GBP/AUD 4-Hour Timeframe AnalysisGBP/AUD 4-Hour Timeframe Analysis

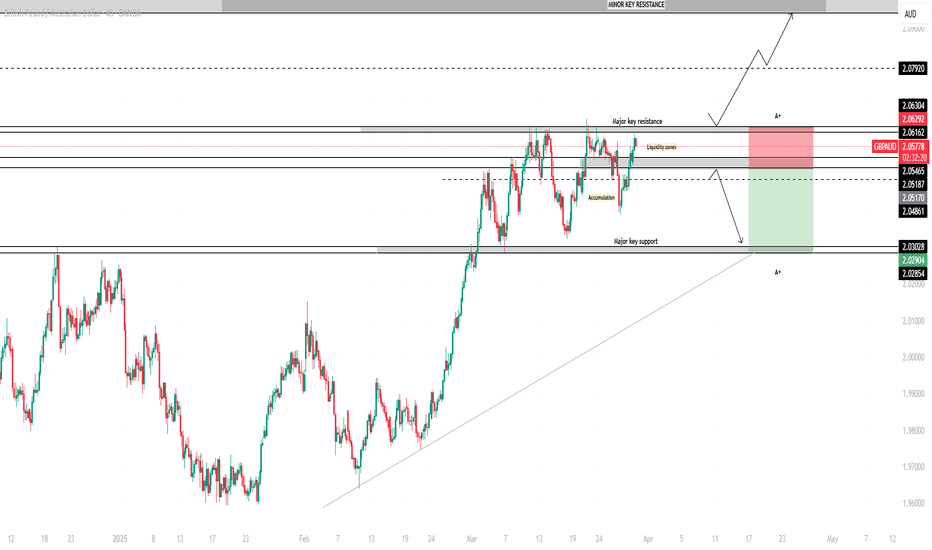

GBP/AUD has shown signs of losing momentum from its previous bullish trend, with price action consolidating within a range. We have identified key levels to watch, including a major key resistance at 2.06200 and a major key support at 2.03000. Additionally, a minor key support level at 2.05400 serves as a short-term pivot point for potential price movements.

If price breaks above the major resistance at 2.06200, we anticipate a continuation of the bullish trend toward the next minor key resistance at 2.09400. However, if price retraces and breaks below 2.05400, sellers could push the pair lower toward the major key support at 2.03000.

Outlook and Key Technical Levels

🔹 Major Key Resistance: 2.06200 (Breakout level for bullish continuation)

🔹 Minor Key Support: 2.05400 (Break below signals bearish move)

🔹 Major Key Support: 2.03000 (Downside target for sellers)

Fundamental Insight and Market Sentiment

📉 GBP Weakness: he British Pound faces mounting pressure due to weakening fundamentals. UK inflation dropped to 2.8%, fueling speculation of a Bank of England (BoE) rate cut in May. With inflation cooling, the urgency for tighter monetary policy diminishes, making GBP less appealing to investors. Adding to this downside risk, UK Chancellor Rachel Reeves’ Spring Statement introduced public spending cuts, further dampening growth prospects for 2025 and increasing concerns about the UK’s economic trajectory.

📈 AUD Resilience: The Australian dollar initially faced losses due to a lower-than-expected CPI print, raising expectations for an RBA rate cut. However, optimism surrounding Australia's recent budget and positive risk sentiment helped the AUD recover.

