SP500 vs fedfundsrateThe interest rate and the S&P 500 share a complex yet significant relationship in financial markets. When interest rates rise, the cost of borrowing typically increases for companies, which can reduce their profits and, in turn, put downward pressure on S&P 500 stock prices. Additionally, higher rates make bonds and other fixed-income assets more attractive compared to stocks, potentially leading to a shift of capital away from the equity market. Conversely, when interest rates are low, companies can borrow more cheaply, which tends to boost earnings and, consequently, the performance of the S&P 500. However, other factors such as economic growth, inflation, and market expectations also play a role in this dynamic, making the relationship neither linear nor entirely predictable.

SPY trade ideas

A Huge Technical Re-Test of This Important TL Has Just Occurred!Trading Family,

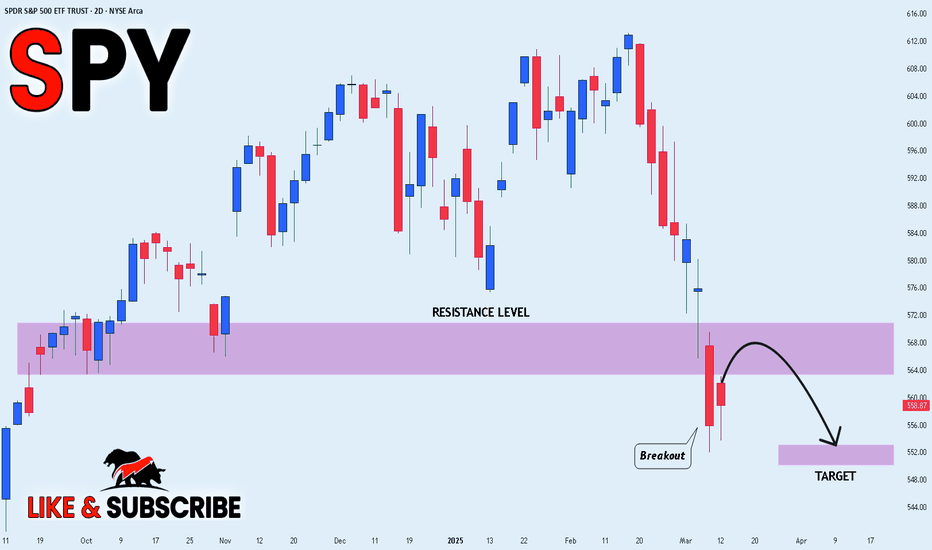

Tariff FUD is recking traders rn. After breaking important support which started in Nov. '24, I knew the SPY was in trouble. My first target down was 563. We hit that and broke it. My second target down was 550. We are there right now! Will it hold? I don't know. TBH, I don't think any analyst that is honest knows. Investors have never seen Tariffs levied like they have been recently by the Trump admin. Noone really knows how this is going to impact the current economy, which is now global (big diff from the last U.S. tariff econ in the late 1800's).

But I can say that this is a big support which is the neckline of our large long-term Cup and Handle pattern started all the way back in Jan. of 2022! We did have one retest already. Usually, this is all that is needed. But apparently, the market wants another. Though the support is strong, remember, every time it is tagged, it weakens. Thus, if it can't hold this current downturn, I suspect it will drop hard from here should it break, possibly dropping all the way to 460. Be prepared for this and watch your trendline closely!

On the other hand, if it holds, I see a huge bounce incoming! We'll probably then go all the way back up to test the underside of that support (red with two with lines) that we broke. Hold on to your hats! We are living in unprecedented times with unprecedented market volatility.

The last item to note is that, once again, this all seems to be occurring at the same time that U.S. congress and senate are voting on a continuing resolution. Correlation does not necessarily equal causation however, in this case, I would suggest that should a U.S. gov't shutdown occur, our support will break and down we'll go. Should a CR pass, big bounce incoming. Stay tuned and watch the news closely for this. It seems to be a news driven event.

✌️ Stew

SPY/QQQ Plan Your Trade Update For 3-13-25 - Fear Settling InWith the US government only about 39 hours away from a complete SHUT DOWN, I want to warn everyone that metals are doing exactly what they are supposed to do - hedge risks. While the SPY/QQQ are continuing to melt downard.

I created this video to show you the Fibonacci Trigger levels on the 60 min SPY chart, which I believe are very important. Pause the video when I show you the proprietary Fibonacci price modeling system and pay attention to the fact that any upward price trend must rally above 563.85 in order to qualify as a new Bullish price trend.

That means we need to see a very solid price reversal from recent lows or an intermediate pullback (to the upside) which will set a new lower Bullish Fibonacci trigger level.

Overall, the SPY/QQQ are in a MELT DOWN mode and I expect this to last into early next week unless the US government reaches some agreement to extend funding.

This is not the time to try to load up on Longs/Calls.

The US and global markets are very likely to MELT DOWNWARD over the next 2 to 5+ days if the US government does SHUT DOWN.

