EURAUD Is Bullish! Buy!

Please, check our technical outlook for EURAUD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.785.

The above observations make me that the market will inevitably achieve 1.787 leve

Related currencies

: EUR/AUD | Rising Wedge Pattern Near Key ResistanceEUR/AUD has been consolidating after forming a clear Rising Wedge structure between the first peak (Top 1) and the second peak (Top 2). Price action has recently tested the resistance area around 1.7860–1.7900, while holding above a demand zone near 1.7820.

From a market structure perspective:

CHo

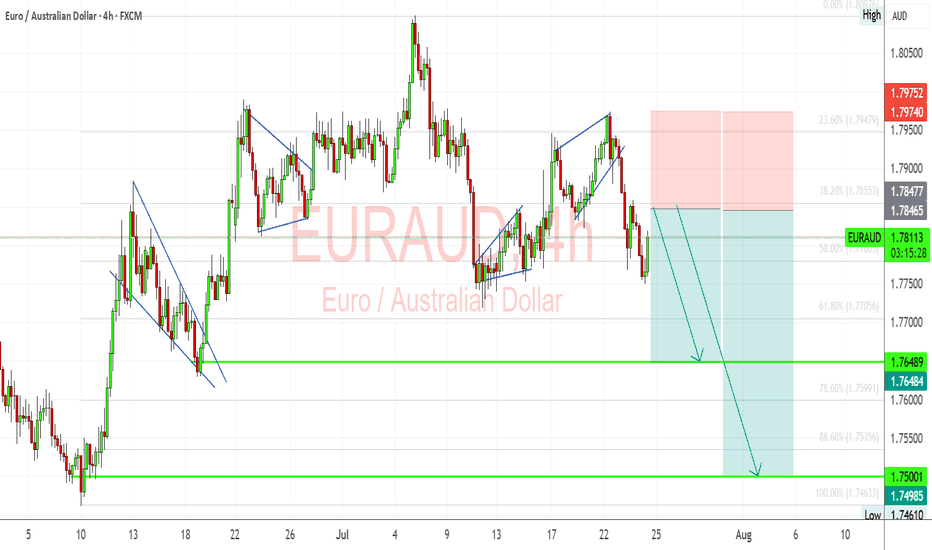

EUR/AUD Confirmed Downside Direction,Short Setup To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this sideways movement , the price finally closed below my res and we have a good confirmation with 4H Bearish candle closure below my res so i`m waiting the price to go back to retest this broken res

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup m

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Austr

EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend Short Idea)

Sometimes markets climb too far, too fast — and that’s when opportunity knocks. EURAUD has been riding a strong uptrend, but it’s now stalling at a key resistance zone. Both the Euro and the Aussie are fundamentally soft, a

EURAUD Short Trade Setup Targeting 1.76806 with Stop at 1.79902This is a 1-hour EUR/AUD trading chart showing a short (sell) setup. The entry is near the current price level, with a target at 1.76806 and a stop loss at 1.79902. The green arrow indicates the expected downward move, while the red arrow shows the risk of upward movement if the trade goes against t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of AUDEUR is 0.56056 EUR — it has decreased by −0.19% in the past 24 hours. See more of AUDEUR rate dynamics on the detailed chart.

The value of the AUDEUR pair is quoted as 1 AUD per x EUR. For example, if the pair is trading at 1.50, it means it takes 1.5 EUR to buy 1 AUD.

The term volatility describes the risk related to the changes in an asset's value. AUDEUR has the volatility rating of 0.16%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The AUDEUR showed a 0.20% rise over the past week, the month change is a −0.71% fall, and over the last year it has decreased by −6.89%. Track live rate changes on the AUDEUR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

AUDEUR is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDEUR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with AUDEUR technical analysis. The technical rating for the pair is neutral today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the AUDEUR shows the sell signal, and 1 month rating is sell. See more of AUDEUR technicals for a more comprehensive analysis.