Finer Market Points: ASX Top 10 Momentum Stocks: 11 Jul 2024ASX:I88 ASX:AL3 NYSE:WTM ASX:FBR ASX:ACW AMEX:TTT NYSE:ENR CBOE:RXM ASX:DRO NYSE:BIO

Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appeari

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.005 AUD

−27.77 M AUD

836.71 K AUD

4.22 B

About FBR LTD

Sector

Industry

CEO

Mark Pivac

Website

Headquarters

High Wycombe

Founded

1982

ISIN

AU000000FBR4

FIGI

BBG000BD1159

FBR Ltd. operates as a robotic building technology development company. It develops technology to build an automated robotic machine to complete the brickwork of a full home structure. The company was founded in 1982 and is headquartered in High Wycombe, Australia.

Related stocks

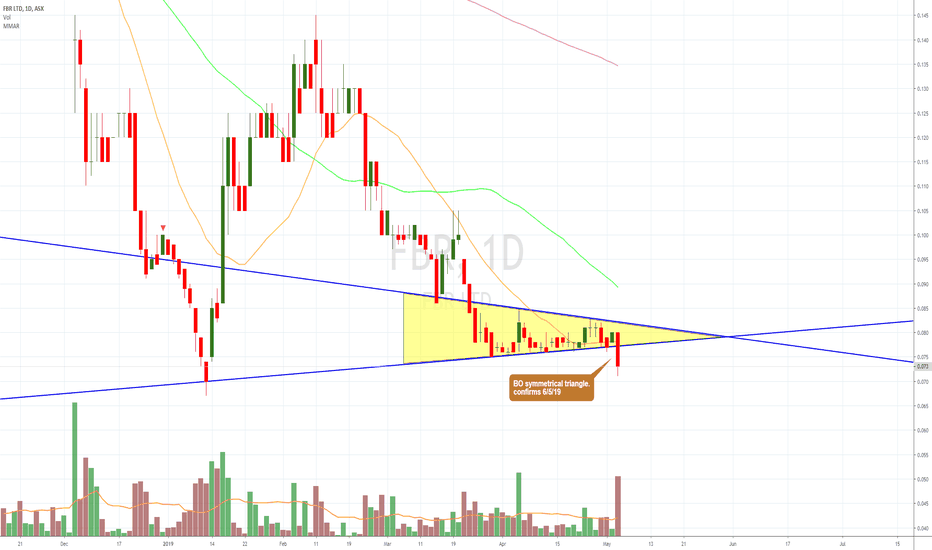

$FBR.AX is setting up nicely - Higher prices coming #ASX $FBR$FBR.AX is setting up nicely - Higher prices coming #ASX $FBR

FBR Ltd (FBR, formerly Fastbrick Robotics Ltd) designs, develops and builds stabilised robots to address global needs. These robots are designed to work outdoors using the FBR's Dynamic Stabilisation Technology. FBR is commercialising pr

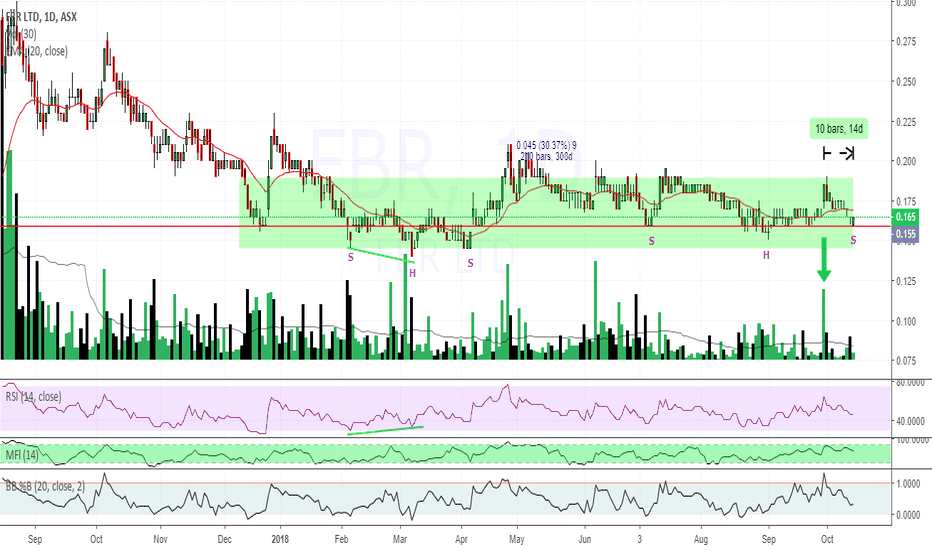

SHORT ON FBR (4hr)- Historically FBR trends have respected all Descending Triangle Formations

- The blue shaded area represents the Orange Descending triangle size, which projects the fall size

- There appears to be strong support at 2 cents, this could take a crack before pushing though

- There's a gap at around 1.8

FBR overall Short Bias but Potential Bullish H&S formimgThis is my first chart ever so definitely not advice

Overall I have a short bias due on this stock at the moment with a continuation of the downtrend. On the contrary: It is historically cheap, so the H&S could be a contending reversal at this point...

Should be watched closely for confirmation t

Last chance for FBR?FBR stock prices have taken a huge hit following the news that construction giant Caterpillar Inc. and FBR were terminating the memorandum of understanding between the two companies. Prices are down 74% since all time highs last year and down by 65% in just the last two months. It is unsure exactly

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of FBR is 0.006 AUD — it has increased by 20.00% in the past 24 hours. Watch FBR LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on ASX exchange FBR LTD stocks are traded under the ticker FBR.

FBR stock hasn't changed in a week, the last month showed zero change in price, over the last year FBR LTD has showed a −83.33% decrease.

FBR stock is 20.00% volatile and has beta coefficient of 3.10. Track FBR LTD stock price on the chart and check out the list of the most volatile stocks — is FBR LTD there?

Yes, you can track FBR LTD financials in yearly and quarterly reports right on TradingView.

FBR LTD is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

FBR net income for the last half-year is −16.87 M AUD, while the previous report showed −7.99 M AUD of net income which accounts for −111.07% change. Track more FBR LTD financial stats to get the full picture.

No, FBR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FBR LTD EBITDA is −26.85 M AUD, and current EBITDA margin is −3.06 K%. See more stats in FBR LTD financial statements.

Like other stocks, FBR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FBR LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FBR LTD technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FBR LTD stock shows the sell signal. See more of FBR LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.