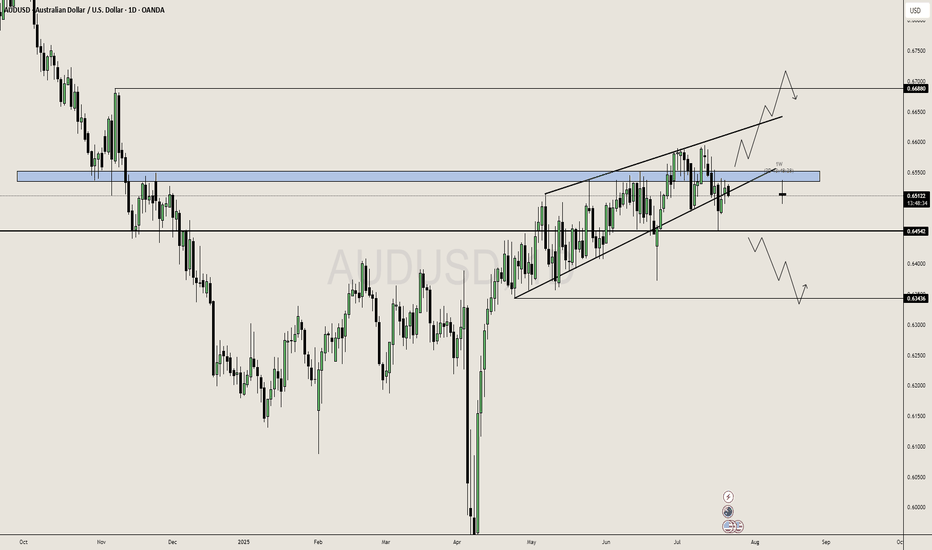

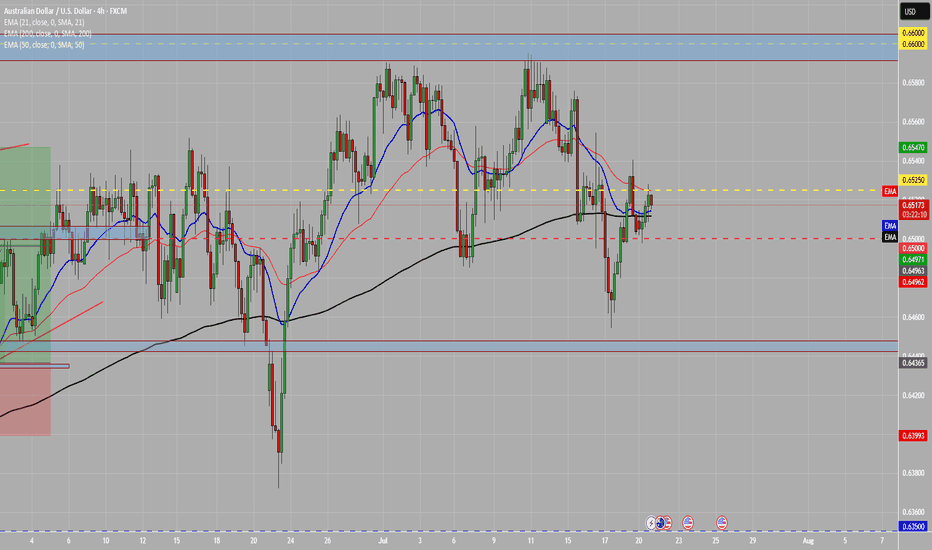

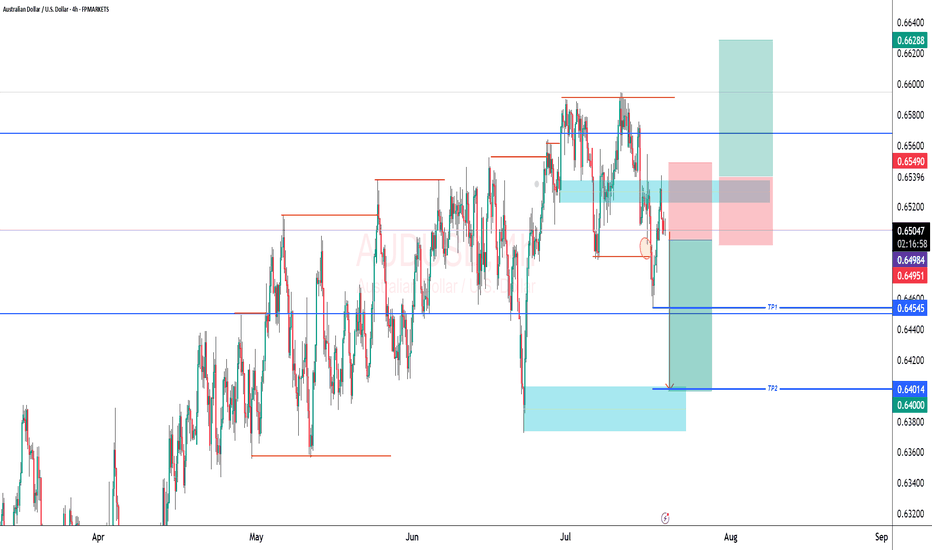

AUDUSD holding, Might Trigger a Upside MoveAUDUSD is still in Solid Sideways Range in Daily Chart. More Probabilities looking towards buy side, looking for liquidity at 0.66880.

It's in Range since 18 April, 2025 and hunting liquidity for both the buyers and sellers. Possibly it could trap seller and go in Buy Side.

In other case, The Sell Momentum can come if it breaks and holds below the 0.64500 Level. Then we can expect a sell momentum till the support level of 0.63400.

