Weekly $SPY / $SPX Scenarios for March 31 – April 4, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Anticipated U.S. Jobs Report: The March employment data, set for release on Friday, April 4, is expected to show a slowdown in job growth, with forecasts predicting an increase of 140,000 nonfarm payrolls, down from 151,000 in February. The unemployment rate is projected to remain steady at 4.1%. This report will be closely monitored for signs of economic momentum and potential impacts on Federal Reserve policy.

🇺🇸💼 President Trump's Tariff Announcement: President Donald Trump is scheduled to unveil his "reciprocal tariffs" plan on Wednesday, April 2, dubbed "Liberation Day." The announcement is anticipated to include a 25% duty on imported vehicles, which could significantly impact the automotive industry and broader market sentiment. Investors are bracing for potential volatility in response to these trade policy developments.

🇺🇸📊 Manufacturing and Services Sector Updates: Key indicators for the manufacturing and services sectors are due this week. The ISM Manufacturing PMI, scheduled for Tuesday, April 1, is expected to show a slight contraction with a forecast of 49.5%, down from 50.3% in February. The ISM Services PMI, set for release on Thursday, April 3, is projected at 53.0%, indicating continued expansion but at a slower pace. These reports will provide insights into the health of these critical sectors.

MarketWatch

📊 Key Data Releases 📊

📅 Monday, March 31:

🏭 Chicago Business Barometer (PMI) (9:45 AM ET):

Forecast: 45.5

Previous: 43.6

Measures business conditions in the Chicago area, with readings below 50 indicating contraction.

📅 Tuesday, April 1:

🏗️ Construction Spending (10:00 AM ET):

Forecast: 0.3%

Previous: -0.2%

Indicates the total amount spent on construction projects, reflecting trends in the construction industry.

📄 Job Openings (10:00 AM ET):

Forecast: 7.7 million

Previous: 7.7 million

Provides insight into labor demand by measuring the number of job vacancies.

📅 Wednesday, April 2:

🏭 Factory Orders (10:00 AM ET):

Forecast: 0.6%

Previous: 1.7%

Reflects the dollar level of new orders for both durable and non-durable goods, indicating manufacturing demand.

📅 Thursday, April 3:

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 226,000

Previous: 224,000

Measures the number of individuals filing for unemployment benefits for the first time, providing insight into labor market conditions.

📊 Trade Balance (8:30 AM ET):

Forecast: -$123.0 billion

Previous: -$131.4 billion

Indicates the difference between exports and imports of goods and services, reflecting the nation's trade activity.

📅 Friday, April 4:

💵 Average Hourly Earnings (8:30 AM ET):

Forecast: 0.3%

Previous: 0.3%

Measures the change in earnings per hour for workers, indicating wage inflation.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY trade ideas

SPY $545 Downtrend ContinuesSymbol: SPY

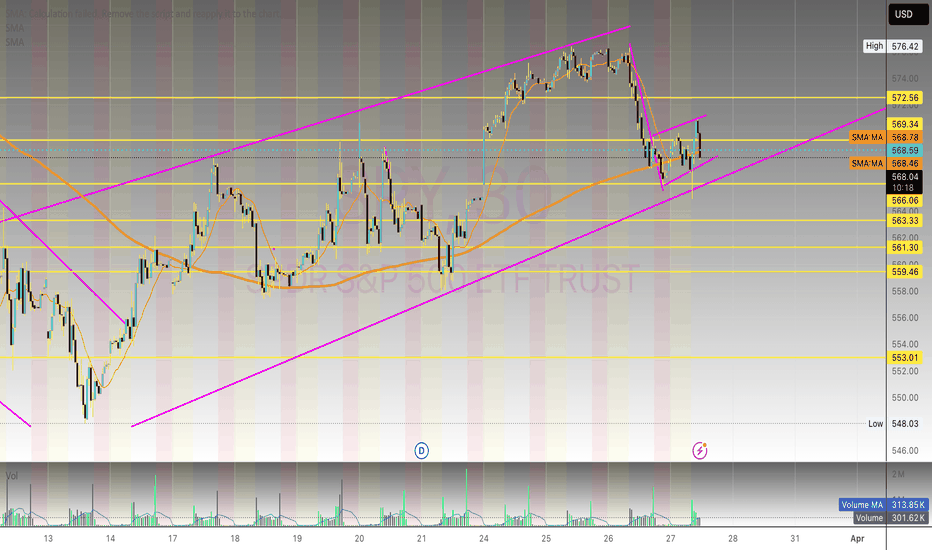

Timeframe: 30-minute chart (for your analysis)

