LYC - Trade PlanLYC has been making higher highs but on the weekly chart we can see Bearish Divergence on the MACD and RSI, which is a sign that the momentum may be running out of steam. I expect a decent pull back for a possible buying opportunity. My Buy Zone is between $5.15 - $5.75, where I would be entering after some sort of Bullish price action confirmation. Lets see how it develops.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

LYC trade ideas

LYC @ 10 SEP 2021LYC

- Previous analysis was done on 31 Aug - Suggested waiting for successful rebound to 7.50 levels

- Stock recently formed a mini retracement wave and today’s price action would be considered a successful rebound

- Technically, the stock hasn’t successfully rebounded after the mid-Aug retracement

- To manage risk, half position entries are recommended

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest half position entry at current levels if confident that stock can rebound to 7.50 levels

LYC Lynas Rare Earth lynasrareearths.com

Lynas is the only producer of scale of separated Rare Earths outside of China and the second largest in the world. Rare Earths deposit in Mt Weld, Western Australia, is acknowledged as one of the highest grade Rare Earths mine in the world and we operate the world’s largest single Rare Earths processing plant in Malaysia.

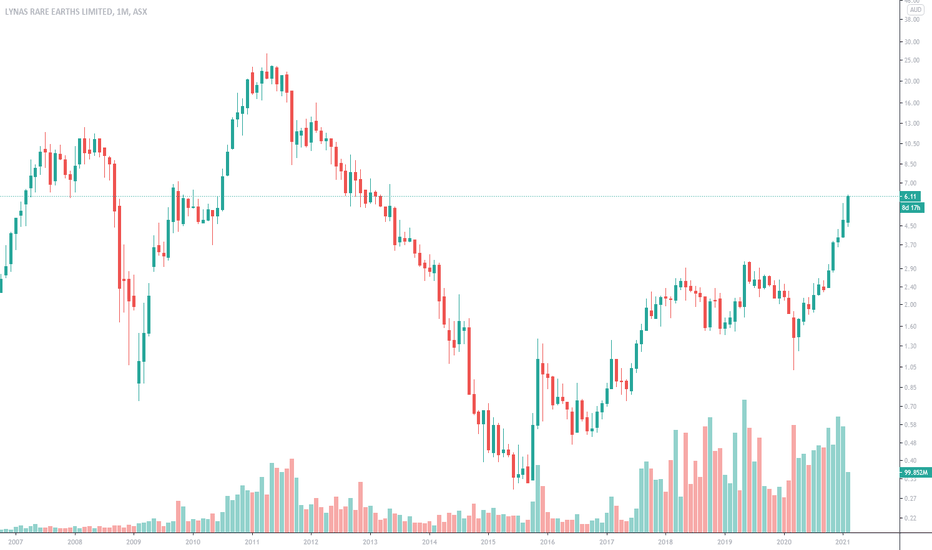

700% growth since Mac 2020

LYC @ 31 Aug 2021LYC

- First time doing a written analysis on LYC

- Has some history of good uptrends that lasts for months

- Also has history of downtrends that lasts for years -> represents overhead resistances for the stock

- Stock price may not go up as fast as other stocks without these overhead resistances

- Stock is currently trading between the short- and mid-term averages -> any break of support or resistance would require above average volume

- A rebound to around 7.50 levels would be considered a successful rebound

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful rebound to 7.50 levels

It’s a short from hereWXY correction. In x C wave truncated. Currently In a triangle pattern as a B wave, where in a ABCD E wave has penetrated above the triangle. But pattern is bearish. Because market takes the direction of B Wave. Objective trade with stop. Low volume suggests validity of the triangle pattern

LYNAS RARE EARTH (ASX:LYC) Technical vs Fundamental analysis??LYNAS is a company that has recently come under my radar for a potential trade and upon investigation is becoming a perfect candidate for both Fundamental and Technical traders. For both styles of trading it shows very polarising stories. From a Fundamental perspective there is a long term bullish potential however from a Technical standpoint a short bearish turn seems evident. In the following paper i will outline factors for both trading styles and what potential outcome can occur.