Daily is in Range so we can Predict the Price more clearly but if any of level from support or resistance breaks we can see a long-term Opportunity.

AUDUSD trade ideas

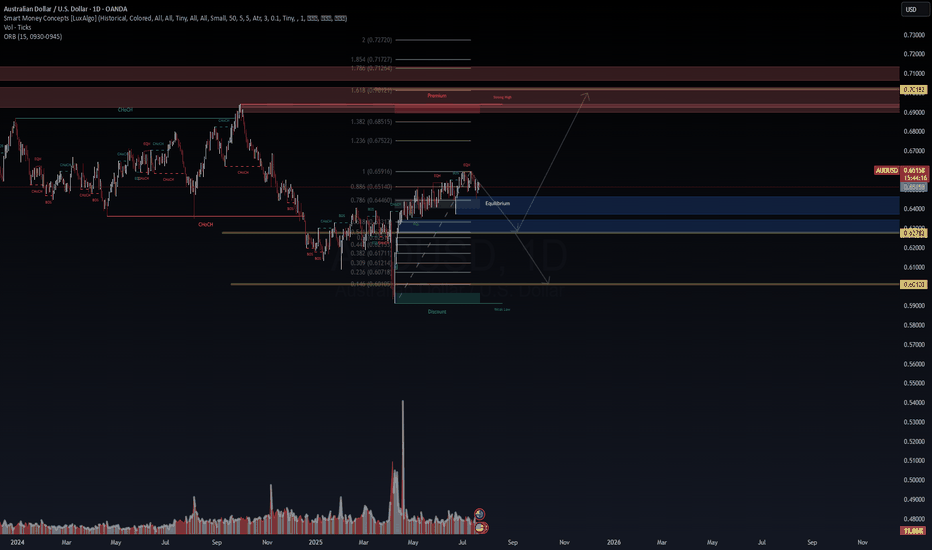

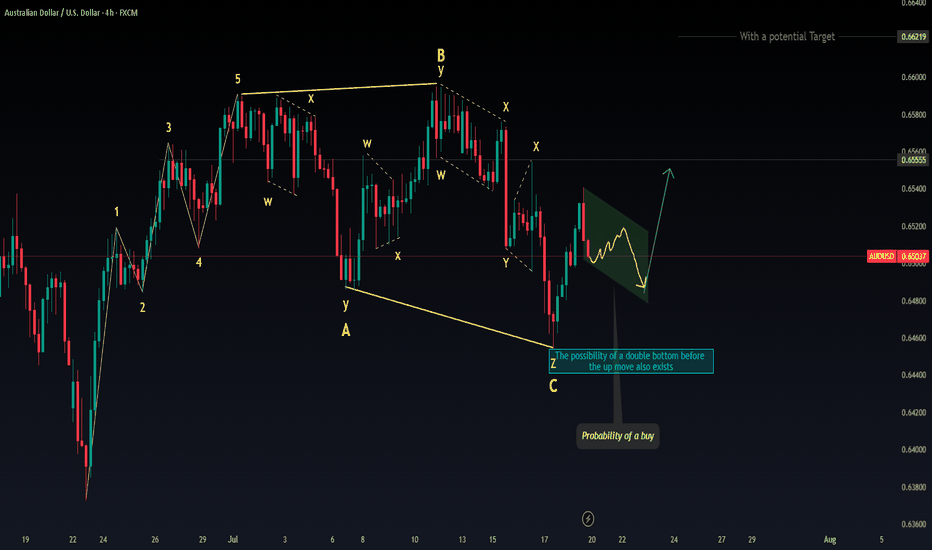

VolanX AUD/USD Tactical Short ThesisVolanX AUD/USD Tactical Short Thesis

The Aussie is showing signs of exhaustion near the 0.886 retracement and has swept major equal highs. Liquidity was engineered and harvested.

Now price is sliding into a vacuum—first target is the imbalance around 0.6440, with a deeper structural demand zone below at 0.6278.

We are positioned via /6AU5 put options, targeting this sweep as AUD re-aligns with declining China demand, copper softness, and USD firmness.

🎯 Trade Type: Long Put (0.6400P)

🎯 Target: 0.6278

🎯 Trigger: BOS below 0.6485

#VolanX #MacroTrading #SMC #AUDUSD #Options #Futures #TradingView #SmartMoney #InstitutionalLevels

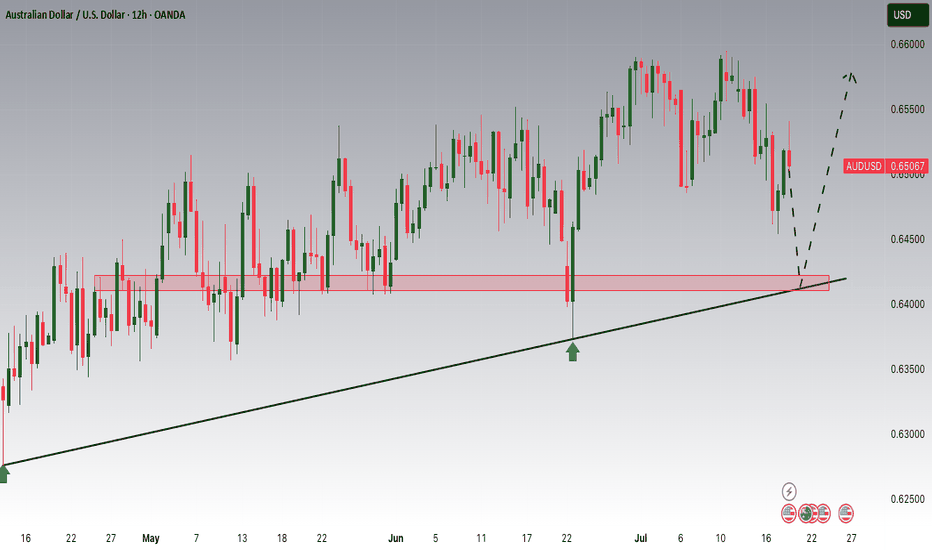

AUDUSD Long PullbackOANDA:AUDUSD taking a pullback towards up, catching this pullback.

