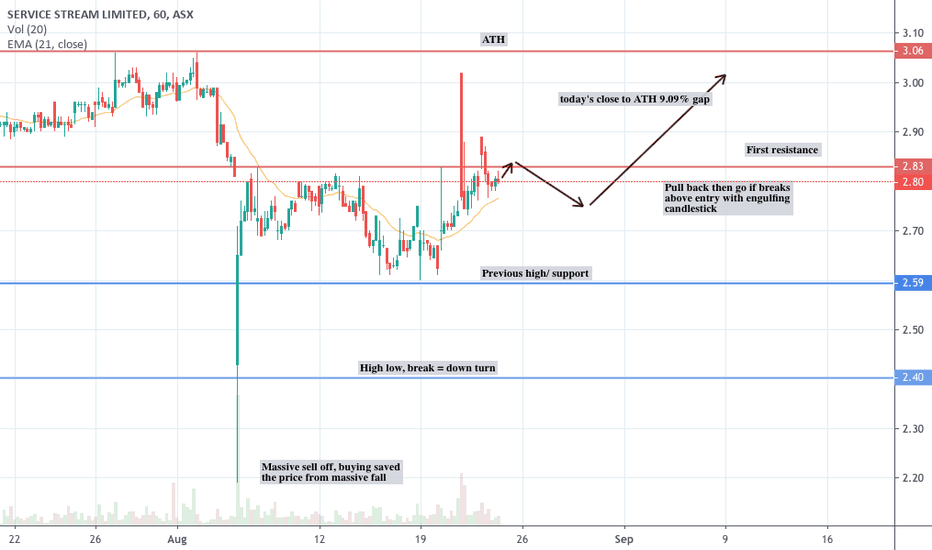

Bullish potential detected for SSMEntry conditions:

(i) higher share price for ASX:SSM along with swing up of indicators such as DMI/RSI.

Stop loss for the trade would be:

(i) below the support level from the open of 13th March (i.e.: below $1.725), or

(ii) below the support level from the open of 26th February (i.e.: below $1.67

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.085 AUD

32.30 M AUD

2.29 B AUD

546.30 M

About SERVICE STREAM LIMITED

Sector

CEO

Leigh Mackender

Website

Headquarters

Melbourne

Founded

1996

ISIN

AU000000SSM2

FIGI

BBG000PLXF50

Service Stream Ltd. engages in the business of designing, constructing, operating, and maintaining critical infrastructure networks. It operates through the following segments: Telecommunications, Utilities, Transport, and Other. The Telecommunications segment includes operations, maintenance, installation, design, and construction services to the owners of fixed-line and wireless telecommunication networks. The Utilities segment is involved in gas, water, and electricity network owners, industrial asset owners, and other customers. The Transport segment focuses on long-term operational support and maintenance services to public and private road and tunnel asset owners. The company was founded by Adrian Field and Russell Andrew Small on January 8, 1996 and is headquartered in Melbourne, Australia.

Related stocks

SSM - Triple Bottom Looking Strong.SSM broke out of the downtrend line in late June 2021, and rallied and formed a high of $1.030. This indicates its end of the downtrend. The current pull back has retested support and bounced off as of lately and forming a triple bottom pattern which looks quite bullish. I would be targeting the pre

SSM - Looking StrongSSM looks like it has changed its trend and is expected to move much higher. Any pull back lower could be a very good opportunity to buy. It has broken its downtrend line with high volume indicating a change in trend. I have my buy zone between $0.880 - $0.930, where I will be looking for bullish pr

Service Stream Limited - SSM 19 weeks long ascending triangleService Stream Limited - SSM 19 weeks long ascending triangle breakout, the week closed 0.08 cents or 4.47 per cent higher to $1.87.

The shares price profit target is around 19 per cent or $2.12.

Service Stream Limited ( SSM ) is a provider of essential network services to the telecommunications

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SSM is 1.990 AUD — it has increased by 0.25% in the past 24 hours. Watch SERVICE STREAM LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on ASX exchange SERVICE STREAM LIMITED stocks are traded under the ticker SSM.

SSM stock has risen by 2.58% compared to the previous week, the last month showed zero change in price, over the last year SERVICE STREAM LIMITED has showed a 42.14% increase.

We've gathered analysts' opinions on SERVICE STREAM LIMITED future price: according to them, SSM price has a max estimate of 2.22 AUD and a min estimate of 2.00 AUD. Watch SSM chart and read a more detailed SERVICE STREAM LIMITED stock forecast: see what analysts think of SERVICE STREAM LIMITED and suggest that you do with its stocks.

SSM stock is 2.05% volatile and has beta coefficient of 0.26. Track SERVICE STREAM LIMITED stock price on the chart and check out the list of the most volatile stocks — is SERVICE STREAM LIMITED there?

Yes, you can track SERVICE STREAM LIMITED financials in yearly and quarterly reports right on TradingView.

SERVICE STREAM LIMITED is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

SSM earnings for the last half-year are 0.06 AUD per share, whereas the estimation was 0.05 AUD, resulting in a 34.14% surprise. The estimated earnings for the next half-year are 0.05 AUD per share. See more details about SERVICE STREAM LIMITED earnings.

SERVICE STREAM LIMITED revenue for the last half-year amounts to 1.22 B AUD, despite the estimated figure of 1.24 B AUD. In the next half-year revenue is expected to reach 1.25 B AUD.

SSM net income for the last half-year is 33.08 M AUD, while the previous report showed 19.53 M AUD of net income which accounts for 69.38% change. Track more SERVICE STREAM LIMITED financial stats to get the full picture.

SERVICE STREAM LIMITED dividend yield was 3.52% in 2024, and payout ratio reached 85.71%. The year before the numbers were 1.85% and 208.33% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SERVICE STREAM LIMITED EBITDA is 125.52 M AUD, and current EBITDA margin is 4.83%. See more stats in SERVICE STREAM LIMITED financial statements.

Like other stocks, SSM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SERVICE STREAM LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SERVICE STREAM LIMITED technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SERVICE STREAM LIMITED stock shows the strong buy signal. See more of SERVICE STREAM LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.