Bias: Short (after the anticipated bounce)

Prediction: I anticipate a short-term bounce in SPY from Friday's sell-off towards the upper level of the weekly regression channel, around 560. I plan to look for a short entry at this level, expecting the price to then continue its downtrend towards the monthly regression channel support around 545.

Analysis:

Weekly Trend Channel (Blue Double Lines): The blue double lines on my chart represent a weekly trend channel for SPY. This channel was determined by performing a linear regression on the price action over the past week. The upper and lower boundaries of the channel are set at two standard deviations away from this linear regression line. This method helps to identify the statistically probable range within which the price is likely to trade over the weekly timeframe.

Monthly Trend Channel (Yellow Double Lines): Similarly, the yellow double lines indicate a monthly trend channel. This channel is derived from a linear regression of SPY's price action over the past month, with the boundaries set at two standard deviations. I expect SPY to eventually find support within this monthly channel, with the lower boundary currently around the 545 level. This is my primary downside target.

Recent Price Action and Anticipated Bounce: The aggressive 2% downtrend on Friday likely pushed SPY towards the lower end of the weekly channel, potentially creating oversold conditions in the short term. I am anticipating a bounce from this sell-off towards the upper boundary of the weekly channel, which I estimate to be around 560. This level is expected to act as resistance.

Short Entry Opportunity: I will be closely watching price action around the 560 level, which coincides with the upper boundary of the weekly regression channel. If I observe signs of rejection or bearish confirmation at this resistance, I will look to enter a short position.

Contributing Factors: President Trump's aggressive tariff policies continue to contribute to market uncertainty and the overall bearish sentiment, supporting the technical outlook for further downside.

Conclusion:

I am predicting a short-term bounce in SPY to approximately 560, which aligns with the upper level of the weekly regression channel. I will be looking for a short entry at this level with the expectation of a subsequent move down towards the monthly regression channel support around 545. This strategy aims to capitalize on a potential retracement within the established downtrend, guided by regression-based trend channels and influenced by fundamental concerns regarding tariff policies.

Disclaimer: This is my personal analysis and not financial advice. Please conduct your own research before making any trading decisions.

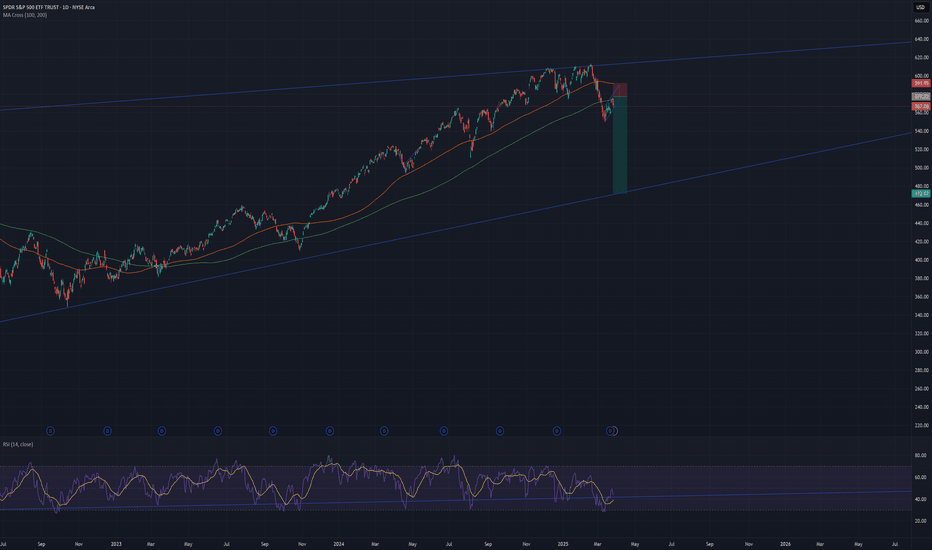

The Greatest Opportunity of Your Life : Answering QuestionsThis video is an answer to Luck264's question about potential price rotation.

