AUDJPY BULLISH OR BEARISH DETAILED ANALYSISAUDJPY has successfully broken out of a long-term descending channel and is currently trading around 94.50. The breakout is clean and supported by solid bullish volume, which confirms that momentum is shifting in favor of the bulls. This setup indicates a clear trend reversal on the daily timeframe, and with the pair establishing higher lows and breaking resistance, the path toward 100.00 looks technically achievable in the coming weeks.

From a fundamental standpoint, the Australian dollar is gaining strength after the Reserve Bank of Australia (RBA) maintained a firm stance on inflation management. The latest CPI figures remain above the RBA’s comfort zone, and recent wage growth data has further reduced the probability of near-term rate cuts. Meanwhile, the Japanese yen continues to lag due to the Bank of Japan's ultra-loose monetary stance and consistent verbal intervention that lacks follow-through, keeping JPY broadly weaker across the board.

Technically, we’ve seen strong follow-through after the breakout, with price now holding firmly above prior resistance turned support. If this momentum sustains, we could see buyers step in aggressively, targeting 96.50 short-term and extending toward the key psychological level of 100.00 in the medium term. The risk-reward remains attractive with a clearly defined invalidation point below 91.00.

Overall, AUDJPY stands out as one of the most bullish JPY crosses on my radar. With a clean breakout, supportive fundamentals from the Australian side, and persistent weakness in the yen, this trade aligns with broader macro sentiment and could offer strong upside potential heading into the next quarter.

AUDJPY trade ideas

AUDJPY Breakout on Rising Yields – Path Open to 95.70AUDJPY is maintaining strong bullish structure after breaking through key resistance around 91.65. Price is forming higher lows supported by an ascending trendline, indicating healthy buyer momentum. Fibonacci retracement levels show price holding above the 50% and 61.8% zones, strengthening the bullish case.

🔑 Key Levels:

Current Price: 91.65

Support Zone: 90.85 – 91.00 (previous structure + fib support)

Resistance Targets:

TP1: 93.15 (previous swing high)

TP2: 95.70 (full recovery move from March highs)

✅ Bullish Confluence Factors:

Ascending triangle breakout in progress

Strong higher lows and clean market structure

Holding above major 61.8% Fib retracement

Australian dollar supported by improved risk sentiment globally

BOJ expected to stay dovish and delay hikes, keeping the yen weak

🧠 Fundamental Context:

Japan Outlook: BOJ to hold rates steady at 0.5% amid US tariff risks. IMF projects a downgrade in Japan’s growth, weakening JPY outlook.

Sentiment on JPY: No strong intervention support for yen despite media noise. Japan’s government denied any push for stronger yen.

Australia Outlook: Risk sentiment steady, equities firmer globally, and higher AUD correlations to risk-on tone favor upside continuation.

💡 Trade Idea:

Bias: Bullish above 91.00

Entry: On confirmation bounce above 91.60

Target 1: 93.15

Target 2: 95.70

Stop Loss: Below 90.50

📌 Note: Watch for possible mild pullback into 91.30-91.50 zone before new upside leg. Strong US data midweek could temporarily lift JPY but broader BOJ dovishness remains the driver.

Trading idea AUDJPY, break at trendlineNOTE: I am not an expert trader by any means, I am open input and sharing my ideas. I am still learning.

-------------------------------

There is a break at the trendline.

I have two ideas.....

#1.. it was a fake out and will continue up to make an extension to 127%. (Near, green arrow head and buy position projection )

Factors:

A) Price still holding above key support

B) RSI oversold

C) News is positive for this pair

News= Increase in Aus. employment data, and trade surplus exceeded expectations = strength

#2 it will retest below trendline and continue down. (Somewhere near, red arrow head and sell position projection )

Factors:

A) Break of trendline

B) Some indicatiors are neutral, so price can do either way

We shall wait and see.

--------

(please know arrow bounces are not exact.... just showing price may bounce before making it to sell or buy targets.)

---------

Open to all advise or comments. Would love input on how I break down the market or make my analysis ...

------

FYI there is not audio my cursor is explaining this text here and the text on screen.

Happy trading.

