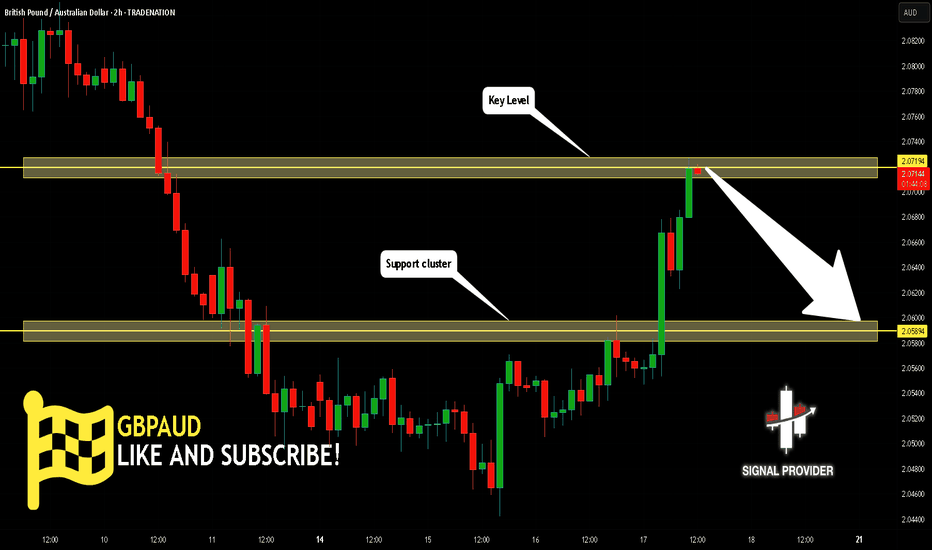

GBP_AUD BEARISH BIAS|SHORT|

✅GBP_AUD is going up to retest

A horizontal resistance of 2.0892

Which makes me locally bearish biased

And I think that we will see a pullback

And a move down from the level

Towards the target below at 2.0805

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDGBP trade ideas

GBPAUD Trade Plan

I am considering we are currently inside blue B corrective wave, and expect further downside for blue C.

Wave B could be finished, but I´d prefer to see a liquidity sweep targeting 50% pullback, and dropping right back below the green resistance zone.

This would be a great place to enter a short trade.

GBP-AUD Short From Resistance! Sell!

Hello,Traders!

GBP-AUD made a retest of

The horizontal resistance

Around 2.0800 from where

We will be expecting a

Local bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

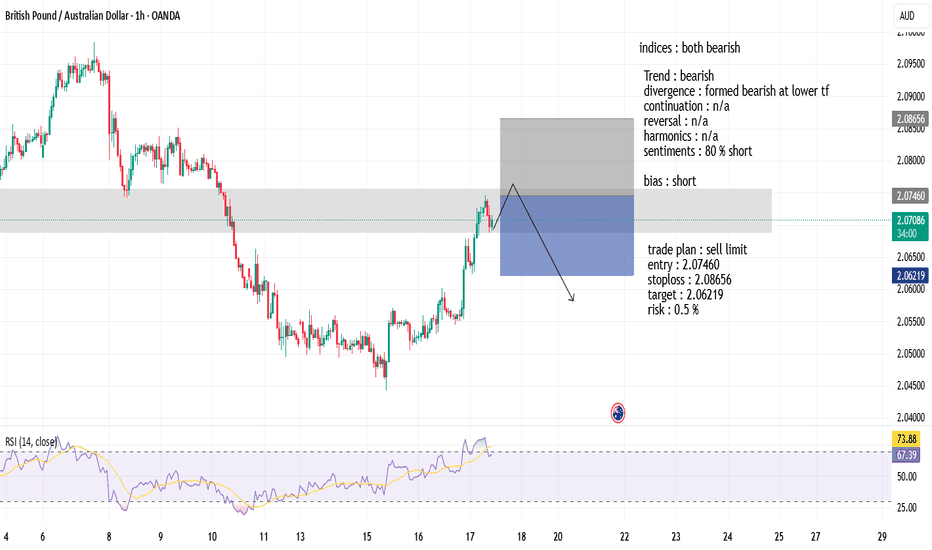

GBPAUD Will Go Lower From Resistance! Sell!

