XAO trade ideas

ASX: XAO MAKING HIGHER LOWS SIGNALS THE BOTTOM IS IN..?After narrowly missing my target of 6049 by 25 points by the 12th of November the ASX: XAO took a steep 2 day dive South from what looks to be echos of the volatile carnage on US Markets, particularly the FANGS suffering self created TRUST issues.

Having shot themselves in the foot by abusing Customer/Investor TRUST (like the Banks here) the FANGS, along with the cheap easy money of low interest rates and QE, have been primarily responsible for driving US Markets to unrealistically high Valuations over the past several years.

Unfortunately the ASX still seems to have uncoupled from the US sufficiently to not avoid catching a Cold when our big cousin across the Pacific sneezes...

Fortunately its NOT a baddie (or based in anything rational! ) and OUR retrace seem to have arrested at 5780 on the XAO. If this key support level holds Australian Investors should be able to have confidence that the All Ordinaries HAS FOUND A BOTTOM at my previous assertion swing low of 5723.

At moment of posting, the Bourse was deciding its next move at 5838.

As we see it climb higher as I strongly suspect towards the end of the Trading Week, I retain my CONFIDENCE of early posts on this topic that the larger drawdown that started in early October is done for. For the EMA's to return to the projected Parabolic path it may take a short while longer than originally anticipated on the 12th.

That is for Australia. I AM not so confident this is the case in the U.S. Markets..? Any U.S. friends care to give your brief take in comments of what you think is in store for you guys in the near term..?

With Brexit jitters still faffing about like an annoying English Fop causing uncertainty in Global Markets this dynamic WILL continue UNTIL Boris Johnson and fellow HARD BREXITEERS MAN UP and remove the derisive, laughable "Dancing Queen" Teresa May. This drawn out saga, that has long past becoming a 'yawn' Internationally, will continue to create unnecessary volatility in Europe. FX and Futures Traders should be making hay whilst the Sun shines brightly here. It wont last for much longer with the Queen of the EU Puppets, May, being deservedly tossed out on her treacherous wooden ear within a fortnight!

Back to the Land Downunder...

If the 2nd lowest support line (grey dashed line) holds @ 5780 this shows the Market has put in a higher low @ 5838 (pink dashed line) and thus...THE RALLY IS ON !

*Note - the lower Volumes being put in on the selldown highlighted on the 'AO' oscillator (The green dotted line with circled arrow) and the lower peak of the pink DMI line (red circled arrow and dashed line from previous peak showing alignment) which aligns with the thesis of lower Volume being sold off for lower prices (ie. a drop in Selling pressure.)

As such I AM even further convicted to add LONG positions to the ASX: XAO as the recent shakeout has strengthened the Market and the large Short Sellers will have to turn hide and run, admitting defeat that they cant find any more suckers to buy their irrational "doom and gloom" Bear fantasy.

Confirmation of this will STILL only come after a close above my initial target of 6050 but by that stage the Alpha gains have largely evaporated.

Choose your Risk - own it, place your Bet and "as you sow so shall you reap..!"

Remember in the Markets, as in Life FORTUNE favours the BRAVE.

Always DYOR.

ASX:XAO > ...I BEAT that BITCH with a BAT!"For those of you that have been following my commentary on the ASX: XAO's 'stellar' resurrection from the late October low it can be seen that PRICE ACTION has complied diligently to My Projection (dashed dark blue line).

All that is required for this Market Prophecy ( originally concocted 29th October - see "ASX gives October the BOOT!" post) to completely manifest now is a STRONG upward THRUST tomorrow and us Bulls that have MADE THIS HAPPEN will whip those wonky, wayward EMA's (light blue =50 day and 'Gold' = 200 day) into shape.

Me to the XAO;

"Bitch... STFU and get in that Kitchen and really start to Cook! Me and my Mates are RAVENOUS !" :o

GO AUSSIE GO! ;/

DYOR

ASX: XAO ALL ORDINARIES PLAYING OUT AS PROJECTED.I AM very happy to see that the Australian All Ordinaries (entire Market) is following my projected path nicely.

