AUDEUR trade ideas

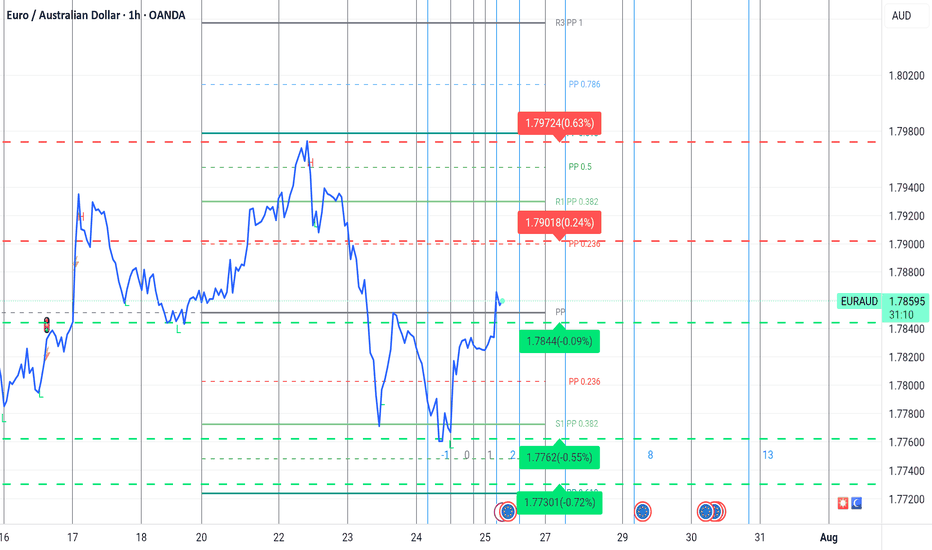

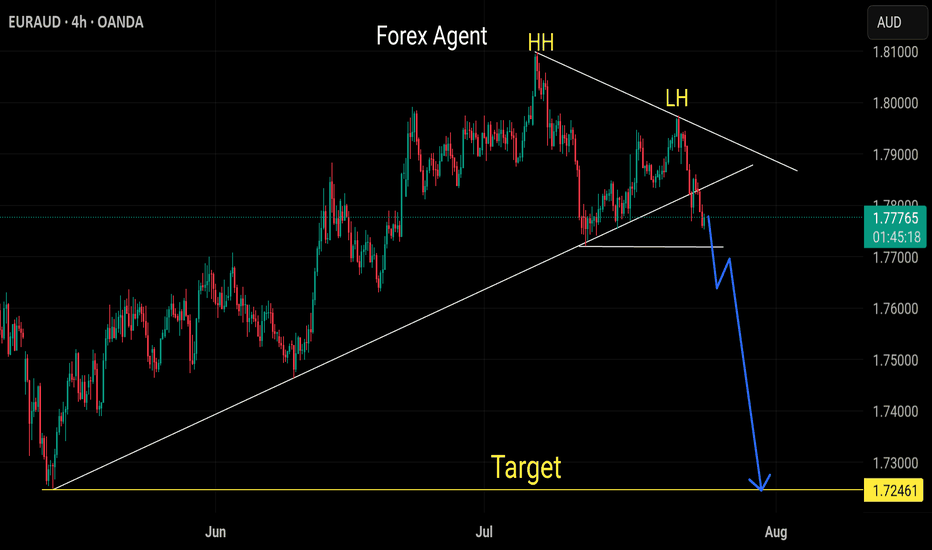

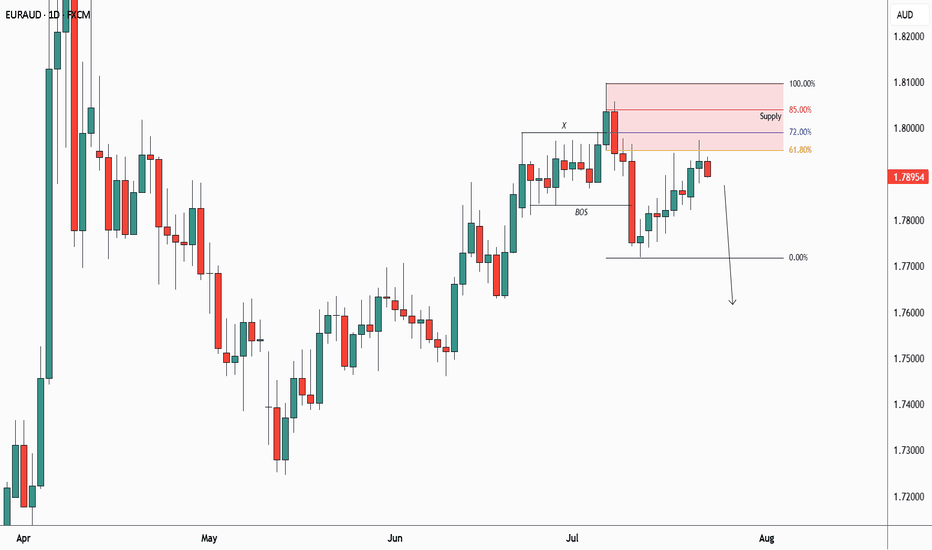

EURAUD Set To Fall! SELL!

My dear followers,

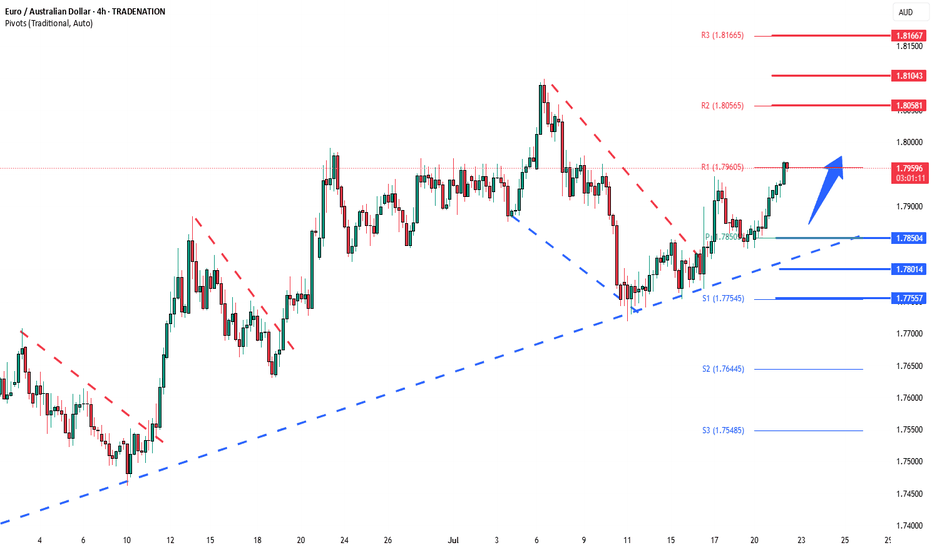

I analysed this chart on EURAUD and concluded the following:

The market is trading on 1.7917 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.7840

Safe Stop Loss - 1.7966

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURAUD: Bullish Forecast & Outlook

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURAUD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURAUD – Planning Ahead, Not PredictingAs usual, I have marked my level.

🎯 I’m waiting for the price to reach it and if a valid sell signal appears, I will enter a short position.

If the level is broken cleanly,

I’ll wait for a pullback and enter a buy trade.

We are just traders, not predictors.

We have no impact on the market —

we are just a tiny part of a huge system.

🧠 So I never say: “Price will come here, then must fall.”

That’s not my mindset.

My belief is simple:

Manage risk, be prepared for everything.

One trade won’t make me rich,

and I won’t let one trade destroy me.

📌 Stop-loss is the first and last rule.

Trading without a stop-loss is just gambling.