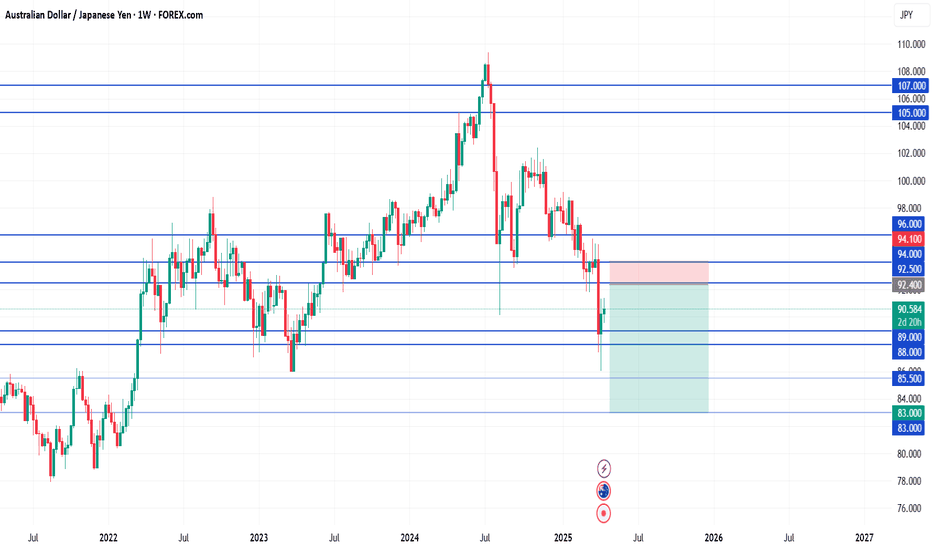

AUD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the AUD/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 88.446 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/JPY “Aussie vs. Yen” Skyrocketing Safari!🌈 G’day, Forex Adventurers & PIP Hunters! 🌏✨

Join our epic AUD/JPY Forex expedition! 🦘🚀 Our Stellar Navigator Strategy fuses pinpoint technicals with powerful fundamentals to chase profits in the Aussie-Yen jungle. Ready to soar to new heights and grab those pips? Let’s embark on this bullish quest! 🌍💰

🌟 The Stellar Navigator Plan

Entry Points 🛫:

🦅 Bullish Launch: Jump in after a breakout above the Sky High at 94.800—your cue for bullish gains!

🐾 Pullback Path: Place buy limit orders near the 15M/30M support (94.200) for a savvy entry.

Pro Tip: Set alerts to spot the breakout spark! 🔔

Stop Loss (SL) 🛡️:

Bullish Trade: Secure SL at the 2H support (93.600) for day trades.

Tailor SL to your risk, lot size, and order count. This is your safety net—keep it snug! ⚠️

Take Profit (TP) 🎯:

Bullish Explorers: Aim for the Star Peak at 96.500 or exit if the momentum dips.

Scalpers: Grab quick pips on the long side, but lock in gains with trailing stops! 🚨

🌏 Why AUD/JPY?

The Aussie’s soaring 📈 as of May 12, 2025, powered by:

Fundamentals: RBA’s 4.35% rate dwarfs BoJ’s 0.1%, boosting AUD.

Macroeconomics: Australia’s commodity boom (gold, iron ore) outpaces Japan’s slow recovery.

COT Data (May 9, 2025): Rising AUD net longs signal bullish sentiment (source: CFTC).

Intermarket: AUD/JPY tracks Nikkei 225’s risk-on rally.

Quantitative: RSI (14) at 59 and a break above the 50-day SMA (93.57) confirm upward momentum.

📊 Sentiment Snapshot (May 12, 2025, UTC+1)

Retail Traders:

🟢 Bullish: 53% 😊 (RBA strength, China trade optimism)

🔴 Bearish: 37% 😣 (Yen safe-haven demand on tariff risks)

⚪ Neutral: 10% 🤔

Institutional Traders:

🟢 Bullish: 46% 💼 (Commodity demand, risk-on flows)

🔴 Bearish: 39% ⚠️ (BoJ intervention fears, US yields)

⚪ Neutral: 15% 🧐

📰 Market Buzz (May 12, 2025)

- US-China trade progress lifts risk appetite, pushing AUD/JPY to 94.50.

- Easing tariff concerns weaken JPY safe-haven appeal.

- Japan’s soft consumer spending data pressures JPY.

📡 Risk Navigation ⚡

Markets can be wild—tread carefully:

- Avoid new trades during major news (RBA, BoJ, US CPI).

- Use trailing stops to protect profits and cap losses.

