WES trade ideas

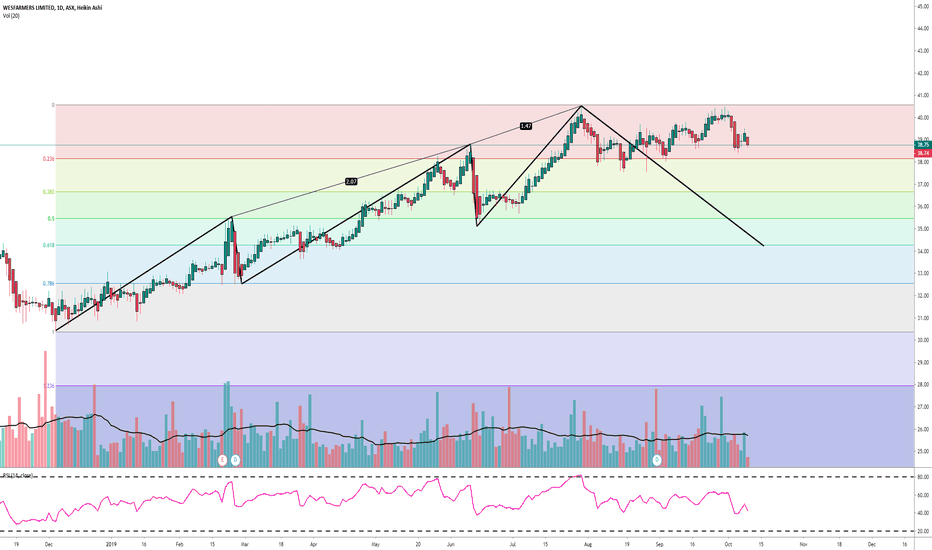

Wesfarmers - Time is upUsing Gann's theory, watch for 30, 60 and 90 days cycle. You can see from my dates noted on the turns, Wesfarmers has been turning on 19th of every month as shown in the chart.

Also another to support this turning point, from the March 19 low to the top on April 19, it's 31 calendar days, and another 30 days down to 50% retracement - May 19.

Should be expecting a turn up from May 19 onwards.

Watchlist ...

Strength to strengthReviewing the top holdings of the A200 by sector

Consumer Discretionary

Wesfarmers Ltd

Can't fault this run, expecting this to continue with possibly dip to regain momentum. I'd like an entry at $47 if there was a suitable dip.

There has to be a retrace on this bull run at some point surely but I'm not a brave enough bear.

WES | Price Discovery | Key Level | 21 EMA Visual Guide Today's analysis – WES – Consolidating below ATH resistance as the 21EMA coils price into its APEX.

Points to consider:

- Strong trend

- Key level (apex)

- Price discovery (blue-sky breakout)

- 21 EMA visual guide

- Oscillators above 50

WES trading in a clean and strong uptrend finding resistance upon retest of its all-time high.

Price is trading at a key level as support (21 EMA) and resistance converge, a break in either direction is imminent.

A rejection at the resistance level, price is likely to retrace to daily support.

Price breaking bullish will induce new all-time highs for WES as it enters price discovery mode.

Further price development will allow the 21 EMA to act as a visual guide assisting to determine the immediate direction of the market. Price trading above the EMA perceived bullish and below considered bearish.

RSI and stochastics trading above 50 validates strength and momentum in the immediate market; oscillators need to range above 50 to maintain the bullish bias.

Overall, in my opinion, a successful S/R flip retest of the current resistance level validates a long trade, utilising the 21 EMA to assist in trade management and defining risk.

If you’ve read this far - thank you for following my work!

And as always,

Focus on you, and the money will too!

WES - FY 2019 Net Profit Surged More Than QuadrupleShare prices are down 2% from the time of reporting and are generally due to profit-taking, big investors driving prices down to reload for the next leg up. Share prices were driven down to around 37.50 support in the first hour of trades before pulling up above 37.90 a Fib retracement price level. Share prices could head back up to 38.60 if it holds above 37.90 support.

$WES - WESFARMERS - Interesting TA area. Might be an interesting conservative play. My feeling is whenever I walk into a Bunnings, Officeworks and KMart they are always busy...

Might be at a good area TA wise, missing volume confirmation though.

Demand bias is there with 691 buyers for 307,733 units vs 441 sellers for 244,803 units.

Wesfarmers Limited is engaged in various business operations, such as supermarkets, liquor, hotels and convenience stores; home improvement; office supplies, and an industrials division with businesses in chemicals, energy and fertilizers, industrial and safety products and coal. The Company's segments include Home Improvement; Department Stores; Office Works; Industrials, which includes Resources, WIS and WesCEF, and Other. Bunnings is a retailer of home improvement and outdoor living products in Australia and New Zealand. Kmart is a retailer with approximately 210 stores throughout Australia and New Zealand. Target operates a network of over 300 stores and sells a range of products for the contemporary family, including apparel, homewares and general merchandise. Officeworks is a retailer and supplier of office products and solutions for home, business and education.

Wesfarmers take 2# long-Primary pattern is a 66 month horizontal range

-Of which as an unmet target of 57.31

-8 day pennant in which I tried the long side of has morphed into a 5 week flag with well defined boundaries

-Tight bollinger band squeeze on the daily

-An attractive R/R

30 basis points of risk planned

AUS200 WES D ShortWES is ex dividend Mon 20 Feb by $1.03 so $43.09 - $1.03 := $42+/-.

Allowing for slippage, it could trade down to $41.85 Monday

before attempting to rally back to support at $42.

But over the next few days I believe it will drift lower

towards old resistance now support at $41.50

There is also that break away body gap at $40.98-41.18

which needs to fill.

The keys will be XJO and AUS200 Futures prices and the bears.

So my thoughts are to stay short until I get a candle(s) or indicator(s)

or gut feel its time to close and reverse.

I will continue to post on this chart and others (STO, Oil, Banks, reader interest etc)

... for just my 2c worth