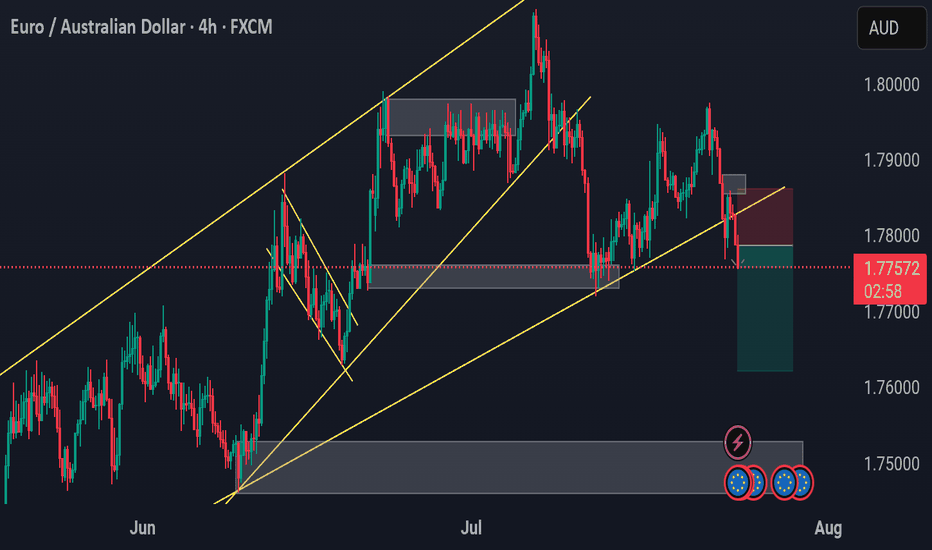

EURAUD SELL EURAUD SELL

🕒 4H Chart | FXCM Feed

Price has broken out of the ascending channel and is now rejecting a key supply zone with a clean break and retest. We anticipate continued bearish movement.

🔹 Sell Entry: 1.77675

🔹 Stop Loss: 1.78500 (−82.5 pips)

🔹 Take Profit 1: 1.76500 (+117.5 pips)

🔹 Take Profit 2: 1.75500 (+217.5 pips)

🔹 Take Profit 3: 1.74500 (+317.5 pips)

📊 Risk:Reward Ratios:

TP1 ≈ 1.42R

TP2 ≈ 2.63R

TP3 ≈ 3.85R

📎 Confluences:

✔️ Ascending channel break

✔️ Bearish retest of structure

✔️ Supply zone reaction

✔️ Clean downside space into demand zone

🔔 Partial profits at TP1 or SL to BE is advised. Let runners play if price flows cleanly.

