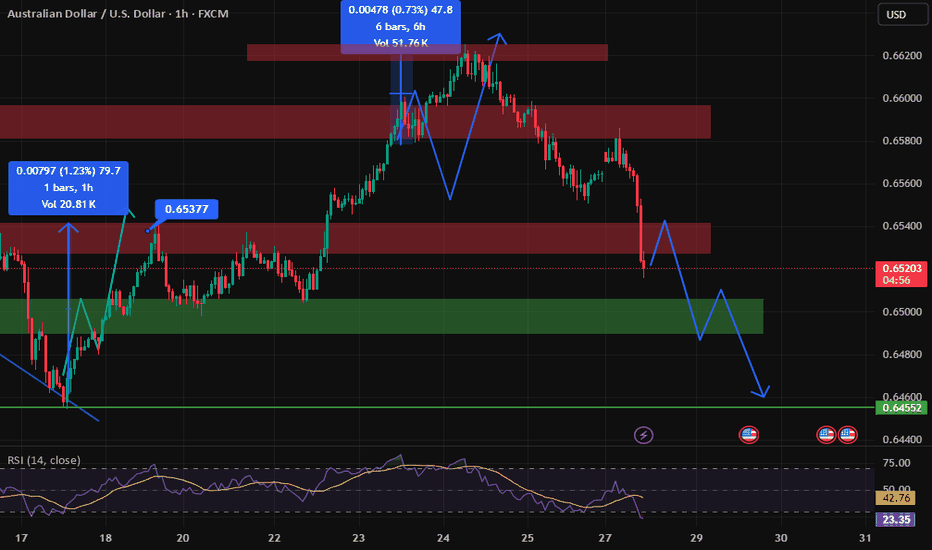

AUD_USD BEARISH BREAKOUT|SHORT|

✅AUD_USD broke the key

Structure level of 0.6460

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of

The broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD trade ideas

AUDUSD SHORT SETUP – BEARISH BREAK & RETEST📉 AUDUSD SHORT SETUP – BEARISH BREAK & RETEST

Price breaks below rising channel support and retests structure as new resistance. Clean rejection confirms bearish continuation bias.

🔻 Entry: 0.6495

🎯 Targets: 0.6420 → 0.6400 → 0.6370

🛑 SL: 0.6545

⏰ TF: 2H

📊 Bias: Bearish

Technical confluence aligns with momentum shift—waiting for follow-through to key demand zone.

#AUDUSD #ForexSignals #PulseTradesFX

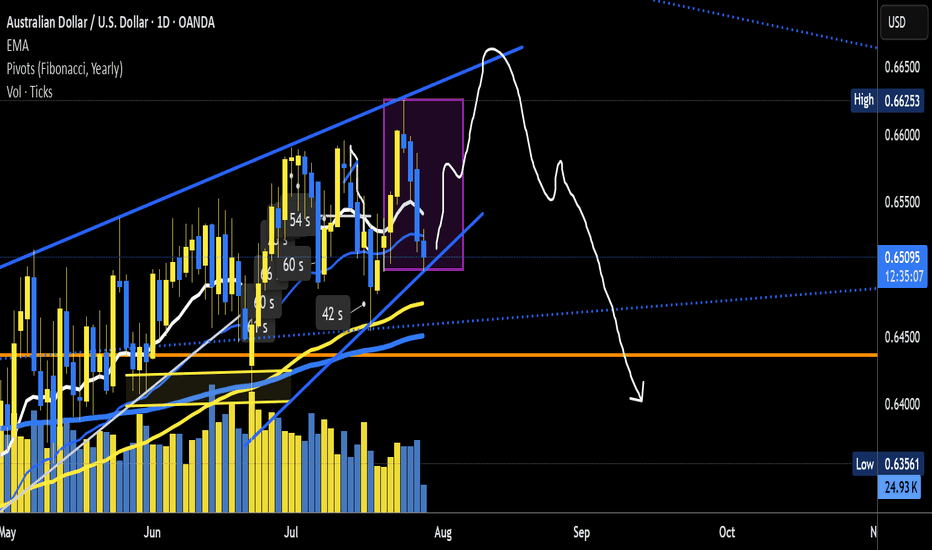

AUD/USD part 2.my trading journal continued.

trend line of ascending triangle bottom appears to be holding. Road map still valid. looking for a entry point at end of 1 hour chart for leg up before a major downward move. (2 potential trades on the table).

remember today some big news out of US today. i final spike down on 5 minute is on the cards.

