stop right under the trend line will limit your losses. Here is the daily chart and how it looks on a bigger time frame. Disclosure: this is no investment advice.