📅 Signal Date: July 24, 2025

📢 @PulseTradesFX

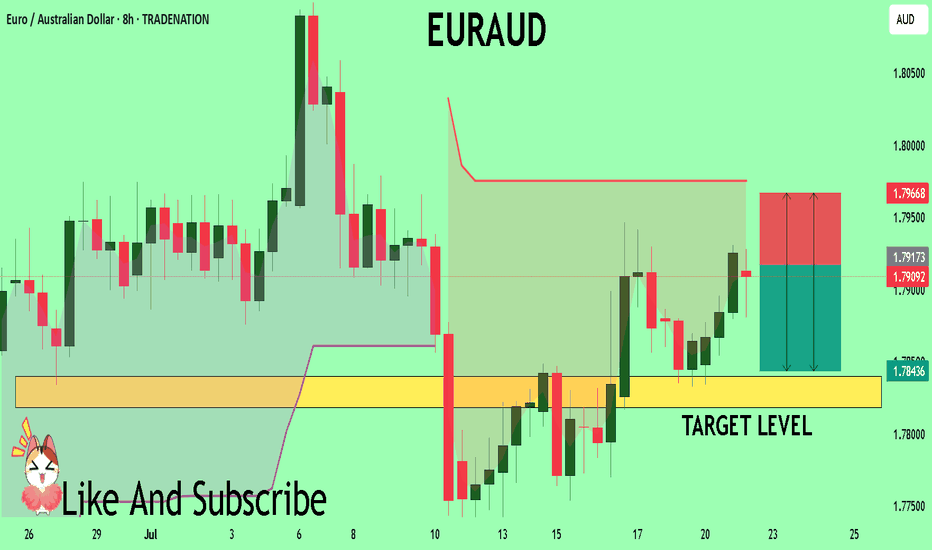

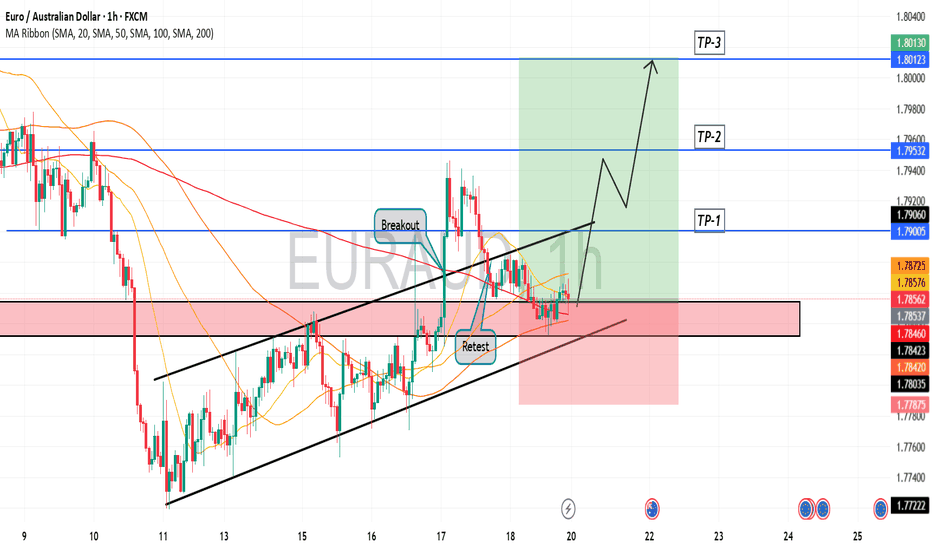

EURAUD: Rebound to 1.798 is high probabilityI am watching for a reversal here EURAUD as marked on my chart, expecting a rejection with a upside target at around 1.798.

This are is where it can become a decision point, either price finds support and bounces, or it breaks below, and that’s when we might see the move start to extend lower.

If we get a decisive move upside, my next area of interest is marked as T2. From there we can expect either potential accumulation or another reaction, depending on broader market sentiment at the time.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

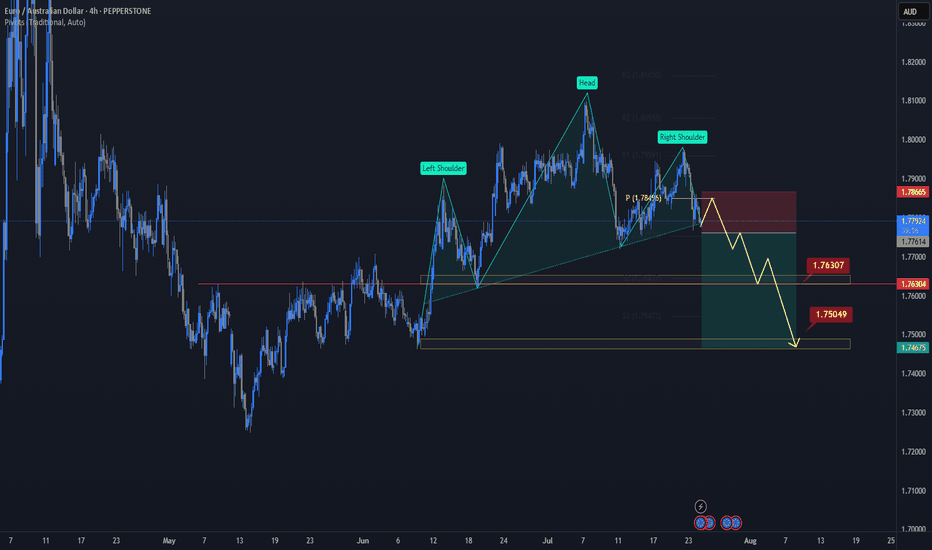

EURAUD ForecastOANDA:EURAUD is poised to confirm a bearish Head & Shoulders pattern.

The price could move higher today on hopes that the ECB can share some positive news on the economy and interest rates.

The European Central Bank is expected to keep interest rates unchanged, ending a seven-year streak of cuts.

If the price manages to break below the neckline of the pattern, it will open the door for further declines.