Risk averse Investors that want a SAFE Investment yet want the ALPHA gains are STRONGLY advised to take LONG positions in the Index before the 12th of November.

The 12th heralds an important new phase according to my proprietary Charts and advanced Elliot and Gann Wave analysis.

This is a GOLDEN opportunity for Individual Investors to get positioned before LARGE Institutions and Fund Managers determine Risk to the downside is negated and a SOLID Rally to the upside is a HIGH Probability outcome.

The 12th...

Always DYOR and GO AUSSIE GO!

ASX:XAO READY TO RUMBLE! ASX:XAO Australian All Ordinaries (entire Market) performing precisely to Projection of previous 3 Posts.

Note the 'Gold' and light Blue lines tracking my 50 and 200 Day EMA projections (dashed dark blue and brownish lines respectively) made @ date/time of previous post.

The light blue vertical line of the 12th of November is where the 2 EMA's WILL intersect and print what I AM here and now dubbing "THE RESURRECTION CROSS" as opposed to the well known term 'the Death Cross' when the 50 crosses the 200 day EMA to the downside.

Well, there is nothing down about this Cross !!!

On the 12th the Market will move into an important new phase and large Institutions and Superannuation/Pension/Managed Funds that buy the entire Index Funds will come roaring back into the Market in large Volumes once this Event materialises.

*Also of Note is the blue Bullish signal line meekly crossing the HOT pink DMI . This should fully assert itself and take an upward trajectory above the Pink DMI whilst the orange will head south below the green 'plimsoll line' set @ approx 20.

If you are looking for a SAFE BET where the ONLY other possibility is COMPLETE MARKET ANNIHILATION then this is it ! Basically If the All Ords caks itself from here then start making Peace with your Maker because its Mad Max from thereon in!

As this is NOT in HIS Blueprint - YET, Getting positioned before the 12th is a great Plan of action. What better diversification can you get in Australia?

Answer = NONE!

So that's the entire Index's projected path.

Having said that Banks are still whiffy and on the nose and could prove a Millstone around the neck of the rest of positive/constructive Industry in OZ and THUS... for those brave souls amongst US seeking Alpha I recommend looking for VALUE and researching elsewhere in OZ (Tip- there is PLENTY ABOUT atm!) ;

Energy, Minerals, Biotech, OZ Tech, Agricultural, basically anything the Chinese or the rest of the World wants from us.

A plethora of VERY EXCITING potentially BIG MONEY plays at early stage entry ;

Expect volatility but the payoff for the brave, tenacious and patient is potentially IMMENSE:

ASX STOCK TICKERS>

CVN - "STAGGERING UPSIDE" - "DISCOVERED 1 BILLION BARRELS OF 'OIL' (not to mention the 'TCF' of GAS IN SHALLOW WATER OFF NORTH WEST SHELF ) - " POTENTIAL GRAND FIELD DISCOVERY"

BIT - " SUCCESSFUL STAGE 2 TRIALS testing A CURE FOR HIV and HEP B/C"

BD1 - "SUCCESSFUL NON-INVASIVE EARLY CANCER DETECTION TESTS PATENTED - OVARIAN/BREAST/LUNG/PROSTRATE etc."

4DS - "REVOLUTIONARY 'INTERFACE' SWITCHING RE-RAM MEMORY CHIP (FASTER, MASSIVELY HIGHER CAPACITY, MORE EFFICIENT THAN ANYTHING ON MARKET) UNDERGOING LARGE SCALE DUPLICATION PROCESS STREAMLINING @ IMEC"

***Disclosure - I hold all 4 Stocks.***

As for the XAO - like Led Zeppelin song goes - "...Gonna Bring It On Home...Bring it on Home to YOU...Watch out watch out Mesmerize..."

PEACE LOVE AND RESPECT TO ALL

...and ALWAYS DYOR.

ASX ALL ORDINARIES SHOWS PARABOLIC TRAJECTORY FOR NOVEMBER 2018 Please refer to previous 2 Publications if you have come late to this Story and particularly if you are non-locally based.