From a Technical Standpoint:

Bearish Technical Analysis:

---> RSI overbought and has a knack to correct once hits an overvalued RSI

--> Bollinger bands above 2 standard deviations away from mean which provides a bearish signal

--. ATR is approaching all time highs which have not been met since major reversals

--> Bearish Candlestick pattern (Dark Cloud Cover) developed on the 18/2/2021 and is an effective pattern when conjoined with other indicators

Bullish Technical Analysis:

--> MACD is still bullish but is also a well known lagging indicator and therefore can be misleading

--> Increased buy volume can show a positive outlook on LYC's future due to news about increased demand

From a Fundamental Standpoint:

Bullish Fundamental analysis:

--> Minor competitors for market share: Apart from China LYC is the only producer of rare earth resources

--> Growing tensions with China can bring increased demand to LYC

--> American military suppliers such as Lockheed have been showing increased interest for LYC.

--> American US defense invested 30mil for LYC to build a facility within Texas. This is evidence for the deep interest for the business.

Bearish Fundamental Analysis:

--> Unknown whether LYC can handle an overwhelming amount of demand. Are they prepared for a potential influx of interest?

Overall I have come to a simple conclusion. From a short term perspective it LYC is bearish and is due to a minor downturn (2-10%) however within the long run it is evident that if LYC plays its cards right is has a bright future ahead of it. I am leaving my investment strategy as neutral as I would expect a turn either way however I am intrigued to see whether Fundamentals beat Technical analysis.

Any thoughts on this will be greatly appreciated :)

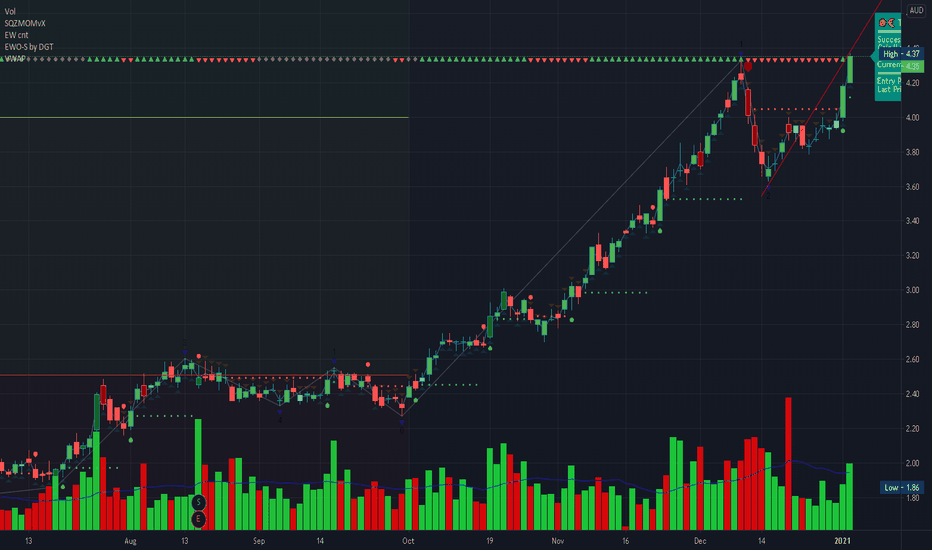

Analysis : LYC Long short - following Vol Flow and CoppockAn a analysis of LYC.AX

Was long on the long climb up.

Amusing how an article saying how positive LYC is , came out just 16 hrs before the peak price occurred and is about to fall. At least that is my expectation now

Absolute Peak was $6.18 , I got out at $6.15 , good enough

LYC is seen now peaked - using Volume Flow and custom Coppock - changes are all public - help your self to code changes

The special source is in the interpretation - not the code (double entendre, so will you risqué the trade ? )

Careful with the time scale you analyse the indicators in. Different time scale give different results

Short position now taken, close to the peak, could have been closer to teh peak, but only thought to short a little while later

Offered for educational value only.

ASX:$LYC - watch out this stockThe world's largest producer of rare eart

high quality products include

Neodymium and Praseodymium (NdPr) used in magnets

Lanthanum (La)

Cerium (Ce) and

Mixed Heavy Rare Earths (SEG).

About Lynas Rare Earths Ltd outside China.

Rare Earth Oxides (REOs) are a much sought after resource, particularly within the high technology and low carbon industries. For example, REOs have played an important role in helping reduce energy consumption in many of today's electronic audiovisual, photographic, and music devices.

