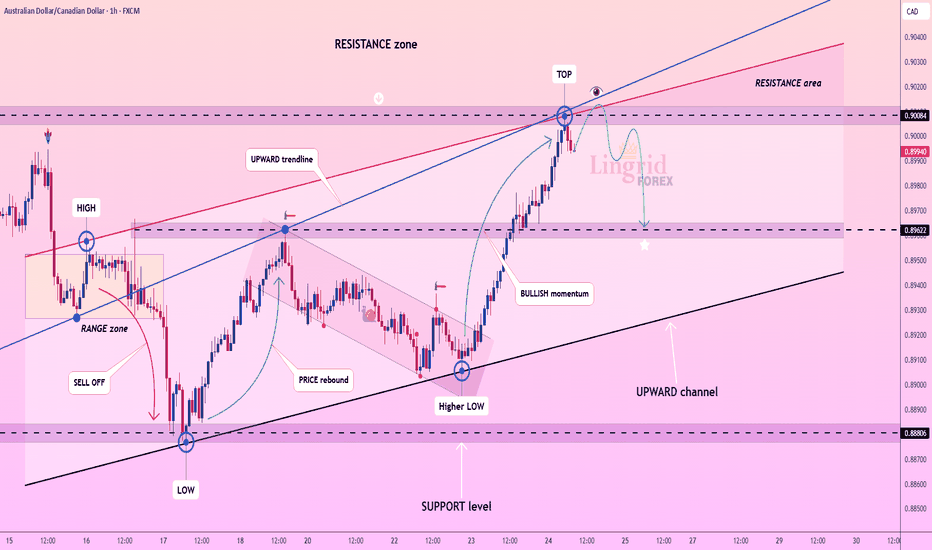

Lingrid | AUDCAD Swap Zone. Potential Selling OpportunityThe price perfectly fulfilled my last idea . FX:AUDCAD is rebounding from a strong support area after a fake break below 0.88805 and is now moving toward the descending trendline. The price is expected to test the swap zone near 0.89421, where prior support may flip to resistance. This setup favors a SELL scenario from the lower high structure within the flag and downtrend. A rejection from the trendline could resume the bearish continuation back toward support.

📌 Key Levels

Sell zone: 0.89421 – 0.89500

Buy zone: 0.88805 – 0.88600

Target: 0.88805

Invalidation: Break and close above 0.89550

💡 Risks

Bullish breakout through the descending trendline

Sharp reversal from macroeconomic news

Short-term consolidation above 0.89100 weakening momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

