Buy Idea: CPU.ASX – Earnings Momentum PlayEarnings Date: 📅 19 August 2025

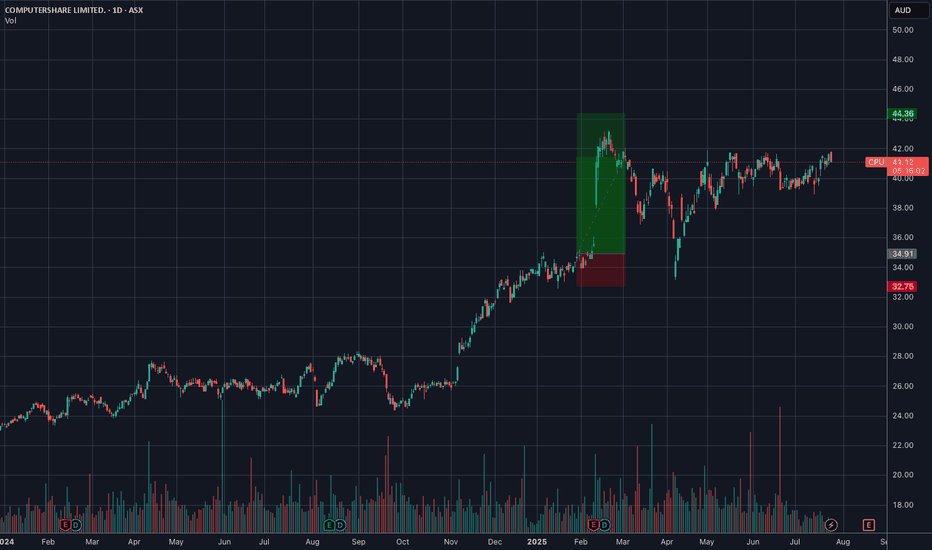

📊 Technical Setup

• CPU is forming a tight volatility contraction pattern (VCP) near highs, coiling above the 21EMA and 50MA.

• Strong bounce off support with increasing volume and bullish momentum crossover.

• Setup has clear risk-defined structure and is supported by a solid base breakout.

• MACD turning up, and trend indicators flashing early long signals.

💡 Why This Trade

• Pre-earnings positioning: CPU tends to trend strongly into earnings — historically sees strength 2–4 weeks out.

• Volume confirming the move: Last few candles show institutional footprints with demand near $40.

• Fundamental kicker: As a financial services platform, CPU benefits from a rising rate environment and high transaction volumes globally.

📈 Trade Plan

• Target 1 (1R): $44.16 – consider trimming 1/3

• Target 2 (2R): $46.81

• Trail remaining if breakout extends into earnings

📌 Risk Note: Trim or reduce if it loses $40.00 on high volume. Will reassess before earnings.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

CPU trade ideas

BUY IDEA: CPU.ASX – VCP Breakout in Motion

💰 Entry: $41 - 42

🛑 Stop: $39.50

🎯 Target: $44.80+ (1.5–2R potential)

⸻

🧠 Setup Thesis

CPU.ASX is breaking out of a textbook Volatility Contraction Pattern (VCP) with clean tightening just above the 21EMA and 50MA. After weeks of base-building with declining volume, today’s breakout comes with:

✅ Strong closing candle

✅ Volume expansion

✅ All key MAs supporting the move

This breakout follows a multi-month uptrend, and the current risk:reward is ideal with defined structure.

