AUDJPY trade ideas

AUDJPY: HIGH RISK, HIGH REWARD🏆 Trade Setup & Recommendation

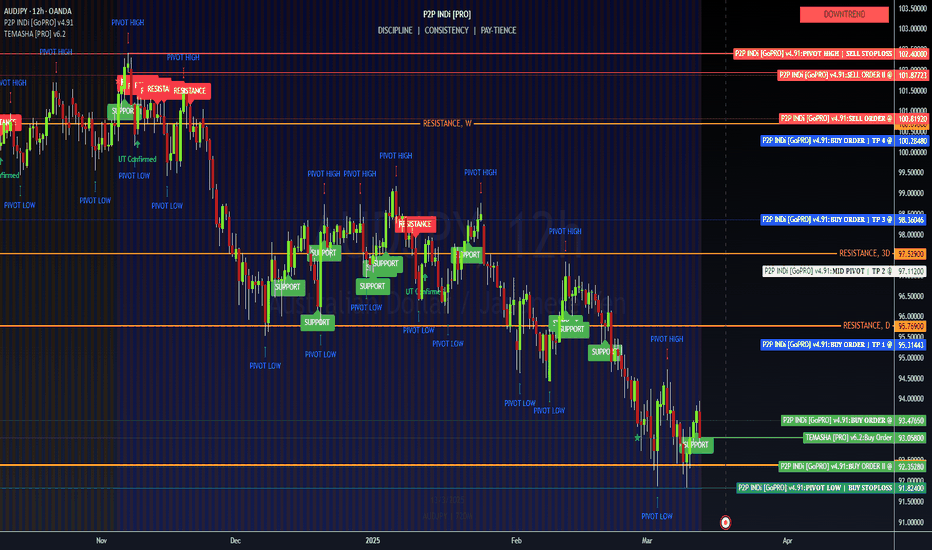

📉 BEARISH SCENARIO (Primary Bias)

Sell Zone: 94.50 - 95.50 (retest of resistance)

Entry Confirmation: Bearish rejection candle near resistance

Targets:

TP1: 93.47 ✅

TP2: 92.99 ✅

TP3: 91.82 🎯

Stop Loss: Above 96.00 (invalidates bearish setup)

📈 BULLISH SCENARIO (Alternative Setup)

Buy Zone: 91.82 - 92.50 (if support holds)

Entry Confirmation: Bullish engulfing candle, RSI > 45

Targets:

TP1: 94.00 🏁

TP2: 95.50 🏁

Stop Loss: Below 91.50 (breaks key support)

📌 Final Thoughts

🔴 Dominant Trend: Bearish

🔴 Indicators: MAs confirm selling pressure, Oscillators neutral

🔴 Watch for retracement to resistance for shorting opportunities

🟢 If 91.82 holds, a bounce to 94+ is possible

🚨 Trade Smart – Use Stop Losses & Manage Risk Properly! 🚨

audjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDJPY: Bullish Continuation Confirmed 🇦🇺🇯🇵

On a today's live stream, we spotted a confirmed bullish reversal on AUDJPY.

The price formed a huge inverted head & shoulders pattern on a 4H

and violated its neckline during the London session today.

A bullish movement is now expected at least to 94.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY: Market of Sellers

Balance of buyers and sellers on the AUDJPY pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDJPY The Target Is UP! BUY!

My dear friends,

My technical analysis for AUDJPY is below:

The market is trading on 92.761 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 93.288

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

Almost Perfect Trade opportunity on an Fx-Minor This Week.AUD is usually considered sensitive to Global risk sentiment.

The narrowing yeild between the interest rates between AUSTRALIAN and JAPAN Govs

"can"* shift towards risk aversion

all of which can ed up favoring JPY which is more stable as a currency.

and so i marked this super 1:8 Trade Using my 2025 ADR projections.

AUDJPY SHORT, S/D 1H X OTElooking at the chart there is an untapped supply zone which also falls exactly on the FIB OTE AND might act as a continuation trigger for the price downside, target will also be the previous week low. so lets see if this will play out.