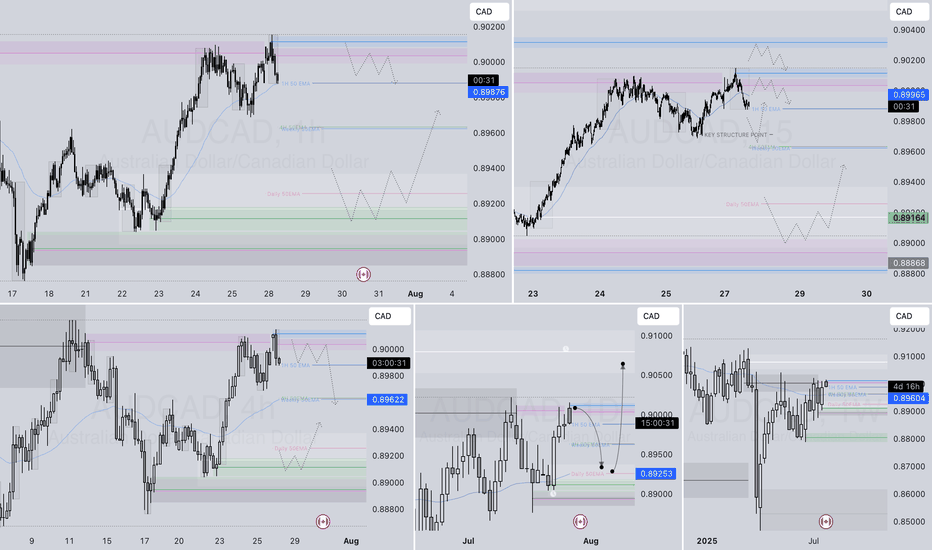

AUDCAD trade ideas

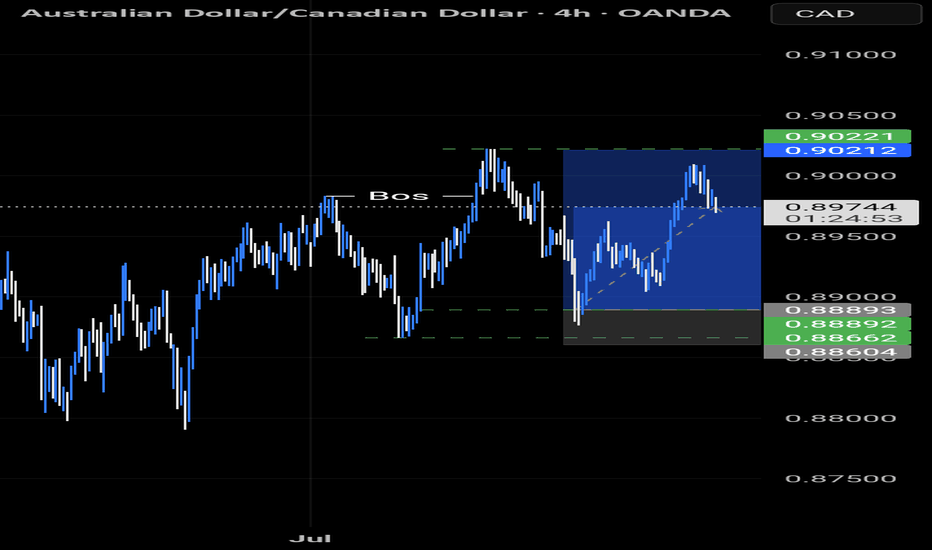

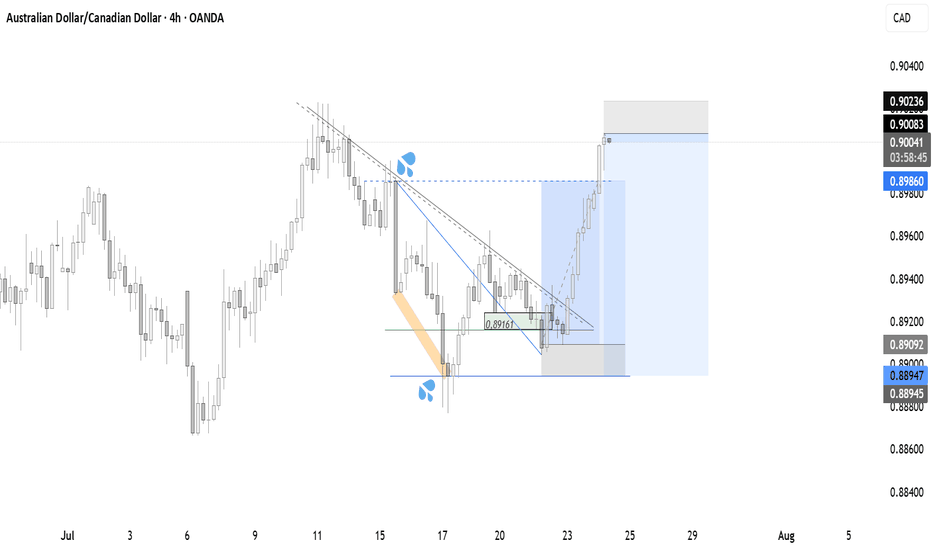

AUDCAD4HR:

The price broke down from a double parallel channel, forming a lower low, which confirms a bearish bias. It then pulled back to retest the broken channel and resistance, where a long-wick candle rejection occurred.

This rejection also aligned with multiple previous Points of Control (POC), adding confluence.