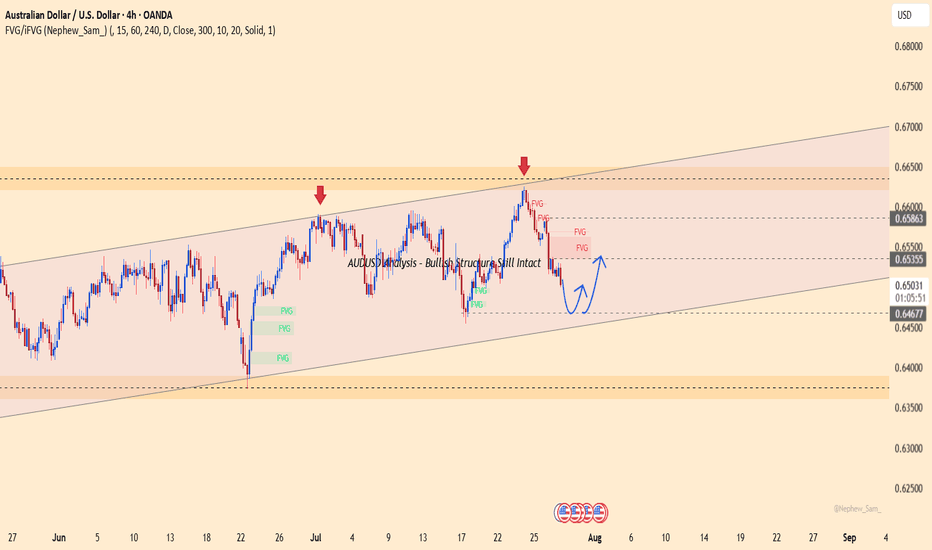

AUDUSD Analysis – Bullish Structure Still IntactAUDUSD is trading within a clear ascending channel on the H4 chart. After dropping from the FVG zone around 0.65800, price has reacted well to the lower boundary support near 0.64650.

Currently, price action suggests the potential formation of a short-term bottom. If this level holds and the pair rebounds, the next target could be the red FVG zone near 0.65400.

Recent Supporting News:

U.S. consumer confidence slightly weakened, causing the dollar to cool off — offering technical rebound support for AUD.

Trading Strategy:

Prefer short-term Buys near 0.64650 if a confirmed bounce appears, with target around 0.65400. Be cautious if price breaks below the ascending channel.

Do you think AUD will continue to rise within this bullish channel?

