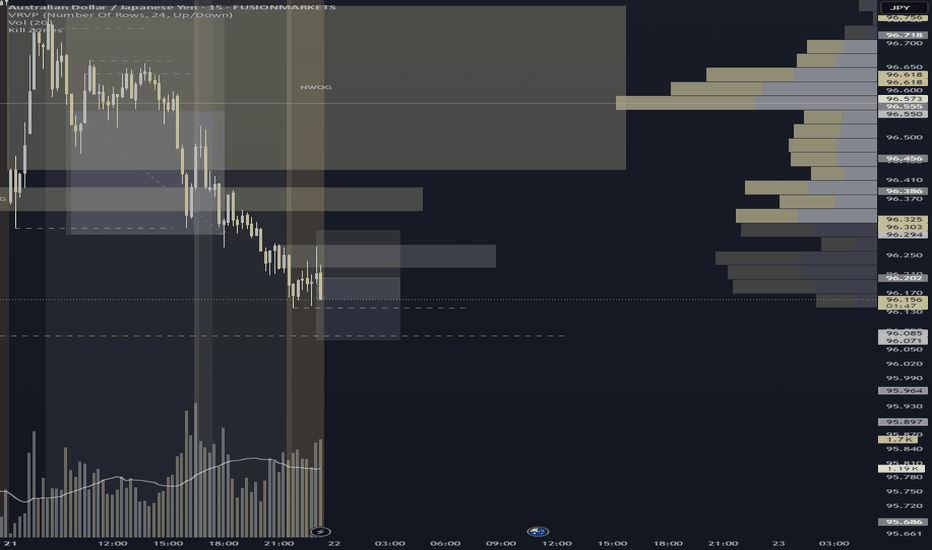

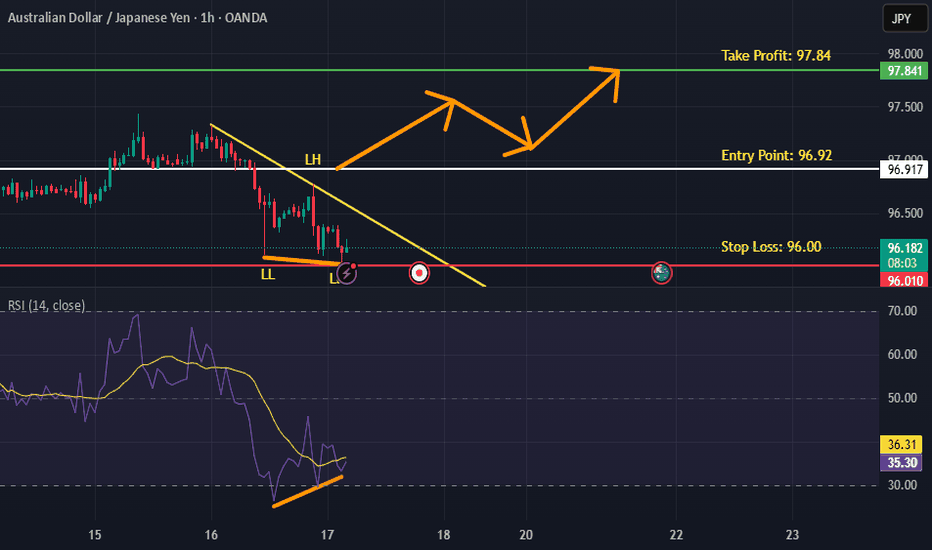

AUDJPY – Resistance Rejection at 96.224–96.273

Executed a disciplined short off the 96.224–96.273 resistance zone, which aligned with bearish structure and rejection candle confirmation. Entry followed lower high formation, with stops placed above the recent swing at 96.303 to allow for volatility breathing room. Target set at 96.079, aligning with a clean sellside draw. Price showed momentum alignment and polarity flip reaction off resistance.