...As I suggested yesterday that the BEARS have CAPITULATED , from the looks of the paths of the 50 Day EMA and 200 Day EMA (Blue and Gold dashed lines) the Australian XAO WILL STORM November like a literal BULL in a CHINA Short Shop, SMASHING AND GRABBING whatever it likes!

Picture a FRENZIED Ellen Degeneres' or Oprah Fan at a Black Friday Sale for HIGH HEELS!

NO PRISONERS WILL BE TAKEN, NO QUARTER GIVEN. IT'S BRUTAL AND UGLY!

...AN ONSLAUGHT of MASSIVE, SUSTAINED BUYING CARNAGE shall be imposed on our already mildly battered Furry Foes.

TRUST ME boys you ain't seen nothing YET!

Wait till you see what I have in store..? Best keep some of those BLACK eyes in the back of your head or better still spin it 180 degrees as only you $horter$ are capable of and get about for awhile A$$ ABOUT FACE!

Won't that be a pretty picture..? Best get the 'COVER' & 'RUN FOR THE HILLS BUTTON' ready, then you can lurk momentarily in relative Safety out of the LIGHT and plan your next YIN TANTY.

I digress...

To the Chart;

I'll keep this short and sweet.

Key Takeouts>

-Bears have capitulated (At time of Closing the XAO was closing ( 5913.3 ) hard on the first Resistance hurdle, which it WILL effortlessly clear I BELIEVE.

-Tomorrow will confirm this with a close above the grey dashed line north of 5927.

(Last cheap tickets- train leaves end of Session , stragglers will be left behind)

Locomotive XAO will be hammering at top speed up the 'Khyber Pass by Monday November 5th opening strongly with a BIG ANGRY BULL with BIG BANGING BALLS (BBB!) firmly in the ENGINEERS seat!

- The 50 DAY EMA crosses the 200 DAY EMA at a crucial junction on the 12th Of November.

(pencil that day in, and you heard it HERE first! Surely that would be worth a few MILLION FOLLOWS when I AM proved right about that? )

On this fine day the BIG CAT BOUNCE has reached the crucial level of 6051 which will guarantee this move is the end of the shakeout and the continuation of the Grand SUPERCYCLE BULL RALLY up to the next Crest of the Wave to challenge and then OVERWHELM the ALL TIME HIGHS not seen since the 'Royal Scam' of 2008 (any Steely Fans out there..?)

If you like my material and you think my style is something else...well you would be right! :D

Please Like and Follow, try giving something with no expectation and the ALPHA & the OMEGA will reward you

Peace Love and Respect for ALL...

and ALWAYS DYOR.

Bears Capitulate, Get positioned NOW if you Short Covering RallyTrading View Publication 000000002 30_10_2018

Please see previous Publication 0000000001 " ASX All Ordinaries gives October the boot"

Here is Today's result as the Market grew a pair.

Bears DONE & DUSTED!!!

-"..too early to call" I hear..? Yeah well maybe for some...I'll wave to you as the Train hits full steam.

Please see purple Text box for brief comment on what is about to unfold in wider Indices.

Banks are still a BASKET CASE...

Forget them and go put your hard earned into something CONSTRUCTIVE and GIVES something to this World , instead something that just takes and takes and gives very little back!

Msg to ALL Central Banks:

#shutitdown because soon CRYPTO will do that for you anyway!

The ASX All Ordinaries gives October the BOOT!!!No. 0000001 Published Chart on TradingView;

Here is My take on the Price Action in the XAO - The ASX Australian All Ordinaries over the the last regrettable Month for those who like to live in the Light and without Fear...

. Ie. The Bulls.

Things are looking up IMO for November...significantly.

Now that the Australian Banks have been significantly repriced to reflect potentially heavily reduced future earnings post the SAVAGE Mauling by the OUTRAGED Australian Public being SWINDLED and ABUSED by heinous Unconscionable Practices and Immorality of ALL descriptions (- AS represented by the Kenneth Hayne Royal Commission into the Australian Banking Industry) , who will NO LONGER stand to be price gouged and MILKED like pathetic Cows and treated like $LAVE$ to the Banks.