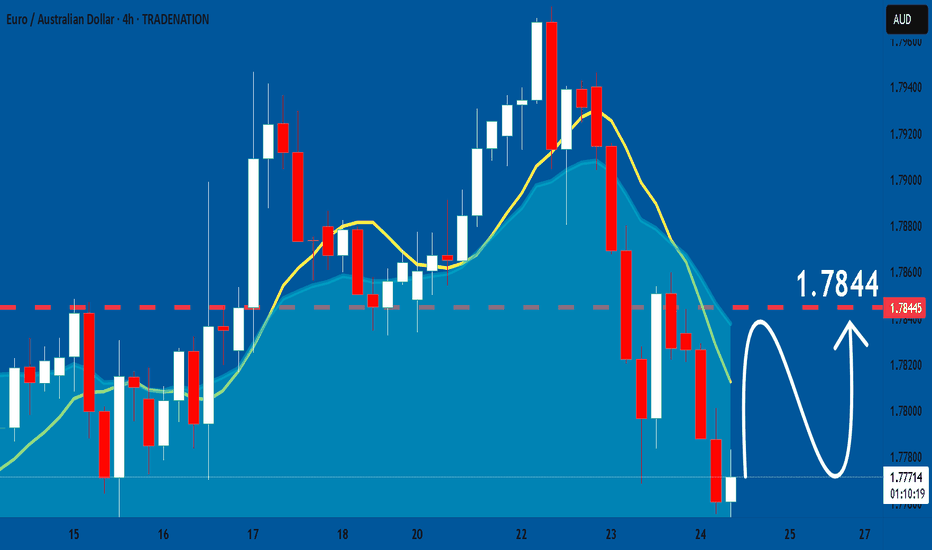

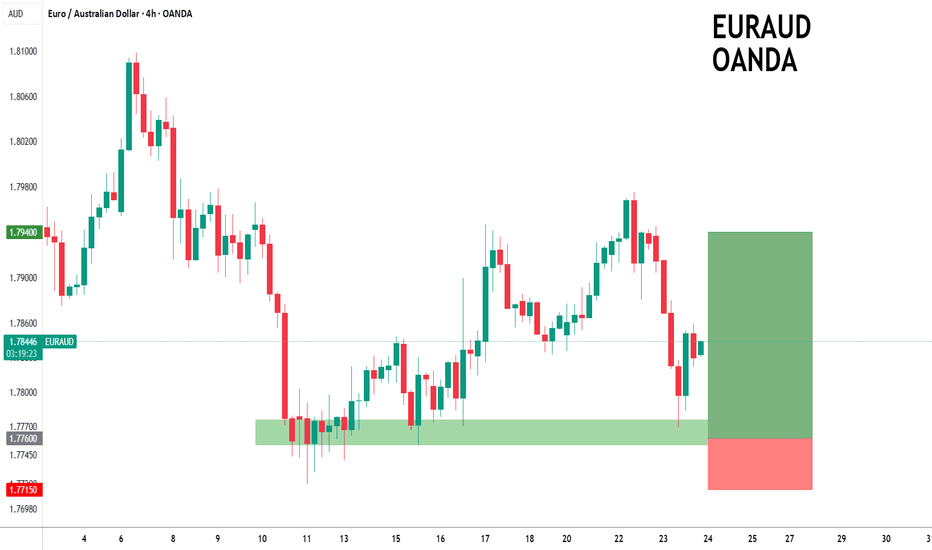

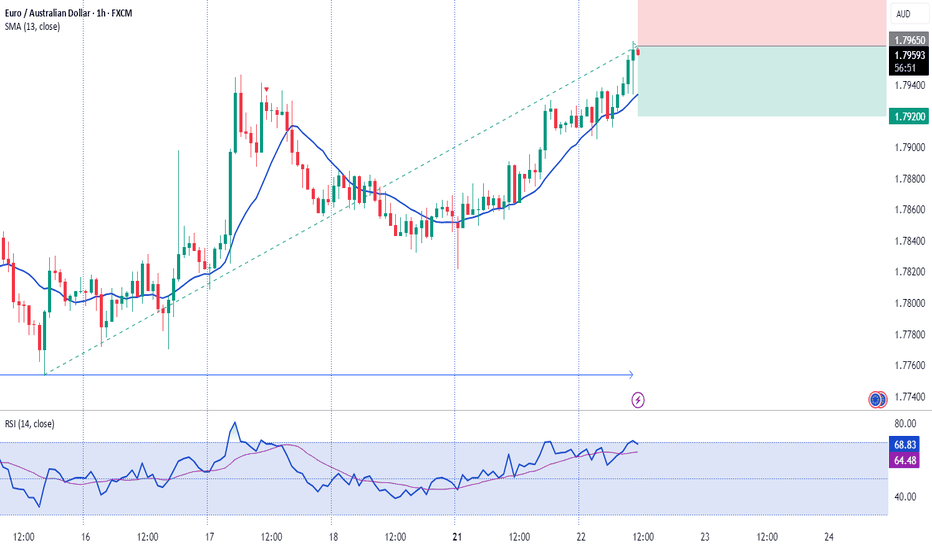

EURAUD to find buyers at previous support?EURAUD - 24h expiry

The primary trend remains bullish.

We are trading at oversold extremes.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7760.