🔹 Strategy: Trap-to-draw execution

🔹 Entry: Post-rejection confirmation

🔹 SL: Above 96.303 swing

🔹 TP: Into 96.079 liquidity magnet

A precise, structure-backed short targeting engineered liquidity

AUDJPY trade ideas

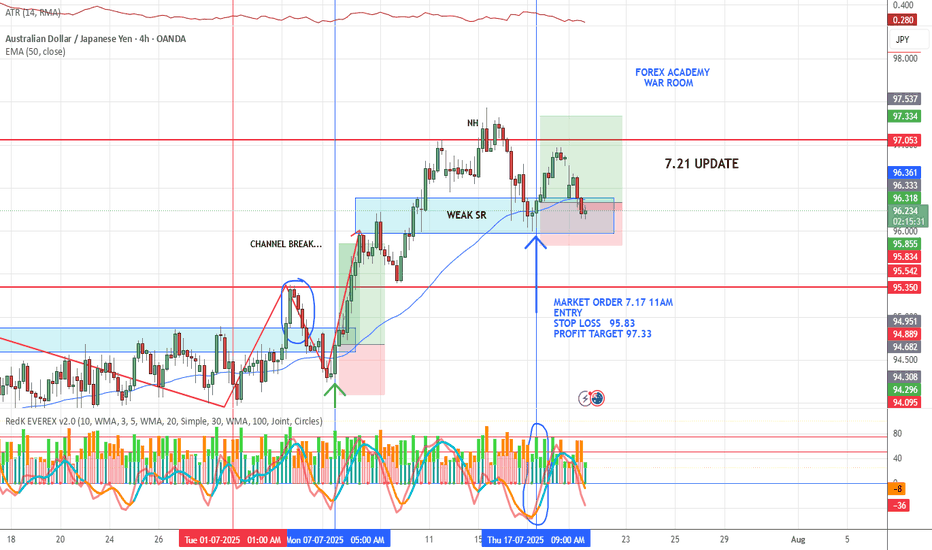

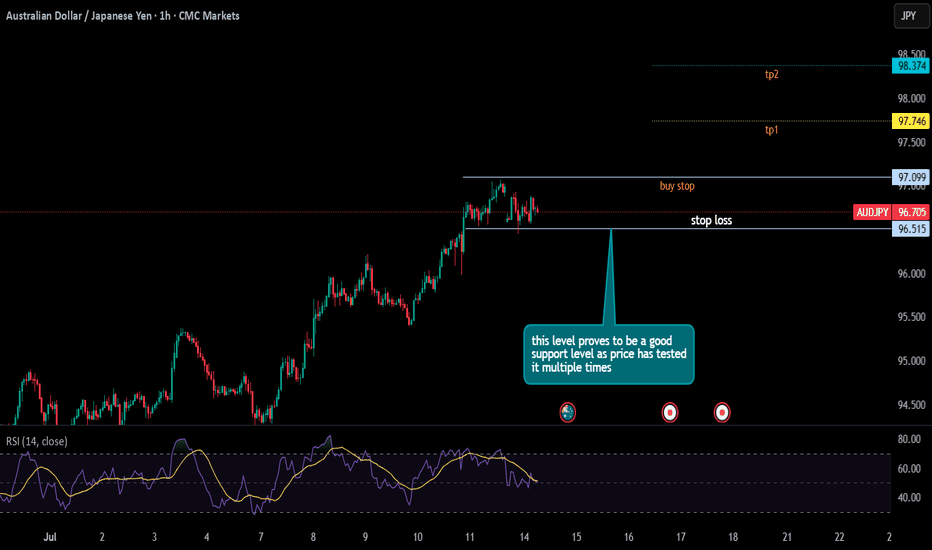

AUD/JPY LIVE TRADE UPDATESwing Trade Update – Gap Down Open

We entered this trade last Thursday based on our VMS swing setup.

When the market opened Sunday, price gapped down against us.

Now we’re watching for:

*Price to find support at this level

*A potential bounce and continuation in trade direction

📌 The gap doesn’t break the setup—structure will tell the truth. Patience required.

