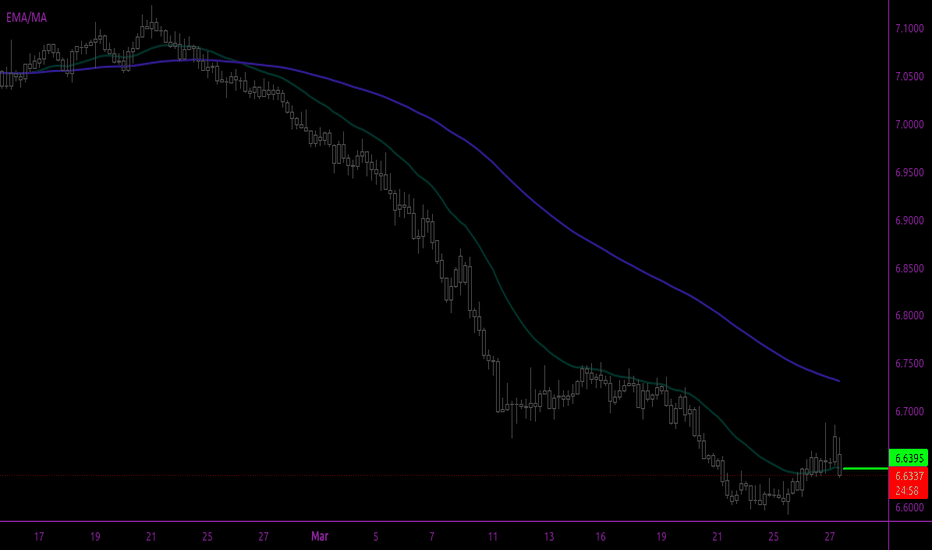

AUDNOK trade ideas

Education: How to Dominate the 2025 Markets with a Solid PlanAs the world hurtles toward 2025, the financial landscape is poised for both opportunities and challenges. For traders, investors, and business owners alike, the key to success is not simply reacting to market movements, but proactively creating a solid plan that allows you to dominate whatever the markets throw your way.

Today, we’ll break down the core elements of a strategy that will not only help you survive but thrive in the coming year. It’s time to stop guessing and start planning.

1. Understand the Big Picture

The first step to dominating the 2025 markets is understanding the macroeconomic forces shaping them. In 2025, we’ll still see the effects of post-pandemic recovery, shifts in global trade, and technological innovations that will change how we interact with financial markets. But there are other things on the horizon too—potential interest rate hikes, geopolitical tensions, and emerging market dynamics that can influence everything from commodities to currencies.

If you want to play the markets effectively, you need to get ahead of these trends, rather than reacting to them. You can’t predict every move, but by staying informed on what’s going on globally, you’ll be better prepared to make moves when the market presents opportunities.

Practical Tip:

Set aside time each week to catch up on world events, economic reports, and financial news. This gives you the context you need to make decisions beyond just looking at your charts.

2. Master Your Trading Psychology

A successful trading plan in 2025 won’t just be about technical setups or market conditions—it will depend largely on your mindset. As traders, we all face the emotional rollercoaster of drawdowns, missed opportunities, and the temptation to break our own rules. This is where a solid psychological foundation can make or break your success.

Having the right mindset means understanding that losses are part of the process and not an indicator of failure. You must embrace discipline, patience, and emotional control. The real key to dominating the market is sticking to your plan when things aren’t going well, not abandoning it at the first sign of trouble.

Practical Tip:

Use tools like TradingView’s alert system to stay detached from the screen and avoid emotional overtrading. This can help you focus on your long-term strategy and prevent impulsive decisions during high-pressure moments.

3. Leverage the Power of Backtesting and Data Analysis

By 2025, data is more powerful than ever. Whether you’re trading stocks, forex, or crypto, having access to historical data allows you to backtest your strategies and refine them based on actual performance rather than guesswork. Backtesting helps you determine if your strategy has been profitable under various market conditions—taking the guesswork out of your trading decisions.

Think of backtesting as practice before the real game. It’s like running drills before a big match, and it’s absolutely essential if you’re serious about dominating the market. When you know that a strategy works in various conditions, you can confidently execute it when the time comes.

Practical Tip:

Use platforms like TradingView or MetaTrader to backtest your strategies using historical data. Look for patterns, analyze risk-to-reward ratios, and refine your entry and exit criteria.

4. Refine Your Risk Management

A solid risk management plan will separate you from the pack in 2025. Market conditions will be volatile, and having a solid framework for controlling risk is critical to surviving and thriving. The best traders are not the ones who make the most money on each trade—they are the ones who manage their losses effectively.