I go into much more details because I want to highlight the need to keep price action in perspective related to overall (broader) and more immediate (shorter-term) trends.

Additionally, I try to highlight what I've been trying to tell all of you over the past 3+ years...

The next 3-%+ years are the GREATEST OPPORTUNITY OF YOUR LIFE.

You can't even imagine the potential for gains unless I try to draw it out for you. So, here you go.

This video highlights why price is the ultimate indicator and why my research/data is superior to many other types of analysis.

My data is factual, process-based, and results in A or B outcomes.

I don't mess around with too many indicators because I find them confusing at times.

Price tells me everything I need to know - learn what I do to improve your trading.

Hope you enjoy this video.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY - Keep It SimpleAll about trend lines. Since 2020 to today, there have been three major trends. The first was the bull run from covid bottoms to the 2022 highs; a very distinct trend line being drawn. The second was the correct in 2022; another distinct trendline drawn. Recently, we have a break of the uptrend associated with a bear flag continuation pattern. Keeping it simple, we take the pole of the flag and we measure it; 515-520 is a potential target. It lines up with prior lows and also the 0.385 fib level.

SPY: Bulls Will Push

The price of SPY will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

SPY: End of March/Start of April Hey everyone,

Going to keep this short because I feel like, between projections and levels, I have a good idea of what is going to happen next week.

The chain of events seem to be gap down/ or sell towards 550 / 549, then up to 557 (which is also our reference target, that yellow line in the chart) where we see rejection to sub 550.

I am a little shook that this is moving super quick, but the last correction in a Trump era was fairly swift, tumbling over 20% in the span of maybe 3 months if I remember correctly (2018). But it was a complex market because there was an initial collapse, then a choppy grind up to highs, then an even deeper sell. I am hoping that this does not repeat because that would be annoying.

Here is the forecast:

The red line is the best fit projection.

Looking at the forecast overlaid with the levels for next week it does really align well with the move to 557.

If we are to break over 557, then I would be looking for a cap at 559.

The best fit low is 546, which means dropping below previous support.

The ultimate target as of right now is a move back to the quadratic mean in the 490s. Though we could find support on the upper confidence level.

If we are doing a very fundamental correction, 472 is SPY's mean based on the US money supply:

As of right now the target to really just care about is 546.

And as a side note, there was a ton of volume uptick in that 555 range. We only hit it on Friday, but over the last 5 days, 555 comprised the HIGHEST volume, all selling, to the point of being SPY's 5 day POC. That is pretty intense for a new low on the week achieved Friday a few hours before market closed for the weekend to comprise the most volume and it being 95% in one direction. This stark EOW volume generally would lead to gap in the direction of the volume, which was bearish, so hence I do expect a bit of a gap down.

Anyway, those are my thoughts, keeping the idea fairly simple this week because I'm tired haha.

Safe trades, enjoy your weekend!

P.s. Thank you as always to Tradingview for allowing people to do plots with pinescript on public ideas! 🙏🙏🙏

SPY Set To Grow! BUY!

My dear friends,

SPY looks like it will make a good move, and here are the details:

The market is trading on 555.80 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 569.99

Recommended Stop Loss - 549.79

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SPY is still on thin iceA month back I wouldn't have believed this post though I did expect 10% correction and exited my major position at the top. I post this as pure academic purpose and my own record. I find volume profile the most important tool in technical analysis. Whatever I present here is an educated guess and not pure speculation. Before doing the profile I did a VP study on major stocks, since VP shows more clarity on the stocks

Based on Volume profile the sellers will have little resistance breaking through thin ice zone. We could still be looking at 514 easily. Then it starts facing some resistance