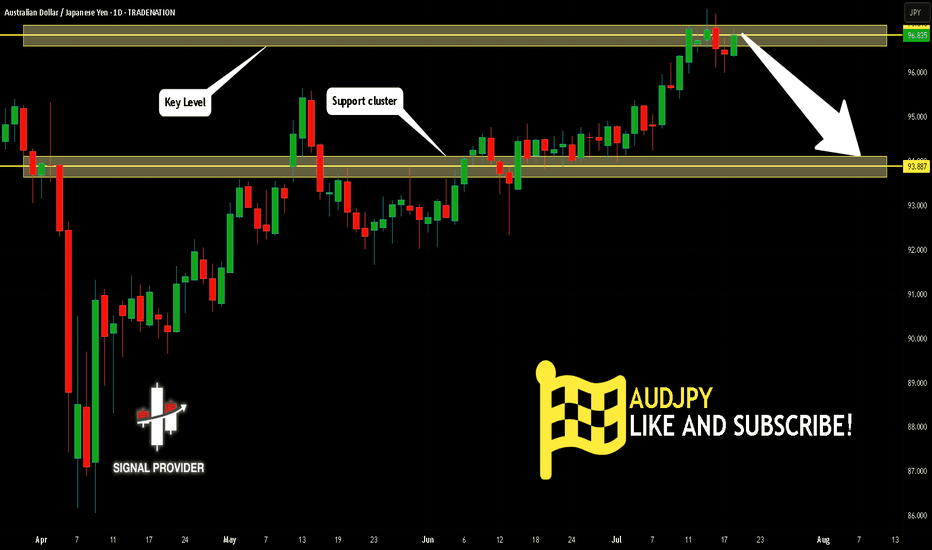

AUDJPY Will Go Lower From Resistance! Sell!

Please, check our technical outlook for AUDJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 96.835.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 93.887 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

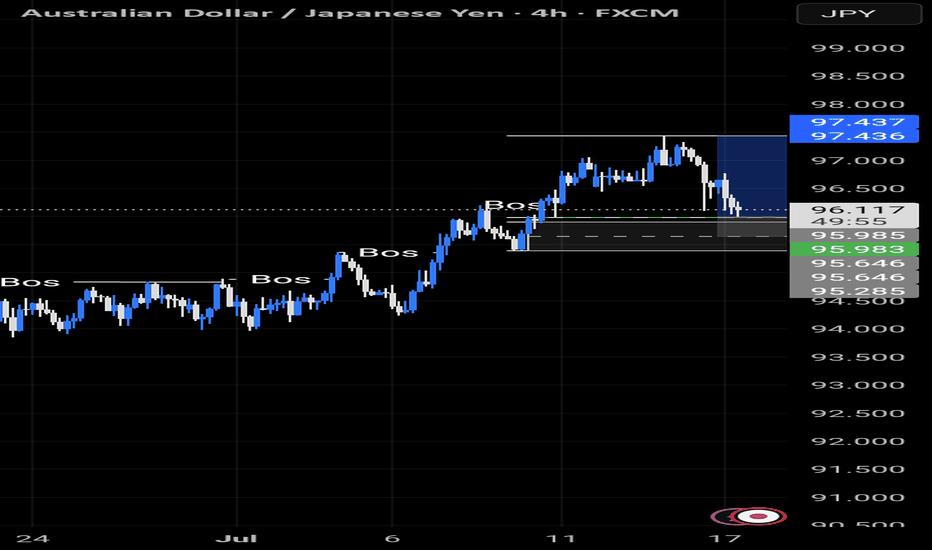

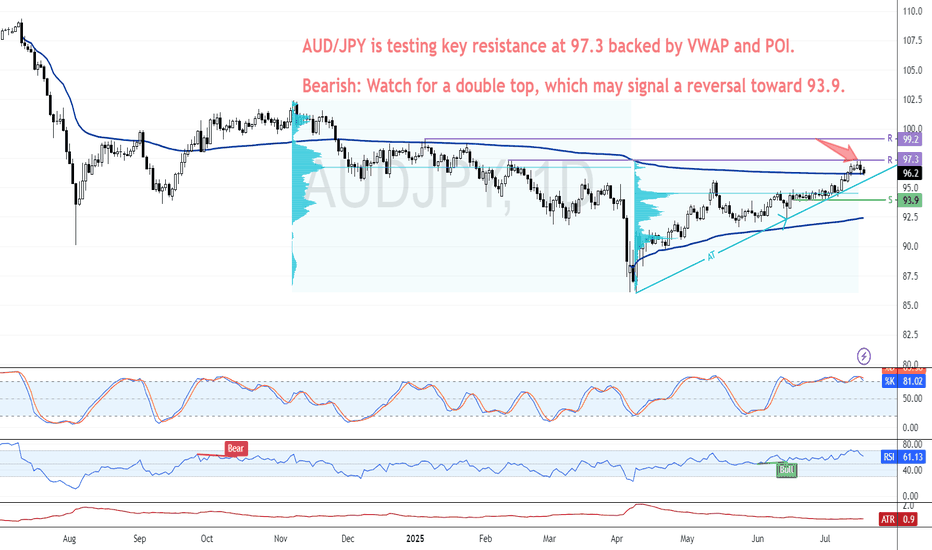

Unique Bearish Setup Emerges for AUD/JPY This QuarterFenzoFx—AUD/JPY is bullish, currently testing the critical resistance and order block at 97.3. This level coincides with the VWAP and volume profile point of interest. Bears are interested in adding short positions at the 97.3 price level.