I believe we have found the bottom after the precipitous plunge of the last 3 weeks. It was NEVER anything more than the BANKS which in Australia, enjoy undue weighting along with the Mining Sector.

Combine that with the usual October selling to square books and write off losses against Tax in the US due to the Official end of their Financial year...

AND

MOST IMPORTANTLY the raising of Interest rates, IMO, prematurely and unnecessarily applying untoward pressure to Trump's mid Term campaign. (As if they dont already have enough to deal with..!!) ...but the SScum dont SSleep.

Message to Fed > #shutitdown

Anyways I digress..

Note the top left red circle that started the MOVE (with finger pointer)

...True to form - "THE DEATH CROSS" where the 50 day EMA and the 200 day EMA cross which reliably indicates a sustained Drawdown...saw the dreaded Bear emerging from its dank Den, ANGRY and HUNGRY!!!

***NOTE Despite the steep Price Fall, the large Volume expansion (pink expansion arrows below) and positive divergence relative to price in the DMI Indicator during this STEEP fall! (???) Hmmm what do we have here...?

SNIFF SNIFF..? Smells RANK! Ewwww I smell Short Sellers- BIG Stinky Ones! Probably the Banks shorting each other in ALL honesty!

>The next Blue circle to the right saw significant buying at the Dip >

Cross reference the AO Indicator below to see volume bought and sold...it was healthy as new entrants took early positions.

(***NOTE the positive divergence in the DMI Indicator relative to price with pink expansion arrows below )

> The Purple Circle (with the 'Tick') to the RIGHT (Go Trump!) has GAPPED up nicely at Todays Open.

This IMO indicates smart Money has caught the scent on the Breeze and soon Volume MAY return..?

If I were a betting Man (?!) I'd wager a SLAB of the Ice Cold for this to occur by Thursday Nov 5th 2018...Any Takers please PM Me ?

The ONLY element of concern for me is the downwards slope on the final Lipstick Pink peak of the DMI...?

Perhaps the shorters have further to go..?

I doubt it though...if they do, as always, the BEST defence against Shorters is to assess the RISK carefully, OWN IT and then HIT BUY!!! BUY!!! BUY!!! Until the Bear recoils, turns hide and Runs!

..Knock em back into LAST CENTURY where they belong !

This will cause them to panic like a shoal of terrified SQUID being menaced by a hungry MOBY DICK and COVER their little SHORTS in case they get exposed revealing The embarrassing TRUTH - TINY NUTS!!!

The Index will rapidly recover and they will be nursing smashed teeth and TWO Black Eyes along with a critical puncture through their Ribs into their Heart as they rapidly BLEED to Death!

They must be aware that they are NOW in A DANGEROUS NO MANS LAND at this point..? (For the wider Market...maybe not the Banks?)

Wait for the VIOLENT THRUST of those Horns my Furry Foes. Its coming!

One quick thrust followed by a sustained 3 Soldier Thrust and its time to draw the curtains back at your Den sweeties.

...but SERIOUSLY...

I think it should be all smiles from hereon up as THE BULLS that believe in the GREAT POTENTIAL OF AUSTRALIA as a NATION take FIRM CONTROL!

Its all about Balls GentleMen! (Hence the Bull Iconography) - Grow some of those and thrust your Horn critically upward through the Heart of the Bear! (3 x)

That should finish him off quite quickly...

I will stay abreast of this dynamic situation and attempt the periodic update.

Please always DYOR and NEVER take my commentary or opinion as any sort of Financial advice relevant to ANY specific situation or Investment Scenario.

PEACE LOVE AND RESPECT to ALL.

Australian All Ords Point and Figure Bullish Price Objective.Fellow traders/analysts, prior post of mine looked at EW forecast of an Intermediate Degree where the target of it is also shown ( top forecast at 6764) shown at the top of this chart. Time to look at Point and Figure chart to see if there is a harmony/sync between two ?

We must bare in mind the box size of this chart in this analysis ( 40.4 points).