Market is still breaking through bubble territory. The reason I call bubble territory is because the volume became significantly lower after May 24. Most of the large investors and funds had bought their major holding by then. If fact based on news Warren Buffet and Michael Burry started selling USA market in August and kept selling till end of Dec. WB sold his entire holding of American express, one of his favourite company Berkshire was holding largest cash balance in is history by Dec. Smart guy. So I just followed him. Then I ask If these heavy weights are selling will they back after 10% correction? No way, they would wait for at least 20% or more markdown

This give me confidence in my analysis and economic environment supports that too

The market will quick fall through low volume region or imbalances. These act like magnets for the price and stop or pause for a breath at High volume nodes and even bounce back to take back some the low volume nodes. These can create a flag structure. This what happened when the market bounced back from 5500 to 5790 and reversed again. I correctly said in a previous post it was a bear flag

When the market is euphoric and in FOMO stage it will leave lots of volume gaps which attracts the market back to those levels

$SPY Short position.To add context, I am an average joe in his 20's who graduated high school with a 1.6 GPA.. Prior to my current employment at a financial institution, I worked as a gas station clerk. I am not someone who sees himself as a genius, but I am somebody who identifies patterns not only in people, but charts as well. I've worked for a bank on the credit card side coming up on 5 years. Day in day out, people are struggling to keep up with their credit card payments. 750-830 FICOs struggling to keep up with bills. Keep in mind, I only work with what we deem our 'high value', cliental. If our card holders who we deem to be good or great consumers are struggling to keep up, I can only imagine what it looks like for those who don't qualify to get to my department (which is a rather big pool of people). This thesis is centered around a possible correction in the short term, that may lead to a long-term reset based off of 4 things: human behavior, Federal Reserve Data, inflation, and credit.

The market as we know it has been propped on lies, fraud, and negligence. This is not a political post, but if you look at Federal Reserve Reports through FOMC under the previous administration, over 48% of job reports specifically, were revised downwards. During the duration of March of 2021 to September of 2024, approximately 808,000 jobs were "added", to the economy. One can make the argument that these numbers were there to, 'fluff, reportings to hide one of the worst economies in history.

The Dollar has been a concept and an asset since 1785. Since 2020, we've printed over 60% of all dollars circulating. Over 200 years and it only took the U.S. a little under 5 years to print over 60% of all U.S. currency circulating. The inflation never left; it was hidden by false or fraudulent data. Americans have been squeezed from their hard-earned dollar for the last 4 years, between higher interest rates, higher inflation and cost of living. Remember how I mentioned I work for a bank on the credit card side? Minimal payments, easily $6500 dollar balances on average, being carried month to month between 24-27% APR. Americans DO not have money. Over the last month, one of the most common statements I've heard is, "The only way I can pay this off is I cash out on assets.". Delinquencies are sky rocketing to levels not seen since '07 - '08. People are slowly getting the same thought.

The first week of April in my opinion is do or die. Trump is set to announce new tariffs as of April 2nd. If Trump decides to really lay down the tariffs and kick off a real trade war, markets will react in a manner of uncertainty. If in that same week, the Federal Reserve forecasts a lower GDP, a higher CPI, a decrease in forecast in employment, that could be the kick that takes the stool out from under the market.

If you've made it this far, thank you for taking the time to consider my first publication.

-ScG

SPY/QQQ Plan Your Trade For 3-28-25 EOD Review : Brutal SellingI sure hope all of you were able to profit from this big selling trend today.

And I also hope you didn't get trapped in the potential for a base/bottom rally off the recent lows.

This move downward reminds me of the 2022-2023 downward trending pattern when the Fed was raising rates.

What Trump is doing with tariffs is very similar. It is slowing the economy in a way that will not break it - but it will result in slower, more costly, economic function.

Watch this video and I sure hope all of you have great (profitable) stories to share with me today.