We look to Buy at 1.7760 (stop at 1.7715)

Our profit targets will be 1.7940 and 1.7960

Resistance: 1.7840 / 1.7900 / 1.7950

Support: 1.7750 / 1.7720 / 1.7700

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

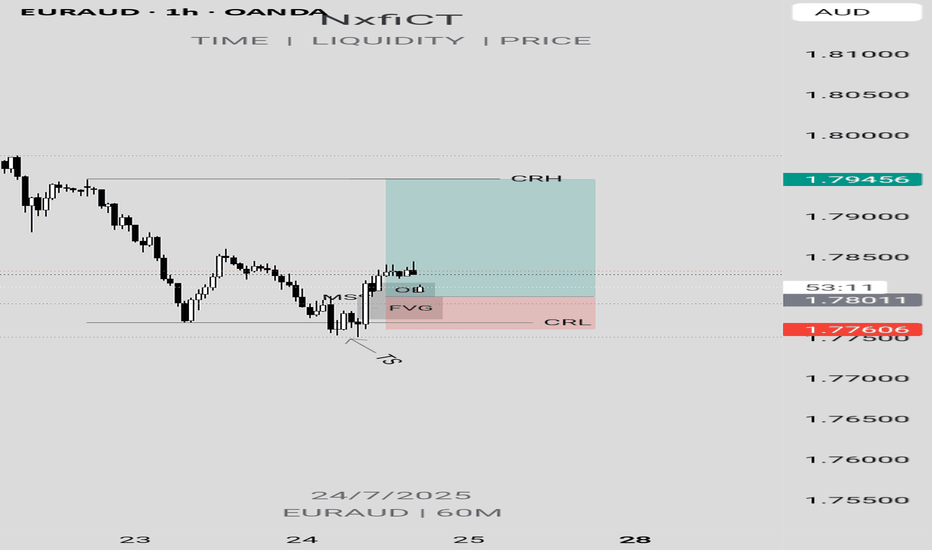

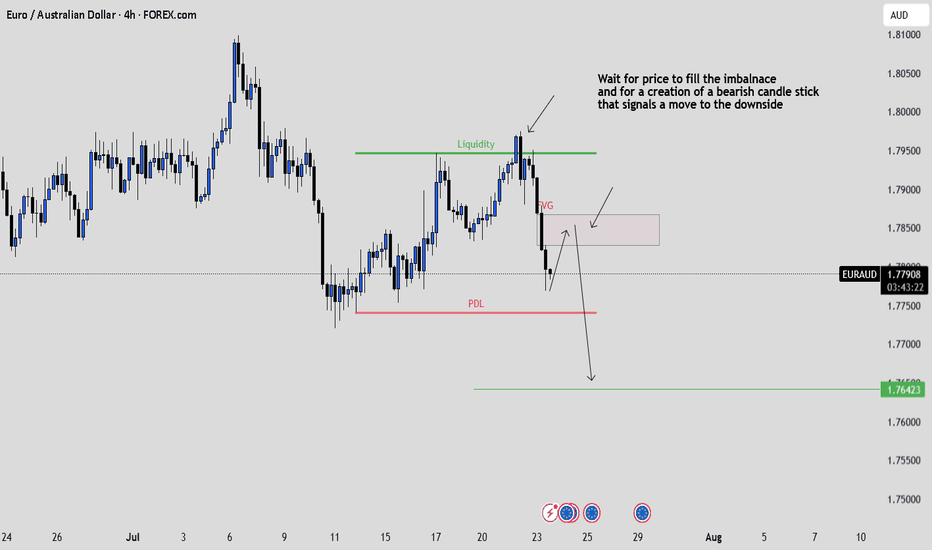

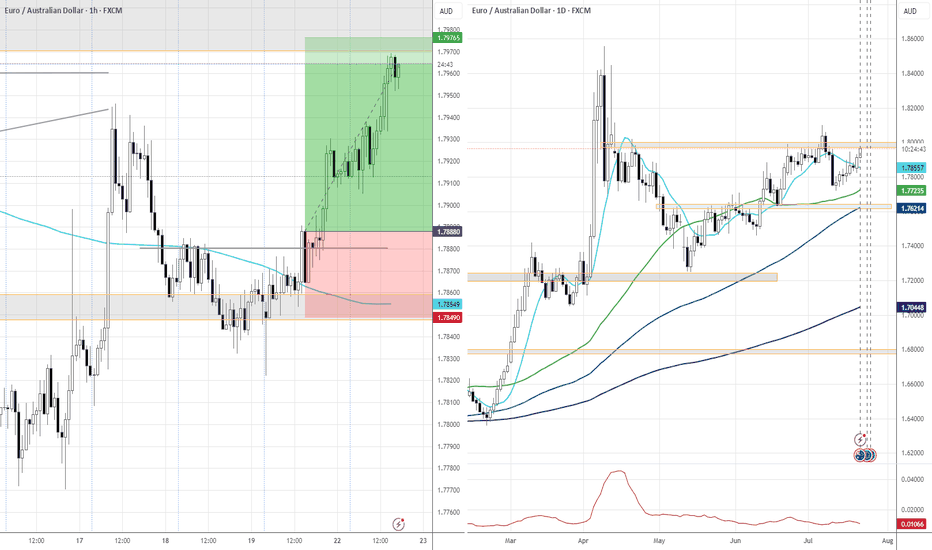

EURAUD: Waiting for the FVG Tap and Confirmation to ShortPrice ran previous liquidity and dropped aggressively, creating a clean FVG.