Please, check our technical outlook for GBPAUD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 2.071.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 2.058 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

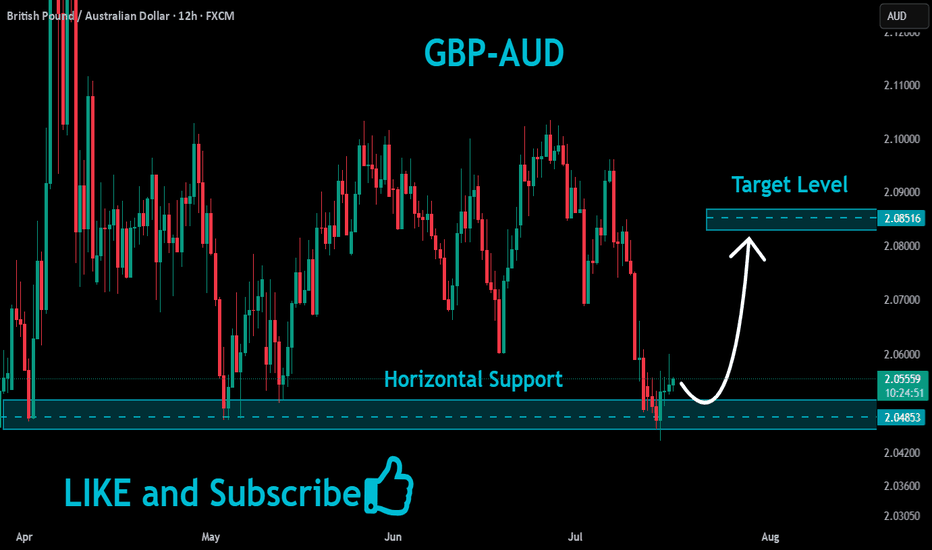

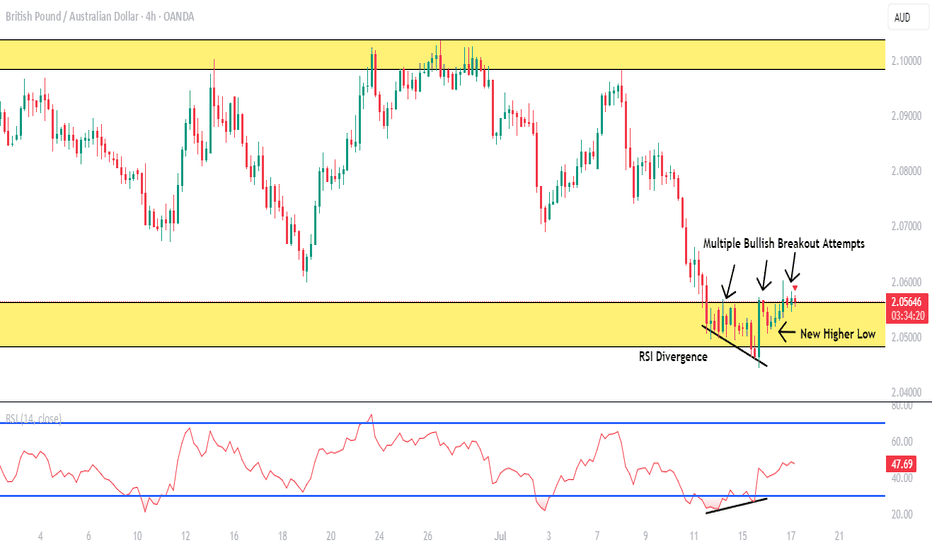

GBPAUD BUY LOW OF THE RANGE (BLSHS)Price is in 3 month trading range, price attempted breakout in either direction but failed multiple times.