I know I do. And, I'm positioned for the weekend. Ready to profit no matter what the markets do.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY Bearish wave count The only one !The chart posted is that of the spy updated for the bearish wave structure . I have now exited my 125 % long position as the formation is forming SO FAR an ABC rally up with two legs if equal we should top today in cash at 5796 5805 in spy 575/577.9 IF the beasish count is correct we should see a 3 wave drop to retest the low or make a small new low for wave B then I will enter the long calls once again for a 5 wave rally under the bearish count the limit is .786 but based on history dated back to 1902 we should peak at .618 to .66 if The bearish wave count is were we are in the Cycle . But if we rally from here and close above 5805 I would see the market making New all time Highs .Best of trades WAVETIMER 1

SPY to follow DJT and XHBIn last year's big move up SPY trailed DJT (Dow Jones Transportation Index) and XHB (A Homebuilders ETF) by 2-months and 1-month respectively. In November, DJT crashed. In December, XHB crashed. It's January now. If nothing is being delivered, and homebuilders have no one to sell to that can't be good for the greater market.

SPY/QQQ Plan Your Trade For 3-28-25 : Carryover in Counter TrendToday's pattern suggests the SPY/QQQ will attempt to move downward in early trading. The SPY may possibly target the 564-565 level before finding support. The QQQ may possibly attempt to target the 475-476 level before finding support.

Overall, the downward trend is still dominant.

I believe the SPY/QQQ may find some support before the end of trading today and attempt to BOUNCE (squeeze) into the close of trading.

Gold and Silver are RIPPING higher. Here we go.

Remember, I've been telling you of the opportunities in Gold/Silver and other market for more than 5+ months (actually more than 3+ years). This is the BIG MOVE starting - the BIG PARABOLIC price rally.

BTCUSD has rolled downward off the FWB:88K level - just like I predicted. Now we start the move down to the $78k level, then break downward into the $58-62k level looking for support.

Love hearing all of your success stories/comments.

GET SOME.

Happy Friday.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY’s Epic Crash: Bearish Flag Unleashed!Buckle up, trading fam, because the SPDR S&P 500 ETF Trust (SPY) just pulled a move so wild, it’s giving Keeping Up with the Kardashians a run for its money. We’re talking a bearish flag breakdown on the 4-hour chart that’s got more twists than a Game of Thrones finale, more drama than a Bachelor rose ceremony, and more profit potential than a Shark Tank pitch gone viral. If you’re ready to laugh, learn, and maybe make some cash, then grab your popcorn—this 2,500-word rollercoaster is about to take you on a ride you won’t forget! 🎢

Act 1: SPY’s Golden Era—Living Its Best Barbie Life

Let’s set the scene: it’s late October 2024, and SPY is strutting its stuff like it’s Margot Robbie in Barbie. The price climbs from $570 to a dazzling $607.98 by mid-January 2025—a 6.5% glow-up that’s got traders swooning harder than Ken at a Dreamhouse party. SPY’s basically saying, “I’m not just an ETF—I’m iconic,” as it basks in the glow of a bull market hotter than a Love Island villa.

But here’s the tea: even the shiniest stars can fall. By mid-January, the Stochastic Oscillator at the bottom of the chart is flashing “overbought” signals louder than a Real Housewives reunion meltdown. It’s the first sign of trouble—like when you realize the DJ at the club just played “Sweet Caroline” for the third time, and the vibe’s about to go south. SPY’s living large, but the party’s about to get crashed, Jersey Shore style.

Act 2: The Flagpole Plunge—SPY Sinks Faster Than the Titanic

Cue the dramatic music, because mid-January 2025 is when SPY decides to pull a full-on Titanic. The price plummets from $607.98 to $566.77 in a matter of days—a $41.21 drop, or 6.8%, that’s got traders screaming “I’m not okay!” louder than a Euphoria episode. This sharp decline is the flagpole of our bearish flag pattern, and it’s a doozy. SPY’s sinking faster than Jack and Rose’s ship, and the bulls are left clinging to the wreckage like there’s no room on the door. 🚢

The Stochastic Oscillator dives into oversold territory (below 20), confirming the bearish momentum is stronger than the Hulk after a double espresso. It’s a bloodbath on Wall Street, and SPY’s the main character in this tragic plot twist. But just when you think the drama’s over, SPY decides to play coy—like a Bachelor contestant who says “I’m not here for the right reasons” but sticks around for the drama anyway. Enter the consolidation phase, aka the “flag” part of the bearish flag pattern. Let’s break it down, shall we?