Since this level is highly important and has the potential to change the trend, it is necessary to form a double top at this price, which has not happened before.

From a technical perspective, if a double top pattern forms at 97.3 and this level holds, a new bearish trend will likely emerge. In this scenario, the 93.9 level is likely to be targeted.

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are going short on the AUD/JPY with the target of 92.517 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trump v Powell: Round 6A day that looked like it was drifting into a 'summer lull' kind of day, suddenly had bouts of volatility when the TRUMP / POWELL SAGA re-emerged. Which is making it difficult to hold an opinion at the moment. If the president wins the battle and the FED cut rates more than expected, the USD (should) weaken. If Mr Powell (and the FED board) remain steadfast and keep the wait and see narrative, the USD (should) remain bouyed.

Yesterday's AUD JPY trade stopped out when the market ultimately decided the data didn't move the dial for potential rate cuts. It turned out that 'USD JPY long' would have been the optimal trade. And that's the risk you take when placing a trade 'post data' but 'pre US open'.

Of course, the risk to waiting for the US open is that the opportunity could have passed. It's a conundrum I don't think will ever have a clear answer.

Ultimately, I don't regret yesterday's trade given the information I had at that moment.

Inflation remains 'sticky' in the UK and a lot of emphasis is being put on Thursday's employment data. A 'soft' number will put the BOE in a bind of needing rate cuts to stimulate the economy, but unable to cut due to high inflation.

We also have upcoming AUD employment data, an improvement on last month is forecast, which should see the RBA remain hawkish. And I continue to hold my view that 'fundamentally' AUD JPY long is a good trade. It's just a case of waiting for the right moment. I have read that this week's JPY strength could be attributed to profit taking following recent weakness and ahead of elections in Japan this coming weekend.

Currently, it's a case of staying patient, maintaing a narrative. And trade when you feel like momentum backs up bias. If you only feel comfortable with a 1.2:1 risk reward, I would suggest that could be wise for the time being.

Tricky times, please feel free offervthoughtd or questions:

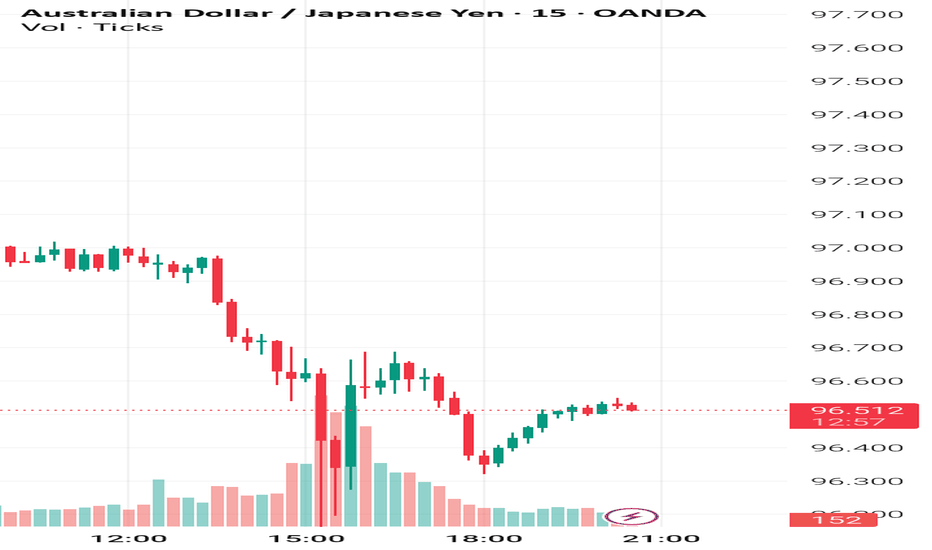

AUD JPY long. Entry: 97.13The market appears to like the month on month below forecast US CPI data.

The JPY is currently the weakest, I've therefore entered a straightforward 'risk on' AUD JPY catalyst trade.

It's a 20 pip stop loss with 30 pip profit target.

The risk to the trade is if the market changes its mind, or simply negative sentiment at the US open.

FOREX: Weekly Review: The week starting Monday 7 was a fairly sanguine week. With limited US data on the agenda, all eyes were on commentary surrounding the July 9 tariff deadline. Ultimately, any tariff concerns were be brushed aside when a 'fresh deadline' of August 2 was announced. Any attempts at fresh escalation following the announcement were met with ambiguity, as the market continues to hold the view that the president's bark is worse than his bite.

It was very pleasing to see the JPY weaken so much, without reading about a particular cause for JPY weakness, I put it down to a possible re-emergence of the 'carry trade'. Which is hopefully good news moving forward.

It was also nice to see the AUD so strong. A data dependent hold, combined with the overall positive risk environment and the rising price of copper, all contributed to AUD JPY long being a very viable trade all week.

The RBNZ also held rates, but with not as hawkish a narrative as the RBA.

The GBP continues to remain under pressure, the narrative surrounding the fiscal competency of the government compounded by 'soft' GDP data. And if anyone thinks a 'relative fundamental' GBP AUD short is a good idea, I wouldn't disagree.

I'm finding it difficult to have faith in the direction of the USD, caught between the post NFP strength / higher for longer narrative. And the overall market consensus that rate cuts will be coming soon.

All in all, I'll begin the new week keeping an eye on the tariff narrative, but, barring any 'strong negativity' (I'll let the VIX decide how negative the news is), I'll continue to hold a view that 'risk on' trades are viable. And with US CPI in the limelight, 'hopefully' a 'soft number' will compound the 'risk on narrative'.

On a personal note, it was a week of two trades, both AUD JPY long. The first hit profit and the second trade stopped out, interestingly, I was a lot more confident in the stop loss of the second trade, which goes to show no matter how confident we feel, we can only ever expect a 50% win rate.

Please excuse my lack of narrative at end of the week. On Thursday I suffered a strong migraine, which wiped me out for 48 hours. And is a reminder to myself to get my eyes tested, and perhaps to drink more water in this unusually hot UK weather. But if anyone did continue to short the JPY on Thursday and Friday, I would suggest it was a very valid trade idea.

Results:

Trade 1: AUD JPY +1.2

Trade 2: AUD JPY -1

Total = +0.2%

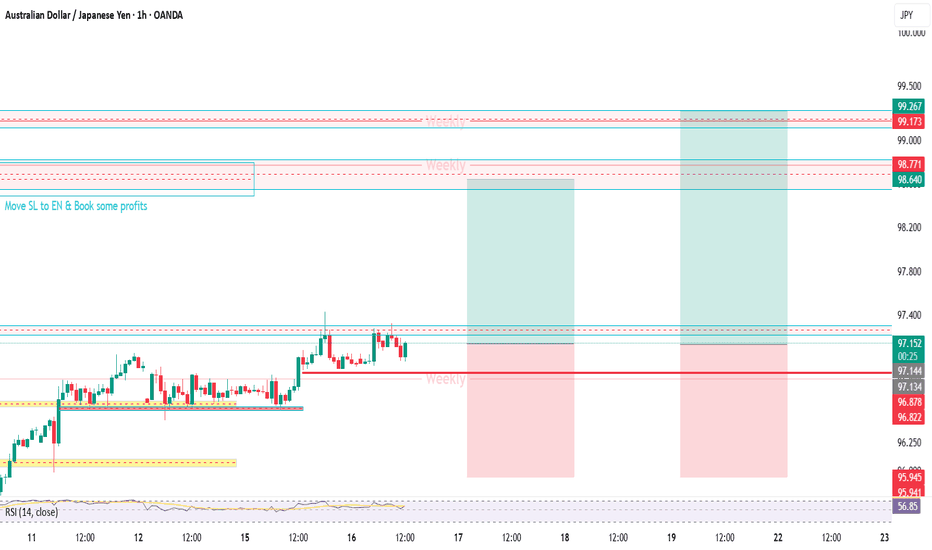

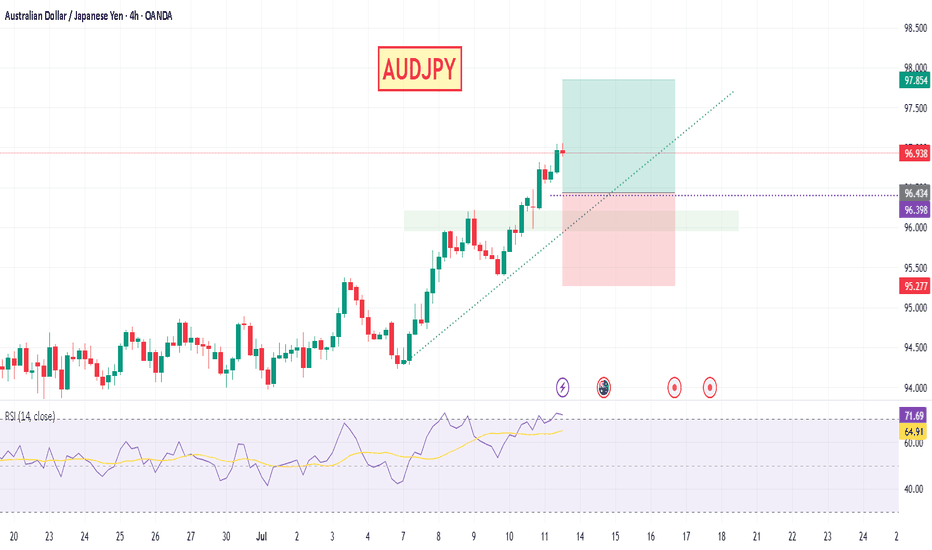

AUDJPY 4Hour TF - July 13th, 2025AUDJPY 7/13/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bearish

4hour - Bullish

Looking good on AJ! Last week’s analysis played out perfectly and we can see going into this week we have a similar scenario.

Here are the two potential trade paths for the week ahead:

Bullish Continuation - This is the most likely scenario going into this week as we just broke our 96.500 resistance and are now testing it as support. If we can confirm a higher low with strong bullish conviction we can look to enter long and target higher toward major resistance levels.

Bearish Reversal - For us to consider AJ bearish we would first need to see a break back below 96.500. If we can spot a clear trend change and some lower highs below 96.500 we can begin looking short. Target lower toward major support levels if this happens.

"AUD/JPY: Bulls About to Raid Tokyo? (Long Plan)"🎯 AUD/JPY BULLISH BANK HEIST! (Long Setup Inside) - Thief Trading Strategy

🚨 Yen Carry Trade Alert: Aussie Loot Up For Grabs! 💰

🦹♂️ ATTENTION ALL MARKET PIRATES!

To the Profit Raiders & Risk-Takers! 🌏💣

Using our 🔥Thief Trading Tactics🔥 (a deadly combo of carry trade flows + risk sentiment + institutional traps), we're executing a bullish raid on AUD/JPY—this is not advice, just a strategic heist plan for traders who play by their own rules.

📈 THE LOOTING BLUEPRINT (LONG ENTRY PLAN)

🎯 Treasure Zone: 92.700 (or escape earlier if bears attack)

💎 High-Reward Play: Neutral turning bullish - trap for yen bulls

👮♂️ Cop Trap: Where bears get squeezed at support

🔑 ENTRY RULES:

"Vault Unlocked!" – Grab bullish loot on pullbacks (15-30min TF)

Buy Limit Orders near swing lows OR Market Orders with tight stops

Aggressive? Enter at market but watch JPY news

🚨 STOP LOSS (Escape Plan):

Thief SL at nearest swing low (4H chart)

⚠️ Warning: "Skip this SL? Enjoy donating to yen bulls."

🎯 TARGETS:

Main Take-Profit: 92.700

Scalpers: Ride the Asian session momentum

🔍 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ BOJ Policy (Yen weakness continuing?)

✅ Commodity Prices (Iron ore/coal supporting AUD?)

✅ Risk Sentiment (Stocks rally = carry trade fuel)

✅ Interest Spreads (AUD-JPY yield advantage)

🚨 RISK WARNING

Avoid BOJ/RBA speeches (unless you like volatility torture)

Trailing stops = your golden parachute

💎 BOOST THIS HEIST!

👍 Smash Like to fund our next raid!

🔁 Share to recruit more trading pirates!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#AUDJPY #CarryTrade #TradingView #RiskOn #ThiefTrading

💬 COMMENT: "Long already—or waiting for better entry?" 👇🔥

P.S. Next heist target already being scouted... stay tuned! 🏴☠️

AUD_JPY IS OVERBOUGHT|SHORT|

✅AUD_JPY is trading in a strong

Uptrend but the pair is now

Locally overbought so after the

Pair hits the horizontal resistance

Level of 97.350 we will be expecting

A pullback and a bearish correction

On Monday!

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

AUDUSD Technical Analysis: Bullish BreakoutAUDUSD has recently broken decisively above a key resistance zone that had previously cape price for several months. This bullish breakout followed a period of compression and range-bound price action, signalling strong accumulation and building momentum.

As long as price holds above the retested resistance zone, the bullish outlook remains intact. With the current structure and upward momentum, AUDUSD is likely to extend higher towards the next major target near 0.97006.

You can see more details in the chart Ps Support with like and comments for more analysis.

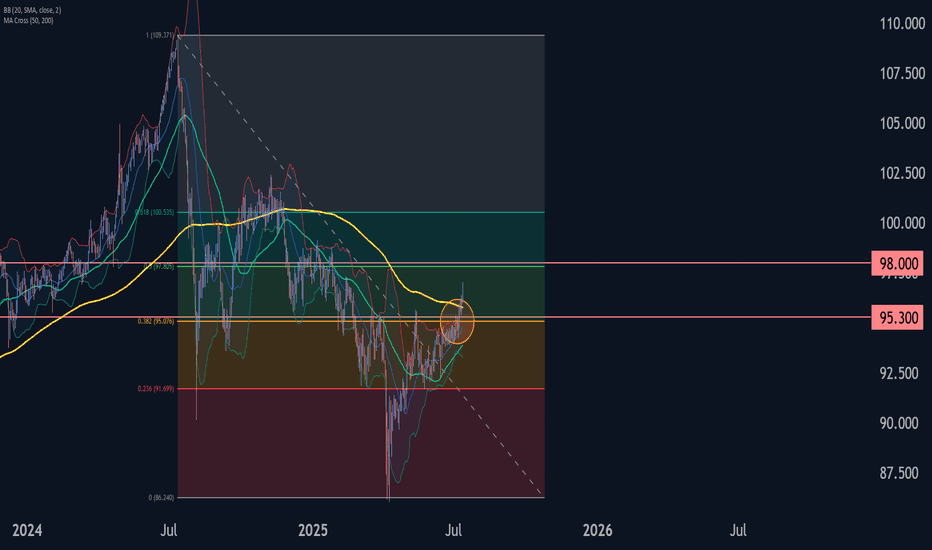

AUDJPY Wave Analysis – 11 July 2025

- AUDJPY broke resistance zone

- Likely to rise to resistance level 98.00

AUDJPY currency pair recently broke the resistance zone between the resistance level 95.30 (which has been reversing the price from March) and the 38.2% Fibonacci correction of the downward impulse from July.

The breakout of this resistance zone continues the active impulse wave 3, which belongs to the intermediate impulse wave (C) from May.

Given the strongly bearish yen sentiment seen across the FX markets today, AUDJPY currency pair can be expected to rise to the next resistance level 98.00 (target price for the completion of wave 5).

AUDJPY continues vigorously to five-month highsThe yen has declined in most of its widely traded pairs in recent days as trade tension between the USA and Japan escalated again. JPY’s appeal as a haven appears to be lower compared to the situation early last quarter. Meanwhile the RBA unexpectedly held its cash rate on 8 July. Although the BoJ is fairly likely to hike to 0.75% at the end of July, it seems unlikely the differential in rates for AUDJPY will go below 2% for the foreseeable future.

Much like AUDUSD, volume and ATR have declined significantly here and the stochastic signals overbought, but the shape of the chart is quite different and the latest high was accompanied by a significant uptick in momentum. The 50% weekly Fibonacci retracement around ¥97.70 is an obvious possible resistance.

A sustained move lower seems less favourable based on the current situation of both fundamentals and the chart. The 38.2% Fibo slightly below ¥95 might now flip to being an area of support. However, there’s a significant amount of important data for AUDJPY coming out in the next few days: Australian consumer confidence on 15 July, then Japanese balance of trade and inflation on 17 and 18 July respectively. Surprising results might significantly change the technical picture.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.