Afterward, a shift from bullish to bearish was confirmed on the 15-minute timeframe.

A clean 1:2 risk-reward trade setup followed.

DAILY AUDCAD SELL IDEA 📍AUDCAD Market Breakdown – ABC Setup in Play

Right now, AUDCAD is showing signs that we’ve entered the B to C leg of our ABC framework.

We had a clean consolidation phase that transitioned into a decisive expansion, textbook market behavior that aligns with the buildup and breakout principles we teach. That expansion gave us our possible “B” point, and now we’re seeing the retracement phase unfold which is the real gem for Snipress-style execution.

Price action has now tapped into a key level we’ve been watching for high-quality continuation shorts. The structure is aligning:

✔️ We’ve got the retracement

✔️ Price is reacting to a prior supply zone

✔️ Momentum is slowing near the level, a sign we may be gearing up for the “C to completion” leg

This is not the time to guess, it’s time to observe, confirm, and strike when the candle gives permission. Let the trade come to you. Stay sniper-minded. 🧠🔫

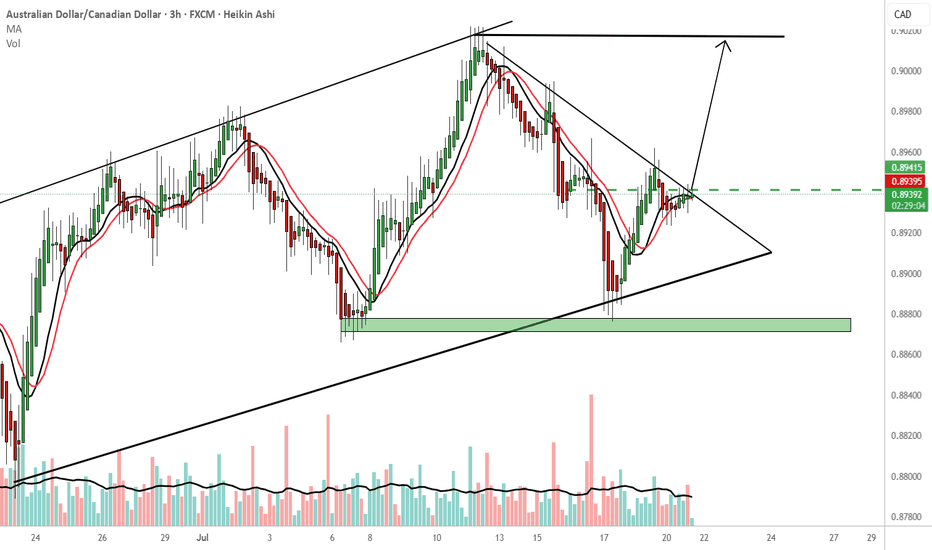

AUDCAD; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of AUDCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

