Market review week ending Friday 4th April- Part oneVideo review of the state of the market and part one of trading plan for next week. Covers macroanalysis of current currency indexes along with VIX and starts reviewing our chosen watchlist verifying assets we are interested in creating trading plans for the week on.

AUDCHF trade ideas

AUD/CHF "Aussie vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

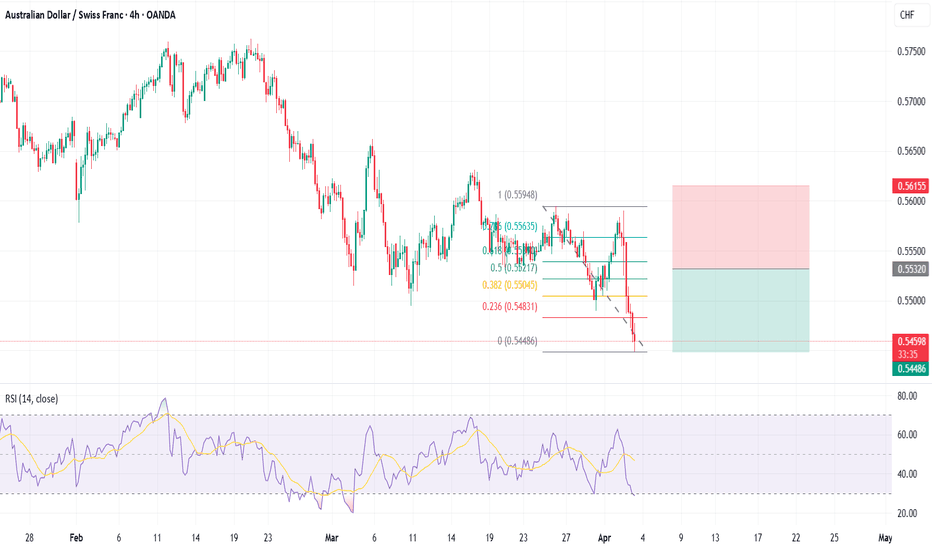

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗AUD/CHF "Aussie vs Swissy" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.56500) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.53500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

AUD/CHF "Aussie vs Swissy" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.📰🗞️Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend.

☀⭐☀Fundamental Analysis

Interest Rates: The Reserve Bank of Australia (RBA) has maintained an interest rate of 3.35%, while the Swiss National Bank (SNB) has kept its rate at -0.75%.

GDP Growth: Australia's GDP growth rate is 2.3%, while Switzerland's GDP growth rate is 1.4%.

Inflation Rate: Australia's inflation rate is 6.8%, while Switzerland's inflation rate is 2.2%.

Employment Rate: Australia's unemployment rate is 3.7%, while Switzerland's unemployment rate is 2.2%.

☀⭐☀Macroeconomic Factors

Trade Balance: Australia's trade balance is AUD 13.3 billion, while Switzerland's trade balance is CHF 2.4 billion.

Current Account Balance: Australia's current account balance is AUD -2.3 billion, while Switzerland's current account balance is CHF 21.1 billion.

Government Debt: Australia's government debt is 45.1% of GDP, while Switzerland's government debt is 41.1% of GDP.

☀⭐☀Global Market Analysis

Risk Appetite: Global risk appetite is currently neutral, with investors cautiously optimistic about the global economy.

Commodity Prices: Commodity prices, particularly iron ore and coal, have been volatile, impacting the Australian economy.

Global Economic Growth: Global economic growth is expected to slow down, with the IMF forecasting 3.2% growth in 2025.

☀⭐☀COT Data

Net Positioning: As of March 11, 2025, the net positioning of AUD/CHF is -10,000 contracts, indicating bearish sentiment.

Long/Short Ratio: The long/short ratio is 0.75, indicating that short positions outnumber long positions.

Open Interest: Open interest is 35,000 contracts, indicating moderate market participation.

☀⭐☀Intermarket Analysis

Correlation with Other Currencies: AUD/CHF is positively correlated with AUD/USD and negatively correlated with USD/CHF.

Commodity Prices: AUD/CHF is positively correlated with iron ore and coal prices.

Yield Spreads: The yield spread between Australian and Swiss government bonds is 1.25%, indicating a moderate advantage for the Australian dollar.

☀⭐☀Quantitative Analysis

Trend Analysis: The AUD/CHF is currently in a neutral trend, with a 50-day moving average of 0.5520.

Momentum Indicators: The Relative Strength Index (RSI) is 50.2, indicating neutral momentum.

Volatility: The Average True Range (ATR) is 0.0065, indicating moderate volatility.

☀⭐☀Market Sentiment Analysis

Bullish/Bearish Sentiment: Market sentiment is currently bearish, with 55% of traders expecting a decline in the AUD/CHF.

Positioning: The majority of traders are short AUD/CHF, with a short/long ratio of 1.2.

☀⭐☀Positioning and Next Trend Move

Based on the analysis, the AUD/CHF is expected to move lower in the short term, targeting 0.5450. However, a break above 0.5620 could indicate a reversal of the trend.