Also, used in everything from iPhones to weapons,

LYC:ASX - LYNAS CORPORATION - Rare Earther back at highsLynas is back at old time highs after a strong bollinger break with growing volume. I like that they announced earlier in the year that they have a contract signed with the US Department of Defense for Phase 1 work on the proposed U.S. based HRE facility. Might be a bit overbought now looking at the RSI, but rare earths does seem to have some interest at the moment so could be worth a watch.

Previous highs:

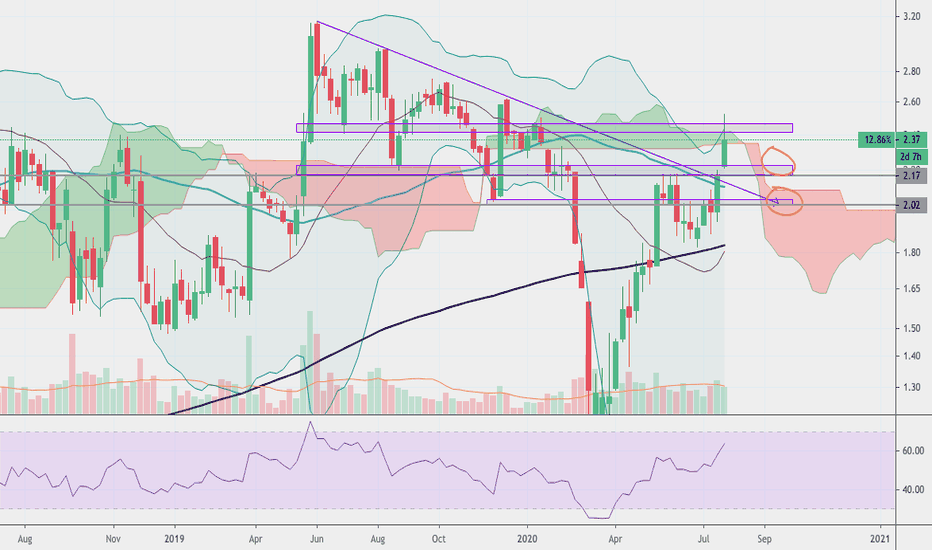

LYC Bullish move above 2020 highLYC broke it's bull flag patter at end of July and is now set to break it's 2020 high and then the chase is on for the 52 week high ($2.95) with the 1st profit target being the Fibonacci level of 0.786 which is a $2.73 share price. Recent supporting bullish activity on the chart is the golden 50 and 200 moving average cross occurring. Add to this that rare earths sector which LYC operate in is currently in flavour as well. My opinion is bullish on this with a 1st proft target of $2.73 before some consolidation and a run towards the 52 week. This is only my opinion and you should always do your own research before investing.

LYC has broken downward trendLYC has broken a long term downward trend, great news! However, it seems to have trouble with the above horizontal resistance.

So now it's important to wait for a retest and LYC finding support.

This could be around AUD 2.17 where a gap was left recently and we have horizontal support.

Or it could be around AUD 2.00-2.04, which will be a retest of the trendline and roughly where the 50MA (on the weekly) will be by then. And not to mention there is a gap there too at AUD 2.02.

Once we get to either support, we need to monitor behaviour for clear signs of finding support. Then I'll be looking for a buying opportunity.

All eyes on this chartIn the business of rare earths extraction, processing & development in Australia & Malaysia (risk). As things heat up with China (who controls rare earths globally) this bears watching. The price is close to the long term trend line. Support & resistance zones in red dotted lines

LYC: ASX - Critical support and resistanceLYC share prices surged in yesterday's session after it gapped up during the opening trades and closed at 2.38 up 9.72%. There were signs of profit-taking towards the end of the trading session which saw share prices retreated from its highs at 2.45 and closed at 2.38.

2.30 is the critical support to watch; share prices could head down to close the price gap if it fails to hold above this price point. A break above 2.43 could see share prices continue to its next target at around 2.53

LYC - LYNAS CORPORATION shares up 2.20%LYC - LYNAS CORPORATION shares closed at 2.32 up 2.20% in today's trading session. Share prices bounced back during the opening session at a critical Fib retracement level at 2.20 and rose to 2.38, the highest price point of the day before coming down and closing at 2.31. Share prices could progress to the upside if it holds above 2.30 support.