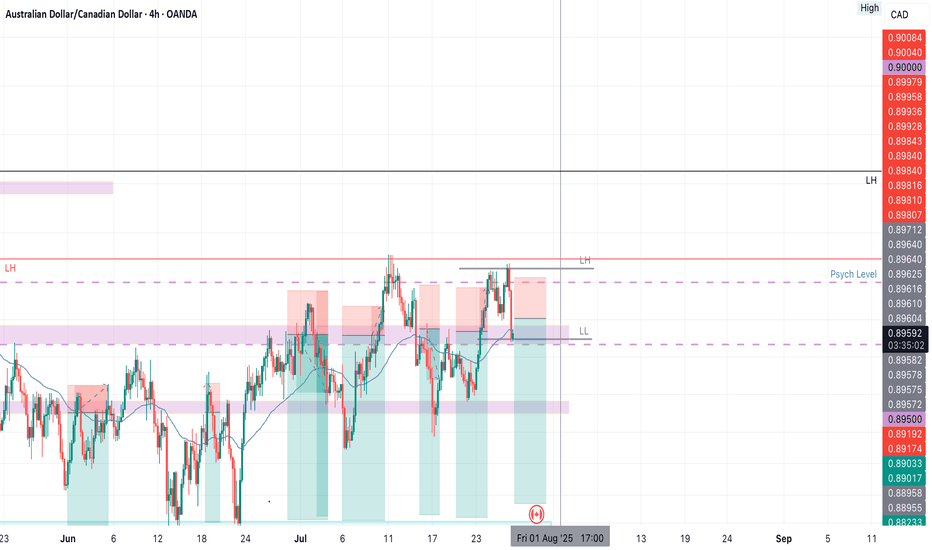

AUDCAD SHORT Market structure bearish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psych Level 0.89500

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.18

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

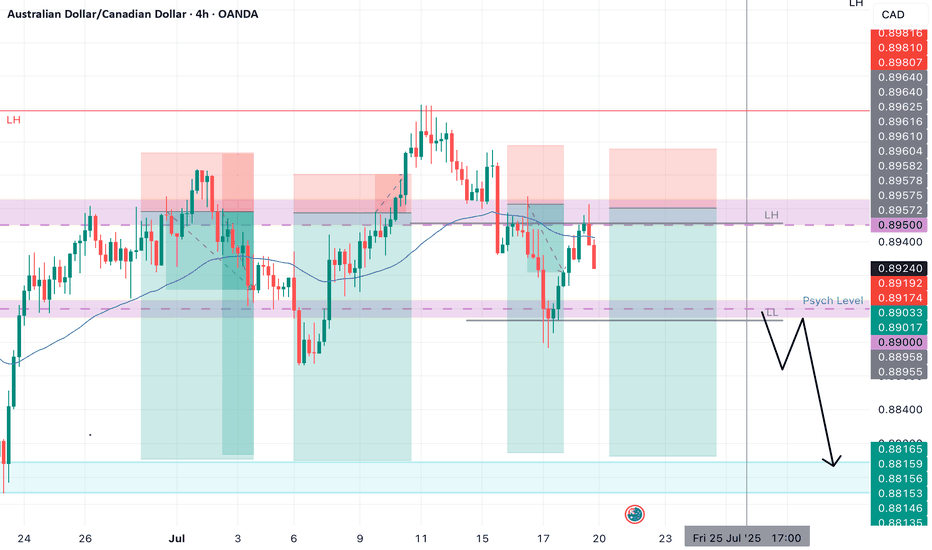

Bearish drop?AUD/CAD has rejected off the resistance level whihc is a pullback resistance and could drop from this level to our take profit.

Entry: 0.89386

Why we like it:

There is a pullback resistance.

Stop loss: 0.89800

Why we like it:

There is a pullback resistance.

Take profit: 0.88661

Why we like it:

There is a swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal?AUD/CAD is rising towards the pivot, which aligns with the 50% Fibonacci retracement and could reverse to the swing low support.

Pivot: 0.89487

1st Support: 0.88664

1st Resistance: 0.89810

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDCAD SHORT Market structure bearish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psych Level 0.90000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.51

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

AUDCAD – DAILY FORECAST Q3 | W31 | D30 | Y25

📊 AUDCAD – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDCAD

AUDCAD: Long Trade Explained

AUDCAD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCAD

Entry - 0.8914

Sl - 0.8901

Tp - 0.8941

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDCAD I Daily CLS I Model 2 I HTF DOL TargetYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

AUDCAD: Bullish Move From Trend Line 🇦🇺🇨🇦

AUDCAD may bounce from a solid rising trend line on a 4H.

The price started to consolidate on that after its test.

A breakout of a minor horizontal resistance is a strong bullish confirmation.

Goal - 0.8999

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

audcadAUD/CAD Trade Signal – Strategic Short Opportunity Identified

A compelling short-selling opportunity has materialized on the AUD/CAD currency pair, presenting traders with a potential low-risk, high-reward setup. The pair is currently trading near a key resistance level, showing signs of bearish exhaustion and potential reversal. Market participants are encouraged to consider initiating a short position around the entry price of 0.89929, where the pair appears overextended and vulnerable to downside pressure.

