AUD-CAD Will Fall! Sell!

Hello,Traders!

AUD-CAD made a retest of

The horizontal resistance

of 0.8880 then established

A double top pattern so we

Bearish biased and we will

Be expecting a furter

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD trade ideas

AUDCAD: Bearish Continuation is Highly Probable! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the AUDCAD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDCAD Is Very Bullish! Long!

Here is our detailed technical review for AUDCAD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.853.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.869 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDCAD Buy Limit SetupDirection: Long (Buy)

Entry Type: Limit Order

Risk-to-Reward Ratio: 3.47

Technical Context:

AUDCAD has been developing a strong bullish trend structure with clean higher highs and higher lows. Price has recently broken out of a consolidation range and is now forming a potential continuation setup. The current entry targets a retest of the breakout zone, which overlaps with an area of previous accumulation.

Entry Level:

A Buy Limit order is placed at 0.88339, coinciding with the upper edge of the former consolidation and acting as newly established support.

Stop Loss:

Set at 0.88226, just below the base of the zone, to account for potential wick-based volatility while preserving structural integrity.

Take Profit:

The target is placed at 0.88731, corresponding with a minor resistance zone created by the previous local high, and yielding a favorable risk-to-reward ratio of approximately 3.47.

Trade Rationale:

This setup aims to participate in the continuation of a bullish trend after a textbook breakout and retest scenario. The entry zone is strategically selected based on both horizontal structure and breakout dynamics. A confirmation through RSI behavior supports the underlying momentum.

Notes:

This trade aligns with a broader strategy of scanning major and minor pairs for clear trending opportunities on the 1-hour timeframe, with precise entries executed through limit orders at structurally sound levels.

AUD/CAD "Aussie-Loonie" Forex Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/CAD "Aussie-Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.86400) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.89500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/CAD "Aussie-Loonie" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDCAD Wave Analysis – 14 April 2025

- AUDCAD reversed from the support zone

- Likely to rise to resistance level 0.8860

AUDCAD currency pair recently reversed up from the support zone located at the intersection of the long-term support level 0.8600 (which started two weekly uptrends from 2022) and the lower weekly Bollinger Band.

The upward reversal from this support area created the weekly Japanese candlesticks reversal pattern Piercing Line.

Given the strength of the aforementioned support zone, AUDCAD currency pair can be expected to rise to the next resistance level 0.8860, the former strong support from January.

AUD/CAD 4H Analysis – Smart Money Building a CaseStructure: Bullish | Timeframe: 4H | Pair: AUD/CAD

Alright, keeping this clean and honest 👇

Price swept buyside liquidity earlier around 0.90500, tapped into a bearish order block and dumped hard. That entire move was textbook—OB reaction, BOS confirmed, and then a clean drive down.

Fast-forward:

We swept sell-side liquidity at the bottom (~0.84400), tapped into a refined bullish OB and flipped structure with an MSS → then BOS followed. So yes, bulls took control.

After that, price formed an FVG between 0.85700 and 0.86100 — and it filled beautifully. Price respected it, and we pushed up toward 0.87800.

Right now… we’re in premium territory.

Let me say it clearly:

No fresh buys here. Not the place.

We wait for the price to come back to the FVG zone or OB and then look for a lower timeframe CHoCH or bullish candle.

Not guessing.

Not forcing.

Just reacting to the flow.

If price breaks below BOS and closes below FVG → we flip bias. Simple.

Until then:

📌 Patience wins. Revenge trading doesn’t.

💬 Drop a comment if you're watching this level too.

Let’s see if smart money brings it home from the FVG again.

And yeah, follow if you trade based on logic, not hype.

#AUDCAD #SMC #OrderBlock #FairValueGap #SmartMoney #LiquiditySweep #ForexCitySignal #NoRetailNoise