In a Trading Range we Buy Low Sell High Scalp (BLSHS).

- Upper Range is at (2.10379 - 2.09843).

- Low of the Range at (2.05636 - 2.04819) where price is currently at.

- Price formed a new higher low at 2.07375 showing buyers coming.

- Price was rejected strongly at the low of the range and formed RSI Divergence at the level signaling a reversal the upside.

- AUD employment data released today at 4:30AM if negative price will breakout strongly

Stop loss below the new higher low at 2.07375 or below the setup at 2.04423.

Take profit at 2.07045 or at the top of the range at (2.10379 - 2.09843).

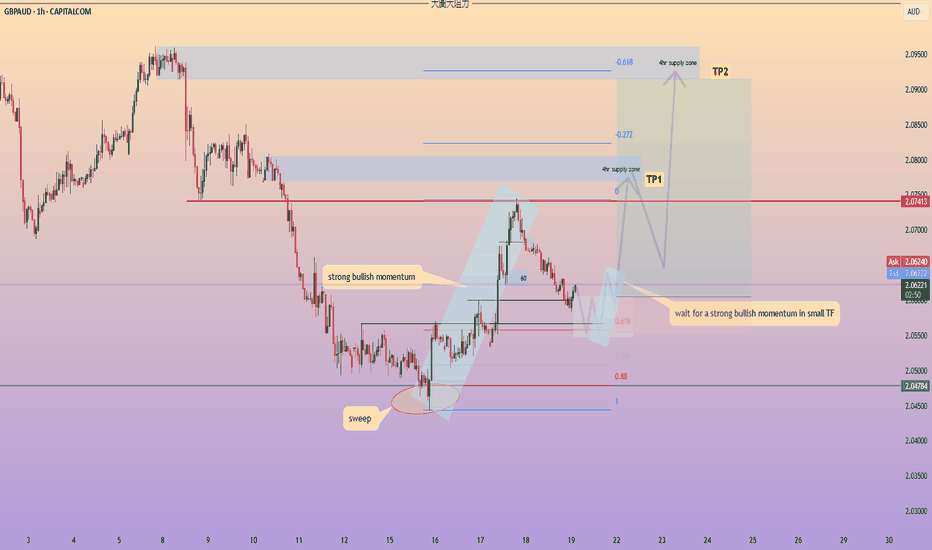

GBPAUD Swing Trade Idea 15-07-2025Hello Traders

Here's a breakdown on GBPAUD: Daily Timeframe

1. Overall trend is bullish; price has been consistently forming HH & respecting HL.

2. Current price is in corrective phase, meaning we should be focusing on sells until we reach our discounted level, and price will be following bearish order flow (Forming LL & respecting LH)

3. Using the identified swing high and swing low, we can place our Fibonacci to identify discounted prices where we can look for possible longs again.

4. Until then we can identify internal swing low and swing high using the H4 timeframe, and we can identify premium levels to look for potential short positions (Counter trend trade) as illustrated.

Will This Breakout Unlock the Money Run? GBP/AUD Heist Begins!💼The Pound Heist: GBP/AUD Break-In Blueprint🔐

“The vault’s half open… Are you in or watching from the cameras?”

🌍 Hey crew! 💬 Hola, Ola, Bonjour, Hallo, Marhaba! 🌟

Welcome to another sneaky setup from the Thief Trading Syndicate™ 🕵️♂️💸

We're setting our sights on GBP/AUD — and the market's flashing green for a bold long entry mission. Read the plan carefully before suiting up. 🎯

🧠 Mission Brief:

The “Pound vs Aussie” market is now playing around a key resistance wall – it’s hot, it’s risky, and it’s primed for a breakout 🎇.

🟢 Entry:

Break & Close Above 2.10500 = 🚨 Green Light

🎯 Set a Buy Stop above the resistance zone —

OR

Sneak in with a Buy Limit during a clean pullback to recent high/low on the 15m or 30m timeframes 🔍.