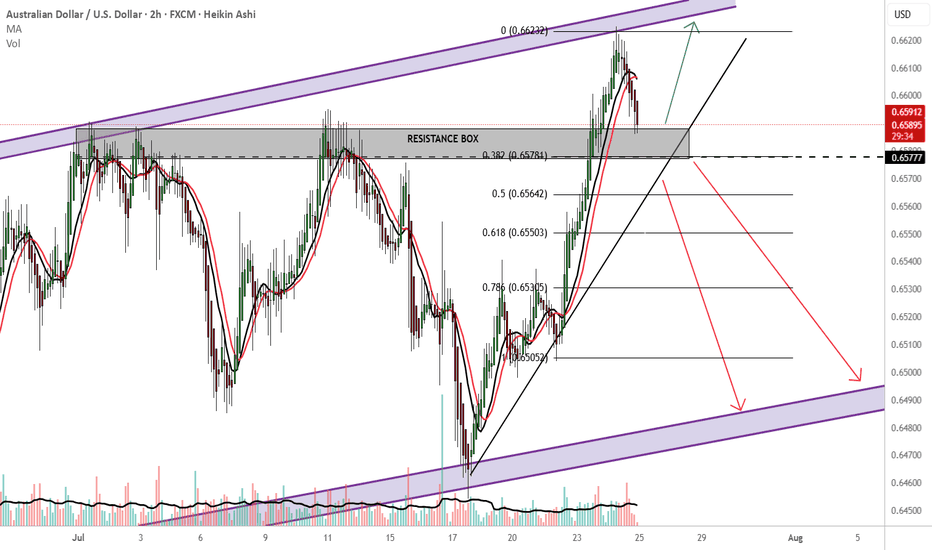

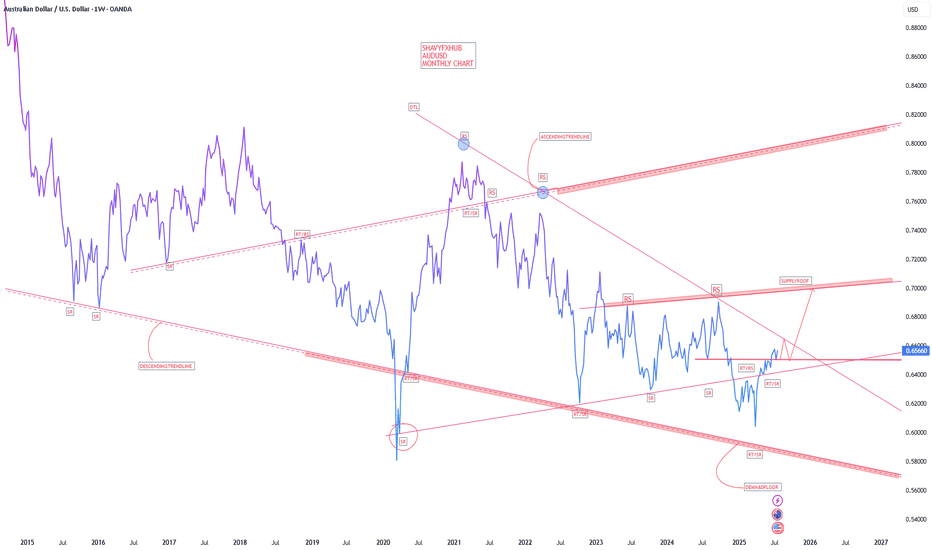

AUDUSD Still early days

20% in me:

Unless strong bullish fundamentals present themselves or the big boys with the big bucks drive a bullish push anywhere from 0.65784 or resistance, I would be looking to sell.

Buy outside the resistance box

TP:0.66600 new immediate high?

Please also consider price action as there are 2 previous rejections in the 0.65784 price area.

80% in me:

-Australia is heavily tied to China via exports

RBA rate cuts?

Falling iron ore prices...

-Perfect price action channel trade. SELL at resistance BUY at support. Bullish long term, bearish short term.

-fib 0.382 downward continuation and close below 0.65784

-Looking for a break below the upward sloping trendline HARD sell

-safer option: wait for a 0.65780 retest, below the upward sloping trendline sells and make bank.

TP: 0.6500

THOUGHTS?

Trade Setup: AUDUSD – Short Opportunity Identified A fresh sel Trade Setup: AUDUSD – Short Opportunity Identified

A fresh sell opportunity on AUDUSD has been spotted, backed by bearish market structure, technical resistance, and macroeconomic sentiment favoring a downside move. AUDUSD is currently trading near a key resistance zone around 0.65250, where the price has previously failed to break higher.

The market has shown repeated rejections near this level, indicating potential for a bearish reversal.

The entry at 0.65239 is strategically positioned just below resistance, allowing traders to catch the move early before momentum builds.

The first target at 0.65150 is a short-term intraday support level and offers a quick, low-risk profit opportunity.

The second target of 0.65000 is a psychologically important level and a common magnet for price action in downward trends.

The third target at 0.64890 aligns with a previous swing low, making it a strong candidate for extended profit-taking if momentum continues.

The stop loss at 0.65340 is placed above the resistance and recent high to minimize losses while giving the trade enough room

AUDUSD(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

0.6538

Support and resistance levels:

0.6610

0.6583

0.6566

0.6511

0.6493

0.6466

Trading strategy:

If the price breaks through 0.6538, consider buying, the first target price is 0.6566

If the price breaks through 0.6511, consider selling, the first target price is 0.6493