Act 3: The Flag—SPY’s Tease Game Is Stronger Than a Love Island Bombshell

From late January to mid-February 2025, SPY enters a consolidation phase that’s more tantalizing than a Love Island bombshell walking into the villa. The price bounces between $566.77 and $577.74, forming a sneaky little upward-sloping channel. It’s like SPY’s playing hard to get, teasing traders with a “Will I rally? Will I crash?” vibe that’s got everyone on edge. The Stochastic Oscillator hovers below 50, like a villa couple who’s “just talking” but definitely not coupled up yet.

This consolidation is the “flag” in the bearish flag pattern, and it’s a classic setup. Think of it as SPY taking a quick breather after its big fall, sipping a cocktail by the pool before diving back into the drama. Bearish flags are continuation patterns, meaning the price is likely to keep falling after this little flirt-fest. It’s like when you’re watching The Masked Singer—you know the reveal’s coming, but the suspense is what keeps you glued to the screen. And trust me, you won’t want to miss the next act.

Act 4: The Breakout—SPY Says “I’m Out!” Like a RuPaul’s Drag Race Exit

Mid-February 2025 arrives, and SPY decides it’s done with the games. The price breaks below the lower trendline of the flag at $566.77, and it’s like watching a RuPaul’s Drag Race queen sashay away after a lip-sync battle: dramatic, fierce, and leaving the bulls in the dust. The breakout confirms the bearish flag pattern, and the bears are strutting their stuff like they just won the crown. 👑

The price doesn’t just dip—it plunges to $546.33 by late March 2025, a further drop of $20.44 (or 3.6%) from the breakout point. The Stochastic Oscillator dives back into oversold territory, confirming the bearish momentum is back with a vengeance. SPY’s basically telling the bulls, “You better work—because I’m not!” as it leaves them gagging on the runway.

Let’s talk about the measured move—the price target for this bearish flag. We take the length of the flagpole ($41.21) and project it downward from the breakout point ($566.77). That gives us a target of $525.56. SPY doesn’t quite hit that mark—it bottoms out at $546.33—but it gets close enough to make traders sweat harder than a Chopped contestant with 30 seconds left on the clock. It’s a solid performance, even if it didn’t stick the landing perfectly.

Pop Culture Parallels: SPY’s Bearish Flag Is a Reality TV Showdown

Let’s take a step back and look at this chart through a pop culture lens, because SPY’s bearish flag is basically a reality TV showdown. The initial uptrend from October to January is the honeymoon phase—think The Bachelor contestants on their first group date, all smiles and champagne. 🥂

The flagpole drop in mid-January is the drama bomb, like when a contestant gets caught kissing someone else in the hot tub. The consolidation phase is the confessional montage, where everyone’s talking smack and plotting their next move. And the breakout? That’s the rose ceremony—SPY’s handing out its final rose to the bears, and the bulls are sent packing with nothing but a suitcase and some tears.

Trading Tips: How to Slay This Bearish Flag Like a Drag Race Superstar

Now that we’ve had our fun, let’s get down to business. How can you trade this bearish flag like a Drag Race superstar? Here’s the tea, served piping hot:

1. Short the Breakout (Sashay, Don’t Shantay)

When SPY broke below the flag at $566.77, that was your cue to short the stock faster than you can say “Sashay away!” A short position here could’ve netted you a $20.44 gain per share as the price dropped to $546.33—enough to buy yourself a new wig for the next challenge.

2. Set a Stop-Loss (Don’t Get Read for Filth)

To avoid getting read for filth by a fake-out, set a stop-loss above the flag’s upper trendline at $577.74. That way, if the breakout flops harder than a Drag Race comedy challenge, you’re safe.

3. Target the Measured Move (Go for the Crown)

The measured move target of $525.56 was the goal, but SPY stopped at $546.33. That’s still a win—like making it to the top 4 but not snatching the crown. If you’d shorted at the breakout, you’d be serving looks and profits.

4. Watch for a Bounce (Don’t Sleep on the Comeback)

As of late March 2025, SPY’s at $546.33, and the Stochastic is oversold. This could mean a short-term bounce is coming, like a Drag Race queen returning for an All-Stars season. Keep an eye on resistance at $566.77 and $577.74—if SPY breaks above those, the bears might be in for a shady twist.