Short-Term

Bullish Scenario: A break above 0.5620 could indicate a reversal of the trend, targeting 0.5700.

Bearish Scenario: A break below 0.5480 could indicate a continuation of the downtrend, targeting 0.5400.

Positioning: Traders are currently short AUD/CHF, with a short/long ratio of 1.2.

Medium-Term

Bullish Scenario: A sustained break above 0.5700 could indicate a medium-term uptrend, targeting 0.5900.

Bearish Scenario: A sustained break below 0.5400 could indicate a medium-term downtrend, targeting 0.5200.

Positioning: Traders are currently short AUD/CHF, with a short/long ratio of 1.2.

Long-Term

Bullish Scenario: A sustained break above 0.5900 could indicate a long-term uptrend, targeting 0.6200.

Bearish Scenario: A sustained break below 0.5200 could indicate a long-term downtrend, targeting 0.5000.

Positioning: Traders are currently short AUD/CHF, with a short/long ratio of 1.2.

☀⭐☀Overall Summary Outlook

The AUD/CHF is expected to remain under pressure in the short term, driven by bearish sentiment and a neutral trend. However, a reversal of the trend could occur if the Australian dollar strengthens against the US dollar or if commodity prices rise.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDCHF Trading Opportunity! SELL!

My dear friends,

My technical analysis for AUDCHF is below:

The market is trading on 0.5567 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.5542

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

FXAN & Heikin Ashi TradeOANDA:AUDCHF

In this video, I’ll be sharing my analysis of AUDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

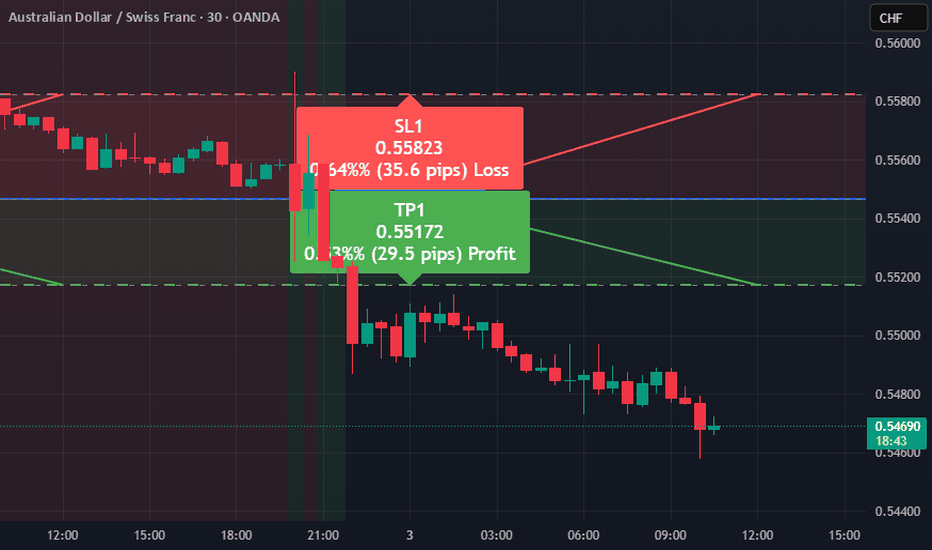

AUDCHF Analysis: Short Opportunity AheadBased on the EASY Trading AI strategy, AUDCHF signals a sell with entry at 0.55467. My analysis underlines bearish pressure supported by current technical conditions indicating weakening momentum of AUD against CHF. The immediate target (Take Profit) is projected at 0.55172, reflecting short-term bearish strength in the pair. To manage risk effectively, set your Stop Loss at 0.55823. Considering current market volatility and price patterns detected by EASY Trading AI, this trade setup provides clear and logical entry, stop loss, and take profit levels aligned with prevailing trends and momentum dynamics. Stay sharp and trade responsibly.