NOTE: no limit order, what we do is watch how the candle react on getting to the zone, look for a pin bar rejection candle ( CRT) and enter on the next candle or wait for a bearish engulfing all on the 1H time frame.

AUD/JPY BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

AUD/JPY pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 92.334 area.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY SHORT 8K PROFIT LIVE TRADE UPDATE The Australian dollar is a cyclical currency which is sensitive to the global economic cycle. When the economy is doing well (economic expansion), companies increase demand for raw materials (think Chinese companies, one of Australia’s major trading partners). And given that Australia is a commodity-linked currency, known for its exports in metals and minerals—such as iron ore, copper, gold and lithium—the increased demand for commodities and inflows into AUD often underpins the currency, and vice versa for an economy doing poorly (economic contraction).

The Japanese yen, on the other hand, is a safe-haven currency; in times of economic uncertainty, funds tend to flow into the JPY during risk-off markets, making it more of a defensive play, if you will.

As a result, the AUD/JPY currency pair is sensitive to changes in global commodity prices, and will often rise when the global economy is doing well and fall when the economy is contracting (as traders and investors bid the JPY). This is why some refer to this currency pair as a risk barometer. In other words, it tends to rise when investors are feeling more confident about the global economy and fall when investors are feeling more risk-averse.

It should also not surprise you to note that there is a strong positive correlation between the AUD/JPY and the S&P 500. As you can see, based on a 60-day rolling correlation coefficient, the two markets correlate most of the time.

AUDJPY LIVE TRADE UPDATE 6K PROFITSFactors Contributing to AUD Weakness:

Commodity Price Fluctuations:

The Australian Dollar is closely tied to commodity prices, particularly those of raw materials like iron ore and coal. Any decline in these prices can put downward pressure on the AUD.

Reserve Bank of Australia (RBA) Policy:

RBA policy decisions, including interest rate adjustments and forward guidance, significantly impact the AUD. If the RBA adopts a dovish stance (indicating potential rate cuts or a slower pace of tightening), it can weaken the AUD.

Australian Economic Data:

Economic indicators such as GDP growth, employment figures, and inflation data play a crucial role. Weaker-than-expected data can lead to a decline in the AUD.

Global Risk Sentiment:

The AUD is often considered a risk-on currency. During periods of global economic uncertainty or risk aversion, investors tend to move away from the AUD, weakening it.

**AUD/JPY Short Trade Recap – 30-Day Swing Trade** **AUD/JPY Short Trade Recap – 30-Day Swing Trade**

I recently exited a **30-day swing short trade** on AUD/JPY, capturing a well-structured move based on multiple confluences.

### **Technical Reasons for the Trade:**

- 📉 **Trend:** Clear **downtrend** alignment.

- 🔴 **Oscillators:** **Overbought** conditions signaled exhaustion.

- 📊 **Price Action:** Strong **sell signal** at a key **supply zone**.

- 🔄 **Mean Reversion:** Price **retraced to the mean** after completing a **5-wave structure** on the 4H timeframe.

### **Fundamental Reasons for the Trade:**

- 📉 **COT Data:**

- **Bearish AUD:** Commercials were aggressively shorting AUD.

- **Bullish JPY:** Commercials increased their long positions on JPY.

- 💰 **Monetary Policy Divergence:**

- **RBA Rate Cuts:** The **Reserve Bank of Australia (RBA)** cut rates to **4.10%** on **February 18, 2025**, citing **slowing inflation**.

- **Japan’s Strength:** Japan’s economy showed **2.8% annualized GDP growth** in **Q4 2024**, strengthening the Yen.

- 🛑 **Market Sentiment:**

- **Risk-Off Environment:** A shift in sentiment favored the safe-haven JPY over the risk-sensitive AUD.

- **Bond Yields:** Rising **Japanese Government Bond (JGB) yields** further supported JPY strength.

### **Trade Outcome:**

This trade played out exactly as planned, reaching its target as AUD/JPY moved lower. A textbook **combination of technical structure, COT positioning, and macro fundamentals**.

✅ **Executed the plan, managed risk, and booked profits. On to the next trade!** 🚀