⏰ Set an alert, don’t miss the moment the vault cracks open.

🛡️ Stop Loss Plan – Lock Your Exit:

🛑 For Buy Stops:

➡️ Wait till the breakout confirms — don’t rush your SL like a rookie 🐣

📍 Suggested SL at swing low (2.08700) based on the 3H timeframe

💡 Always size your SL based on your risk tolerance, not just the setup.

🎯 The Escape Plan – Target:

🏁 First Checkpoint: 2.13000

📤 Or slip out early if you sense heavy guards (resistance) on duty.

Use Trailing SL to lock your loot while staying in the run.

🧲 Scalper's Note:

Only rob the bullish side! If you’re packing heavy funds, hit fast — else join the swing crew and move with caution. 🎒

Lock in profits with trailing exits to avoid being caught in the chop 🌀.

📊 Why This Heist Works – Market Fuel:

🔥 Bullish sentiment fueled by:

Technical setup (Resistance > Breakout > Momentum Surge)

Risk zone analysis

Macro & COT outlooks

Sentiment + Intermarket Alignment

Stay informed — read the full macro game plan, news, and positioning tools. Knowledge = clean escape. 🧠💼

📰 News Alert:

⚠️ Avoid new entries during high-volatility events

✅ Use trailing SLs to protect any active trades

🔐 Stay safe, stay sharp — the market’s watching too 👁️

🆙 Support the Crew:

Smash the 💥 Boost Button 💥 if you ride with the Thief Style Traders 🐱👤💸

Let’s continue bagging pips & stacking gold, one chart at a time.

🚀 Next mission drops soon. Stay sharp. Stay sneaky. Stay paid.

#ThiefTrading #ForexHeist #GBPAUDPlan

GBPAUD neutral - 9th July 2025This is my detailed multi-timeframe analysis for GBPAUD, based on the prevailing market structure, key liquidity zones, and candlestick behaviour.

Quarterly Timeframe:

On the three-month timeframe, price recently reached a significant liquidity region around 2.1600. From this level, the market has attracted substantial bearish orders, as evidenced by the recent quarterly candlestick, which closed relatively bearish. This suggests that bullish momentum has weakened considerably at these highs. Consequently, I expect that additional bearish orders may continue to enter the market, leading to a moderate retracement in the coming quarters.

Monthly Timeframe:

On the monthly chart, while price rejected the major liquidity region at 2.1600, the subsequent monthly candles have shown some signs of bullish intent, as indicated by wicks forming higher highs and higher lows. However, the candlestick bodies reveal an overall lack of follow-through, implying indecision in the market.

June’s monthly candle closed relatively bearish and indecisive, which may suggest that price is currently accumulating orders to fuel its next significant move. My current intuition leans towards a potential continuation higher, provided that price action confirms this bias. Notably, June’s candle could be interpreted as a potential order block, suggesting the possibility of price filling orders for a bullish move.

Nevertheless, the presence of a textbook ‘W’ formation must be acknowledged. The bearish close in June may imply a retest of the neckline around the 2.0300 level. Should bearish confirmations appear, this scenario could unfold in the medium term.

Weekly Timeframe:

The weekly timeframe indicates that price has been consolidating for the past five weeks. This choppy, indecisive price action makes the structure more challenging to interpret with conviction. The base of this consolidation zone sits around 2.0825; a clear weekly close below this level could present a case for bearish continuation, contingent on supporting confluences. At present, my bias on the weekly timeframe remains neutral given the lack of a clear directional signal.

Daily Timeframe:

On the daily chart, the market showed notable bearish activity in the previous session, closing below the key 2.0880 region. The next significant liquidity area to watch lies around 2.0700. My short-term bias for the day is bearish, and I anticipate that price may move towards this region. However, I do not regard this as a high-probability setup, so caution is warranted.