What do we see ? One target from earlier chart pointing the finger at 6764 and one from this analysis at 6941.60 !

I leave rest of the interpretation to you other than to say that I would not be surprised to see XAO knocking on 7000 level during the current up leg. Close enough is also good enough in my book.

Keep well and chart well.

Analysis here is for educational purposes only. It is not an investment advice.

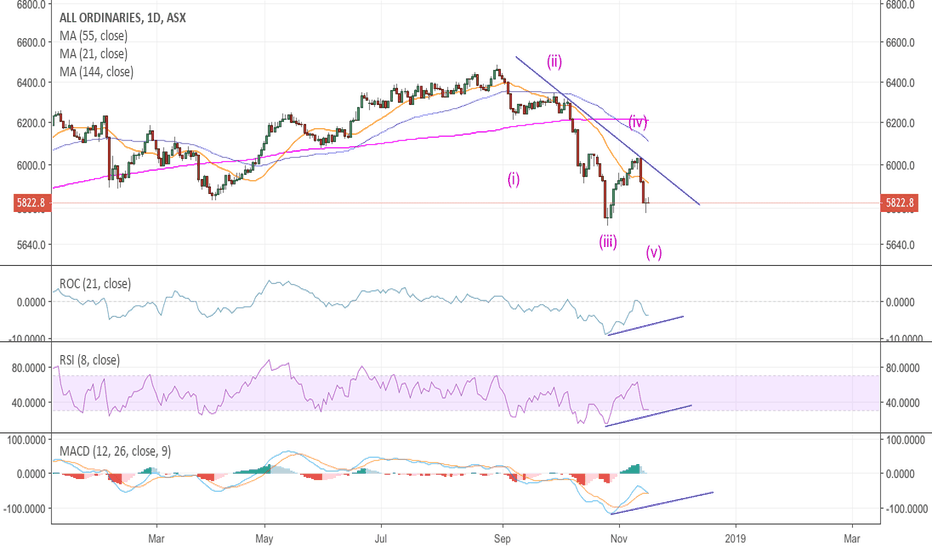

XAO, All Ords position in the trend and where from here ?Long term monthly chart of XAO, focusing on the intermediate degree swings within the next higher degree/time frame. It appears as though the floor for wave 4 is now set at 5834 ( low of penultimate bar). As long as this level is respected, next bullish objective which is likely to mark the high point of the current impulse/motive wave is at 6764 from this EW forecast. This target is also in tune and in sync with the bullish forecasts from point and figure charts which I have.

Above analysis is for educational purposes only. It is not an investment advice.

All Ordinaries to see 3,365? Short-term to visit 5,727A bearish rising wedge has been forming on the All Ordinaries -1.20% since 2009 (see monthly chart). A downside breakout will occur below 5,600 points, with a target of 3,365 points.

The shorter term outlook is likewise bearish . On 5 February a Heads and Shoulders breakout occurred, which was confirmed when prices met the neckline at 6184 points on 27 February. Since then we have had a symmetrical triangle breakout to the downside on 23 March. Prices may come to re-test this pattern, at about 6050 points, but the ultimate target is 5727 points. This is also around the bottom of the downtrend that has formed since the Heads and Shoulders breakout. Expect prices to rest here before potentially completing the longer-term rising wedge pattern to the downside

Australian All Ordinaries (XAO) Short Term Outlook.This analysis of Australian All Ords. (XAO) is for EDUCATIONAL PURPOSES ONLY. It is my view that, latest price action behaviour experienced with XAO has started the process of a MAJOR DISTRIBUTION/TOP. Bar marked as "Sign Of Weakness Bar" is likely to have follow through effect to higher time frames, in time off course. Distribution by smart money/better informed more often than not takes a while ( weeks/months) unless an inverse V correction is on hand. New highs with failed followed - through is also on the cards.

Unfortunately, one box PnF count can not be taken due to a missprint by the software.This said, I have a short horizon bearish price objective of 5847.50 at present from a properly constructed 1 box chart ( not shown).

Analysis continues with interesting times ahead.....