⸻

🔍 Trade Management

• Trim 1/3 at +1R (~$43.40)

• Trail remainder above breakeven

• Invalidation: Close below $39.50

⸻

🔎 Why This Matters

• Breakouts with strong volume post-VCP are among the highest probability setups

• CPU has strong institutional backing and is benefiting from a broader rally in quality tech & services on the ASX

• Low VIX and bullish sentiment post-CPI create a supportive macro backdrop

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

Trade Idea: ASX:CPU – Long Setup

✅ Technical Setup

• Entry: $40.60

• Stop: $37.80

• Target Zone: $44.80 – $47.00

• R:R Ratio: ~2:1 to 3:1

📊 Chart Notes:

• Price has broken out above 50-day MA, signaling momentum shift

• Formed a solid base between $38–$40 — now showing early signs of trend continuation

• Volume picking up on up-days = accumulation

📉 Key Levels

• Support: $38.00 (base of consolidation)

• Resistance: $44.80, then $47.00 (Nov–Jan highs)

🔍 Fundamental Backing

• Strong balance sheet with stable earnings growth

• Interest-rate sensitive model benefits from elevated global rates

• Global registry and mortgage processing exposure = defensive + cashflow-positive

📌 Summary

CPU shaping up for a post-consolidation breakout backed by both technicals and fundamentals.

Solid R:R with support at recent range lows. Risk managed at $37.80.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

buying idea CPUCPU has consolidate at top for some time now and looking to make a move! with a stop around 6.5% (32.74) it's a good entry point to see how it will react in coming weeks to earnings.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

(XNJ): INDUSTRIALS SECTOR (ASX): CPU - COMPUTERSHARE LIMITED || (XNJ): INDUSTRIALS SECTOR

(XNJ): INDUSTRIALS SECTOR

(ASX): CPU - COMPUTERSHARE LIMITED || March 10, 2024

Master of Elliott Wave Analysis: Shane Hua (CEWA-M).

Bottom line: CPU may continue to rise higher.

(Left chart): The broader context (1D chart) shows that wave 2-red appears to have ended at 22.87, and wave 3-red is unfolding towards higher targets. I've counted waves ((i)), ((ii))-green, and wave (i)-purple, with wave (i) having peaked. Now is the time for wave (ii) to dip lower before wave (iii) resumes aiming for higher targets, while price consistently holds above the low at 24.28. A dip below this level calls for serious consideration of alternate wave counts (ALT).

The alternate wave count (ALT) suggests that wave 2-red may extend beyond expectations, and the entire 3-wave advance from the low at 22.87 is just part of its overall process. It's likely a Flat Correction at a higher degree, and its decline would seek support around 22.87 before wave 3-red truly resumes.

(Right chart): The short-term outlook (4H chart) provides more detail on what I've mentioned. Wave (ii)-purple is currently underway, retracing lower, with potential support found in the 0.618 - 0.786 range. If this forecast holds true, it implies that wave (iii)-purple will rise with the setup of the "third of the third of the third," indicating strong upward momentum. It's suggested that price must maintain above the low at 24.28, and a rally above the high at 26.15 would reinforce this bullish outlook.

Master of Elliott Wave Analysis: Shane Hua (CEWA-M).

Bottom line: CPU may continue to rise higher.

(Left chart): The broader context (1D chart) shows that wave 2-red appears to have ended at 22.87, and wave 3-red is unfolding towards higher targets. I've counted waves ((i)), ((ii))-green, and wave (i)-purple, with wave (i) having peaked. Now is the time for wave (ii) to dip lower before wave (iii) resumes aiming for higher targets, while price consistently holds above the low at 24.28. A dip below this level calls for serious consideration of alternate wave counts (ALT).

The alternate wave count (ALT) suggests that wave 2-red may extend beyond expectations, and the entire 3-wave advance from the low at 22.87 is just part of its overall process. It's likely a Flat Correction at a higher degree, and its decline would seek support around 22.87 before wave 3-red truly resumes.

(Right chart): The short-term outlook (4H chart) provides more detail on what I've mentioned. Wave (ii)-purple is currently underway, retracing lower, with potential support found in the 0.618 - 0.786 range. If this forecast holds true, it implies that wave (iii)-purple will rise with the setup of the "third of the third of the third," indicating strong upward momentum. It's suggested that price must maintain above the low at 24.28, and a rally above the high at 26.15 would reinforce this bullish outlook.