4-Hour Timeframe:

The 4-hour timeframe offers little additional clarity beyond the observation that price absorbed considerable bearish orders around the 2.0950 level. If price closes above the 2.0838 level, I will consider a short-term long position targeting the daily liquidity region at 2.0880. Overall, my stance on the 4-hour chart is largely neutral until more decisive price action emerges.

Disclaimer:

This analysis is intended for informational and educational purposes only. It does not constitute financial advice. Please conduct your own research and apply sound risk management before entering any trades.

GBPAUD 4H Rocket Booster Strategy - Breakout MomentumGBPAUD 4H Rocket Boost Strategy – Strong Bullish Structure with EMA Support, Breakout Momentum, ADX Trend Power, and Stoch RSI Buy Signal

The GBPAUD currency pair has set up a compelling bullish scenario on the 4-hour chart, closely fitting the Rocket Boost

Strategy framework. This setup is a powerful combination of trend-following confirmation and momentum-based signals that

many experienced traders look for before entering high-probability trades.

1. Price Above the 50 EMA

GBPAUD is currently holding above the 50-period Exponential Moving Average, which shows short-term bullish control. This

EMA is often used to track immediate price direction, and when \

price consistently remains above it, it suggests strong buying

interest is supporting each pullback. Recent candles have respected the 50 EMA as dynamic support, indicating a solid

foundation for continued upside movement.

2. Price Above the 200 EMA

The 200 EMA is widely viewed as the "line in the sand" between

bullish and bearish bias on higher timeframes. With GBPAUD trading above this level, long-term sentiment confirms that the

market favors the bulls. The 50 EMA sitting above the 200 EMA

also forms a bullish stack, adding even more weight to the long

setup. This dual EMA alignment acts like a runway for bullish continuation.

3. Breakout Candles / Aggressive Price Action

Recent price movement shows a series of strong bullish candles with higher closes and minimal lower wicks. These breakout-style candles reflect aggressive buying, often seen when

institutional orders are flowing into the market. This type of behavior, especially when occurring above both EMAs, is

considered part of the Rocket Boost ignition point—a moment when price accelerates beyond previous resistance without hesitation.

4. ADX Indicator Confirms Trend Strength

The Average Directional Index (ADX) is showing rising values above the 20–25 zone, which signals that the current trend is not

only present but gaining strength. When price action and moving averages align with a rising ADX, it suggests that the trend has

the potential to continue with strong momentum. This increases

the confidence in the breakout being sustainable rather than a false move.

5. Stochastic RSI Generates Fresh Buy Signal

The Stochastic RSI recently moved from oversold levels and has now crossed upward, giving a fresh buy signal just as the

breakout begins. This timing is key—it tells us that momentum is turning in favor of the bulls just as the trend is gaining steam.

When this signal aligns with EMA structure and ADX confirmation, it often acts as a launch pad for the next leg up.

What This Means for GBPAUD Traders

With price trading above both EMAs, strong breakout candles forming, a rising ADX, and a bullish Stochastic RSI cross, the

GBPAUD pair is showing every characteristic of a classic Rocket Boost setup. Traders may want to monitor upcoming resistance

zones—especially previous swing highs and psychological levels—for potential targets.

If momentum continues and volume supports the move, we could see GBPAUD make a strong climb in the coming sessions.

Managing entries and exits around minor pullbacks, Fibonacci extensions, or intraday support zones can help optimize trade outcomes.

To learn more about this kind of setup, search for Rocket Booster Strategy content.

Disclaimer: This article is for educational purposes only and is not financial advice. Always perform your own analysis, and use risk management when trading.

GBPAUD 4H Rocket Booster Strategy – Strong Bullish Structure GBPAUD 4H Rocket Boost Strategy – Strong Bullish Structure with EMA Support, Breakout Momentum, ADX Trend Power, and Stoch RSI Buy Signal

The GBPAUD currency pair has set up a compelling bullish scenario on the 4-hour chart, closely fitting the Rocket Boost

Strategy framework. This setup is a powerful combination of trend-following confirmation and momentum-based signals that

many experienced traders look for before entering high-probability trades.