Trade Execution Parameters:

Entry Point: 0.89929 – This level is aligned with short-term resistance and represents a favorable risk-to-reward entry for sellers.

Take-Profit Objectives:

🎯 Target 1: 0.89888 – Initial support level, ideal for partial profit-taking.

🎯 Target 2: 0.89880 – Deeper retracement, suggesting increased bearish momentum.

🎯 Target 3: 0.89875 – Final target, near the lower boundary of current intraday range.

Stop Loss: 0.89980 – Placed slightly above the resistance area to contain losses in case of an unexpected breakout to the upside.

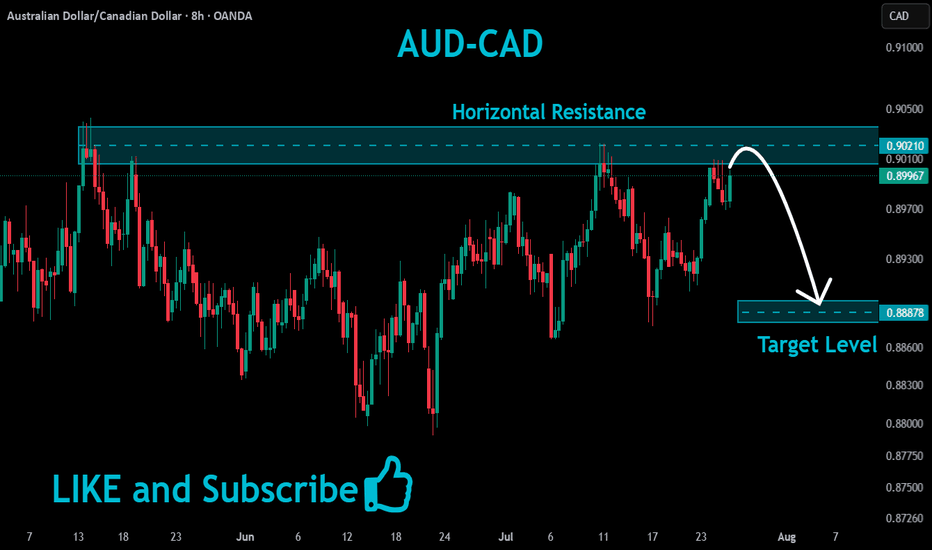

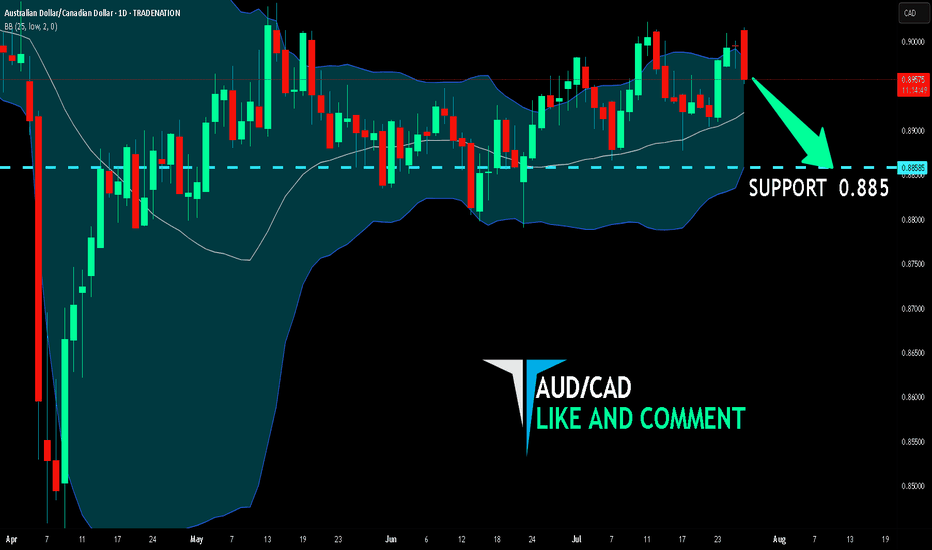

AUD/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the AUD/CAD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.885 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDCAD – DAILY FORECAST Q3 | W31 | D28 | Y25📊 AUDCAD – DAILY FORECAST