I’m now watching for price to retrace into that imbalance and form a strong bearish candle. If it does, I’ll be looking to short down

Clean structure. Just waiting for confirmation.

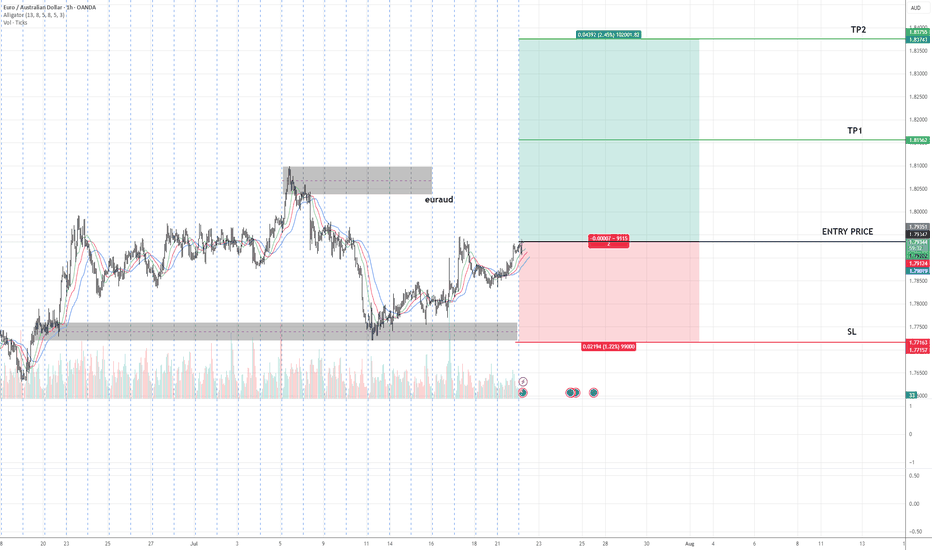

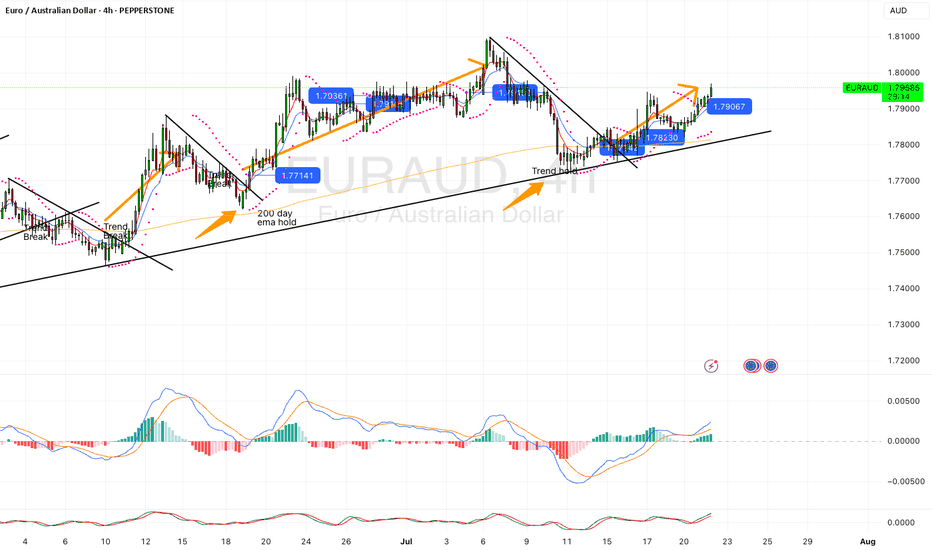

EURAUD Buy Setup – Advanced Analysis Entry: As marked on chart

🎯 TP1: As highlighted on chart

🎯 TP2: As highlighted on chart

🛑 SL: As defined on chart

📊 Technical Insight:

Price has completed a higher low formation, indicating the potential start of a new uptrend phase.

The market has shown an accumulation phase followed by a breakout above minor resistance, suggesting strong demand at current levels.