Note: I am not adding levels etc on chart because I am tired and need to go for breakfast first, simply sharing the what I see.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

AUDUSD(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

0.6506

Support and resistance levels:

0.6572

0.6547

0.6531

0.6481

0.6466

0.6441

Trading strategy:

If the price breaks through 0.6531, consider buying, and the first target price is 0.6547

If the price breaks through 0.6506, consider selling, and the first target price is 0.6481

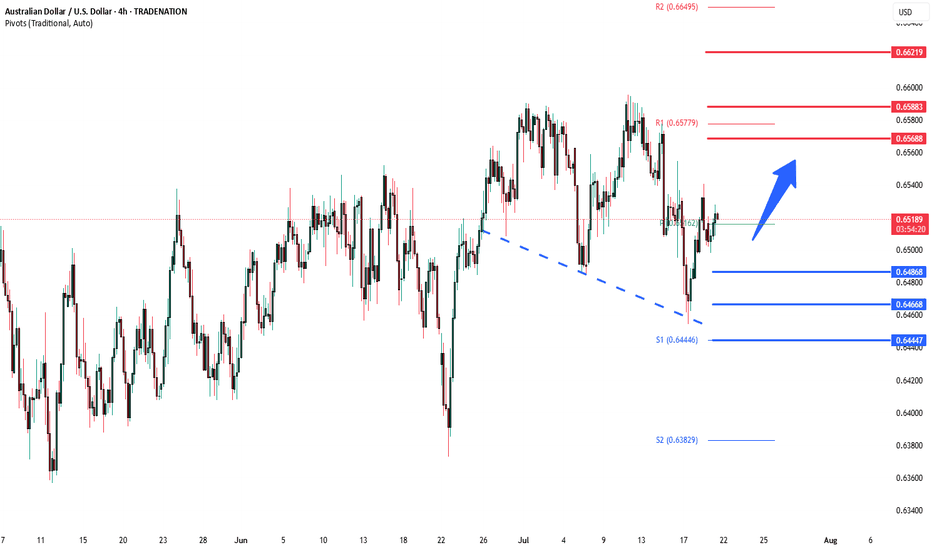

AUDUSD important support at 0.6465Trend Overview:

The AUDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 0.6465 (primary pivot), followed by 0.6445 and 0.6400

Resistance: 0.6570 (initial), then 0.6590 and 0.6625

Technical Outlook:

A pullback to the 0.6465 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 0.6570, 0.6590, and ultimately 0.6625.

Conversely, a daily close below 0.6465 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 0.6445 and 0.6400 as downside levels.

Conclusion:

AUDUSD maintains a bullish structure while trading above the 0.6465 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 0.6570 area. A breakdown below 0.6465, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