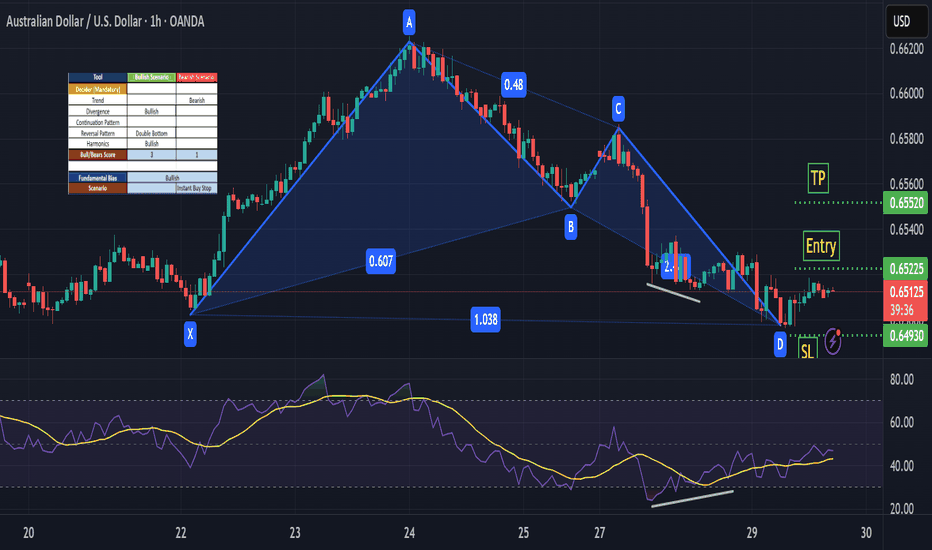

AU LongAUDUSD Entry

Entry @ break and retest of minor support/resistance and trendlines minor and 1H

TP1 where 1H and 4H PRZ share @ 0.66155 TP2 @ 0.66584

which also -27 on major structure fib

HH and HL showing on major structure, continuing the uptrend

Price retraced to 38.2, retesting 1H trendline

AUDUSD – DAILY FORECAST Q3 | W31 | D28 | Y25AUDUSD – DAILY FORECAST

Q3 | W31 | D28 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

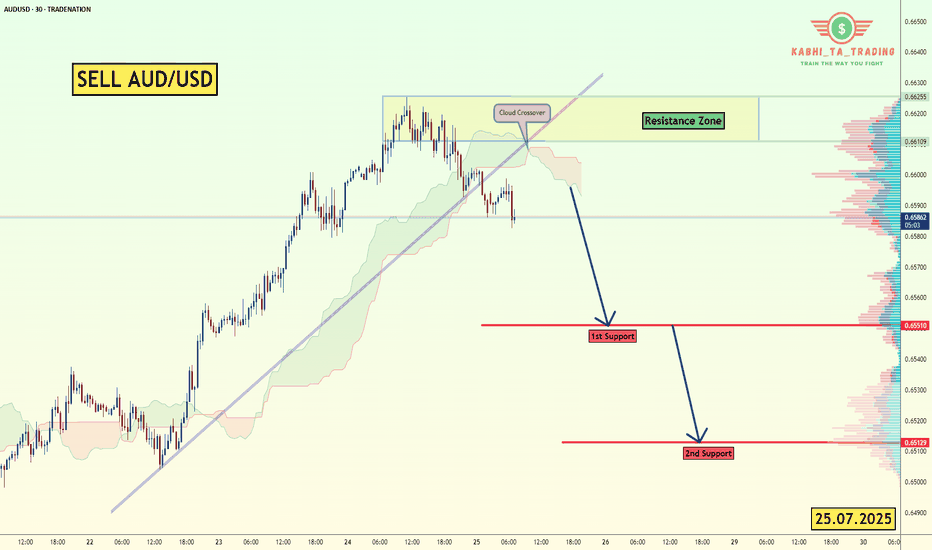

AUD/USD Sell SetupOANDA:AUDUSD

Timeframe: m30

Entry: 0.66151

SL: 0.66266

TP1: 0.66033

TP2: 0.65914

TP4: 0.65681

📊 Setup Rationale

🔺 Channel Top Rejection (8H Overlay) Price has touched the upper boundary of a descending channel visible on the 8-hour chart. This zone has historically acted as a strong resistance, increasing the probability of a reversal.

🧱 Local Structure (30min) Entry aligns with a minor double top (in lower TFs) and bearish momentum. The tight SL allows for a high R:R profile.

🔄 Momentum Shift Watch for bearish engulfing or rejection wick on lower timeframes to confirm entry.

#MJTrading #Forex #AUDUSD #Sell

Psychology always matters:

AUDUSD.JULY 29TH

Bureau of Labor Statistics will publish will JOLTS which measures the Number of job openings during the reported month, excluding the farming industry;

JOLTS Job Openings CB Consumer Confidence forecast 95.9 previous 93.0 .market will watch for data report for clear directional bias .

wednesday 30th

Australian Bureau of Statistics will publish the Consumer price index which Measures Change in the price of goods and services purchased by consumers

'Actual' greater than 'Forecast or below will be watched for clear directional bias .

this data are Frequency Released quarterly, about 25 days after the quarter ends;

and the next report will be on Oct 30, 2025

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate of 2%

Aud CPI q/q forecast 0.8% previous 0.9%

AUD CPI y/y forecast 2.1% previous 2.1%

AUD Trimmed Mean CPI q/q forecast 0.7% previous 0.7%

USD 1:15pm

1:15pm USD ADP Non-Farm Employment Change forecast 82K previous -33K

Advance GDP q/q forecast 2.4% previous -0.5%

Advance GDP Price Index q/q forecst 2.3% previous 3.8%

Pending Home Sales m/m forecast 0.3% previous 1.8%

USD Crude Oil Inventories-3.2M

by 7pm USD Federal Funds Rate previous 4.50% 4.50%

FOMC Statement

7:30pm FOMC Press Conference.

watchout for federal fund rate data report and FOMC (federal open market committee)

NOTE;TRADING ANAY INSTRUMENT IS 100% PROBABILTY ,ANY KEY LEVEL CAN FAIL YOU,DONT EVER TRADE WITH ALL YOUR CAPITAL BECAUSE YOU MENTOR SAY BUY OR SELL.

TRADING IS 100% PROBABILTY AND NO STRATEGY IS PERFECT.

TRADE WITH CAUTION.

WISH A HAPPY NEW WEEK.

BYE.

AUD/USD - Breakout (25.07.2025)The AUD/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.6551

2nd Support – 0.6513

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.