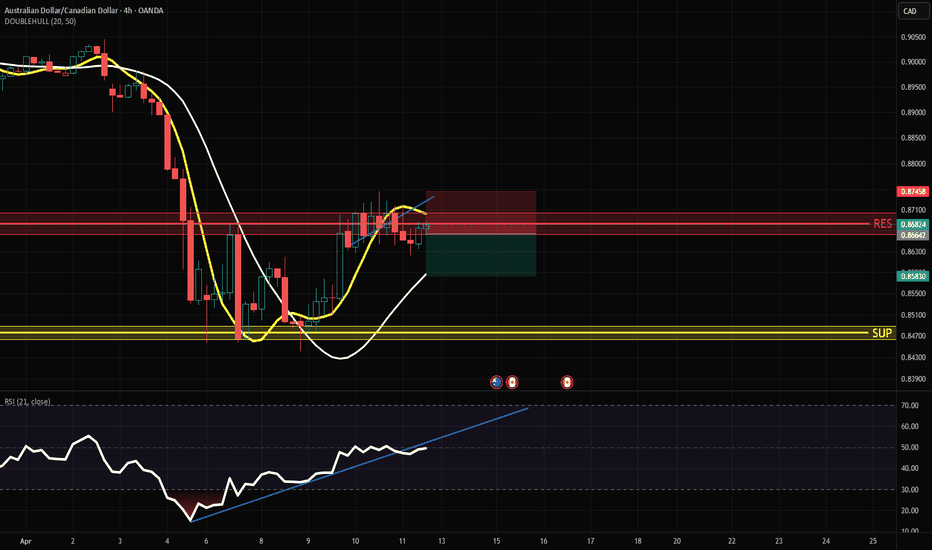

AUDCAD short on central bank policy and risk off sentimentInteresting level on AUDCAD around a 4hr fib retracement. Holding below the 200ema with areas of thin volume being filled and recent days POC's breaking lower.

Hourly chart has OBV and RSI divergence around the level and a potential rising wedge, would like to see OBV breaking lower accompanied by price breaking structure before rushing in.

Currently the BOC is set to hold rates in their meeting later in the week whilst the RBA is set to cut rates by a further 25bps. Furthermore, if the risk sentiment continues to be poor as tariff concerns are still very present, we might see further downside on AUD as a risk on currency.

AUD/CAD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/CAD pair is in the uptrend because previous week’s candle is green, while the price is obviously falling on the 1H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 0.870 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

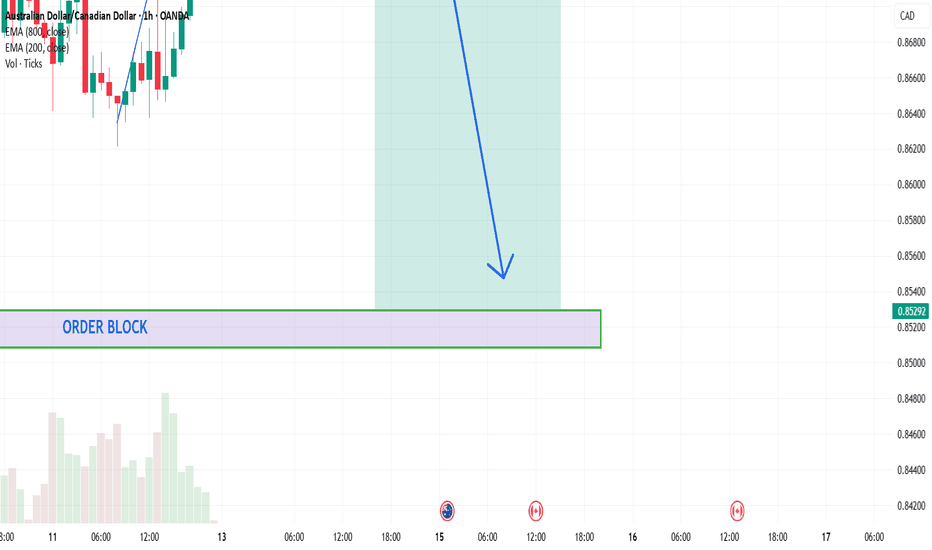

AUDCAD SHORTAUDCAD is expected to go short after completing the current bullish run.

price is expected to reach the bearish orderblock at around 0.91054 and then start a bearish run all the way down to the bullish orderblock at around 0.85295.

NOTE: This is just my analysis, conduct your own analysis before PLACING the trade.

please use proper risk management .

AUDCAD — Breakout coming, or will price keep pushing on?AUDCAD is currently testing a key level. Watching closely to see if price breaks out or continues within the current range. A breakout could open up new trading opportunities, while rejection might signal further consolidation or a move back within structure. Keeping an eye on price action for confirmation.

AUDCAD – Bullish Trade Setup (short term)✅ Key Observations:

Timeframe: 1 Hour

Signal: Bullish Divergence on RSI

Trend Context: Likely in a pullback or accumulation phase within a higher timeframe structure

🔍 Technical Confluences:

RSI Divergence: Price made a lower low while RSI made a higher low – classic bullish divergence

Potential Support Zone: Price likely bouncing from a demand zone

Volume (if visible): Look for declining sell volume or spike in buy volume

📈 Trade Plan – LONG Position

Entry:

On confirmation candle (first strong bullish candle after divergence)

OR break of minor resistance/trendline above divergence pattern

Stop-Loss:

Below the recent swing low (beneath divergence point)

Take-Profit Targets:

TP1: Previous high / structure resistance

TP2: Extension of the move, possibly around 1.27 or 1.618 Fibonacci extension from the swing low

Risk-Reward Ratio: Minimum 1:2

⚠️ Risk Notes:

If price fails to break structure or gets rejected at a minor resistance – re-evaluate

Best to enter when divergence aligns with a support zone or trendline