1. Price Above the 50 EMA

GBPAUD is currently holding above the 50-period Exponential Moving Average, which shows short-term bullish control. This

EMA is often used to track immediate price direction, and when \

price consistently remains above it, it suggests strong buying

interest is supporting each pullback. Recent candles have respected the 50 EMA as dynamic support, indicating a solid

foundation for continued upside movement.

2. Price Above the 200 EMA

The 200 EMA is widely viewed as the "line in the sand" between

bullish and bearish bias on higher timeframes. With GBPAUD trading above this level, long-term sentiment confirms that the

market favors the bulls. The 50 EMA sitting above the 200 EMA

also forms a bullish stack, adding even more weight to the long

setup. This dual EMA alignment acts like a runway for bullish continuation.

3. Breakout Candles / Aggressive Price Action

Recent price movement shows a series of strong bullish candles with higher closes and minimal lower wicks. These breakout-style candles reflect aggressive buying, often seen when

institutional orders are flowing into the market. This type of behavior, especially when occurring above both EMAs, is

considered part of the Rocket Boost ignition point—a moment when price accelerates beyond previous resistance without hesitation.

4. ADX Indicator Confirms Trend Strength

The Average Directional Index (ADX) is showing rising values above the 20–25 zone, which signals that the current trend is not

only present but gaining strength. When price action and moving averages align with a rising ADX, it suggests that the trend has

the potential to continue with strong momentum. This increases

the confidence in the breakout being sustainable rather than a false move.

5. Stochastic RSI Generates Fresh Buy Signal

The Stochastic RSI recently moved from oversold levels and has now crossed upward, giving a fresh buy signal just as the

breakout begins. This timing is key—it tells us that momentum is turning in favor of the bulls just as the trend is gaining steam.

When this signal aligns with EMA structure and ADX confirmation, it often acts as a launch pad for the next leg up.

What This Means for GBPAUD Traders

With price trading above both EMAs, strong breakout candles forming, a rising ADX, and a bullish Stochastic RSI cross, the

GBPAUD pair is showing every characteristic of a classic Rocket Boost setup. Traders may want to monitor upcoming resistance

zones—especially previous swing highs and psychological levels—for potential targets.

If momentum continues and volume supports the move, we could see GBPAUD make a strong climb in the coming sessions.

Managing entries and exits around minor pullbacks, Fibonacci extensions, or intraday support zones can help optimize trade outcomes.

To learn more about this kind of setup, search for Rocket Booster Strategy content.

Disclaimer: This article is for educational purposes only and is not financial advice. Always perform your own analysis, and use risk management when trading.

An Inverted head and shoulder pattern gives opportunity-ForexBDAn inverted head and shoulders pattern has formed on the GBPAUD D-1 timeframe. The market has formed a second shoulder, so if the price goes up and breaks the neckline or resistance line, the market will go into an uptrend.

⭕️Risk Warning : Trading on financial markets carries risks!

©FXBD Official Team

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Gbp/aud possible sniper sell ????Looking at the 1 hr chart I'm seeing a possibility of a pullback trade at the current level of 2.08274 my reasons are a few i can see a lot of negative volume at a poi level of resistance mixed in with a twist of liquidity grab , and a pinch of creative double top forming let's see how this trade pans out , if it breaks and holds a solid 1hr candle upwards past 2.08522 its a stop loss 😤, if it continues a 1 hr candle down its game on down to around 2.068 area

GBPAUD ENTRY CHARTOn this Pair, we are still BEARISH, as TREND is Obviously still DOWN, also in our Intra-day trend, We are having BOS to the Down-side, we took our based of FVG confirmation with our MA+ Zones with our Additional Confluences, If this matches with your idea, you can look to join us, with a Good Risk Management, Thank You.