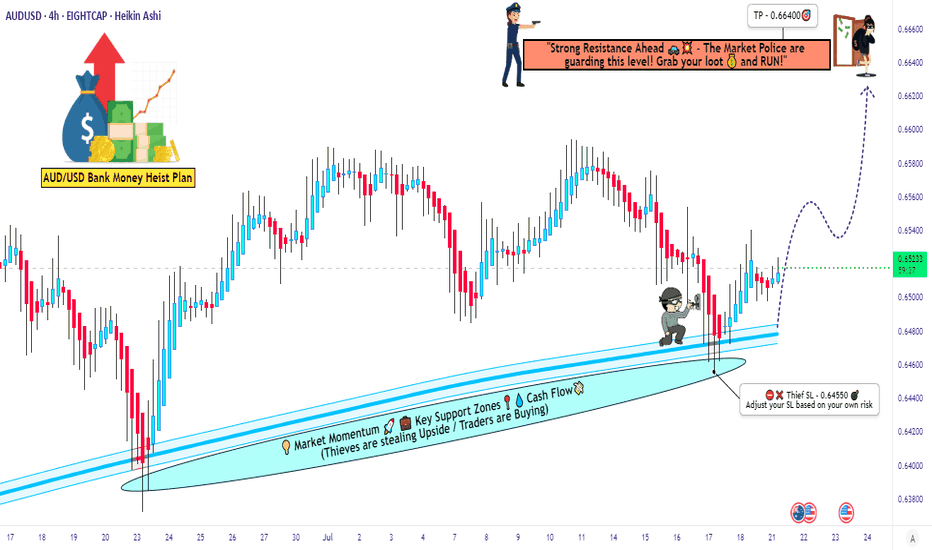

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64550

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

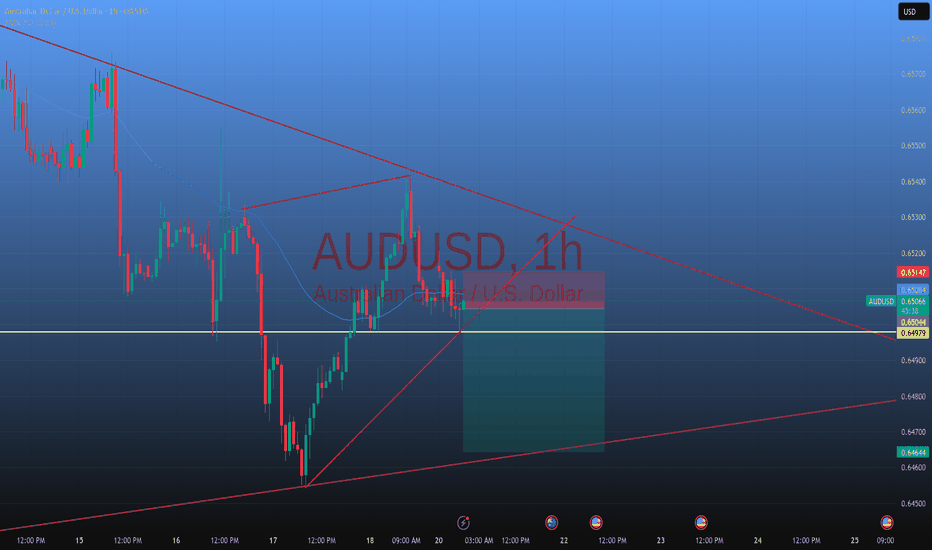

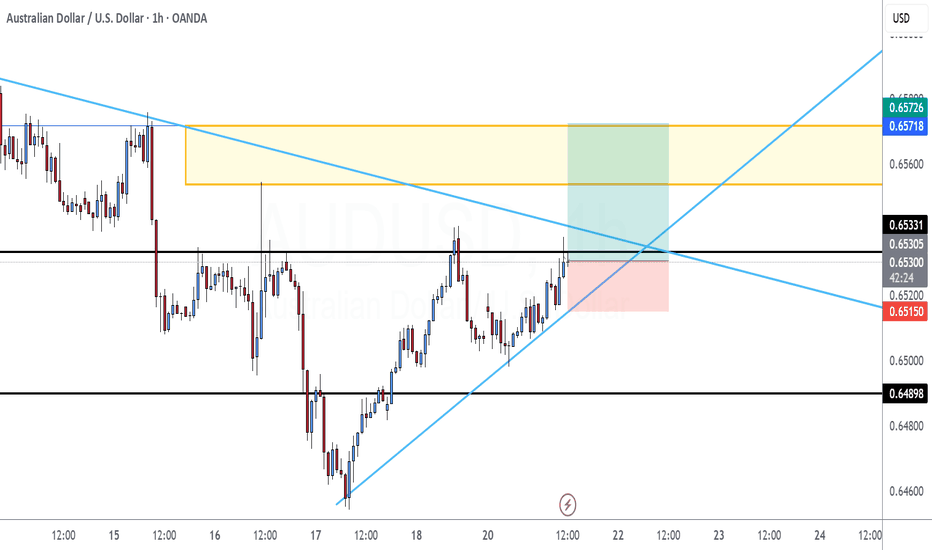

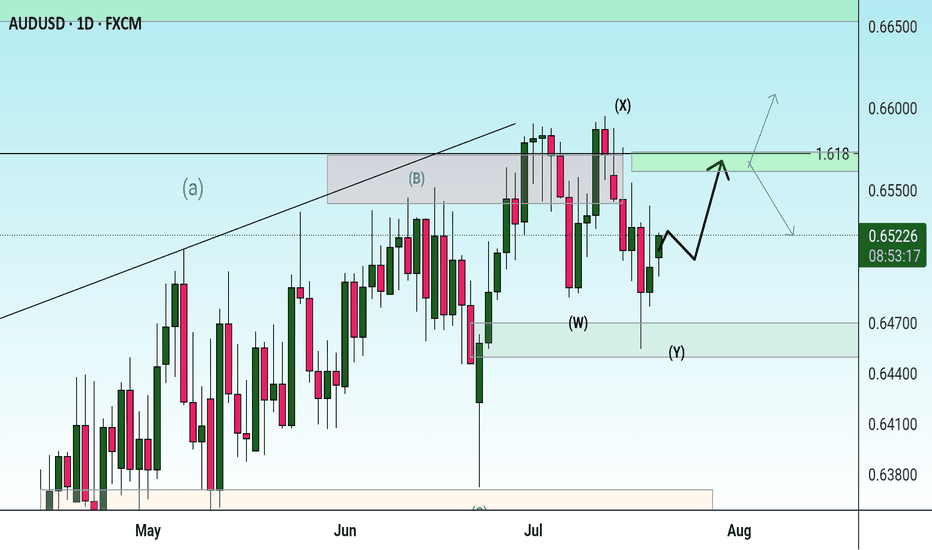

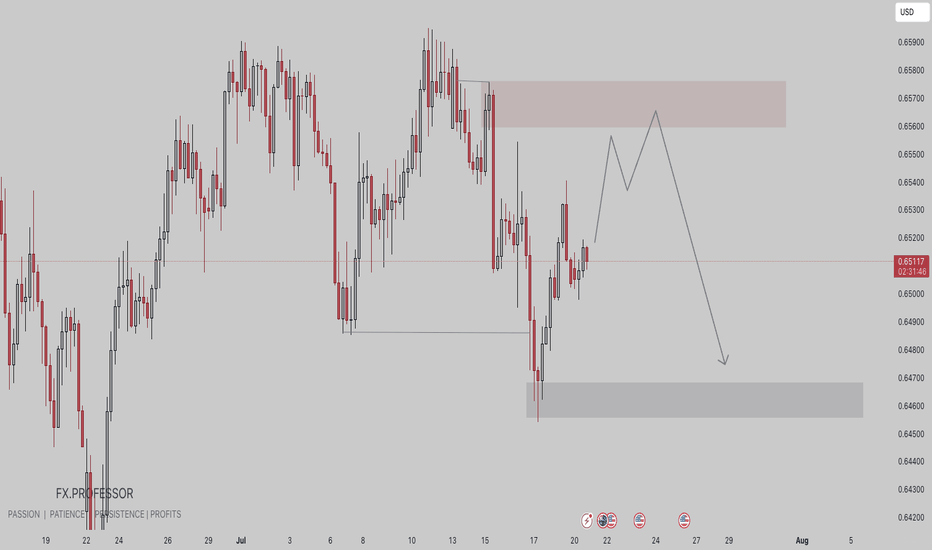

AUDUSD • Premium Supply Zone (Resistance):

• Price is projected to revisit the supply zone between 0.65650–0.65800, which previously led to strong bearish displacement.