Given the technical breakdown and fundamental backdrop, we are monitoring GBP/AUD closely for potential trade opportunities, with a focus on price action near key support and resistance levels.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

AUDGBP trade ideas

GBP/AUD Price Action Update📊 GBP/AUD Price Action Update 🎯

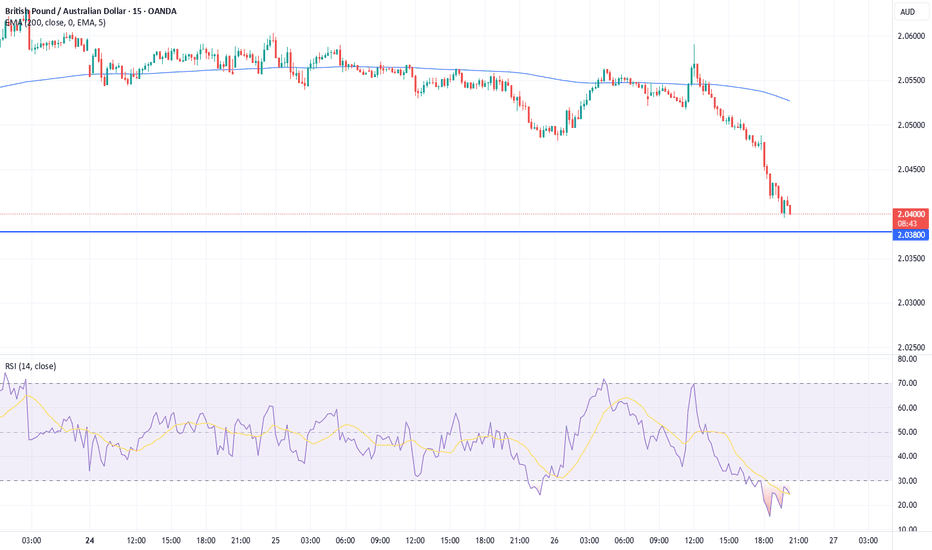

🔹 Current Price: 2.05941

🔹 Timeframe: 15M

📌 Key Support Levels (Demand Zones):

🟢 2.05795 – First Support

🟢 2.05327 – Second Support

🟢 2.04939 – Third Support

🟢 2.04012 – Fourth Support

📈 Bullish Scenario:

If price holds above 2.05795, we might see a push towards 2.06663 and beyond.

A breakout above this level could confirm a strong bullish continuation.

📉 Bearish Scenario:

If price breaks below 2.05795, the next supports at 2.05327 and 2.04939 will be key reaction zones.

A break below 2.04012 could signal a deeper retracement.

⚡ Trading Tip:

Look for confirmations before entering buy/sell trades.

Watch for bullish rejection at demand zones for long positions.

Sell near resistance with bearish confirmation.

#GBPAUD #ForexTrading #PriceAction #TechnicalAnalysis #SmartMoney #ForexSignals

Low timeframe levels exerciseLow timeframe levels, this is an exercise to demonstrate the performance of low timeframe levels. There will be a high success rate in subdued market conditions, and a low success rate during periods of volatility (risk flows). As a trader it's you job to assess market conditions and execute trades that align to market conditions.

GBP/AUD Price Action Update📊 GBP/AUD Price Action Update 🇬🇧🇦🇺

GBP/AUD is currently testing a strong resistance zone (supply area) around 2.0486, marked in red.

📌 Key Insights:

🔴 Supply Zone (Resistance): 2.0486 - 2.0490 📍

This level has been tested multiple times but failed to break convincingly, suggesting a potential reversal or breakout scenario.

📉 Bearish Scenario:

If price rejects this zone, we might see a sell-off towards the 2.0397 support level, as marked on the chart.

📈 Bullish Scenario:

If GBP/AUD breaks and holds above 2.0486, it could trigger a further bullish rally. However, a strong rejection from this level increases the chances of a downward move.

⚡ Trading Tip:

Wait for confirmation candles before entering trades. A strong rejection with bearish momentum could signal a short entry, while a breakout with retest could indicate a buying opportunity.