- Watch for BoJ moves if JPY weakens sharply! 🌪️

💸 Real-Time Market Data (May 12, 2025, UTC+1)

- Forex: AUD/JPY at 94.50, up 0.5% daily (source: Financial Juice).

- Commodities CFD: Gold (XAU/USD) at 2,650, up 0.2%; Iron Ore at 105.50, flat.

- Metals: Silver (XAG/USD) at 31.820, down 1.3%.

- Energies: WTI Crude Oil at 78.40, up 0.6%.

- Crypto: BTC/USD at 62,300, down 0.5%.

- Indices: Nikkei 225 at 39,200, up 0.7%; ASX 200 at 7,850, up 0.4%.

🚀 Join the Stellar Navigator Squad!

Smash the Boost Button to supercharge our Stellar Navigator Strategy and make this safari epic! 🌟 Every boost empowers our crew to dominate the markets. Let’s conquer AUD/JPY together! 🤝

Stay glued to your charts, keep alerts active, and vibe high. See you in the profits, adventurers! 🤑🎉

#StellarNavigator #AUDJPY #AussieYen #TradingView #ChaseThePips

AUD-JPY Risky Short! Sell!

Hello,Traders!

AUD-JPY grew up fast

But then hit a horizontal

Resistance level of 95.750

From where we are already

Seeing a nice pullback

And we will be expecting

A further local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY – Bearish Drift Toward Double Target ZoneAUDJPY – Bearish Drift Toward Double Target Zone

🔻 Short Bias | 🎯 Targets: 91.85410 → 91.36166 | ⏳ Deadline: June

Price action looks heavy, and I’m aiming for both targets shown on the chart. I’ll be entering this trade as soon as the market opens.

If you’re joining me, just be prepared to hold for up to a week—this one may take time to develop.

This is not financial advice. I'm simply sharing how I’m positioning myself.

💡 All trades can be replayed on TradingView for review.

#AUDJPY #ShortSetup #ForexTrading #GlobalHorns #TradingView #BearishBias

AUDJPY SHORT FORECAST Q2 W20 D14 Y25AUDJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY – Short Trade ActiveAUDJPY – Short Trade Active

🔻 In a Sell | 🎯 Target: 94.32657 | ⏳ Intraday Outlook

Aiming for the level marked below, and keeping an eye on price behavior for confirmation along the way.

Should hit within 24 hours.

This is not financial advice. Just sharing what I’m doing.

💡 All trades can be replayed on TradingView for transparency.

#AUDJPY #ForexTrading #IntradaySetup #PriceAction #GlobalHorns #TradingView

Will AUDJPY rebound?FX_IDC:AUDJPY had recently corrected lower, but continues to trade above a broken downside resistance line. Will we see a push back up anytime soon?

Let's dig in...

MARKETSCOM:AUDJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

AUDJPY is BearishPrice was in an uptrend, however now it seems that bulls are exhausted and bears are trying to assume control of the price action. A double top reversal pattern with bearish divergence is printed, and if previous higher low is broken then we can expect a bearish reversal as per Dow theory. Targets are mentioned on the chart.

AUDJPY Wave Analysis – 14 May 2025

- AUDJPY reversed from resistance area

- Likely to fall to support level 93.20

AUDJPY currency pair recently reversed from the resistance area between the key resistance level 95.30 (former monthly high from March), upper daily Bollinger Band and the 61.8% Fibonacci correction of the downward impulse wave (C) from November.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 from the start of May.

Given the overbought daily Stochastic and strongly bullish yen sentiment, AUDJPY currency pair can be expected to fall to the next support level 93.20.

AUDJPY SHORT FORECAST Q2 W20 D15 Y25AUDJPY SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/JPY Struggles to Test March HighAUD/JPY snaps the series of higher highs and lows carried over from last week after struggling to test the March high (95.75).

In turn, AUD/JPY may continue to give back the advance from the start of the week, with a move/close below the 92.80 (50% Fibonacci extension) to 93.30 (23.6% Fibonacci extension) zone bringing the monthly low (91.42) on the radar.

Failure to defend the 91.50 (61.8% Fibonacci retracement) to 91.70 (38.2% Fibonacci extension) region opens up 90.50 (61.8% Fibonacci extension), but a breach above the March high (95.75) may push AUD/JPY back toward the February high (97.34).

--- Written by David Song, Senior Strategist at FOREX.com