• This zone is likely to attract institutional sell orders.

• Current Price Structure:

• Market is retracing upward within a bearish internal structure.

• Expectation: A “lower high” formation before a continuation to the downside.

• Sell Setup Projection:

• Price likely to induce buyers near the mid-range before sweeping them and shifting bearish.

• Anticipated move: Price into premium zone → rejection → continuation toward 0.64700 demand area (gray box).

• Liquidity Engineering:

• Potential internal liquidity being built up to fuel a deeper drop.

• Smart money may use this retracement to trap breakout traders before driving price down.

⸻

🧠 Smart Money Narrative:

1. Retracement into premium for better risk-to-reward shorts.

2. Inducement of breakout buyers before reversal.

3. Short continuation toward demand zone and potential liquidity pockets below.

4. Strategic zone to watch: 0.65700 area for high-probability shorts

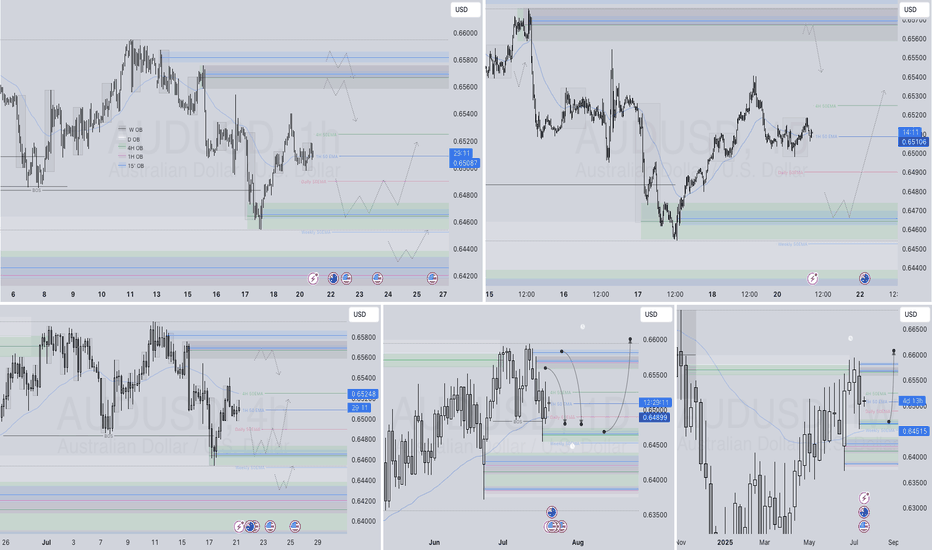

AUDUSD Q3 | D21 | W30 | Y25📊AUDUSD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