Q3 | W31 | D28 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDCAD

AUDCAD – WEEKLY FORECAST Q3 | W31 | Y25📊 AUDCAD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDCAD

AUDCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Weekly Rejection at AOi

Daily Rejection at AOi

Daily Previous Structure Point

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 4.17

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Lingrid | AUDCAD Short Following Resistance Fake Breakout The price perfectly fulfilled my last idea . FX:AUDCAD is rejecting from the top of the resistance zone after a strong bullish impulse and has started forming a rounded top pattern. Price remains inside an upward channel but is showing signs of exhaustion with the blue arrow projecting a pullback. As long as the price stays below 0.9008, we expect a descent toward the 0.8962 region. Momentum is cooling, and a bearish correction is likely before any bullish attempt resumes.

📉 Key Levels

Sell trigger: Break below 0.8990

Sell zone: 0.8995 – 0.9012

Target: 0.8962

Invalidation: Break and close above 0.9025

💡 Risks

Strong bullish momentum may resume if support holds

Failure to break 0.8990 could trap early sellers

Macro data from AUD/CAD region may disrupt the structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

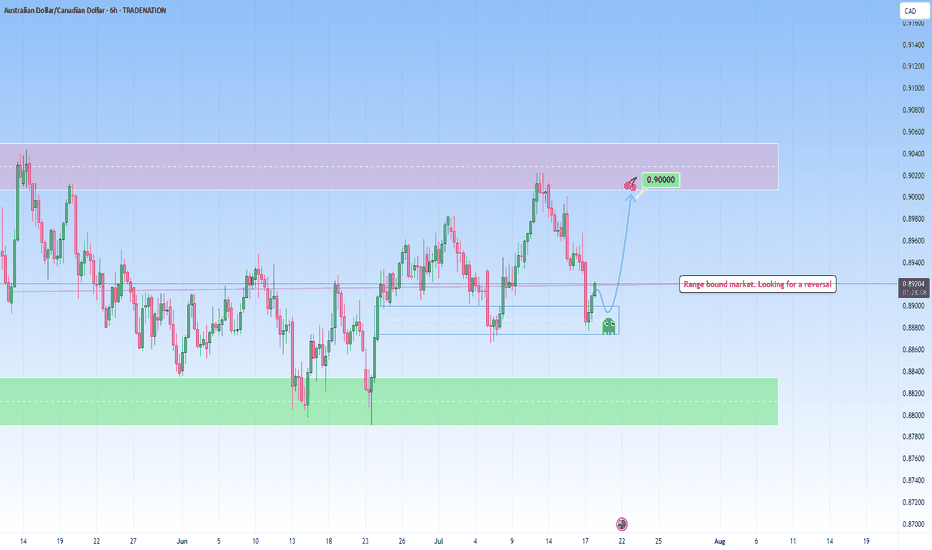

AUDCAD: Respecting Structure, Repeating OpportunityWhat we’re looking at here is a beautifully balanced range market, the kind I love trading, because it speaks so clearly when you take a moment to listen. Price is respecting both sides of this range clearly. The lows are being protected and respected multiple times before.

We’ve already tapped into that lower bound, and the reaction has been good, together with liquidity collecting. And when price finds its feet in these kinds of zones, I immediately think of what the range is offering, right now, with risk clearly defined and reward just sitting at the other edge, waiting.

If price gives us one more small retest, I’m watching for confirmation: not just in candlestick structure, but also in volume behavior. I have my eyes set straight on that upper resistance zone near 0.90000.

And from there unless there’s a news catalyst or volume breakout, that’s where the move likely might exhaust… and that’s where I’m out, before the reversal can bite.

If the structure shifts, I’ll shift too. But until then, this is a perfect range.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.