Volume analysis supports the breakout, with increased participation on bullish pushes and decreasing volume on retracements, confirming healthy trend dynamics.

📍 As long as price holds above the stop loss zone, we expect continuation towards TP1 and TP2 in line with the primary trend.

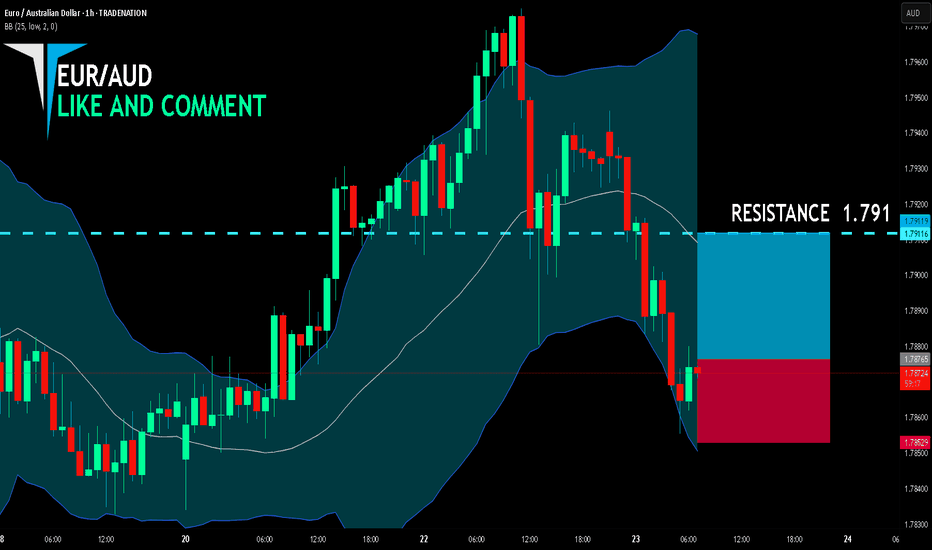

EUR/AUD BUYERS WILL DOMINATE THE MARKET|LONG

EUR/AUD SIGNAL

Trade Direction: long

Entry Level: 1.787

Target Level: 1.791

Stop Loss: 1.785

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

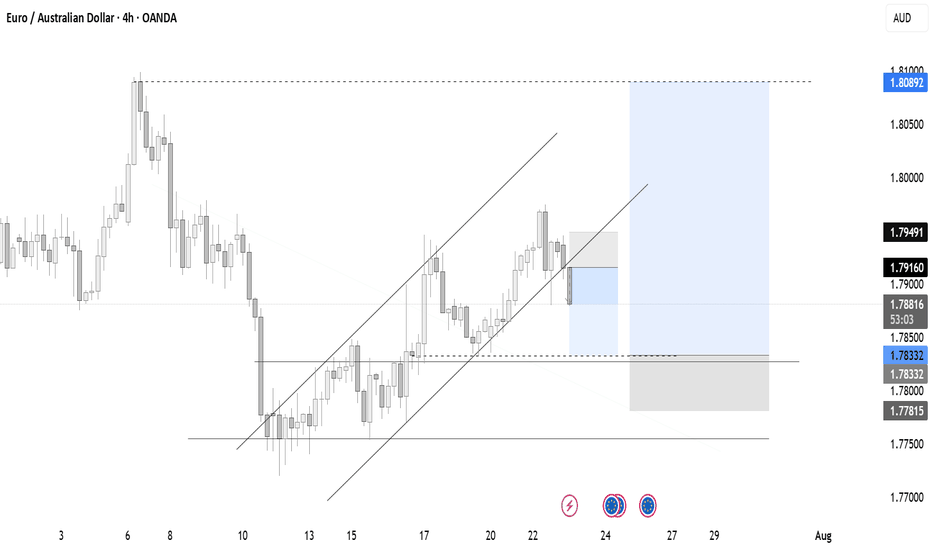

EURUAD is in the Buy directionHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURAUD Bullish breakout supported at 1.7650The EURAUD remains in a bullish trend, with recent price action indicating a continuation breakout within the broader uptrend.

Support Zone: 1.7850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.7850 would confirm ongoing upside momentum, with potential targets at:

1.8060 – initial resistance

1.8100 – psychological and structural level

1.8165 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.7850 would weaken the bullish outlook and suggest deeper downside risk toward:

1.7800 – minor support

1.7755 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURAUD holds above 1.7850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.