SHORT ON AUD/NZDAUD/NZD has given a perfect setup for a sell.

I has bearish divergence as well as a rising channel/wedge into a Major Supply Area from the Higher TF.

We have also change structure from Up to Down on the Lower Timeframe.

I will be selling AUD/NZD to the pervious swing low / demand area for about 100 pips. OANDA:AUDNZD

AUDNZD trade ideas

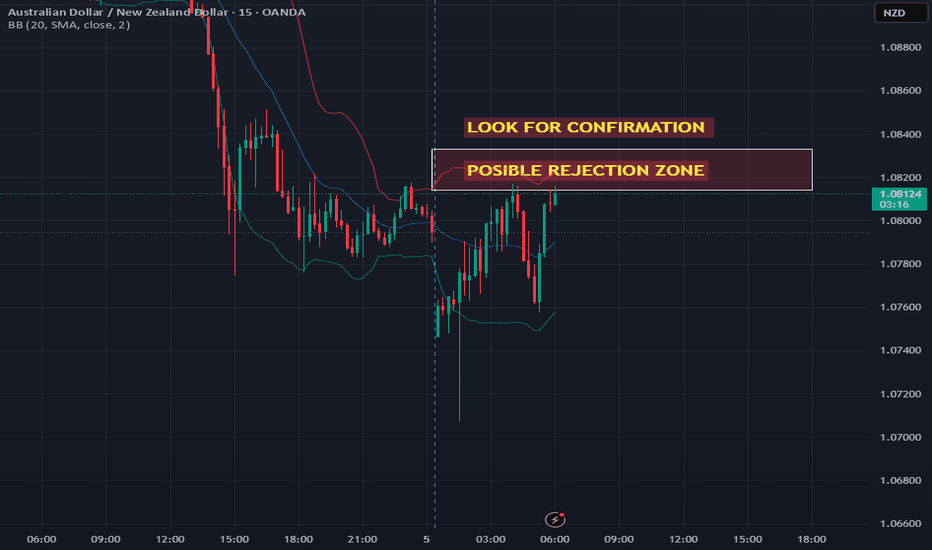

AUD/NZD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie-Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 1.10400 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 4H timeframe (1.09700) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.11700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/NZD Testing Area of Confluence; Further Selling?Following the pullback from lows of N$1.0903 on 20 March in the AUD/NZD cross (Australian dollar versus the New Zealand dollar) – a move that also completed a longer-term double-top pattern at N$1.1180 – buyers and sellers on the daily chart are squaring off at resistance from N$1.1002. Complementing this area is a trendline that has turned from support to resistance (from the low of N$1.0564), and a 38.2% Fibonacci retracement level at N$1.1008.

AUD-NZD Massive Long! Buy!

Hello,Traders!

AUD-NZD has also fallen

Down by a lot last week

And we think that the

Initial panic move is over

So as the pair is oversold

And is about to retest a

Horizontal support of 1.0740

A strong bullish correction

Is to be expected on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_NZD SWING LONG|

✅AUD_NZD is about to retest a key structure level of 1.0750

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY FORECASTGuys! the market has opened with a very good and clean structures! This week looks stunning and impressing as well. What we only need is to be patient waiting for the market to give us a clear picture of what is going to do next! AUDNZD is looking clearer let's watch it with a close eye today and see actually how the market is going to develop!

AUD-NZD Local Correction Ahead! Sell!

Hello,Traders!

AUD-NZD is already making

A pullback form a horizontal

Resistance of 1.1020 so we

Are locally bearish biased and

We will be expecting a further

Local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Will Fall! Short!

Take a look at our analysis for AUDNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.100.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.090 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD_NZD SHORT FROM RESISTANCE|

✅AUD_NZD has retested a key resistance level of 1.1020

And as the pair is already making a bearish pullback

A move down to retest the demand level below at 1.0976 is likely

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

New Chance To Buy AUD/NZD To Who Missed It , 200 Pips Waiting !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

AUD/NZD BEARISH BIAS RIGHT NOW| SHORT

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.098

Target Level: 1.089

Stop Loss: 1.104

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDNZD SELL TRADE PLAN🔥 AUD/NZD TRADE PLAN 🔥

Date: March 28, 2025

Type: MAIN SWING TRADE – Institutional Sell Setup

📉 Market Bias: Bearish (D1 Lower High + H4 Weakness Confirmed)

🧩 Trade Type: Trend Continuation

📌 Entry Type: H4 OB Retest + Liquidity Sweep

⭐ Confidence Level: ⭐⭐⭐⭐ (84%)

(Reason: Bearish structure across D1/H4, OB + FVG alignment, H4 hidden bearish divergence, liquidity sweep confirms institutional positioning)

📌 Status: Price is inside the zone – Awaiting confirmation

📍 Entry Zones:

Primary Sell Zone: 1.0985 – 1.0995

(H4 Bearish OB + minor liquidity sweep on H1)

Secondary Zone: 1.1005 – 1.1015

(H4 FVG + extended liquidity above recent high)

❗ Stop Loss: 1.1025

(Above extended liquidity + last unmitigated H4 wick)

🎯 Take Profits:

TP1: 1.0945 🥉 (Recent H1 swing low + OB reaction zone)

TP2: 1.0910 🥈 (H4 liquidity cluster)

TP3: 1.0875 🏆 (D1 structure low and liquidity zone)

✅ R:R Ratio: Approx. 1:3.6

(Accurate institutional SL/TP spacing for continuation setup)

⚠️ Confirmation Required Before Entry:

– H1 bearish engulfing or rejection wick inside the zone

– Volume spike or absorption candle

– Optional: M30 divergence or exhaustion wick

– H4 RSI Hidden Bearish Divergence (already confirmed)

📌 Reason for Entry:

✔ D1 trend clearly bearish – recent lower high in formation

✔ H4 has shown clear BOS after prior liquidity sweep

✔ Price now retesting H4 OB after sweep of internal high

✔ OB/FVG stack + liquidity inducement = high probability zone

✔ Fundamentals support bearish AUD against NZD

✔ H4 Hidden Bearish Divergence confirms trend continuation pressure

🛡️ Risk Management Reminder:

– Risk 1–2%

– SL to BE after TP1

– Partial profits at TP2

– Optional full exit at TP3 or trail aggressively

⏳ Trade Validity:

Valid for 1–3 days (H4 structure play)

❌ Invalidate if price breaks and closes above 1.1025

🌐 Fundamental & Sentiment Confluence:

✅ AUD remains under pressure – weak economic momentum & rate path

✅ NZD slightly stronger – supported by dairy exports + neutral tone

✅ Retail sentiment mixed – contrarian angle supports continuation

✅ No conflicting macro data in next 24h

📋 Final Trade Summary:

AUD/NZD remains in a bearish structure across all timeframes. We are currently in the sell zone (H4 OB + liquidity sweep). Awaiting confirmation from H1 bearish PA before triggering short. Do not enter prematurely. Plan offers high R:R and aligns with institutional bias.

🧠 Status Recap:

📌 Price is inside the zone – Wait for confirmation trigger on LTF

📌 If confirmed → Enter

📌 If no confirmation → No entry