FYI.

Gold and Silver may EXPLODE HIGHER.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-13-25: Carryover PatternToday's pattern suggests the markets may attempt to continue to find support and move into a sideways pullback (upward) price channel.

I believe the markets have reached an exhaustion point that will move the SPY/QQQ slightly upward over the next 5 to 10+ days - reaching a peak near the 3-21 to 3-24 Bottoming pattern.

This bottoming pattern near March 21-24 suggests the markets will move aggressively downward near that time to identify deeper support.

I believe metals will continue to move higher as risks and fear drive assets into safe havens.

Bitcoin should continue to slide a bit higher while moving through the consolidation phase.

Watch today's video to learn more about what I do and how I help traders find the best opportunities.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY - Trading Levels for March 13 2025

Alright, y’all. We are dangling, unsupported underneath the 200DMA and that Bear Gap. I am trading cautiously today because inflation data days I tend to make a lot of mistakes.

35EMA - this level is a BEAST. We were unable to get above it yesterday. Trace it back 3 weeks and you’ll see it’s been there every time to push us back lower.

I will be looking to the outer spreads and even then I might push it out a little.

If and when I take a position I will update it here.

GL, y’all.

Nightly $SPY / $SPX Scenarios for March 13, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇰🇷🇺🇸 South Korea's Trade Minister Visits U.S. 🇰🇷🇺🇸: South Korea's Trade Minister, Cheong In-kyo, is visiting Washington, D.C., from March 13 to 14 to discuss trade issues, including reciprocal tariffs and investment opportunities, with U.S. counterparts. This visit aims to address concerns about tariffs following President Trump's comments regarding disparities between U.S. and South Korean tariffs. The outcome of these discussions could impact sectors reliant on U.S.-South Korea trade relations.

🇩🇪🛠️ German Debt Reform Debates 🇩🇪🛠️: Germany's Bundestag is set to begin debates on debt reform plans starting March 13, focusing on increasing infrastructure spending and reforming state borrowing rules to fund defense. The proposed creation of a €500 billion infrastructure fund aims to stimulate the economy. These reforms could influence European economic stability, indirectly affecting U.S. markets through global economic interconnections.

📊 Key Data Releases 📊:

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI measures the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.3% month-over-month

Previous: +0.4% month-over-month

📉 Initial Jobless Claims (8:30 AM ET) 📉:This weekly report indicates the number of individuals filing for unemployment benefits for the first time, providing insight into the labor market's health.

Forecast: 226K

Previous: 221K

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY PRINTS RARE 'BUY' SIGNAL FOR THE FIRST TIME SINCE MAR 2020!!On the 2 Day chart, AMEX:SPY is signaling its intent to print a buy signal on our CM Ultimate RSI Indicator as soon as tomorrow, for the first time since March 2020

In this video, we look at that exact signal & see what the past 11 years of price action says about what's the next move for AMEX:SPY

uh owell we've so far passed all my support points and are like in super duper oversold territory. Traders want to bounce but I'm going to finally change my 6 month outlook. BEARISH. Short term it depends on how the chips fall -- if we get some straws to grasp at on the economic data side of things, we could bounce easily to $580.

But people are not liking the current field, even after all the panic selling, there aren't many management firms snatching up the deals. Except for NVDA, people really fell on that knife these past 2 days, hoping its profits remain magnificent and its costs don't increase. Maybe TSLA will be a buy soon -- Musk owns less than 50% of the company right? They can vote him out in June? I mean I was expecting a bounce and extra profits from the CEO being so close to the POTUS but maybe people are sensing he's too MIA, off playing video games or something.

Worst of all, the administration isn't even giving people platitudes. There's no, 'we're doing everything we can to prevent a full Biden recession'. There's almost a calm acceptance that it might happen and we'll be better off for it. At first it was just uncertainty around rate cuts but its blossomed into caution around CapEx and MA (because somehow the outlook on tariffs is even murkier now than in December) and dent in employment activity due to mass layoffs at the federal level. Like this year just cannot get any worse -- and any bullish reversals will be due to that sentiment; that we're impervious to further drops in the stock market because the bad news is already priced in. But we haven't accounted for all the people who will have to cash out of their 401k's this fall and therefore cannot discount the possibility of a 25% market correction or more. Like, I'll change my mind when the administration starts acting like recessions are bad and we should work our hardest to avoid them rather than just making sure Biden gets some of the blame (no way Trump escapes all the blame anymore, he'll be lucky if he can avoid a government shutdown Friday).

Like usually treasuries move inverse to stock market action, but what if the pause in business activity is because of unpredictability at the federal government? How long before we float the idea of reneging on our debts and we get downgraded to a B+? Like we talk about protectionist policies and fiscal conservativism; what could be more of an America first policy than just defaulting on our owed debt? I just hope we can default in tranches so that not all $36 trillion becomes worthless all at once. Maybe the Fed can look into that -- stop selling short term notes for example and commit to honoring our immediate debts...