#fxforever #fxf #GBPAUD #ForexTrading #SmartMoney #TechnicalAnalysis #PriceAction #ForexSignals #DayTrading #MarketAnalysis

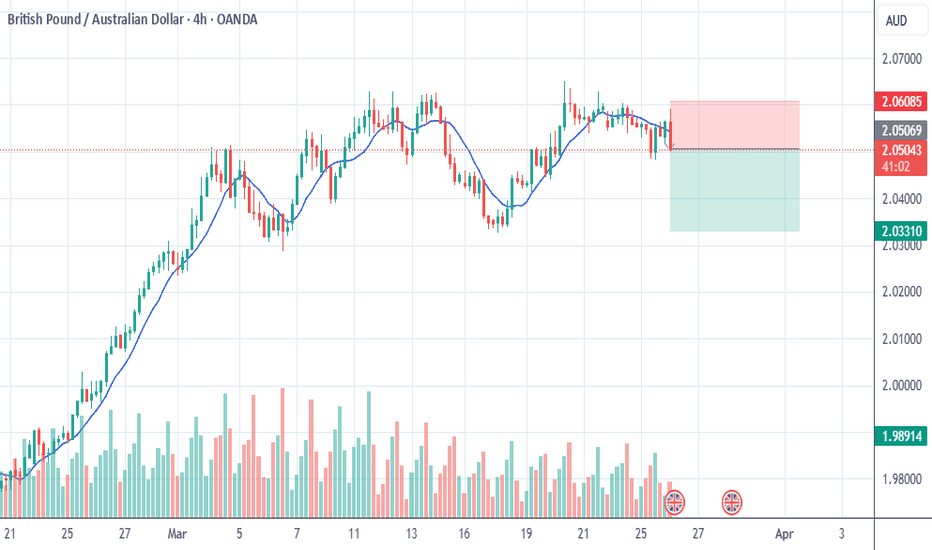

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBAAUD has a buy opportunity at short term periodGBAAUD may have a short-term buy opportunity based on several factors:

estimated entry level: 2.038

target: at around 2.042 - 2.044

Technical Indicators: Positive chart patterns (like breakouts or bullish formations), and moving averages crossing could signal upward momentum.

Fundamentals: Positive earnings reports or key economic data releases could drive short-term growth. For a currency pair, central bank policies or interest rate changes are also important.

Market Sentiment: Positive investor sentiment, upcoming news, or geopolitical events could create buying pressure.

Volume Confirmation: Higher-than-average trading volume can indicate a strong trend, confirming the buy opportunity.

Volatility: Short-term price swings or expected volatility can offer profitable entry points.

In summary, if these factors align, GBAAUD could see potential growth in the short term.

GBPAUD Will Move Lower! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 2.039.

Considering the today's price action, probabilities will be high to see a movement to 2.033.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/AUD break oit Here’s a clear trade setup based on your chart:

Entry: Around 2.0542

Stop Loss (SL): 2.05647 (Above the red resistance zone)

Target: 2.03900 (Marked green target zone)

This setup aligns with the breakdown from the bullish channel and retest of resistance. Manage risk carefully. Let me know if you need further insights. Sell Setup - Key Support & Resistance Levels

Resistance Levels (Potential Entry/SL Zone):

2.05647 – Major resistance (Ideal SL zone)

2.05400 – Immediate resistance within the red zone

2.05200 – Key resistance level (Potential entry zone)

Support Levels (Potential TP Zones):

2.04500 – First support zone (Minor support)

2.04100 – Strong support (Key TP zone)

2.03900 – Final support target (Major TP zone)

This aligns with the downward momentum after breaking the bullish channel. Ensure proper risk management and follow your trading plan.

GBP/AUD Breakout (25.3.25)The GBP/AUD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.0448

2nd Support – 2.0400

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/AUD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/AUD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.054 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

My GBPAUD Long idea 26/03/2025The AUD currency has been seeing some weakness and if we look at the inflation it is relatively weakening. The inflation rate in Australia went from 2.8 to 2.4 and the interest rate for AUD is sitting at 4.1.

The Pound has seen some love due to raising inflation narrative we are sitting at 3.0 and it is expected to drop to 2.9 with the interest rate sitting at 4.5.