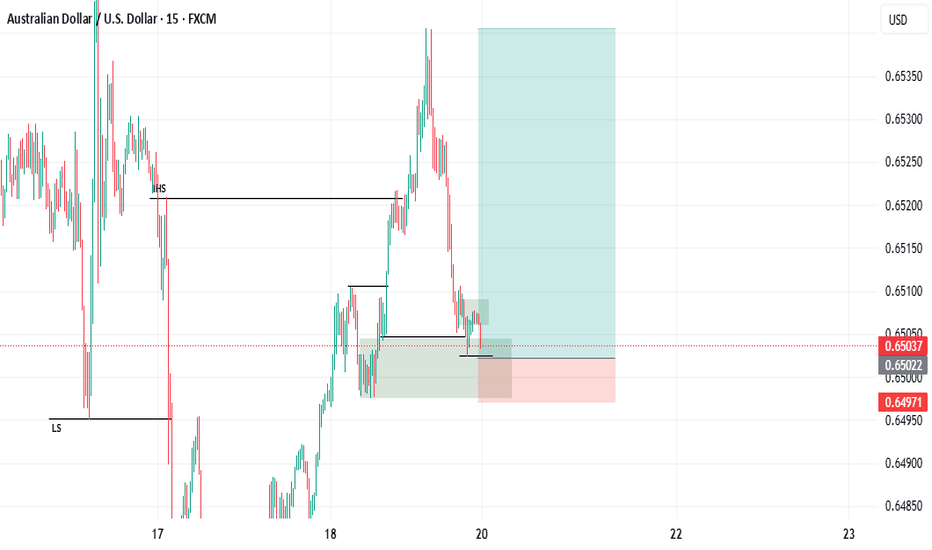

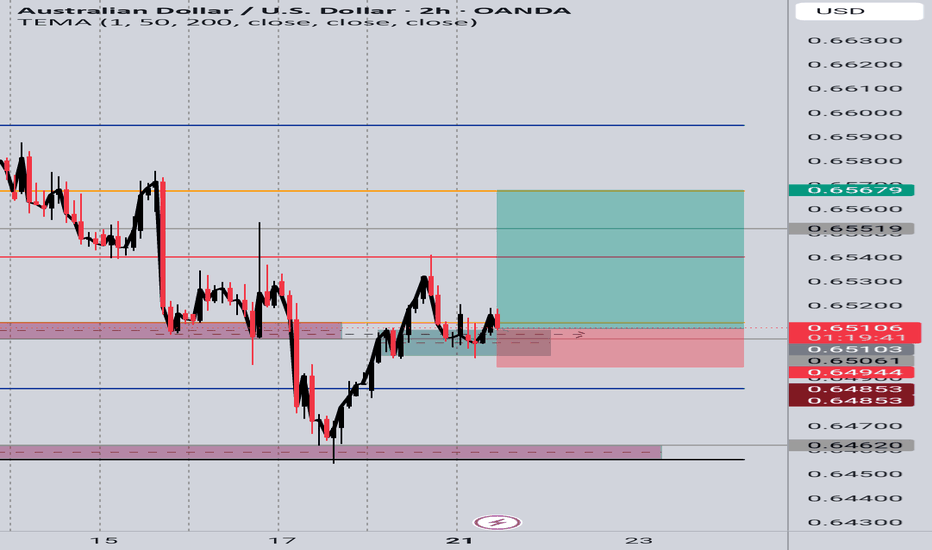

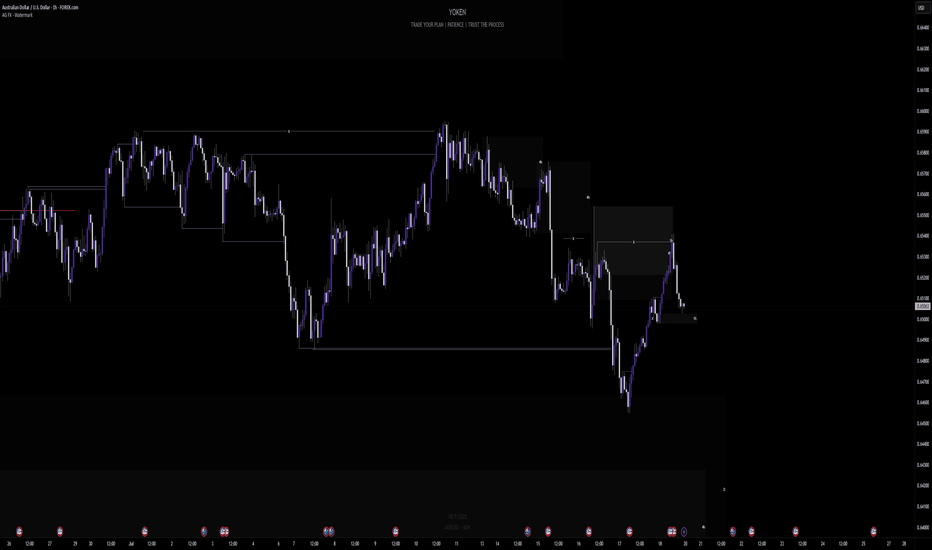

AUD/USD 2H – Price Action Buy SetupAfter a strong bullish push, price pulled back into a previous demand zone near 0.65000, where buyers had clearly stepped in before.

The previous resistance around 0.6510 was broken and now appears to be acting as support — a classic sign of a break and retest.

The current bullish rejection candle near the zone confirms buying interest.

✅ Entry: Around 0.6500

❌ Stop Loss: Below the recent low / demand zone (~0.6485)

🎯 Take Profit: 0.6550 and 0.6567 (previous swing high

Price is now forming higher lows and pushing upward — watching for continuation toward the next resistance.

#AUDUSD #PriceAction #BreakAndRetest #ForexSetup #SupportResistance #TrendContinuation #ForexAnalysis