This means setting stop-loss orders, only risking a small percentage of your capital on each trade, and having clear guidelines on position sizing. A well-structured risk management strategy ensures that you can weather periods of drawdown without blowing your account.

Practical Tip:

Decide upfront how much you’re willing to risk on each trade (usually no more than 1-2% of your capital), and set your stop-loss orders accordingly. Even if a trade goes against you, your account will survive and thrive in the long run.

5. Adapt to Emerging Market Trends

The market in 2025 will be shaped by more than just traditional assets like stocks, bonds, and forex. The rise of cryptocurrencies, advancements in AI and machine learning, and innovations in fintech will play an increasingly important role in the way we invest and trade.

While you don’t need to be an expert in every new trend, it’s important to stay agile and keep your finger on the pulse of emerging opportunities. The traders who adapt first to new markets, whether it’s cryptocurrencies, NFTs, or AI-driven investment strategies, are the ones who stand to gain the most.

Practical Tip:

Start exploring new markets now, even if you're not ready to trade them yet. Get familiar with the technologies, projects, and coins that are emerging. This gives you a head start in identifying potential profitable opportunities in 2025.

6. Create a Daily Routine and Stick to It

Success in trading and investing isn’t about working 12-hour days—it’s about consistency. The traders who consistently succeed are the ones who develop a daily routine and stick to it. Your routine should include time for market analysis, backtesting, reviewing your trades, and staying updated on economic news.

A daily routine keeps you grounded and ensures you are constantly improving your skills while managing your trades with a calm and clear mind. The moment you start skipping steps, rushing through your plan, or making impulsive decisions, you're more likely to miss important opportunities or make unnecessary mistakes.

Practical Tip:

Create a trading checklist that you follow every day. This could include checking the economic calendar, reviewing your previous trades, performing technical analysis, and setting alerts for key levels. By following this routine, you ensure that you're always prepared and never caught off guard.

Final Thought: Your Plan, Your Success

The key to dominating the markets in 2025 is not about hoping for luck or predicting the future—it’s about having a solid plan, mastering your mindset, and executing consistently. If you follow the steps outlined here, you’ll be well-positioned to navigate whatever challenges the market throws your way and come out on top.

But here’s the thing: plans are nothing without action. It’s time to stop reading about success and start implementing these strategies. You know the risks. You know the challenges. Now, are you ready to dominate the 2025 markets? Let me know what strategies you're planning to implement, and how you’re preparing for the coming year! Your thoughts could make all the difference.

Great trade🔥Get ready, wolves🔥

One more triangle for today.

There is a Symmetrical Triangle on AUD/NOK currency pair.

The price was in a slight Bullish trend before this huge consolidation.

Will it be a good confirmation for bulls to go long.

However do not rush the trade.

Just follow the chart and look for the clear breakout.

_____________________________________________________

If you enjoy my FREE Technical Analysis , support the idea with a big LIKE👍 and don't forget to SUBSCRIBE my channel, you won't miss anything!

Feel free to leave comments✉️

And always remember: "we don't predict, we react".

Great triangle⚖️Tired of small frame?! Here is the symmetrical triangle on 1D timeframe on AUDNOK instrument.

There was a slight bullish sentiment before. After that the price entered into consolidation and has drawn symmetrical triangle.

Interesting formation to make money.

Follow the chart and look for the best entering price carefully.

_____________________________________________________

If you enjoy my FREE Technical Analysis , support the idea with a big LIKE👍 and don't forget to SUBSCRIBE my channel, you won't miss anything!

Feel free to leave comments✉️

And always remember: "we don't predict, we react".

Forex-second love🔥Tired of small frame?! Here is the symmetrical triangle on 1D timeframe on AUDNOK instrument.

There was a slight bullish sentiment before. After that the price entered into consolidation and has drawn symmetrical triangle.

Now the price made possible breakout of resistance zone . However it is not too late to earn money on this trade.

According to Elliott Waves theory all the waves are done and broke the zone.

Follow the chart and look for the best entering price carefully.

If you enjoy my FREE Technical Analysis , support the idea with a big LIKE👍 and don't forget to SUBSCRIBE my channel, you won't miss anything!

Feel free to leave comments✉️

And always remember: "we don't predict, we react".

AUDNOK is in the Upward Channel!We can look for an accurate Buy entry.

Reasons:

- the price is on the Upward Channel;

- the price can break the Support/Resistance Zone;

- the trend is bullish;

- potential profit will be in 3...5 times bigger than risk.

Dear followers, the best "Thank you" will be your likes and comments!

Before to trade my ideas make your own analysis.

Thanks for your support!