S32 Long Prediction 2.10 - 2.11 is key area of support.

Already been retested.

Confirmed at the .382 Fibbonaci retracement level

Over the hourly and 4 hourly time frames the 20, 50, 100, 200 ma level acting as a support.

On the daily looks as tho the 20 MA might retest the 200 level.

These are very strong indicators of a strong upward trend occuring.

I believe the price will test the 2.15 at .5 fibbonaci retracement level consolidate and push up towards 2.19 at .618 retracement level.

If the break out past the .618 level is confirmed the 2.35 area looks like an easy target.

These are just some of my thoughts please feel free to comment any idea's.

S32 trade ideas

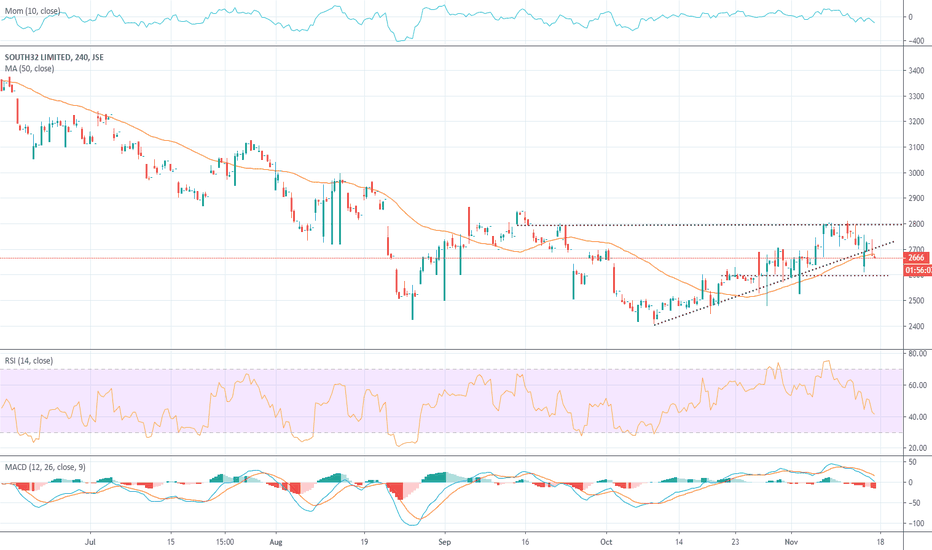

S32: ASX - Share prices break out above 2.80 barrierSouth32 share prices have cleared 2.80 price point barrier following a rebound from the bottom of the price channel in the four-hour price chart. Share prices gained more than 2.5% in today's trading session and could continue to its next challenge at 3.05 price target if it remains above 2.80. Support remains at 2.70, 2.65, 2.55, and 2.50

S32 - Critical Weekly H&SLooking at South 32, we may derive the following from the weekly chart:

1. A noticeable h&s pattern had been formed over the past 2 years.

2. Price is on the neckline support.

3. A push down should trigger the technical pattern.

4. It's pretty dangerous to trade it now, wait for confirmation.

5. As always - maintain your risk management.

Let's see what happens.

Note: The views provided herein do not constitute financial advice.

Long Top5 oversold/overbought according to RSI & South32End of week 26Apr19. Another great week for #Coronation & #Naspers. FTSE/JSE All Share Top5 oversold/overbought according to 14day RSI indicator as follow:

Oversold:

Rebosis Property 30

South32 32

ArcelorMittal 33

Intu Properties 36

Hosken Consolidated Investments 36

Overbought:

Coronation 81

Blue Label Telecoms 78

Santam 73

Transaction Capital 72

Super Group 72

Spending some time on South32 . This is not a share I’m currently personally holding & still fundamentally prefer other Mining Houses in this sector. The share is however making a very interesting formation and as mentioned, is highly oversold according to its 14-day RSI. The 2-year strong momentum still seem to be intact, while Thomson Reuters consensus (according to all analyst forecasts) have a R38.94 (14.5% upside) target price on S32.

For short-term traders who are considering a long position in South32, could possibly watch R32.25 as a possible entry point. I would set my stop-loss to last year Novembers levels of R30.40.

On the upside, resistance could be found at the 200-day (R36.25) and then the 50-day (R37.60) moving averages, with the top of the Pennant pattern (at R38.50) being a strong resistance point. Last mentioned will also be my ultimate target price.

JSE:S32 South32 Looking WeakA little like Kumba S32 is looking week in a strong sector. The relative strength to the resources sector is rolling over. I previously looked at the structure as accumulation but this seems to have been an upthrust (UT) that met with supply (Increased volume on UT). The volatility to the downside has increased from 19 to 28 to 34%. The upward stride has been broken and is being retested. This looks weak and probably is distribution. The recent rally was without any conviction, even though it was over the holiday period.

Watching S32 with a short bias Watching this stock today with a short bias, due to its gap up with a bearish shooting star on the 13 ema. the key level is $4 it cant break through, its try 4 times already, might slip to $3.68 then bounce off of the 50 ema. or the alternative it could be a up trend pull back, but the last candle is not helping its case.

S32.ASX attempts to breakout to the upside at 3.45S32.ASX continued its run to the upside with a price gap in today's trades 14/1/2019. S32 share prices have breached 3.45 resistance in the first hour of today's trades and need to maintain its trading activities above 3.45 to continue to its next target at 3.50.

S32 share prices could pull back to around 3.38 support if it fails at 3.45

Waiting for confirmation of the break.South32 is a globally diversified metals and mining company. They mine and produce bauxite, alumina, aluminium, energy and metallurgical coal, manganese, nickel, silver, lead and zinc in Australia, Southern Africa and South America. In May 2015, South32 successfully demerged from BHP Billiton and listed on the Australian Securities Exchange, the Johannesburg Stock Exchange (JSE) and the London Stock Exchange.

Weekly: There has been a break of the support trendline but price pulled back above it. I will be looking at smaller time frames to confirm whether the break to the downside will be confirmed.

H4: A breakout on this structure would indicate the start of more downside with targets around the 2400 mark. There is the possibility of another leg up but at this point in time I am expecting to see confirmation of the downside.