AUD interest rate projection -> Q1 4.1 -> Q2 3.85 -> Q3 3.85 -> Q4 3.6

GBP interest rate projection -> Q1 4.5 -> Q2 4.25 -> Q3 4.0 -> Q4 4.0

I would love to see the price make some pullbacks to the 50% fib or go a little below to the 100 EMA for a better RR. However, if you pull out the Bollinger Bands you will realize that the 4H price has bounced off of the lower Bollinger.

And if you try drawing a FIB from the recent 4H Swing Low you will notice a bounce from the 50% level. I would try DCA or put a tight SL below 204738 maybe if price stays flat but slowly melting upwards.

GBP/AUD Bulls Eye 2020 HighFutures traders are net-long GBP/USD futures and net-short AUD/USD futures. So it is quite fitting to see GBP/AUD in a strong uptrend, with traders now eyeing the 2020 high.

However, the weekly chart suggests the current upswing may be nearing a cycle peak. A small bearish divergence has also formed on this timeframe. I am therefor seeking evidence of a swing high to form, somewhere around the 2020 high (or below).

For now, the daily chart is grinding higher and the 10-day EMA is supporting. There are also early signs of an ending diagonal / rising wedge, which could still allow for another leg or two higher before the anticipated mean reversion towards the 10 and 20-week EMAs kick in.

Matt Simpson, Market Analyst at City Index and Forex.com

GBP AUD Long [Brought my entry down]I have decided to bring my entry down from 206598 to 206078 as it will give me a better placed stop.

By doing this i have increased my R from 2:1 to 2.2:1

Our limit order underneath the range did not get hit - but I will leave it in my place until my buy stop is triggered. Then take the buy limit off.

Other than that everything the same trading towards 208461 where my plan is to take some profit.

GBPAUD💡Chart Analysis of the GBP/AUD currency pair (4-hour timeframe). Liquidity Sweep: The price broke a previous high, indicating that pending sell orders above it are being targeted. Broken Structure: After the liquidity sweep, the price broke an important support level, confirming the beginning of a downtrend. MACD indicator shows divergence and weak buying momentum.

⛔️Not investment advice for educational purposes only.

GBPAUD Bearish Breakout Imminent: Points to Potential Downside4-hour chart of GBPAUD reveals a critical juncture. We've observed a recent uptrend culminating in what appears to be a rising wedge formation. This pattern, characterized by converging trendlines, often signals a potential reversal, particularly after a sustained bullish run. The upper trendline has faced repeated tests, indicating weakening upward momentum. Crucially, the 2.04938 level acts as immediate support. A decisive break below this point would validate the wedge breakdown and likely trigger a significant bearish move.

Key Levels and Targets:

Immediate Support: 2.04938

Target 1: 2.03263 (Initial downside target)

Target 2: 2.00516 (70.0% Fibonacci Retracement)

Target 3: 1.97478 (100.0% Fibonacci Retracement)

Fibonacci Analysis: The price action has breached the 50.0% retracement level, suggesting a potential continuation towards the 61.8% and lower levels. The 70.0% and 100.0% retracements are critical downside targets.

Trading Implications:

Short Entry: A confirmed break below 2.04938 is the primary trigger for a short entry.

Stop Loss: A conservative stop-loss should be placed above the recent swing high or the upper trendline of the wedge to mitigate risk.

Risk Management: Given the potential for volatility, prudent risk management is essential.

Considerations:

Confirmation: A break below 2.04938 must be accompanied by strong bearish momentum and ideally, increased volume to validate the signal.

Fundamental Factors: Keep a close eye on upcoming economic data releases from both the UK and Australia, as these can significantly impact the pair.

GBPAUD sell up with great potentialGood day traders, today we just confirming the weekly bias on GBPAUD(sell)

On the 4 hour TF we saw yesterday the market opened with a jump lower creating a volume imbalance which later we saw price revisiting those levels and for the most part of the day, price was trading around the VI and closed the day below the VI.

For today we expecting price to close the day lower meaning todays bias is bearish, we want to see it atleast before the end of this week for price to have taken last week Thursday's low.