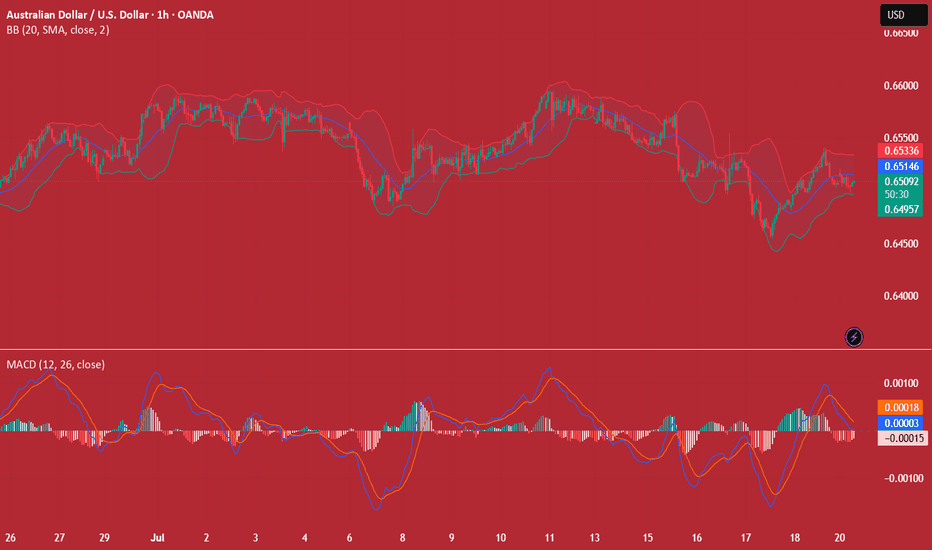

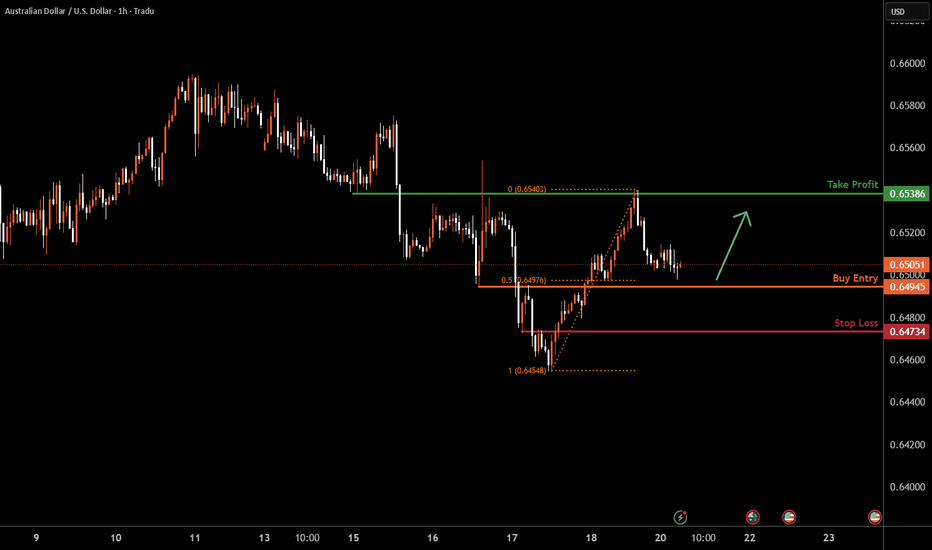

AUDUSD H1 I Bullish Bounce off the 50% FibBased on the H1 chart analysis, the price is approaching our buy entry level at 0.6494, a pullback support that aligns with the 50% Fib retracement.

Our take profit is set at 0.6538, an overlap resistance.

The stop loss is placed at 0.673, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

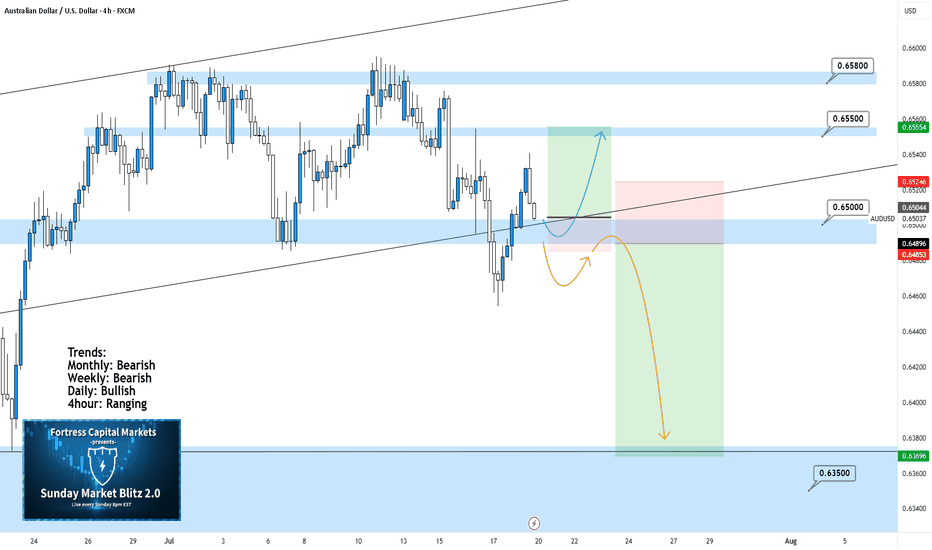

LOOKING FOR SHORTS ON AUD/USDWith Weekly time frame showing a strong downtrend then it is expected that lower timeframe aligns with it andso the Daily and 4HR are showing exactly that .

Double top formed and price trading in the area of our fib GOLDEN ZONE, We are expecting a decline in AUD potentially this upcoming week

I'm looking for potential buy setups after a consolidation.Those who are passionate about trading know that this is a tough business. What you have to understand is that the predictions people are making regarding the price movement directions are based on probabilities. There is no such thing as 100 percent direction in the market, and that is because the market can turn against you or your direction at any time it wants. The reason doesn't even matter; it could be the news of some geopolitical changes, oil cut production or war, or many other factors that could impact the financial market. If you have one or more good reasons that the price will follow a certain direction, all you have to do is take a small risk entry in your direction with a good risk-to-reward ratio and just wait and see how the market will perform. A trader could have 1 good reason or a few reasons why his bias is up or down. The reasons could be based on particular studies, past behavior, fundamentals, technical analysis, or certain observations. The important part for you to understand is that the market is in a continuously changing process; this means that yesterday's prediction, today, could be irrelevant. The market does not have to follow your analysis. You have to follow the market, observe its changes, and react accordingly to them! I hope some of you will find this helpful. Good luck!