The Bigger Picture: Is SPY’s Downtrend the New Black?

Let’s zoom out for a hot second. Before this bearish flag, SPY was in a strong uptrend for months, living its best life like a Vogue cover star. This pattern marks a potential trend reversal, like when skinny jeans went out of style and baggy pants became the new black. If the downtrend continues, the next support level could be around $540—or even lower if things get really messy.

But here’s the million-dollar question: is this the start of a bigger bear market, or just a temporary dip? It’s like trying to predict the winner of Survivor—nobody knows, but everyone’s got a theory. The Stochastic being oversold suggests a bounce might be near, but the overall trend is still bearish. So, keep your wits about you, because this market’s shadier than a Real Housewives dinner party.

Why This Chart Is More Addictive Than a Love Is Blind Binge

If you’re still here, you’re officially obsessed—and I don’t blame you! This SPY chart is more addictive than a Love Is Blind binge because it’s got all the elements of a great reality show: drama, suspense, and a cast of characters (the bulls and bears) who can’t stop fighting. The bearish flag is the villain we love to hate, and the price action is the love triangle we can’t stop watching.

Plus, trading is a lot like reality TV. You’ve got your highs (the uptrend), your lows (the flagpole drop), and those messy in-between moments (the consolidation). But when the breakout happens, it’s like the finale episode where someone finally gets engaged—or in this case, the bears get their moment in the spotlight. 💍

Final Thoughts: Don’t Miss the Next Episode of SPY’s Reality Show

SPY’s bearish flag breakdown is a masterclass in technical analysis, wrapped in a package of drama and sass that’d make even the most stoic trader crack a smile. Whether you’re a Wall Street pro or a newbie just here for the tea, this chart has something for everyone.

So, what’s next for SPY? Will it hit that $525.56 target, or will the bulls stage a comeback like a Love Is Blind couple at the altar? Only time will tell, but one thing’s for sure: you won’t want to miss the next episode of this reality show. Keep your eyes on the chart, your finger on the trigger, and your sense of humor intact—because in the world of trading, you’ve got to laugh to keep from crying. 😜

Join the Trading Villa!

If you loved this recap of SPY’s bearish flag drama, don’t ghost me like a Love Island ex! Drop a comment with your thoughts—are you shorting SPY, or are you waiting for a bounce? And if you want more trading tea, puns, and reality TV references, hit that follow button faster than you can say “I’m here to make friends.” Let’s spill the tea and make some money together! 🍵

Nightly $SPY / $SPX Scenarios for March 28, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📊 Core PCE Inflation Data Release: The Personal Consumption Expenditures (PCE) Price Index for February is set to be released. Economists anticipate a 0.3% month-over-month increase and a 2.5% year-over-year growth, aligning with previous figures. As the Federal Reserve's preferred inflation gauge, this data could influence monetary policy decisions.

🇺🇸🛍️ Consumer Spending and Income Reports: February's personal income and spending reports are due, with forecasts indicating a 0.4% rise in personal income and a 0.5% increase in personal spending. These figures will provide insights into consumer behavior and economic momentum.

🇺🇸🏠 Pending Home Sales Data: The Pending Home Sales Index for February is scheduled for release, with expectations of a 2.0% increase, following a 1.0% rise in January. This index offers a forward-looking perspective on housing market activity.

📊 Key Data Releases 📊

📅 Friday, March 28:

💵 Personal Income (8:30 AM ET):

Forecast: +0.4%

Previous: +0.9%

Measures the change in income received from all sources by consumers.

🛍️ Personal Spending (8:30 AM ET):

Forecast: +0.5%

Previous: -0.2%

Tracks the change in the value of spending by consumers.

📈 PCE Price Index (8:30 AM ET):

Forecast: +0.3% month-over-month; +2.5% year-over-year

Previous: +0.3% month-over-month; +2.5% year-over-year

Reflects changes in the price of goods and services purchased by consumers.

🏠 Pending Home Sales Index (10:00 AM ET):

Forecast: +2.0%

Previous: +1.0%

Indicates the number of homes under contract to be sold but still awaiting the closing transaction.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis