AUDJPY trade ideas

AUD_JPY IS OVERBOUGHT|SHORT|

✅AUD_JPY is trading in a strong

Uptrend but the pair is now

Locally overbought so after the

Pair hits the horizontal resistance

Level of 97.350 we will be expecting

A pullback and a bearish correction

On Monday!

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

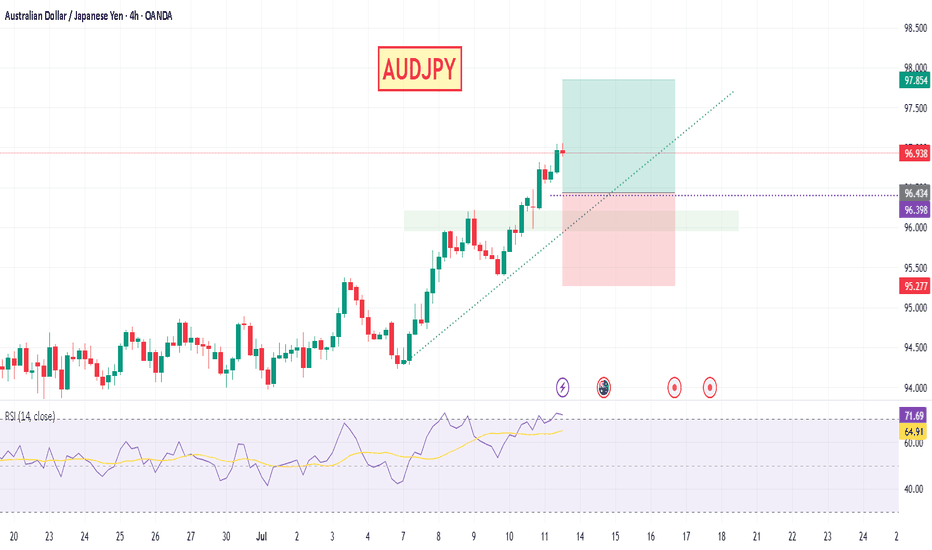

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

AUDUSD Technical Analysis: Bullish BreakoutAUDUSD has recently broken decisively above a key resistance zone that had previously cape price for several months. This bullish breakout followed a period of compression and range-bound price action, signalling strong accumulation and building momentum.

As long as price holds above the retested resistance zone, the bullish outlook remains intact. With the current structure and upward momentum, AUDUSD is likely to extend higher towards the next major target near 0.97006.

You can see more details in the chart Ps Support with like and comments for more analysis.

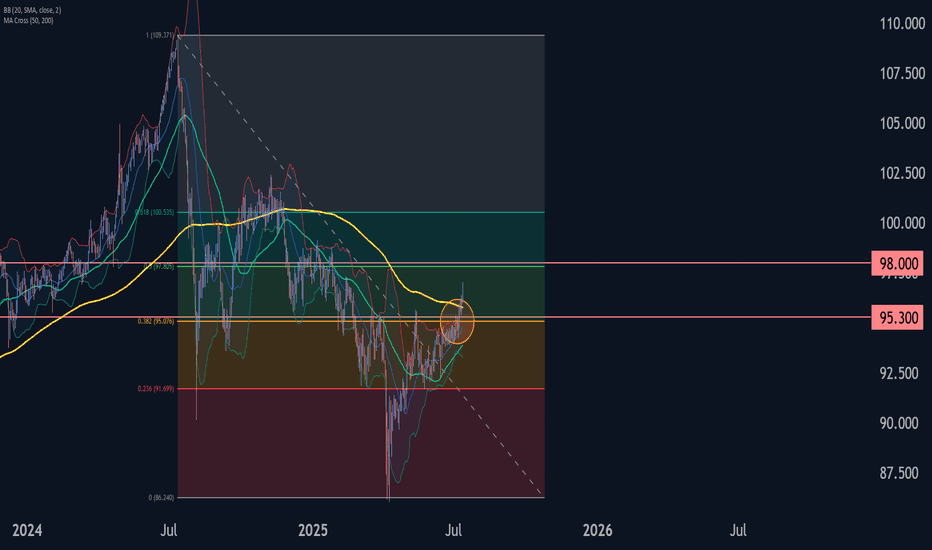

AUDJPY Wave Analysis – 11 July 2025

- AUDJPY broke resistance zone

- Likely to rise to resistance level 98.00

AUDJPY currency pair recently broke the resistance zone between the resistance level 95.30 (which has been reversing the price from March) and the 38.2% Fibonacci correction of the downward impulse from July.

The breakout of this resistance zone continues the active impulse wave 3, which belongs to the intermediate impulse wave (C) from May.

Given the strongly bearish yen sentiment seen across the FX markets today, AUDJPY currency pair can be expected to rise to the next resistance level 98.00 (target price for the completion of wave 5).

AUDJPY continues vigorously to five-month highsThe yen has declined in most of its widely traded pairs in recent days as trade tension between the USA and Japan escalated again. JPY’s appeal as a haven appears to be lower compared to the situation early last quarter. Meanwhile the RBA unexpectedly held its cash rate on 8 July. Although the BoJ is fairly likely to hike to 0.75% at the end of July, it seems unlikely the differential in rates for AUDJPY will go below 2% for the foreseeable future.

Much like AUDUSD, volume and ATR have declined significantly here and the stochastic signals overbought, but the shape of the chart is quite different and the latest high was accompanied by a significant uptick in momentum. The 50% weekly Fibonacci retracement around ¥97.70 is an obvious possible resistance.

A sustained move lower seems less favourable based on the current situation of both fundamentals and the chart. The 38.2% Fibo slightly below ¥95 might now flip to being an area of support. However, there’s a significant amount of important data for AUDJPY coming out in the next few days: Australian consumer confidence on 15 July, then Japanese balance of trade and inflation on 17 and 18 July respectively. Surprising results might significantly change the technical picture.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

AUDJPY SHORT FORECAST Q3 D10 W28 Y25AUDJPY SHORT FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY Ready To "Drop A Shoulder"? Multi-Timeframe May Help!OANDA:AUDJPY is beginning to form a very convincingly strong Reversal Pattern, the Head & Shoulders!

Starting with the Daily Chart we can see that Price is Forming a Doji Candle just after trying to Breakout of a Major Resistance Zone created from the Highs of March 18th and if Price is unable to close above this level, this strengthens the Bearish and Reversal Bias.

Now the 4 Hr Chart shows both the "First Shoulder" or Previous Higher High that was surpassed by the "Head" which is the New Higher High, has formed quite quickly with a slightly Ascending "Neckline" or Support Line where Bulls were able to make their Last Stand.

With a Reversal Pattern, you want to see a Change in Trend, in this case, would be a Lower High then that of the Higher High or "Head" @ 96.204.

*If Bulls are able to Push Price above the "Left Shoulder" or Previous Higher High @ 95.952, this will Invalidate the Head & Shoulders Set-up!

**If Bulls are unable to Break Above 95.952 and Price is pushed back down to the Confirmation or "Neckline" for a 3rd time, this Confirms the Head & Shoulders Set-up!!

Based on the Distance between the Head and Neckline, we can project a potential drop down to the next Support Level as a Price Target @ 95.00 once:

1) Pattern is Confirmed

2) Breakout is Validated

AUDJPY: Short Trade with Entry/SL/TP

AUDJPY

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell AUDJPY

Entry - 95.749

Stop - 96.149

Take - 94.847

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Live trade: AUD JPY long Entry 95.71

Nothing has happened to alter my 'risk in bias'. A, I've been waiting for a 'nice but of support' to place a stop loss behind. And I'm comfortable with the 1hr swings that have formed.

It's a 20 pip stop loss with 30 pip profit target.

The risk to the trade is a fresh bout of negative sentiment

Inverse head and shoulder pattern in AUDJPY - Daily Timeframe!Price just formed an inverse head and shoulder pattern in daily timeframe. Technically, this validates a chance of seeing more bullish price action development. Next resistance will be at 97.333 The higher timeframe (monthly) remains bullish so we’re expecting more of the bullish trend to continue.

AUDJPY 1D: breakout toward 100–105AUDJPY has confirmed an inverse head and shoulders breakout on the daily chart, with a strong move above the neckline. All key moving averages, including MA50 and MA200, remain below the current price — confirming bullish momentum. Volume increased on the breakout, and price has held above the 95.6 neckline zone. As long as that level holds, the setup remains valid. Targets are set at 100.36 (1.618 Fibo) and 105.19 (2.0 Fibo).

AUD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so AUD/JPY is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 95.252.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY Bullish Channel Still Intact, Eyeing Breakout Above 95.00AUDJPY continues to respect its ascending channel, with the current bounce occurring right at the 61.8% Fibonacci retracement and lower trendline support. The structure supports further upside as long as price holds above the 94.00–93.80 zone, with targets set toward 94.77 and 95.36, potentially extending to 95.63 highs.

🧠 Fundamentals:

AUD Strength Drivers:

RBA remains relatively hawkish vs other G10 banks.

Australia's data this week (retail sales, NAB confidence) were mixed, but no rate cut pricing in the near term supports AUD.

Iron ore demand showing resilience despite Chinese slowdown concerns.

JPY Weakness Drivers:

BoJ remains ultra-dovish. No action expected in July.

Japan’s inflation remains tame; the yield gap with other majors keeps widening.

Risk-on sentiment reduces demand for safe-havens like JPY.

🔍 Technical Structure:

Strong upward channel since early June remains valid.

Current pullback held the 61.8% Fib retracement of the June-July leg.

Bullish engulfing near support confirms entry.

Immediate resistance at 94.77 → 95.36 → potential breakout to 95.63.

Invalid if price closes below 93.80 (channel break).

⚠️ Risk Factors:

Risk-off shift (e.g., geopolitical escalation or U.S. CPI surprise) may boost JPY.

China growth fears can weigh on AUD.

A sudden dovish shift from the RBA would invalidate bullish fundamentals.

🔁 Leader/Lagger Dynamics:

AUDJPY typically leads other yen crosses (e.g., NZDJPY, CADJPY) during risk-on moves. It’s also a barometer for broader risk sentiment, often following moves in equity indices like US500 or commodity-linked assets.

✅ Trade Bias: Bullish

TP1: 94.77

TP2: 95.36

TP3 (aggressive): 95.63

SL: Below 93.80

Event to Watch: China data this week + U.S. CPI (Jul 11)

📌 Watch for a strong bullish daily candle above 94.77 for continuation confirmation. Stay nimble around key global risk events.

AUDJPY – Liquidity Trap Short Setup

Box framed between 95.961–94.719, with layered buyside liquidity swept at 95.859 and 95.961. Price printed a bearish body below structural shift (-CISD), confirming trap activation.

Entry executed post-shift → targeting sellside liquidity at 95.521, with extended draw potential toward 94.719.

Liquidation heatmap shows dim clusters above, bright gold clusters below = strong directional bias.

Narrative: smart money sweep complete → trap symmetry locked → discount magnet engaged. 📉🎯