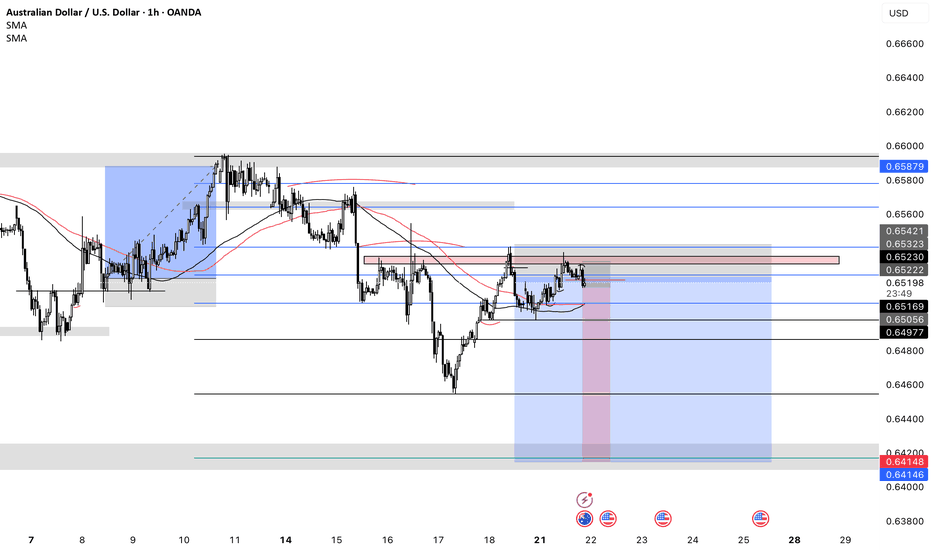

AUDUSD 4Hour TF - July 20th, 2025AUDUSD 7/20/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We’re looking at a fairly large range here on AU and although the higher timeframe suggests a potential bearish move, I am unsure until we have some clarity around 0.65000. Here are two scenarios that break down what could happen this week and how 0.65000 plays into it:

Range Continuation - Since late June we have seen price action establish this large range and stick to it (0.65800 Resistance & 0.65000 Support).

Currently, we can see price action attempting to break 0.65000 support but it has not done so yet. If we don’t break below 0.65000 early this week it is very likely we will see a rally into the top of the range.

Bearish Breakout - This is the setup we want to see play out this week as it presents a beauty of a trade.

For us to see AU as bearish on the 4hour we need to see a clear break below 0.65000 with a confirmed lower high below. If this happens look to target toward major support levels like 0.63500 area.

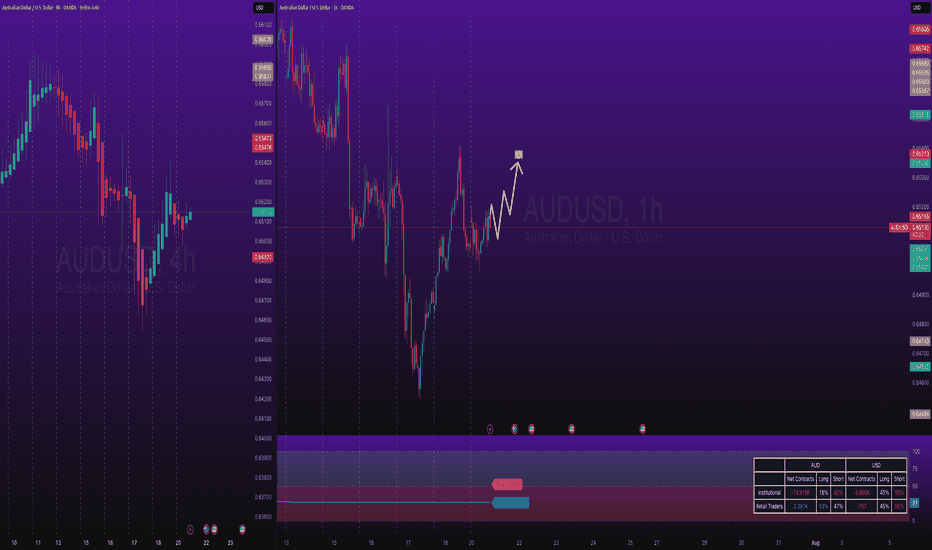

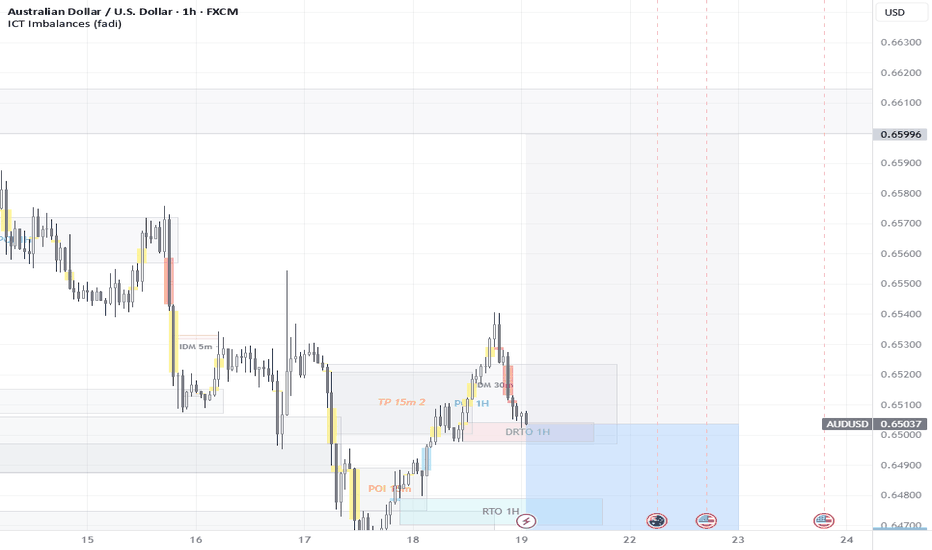

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

AUDUSD Potential UpsidesHey Traders, in tomorrow's trading session we are monitoring AUDUSD for a buying opportunity around 0.64200 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.64200 support and resistance area.

Trade safe, Joe.

AUDUSD: Sell The Rip!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

AUDUSD

AUDUSD has been difficult to trade, as it chops its slow grind upwards. Last week it gave a bearish close. With the USD expected to continue to gain strength, look for sells directed to the liquidity lows in AUDUSD.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.