AUDCHF Wave Analysis – 2 April 2025

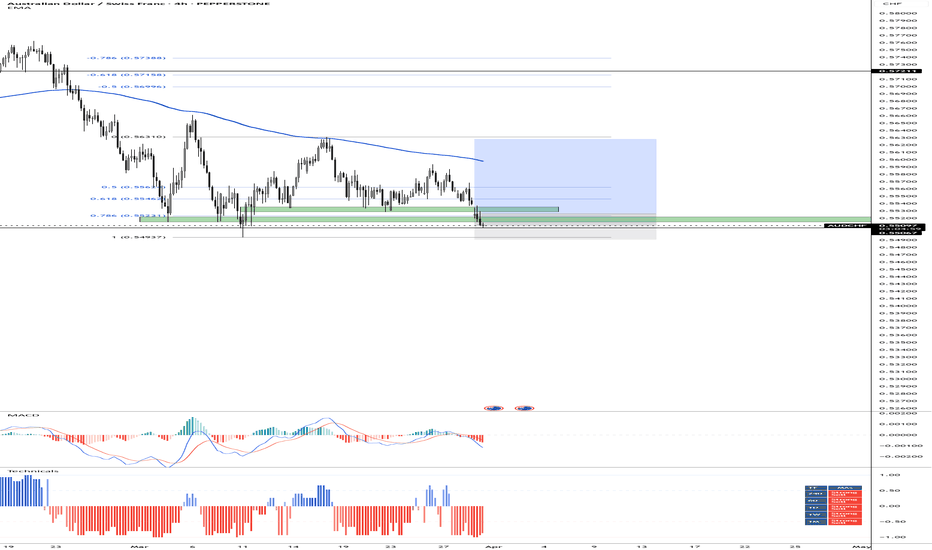

- AUDCHF reversed from the support area

- Likely to rise to resistance level 0.5600

AUDCHF currency pair recently reversed up from the support area between the pivotal support level 0.5485 (which stopped the earlier impulse wave i at the start of March) and the lower daily Bollinger Band.

The upward reversal from this support area formed the daily Japanese candlesticks reversal pattern Hammer Doji.

Given the bullish divergence on the daily Stochastic indicator, AUDCHF currency pair can be expected to rise to the next resistance level 0.5600 (top of the previous correction ii).

The Bad Date BreakawayEver been on a date so disastrously awkward that you just had to make a swift exit? That’s what this short trade feels like a moment of clarity when you decide enough is enough. It’s about recognising a no-win situation, making a bold move, and leaving with your dignity and wallet intact."

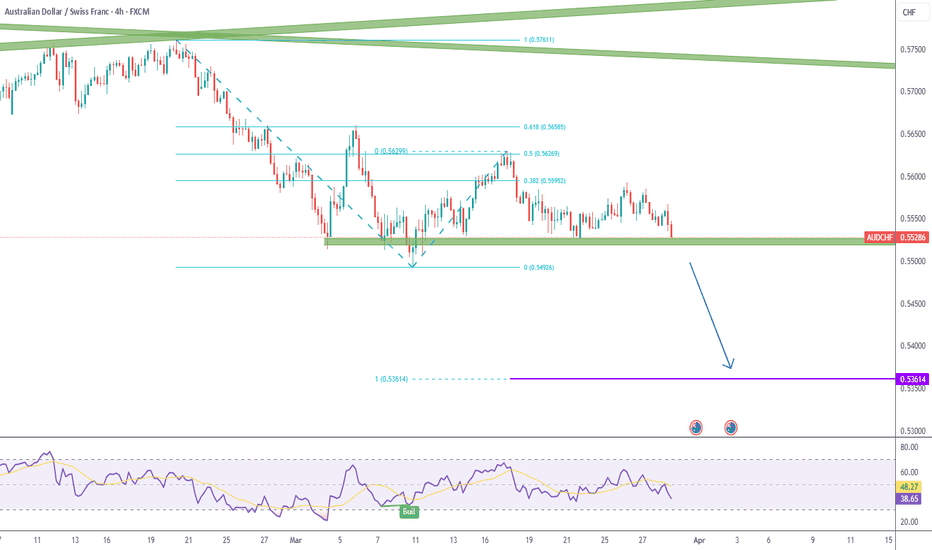

Lingrid | AUDCHF shorting OPPORTUNITY from Previous WEEK's HighThe price perfectly fulfilled my last idea . It hit the target zone. FX:AUDCHF market is currently moving towards the previous week's high after completing an ABC move. In addition, we have the upper boundary of the channel and a trendline, along with the significant round number at 0.56000 above. Since overall trend on higher timeframes remains bearish, I think that the price may rebound from this resistance level again, especially if the market shows the end of this retracement. Overall, I expect the market to form a fake breakout followed by a bearish move from the resistance. My goal is support zone around 0.55285

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

AUDCHF time to see changes?

OANDA:AUDCHF much upsides-downsides we are not see some special moves here from start of Mart.

Today we are have RBA, AUD looks like its gather power, currently price exepcting to come in zone and break of same expecting in this week.

CHF showing self weak and with other pairs, like CAD and GBP.

SUP zone: 0.55000

RES zone: 0.56200, 0.56600

AUDCHF BUYPrice has entered into the wicked area of lows that have been a previous area of momentum change. With interest rates expecting to remain the same. I don't see how the price to drive lower. I'll be looking for Buys to surcharge the price to bounce off the wicked area. Positive Swaps via USD holdings means I'll swing this from entry and work on risk off when price moves into profit and swaps can reduce risked position.

AUD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.553 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

A fall signal found.Dear viewers,today we search AUDCHF opportunities and find what I will mention later...OK,in my view the AUD has started a small downfall since 26 March and a great fall from 20 Feb against CHF.And absolutely a range zone from 4 March is wrought.!So what to do?!come back to the small fall where the price touched the descending channel border and started.Now we can see it closing a small support area.I am watching,watching If the price reacts to support, then I will sell at the indicated level...For now, we are looking at it this way with the AUDCHF.Follow the trend with its waves and enjoy!