AUDUSD_ZERO trade ideas

RBA Holds Their Cash Rate, May Cut Neither Confirmed Nor DeniedThe RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD.

Matt Simpson, Market Analyst at City Index and Forex.com

AUDUSD-SHORTAU is forming a beautiful bearish trend on a 4 hr time frame. AU is also a correlative pair with GA and we see that GA just broke a consolidation zone to the upside giving potential signs of bullish continuation. If AU respects FIB zones, it should continue to the downside to form next lower low. Of course, news will play a role in our bias for now and we will wait for entry before taking sells on AU.

AUDUSD & NZDUSD Sell idea/analysis based on daily timeframeTook this trade based on a downtrend forming and the retest of a H&S on the daily chart with a minimum requirement of 1 lower low and 1 lower high. I saw a bounce before the price touches the previous low on the 4-hour chart, which could shape my 2nd lower high, and I entered the trade.

Why the RBA should cut rates todayThe Reserve Bank of Australia should cut rates today, argues James Glynn in the Wall Street Journal .

Markets, however, expect the central bank to wait until May for its next move. RBA Governor Michele Bullock remains cautious, citing lingering inflation.

But Glynn contends that global uncertainty now outweighs the RBA’s desire to wait for marginal improvements in inflation data. That uncertainty is set to escalate this Wednesday, with the Trump administration announcing sweeping tariffs on U.S. trading partners—likely triggering retaliatory measures.

Andrew Boak, chief economist at Goldman Sachs Australia, appears to support Glynn’s view: “There are costs to waiting until May to cut. Waiting is not always a virtue.”

Is Glynn simply chasing a contrarian headline or is there actually a possibility the RBA could act today?

AUD/USD BUY zone H4 chart analysisAUD/USD:

Trade Setup

Entry: 0.62517

Final Target (TP): 0.64963

Stop Loss (SL): 0.61800 (Below recent support to protect against invalidation)

Support & Resistance Levels

Support Levels: 0.62200 - 0.62500 (Potential demand zone)

Resistance Levels: 0.64000 - 0.64963 (Major supply zone & upper trendline resistance)

Trade Outlook

Bullish Bias: Price is expected to rise from the support zone.

Confirmation Signals: Look for bullish rejection wicks, engulfing candles, or a break above 0.63100 for momentum confirmation.

Risk-to-Reward: Favorable setup with a good upside potential.

Heading into pullback resistance?AUD/USD is rising towards the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.6276

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 0.6321

Why we like it:

There is an overlap resistance that line sup with the 61.8% Fibonacci retracement.

Take profit: 0.6214

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUD/USD 1-hour downtrend - Will 0.6200 Trigger a Reversal?The AUD/USD pair has been trending downward on the 1-hour chart, maintaining strong bearish momentum. In its latest move lower, it formed a significant 1-hour Fair Value Gap (FVG), aligning closely with the 0.786 Fibonacci retracement level.

Given this confluence, there is a possibility that AUD/USD could revisit this level to reject and continuing its decline. However, if bearish pressure persists, the pair may extend its drop toward the key 4-hour support at 0.6200.

A potential bullish engulfing candle at this 0.6200 support level could signal a shift in market structure, indicating a possible change of character to the upside. However, it is still uncertain if we will revisit this 4-hour support.

AUDUSD Price ActionHello Traders,

Liquidity is what makes supply and demand zones truly powerful. As you can see, I've marked both the supply and demand areas—each supported by clear liquidity levels on both sides.

With that structure in place, we can now look for long opportunities, but always with proper risk management in mind.

Just remember: No Liquidity = No Zone Confirmation.

Keep it simple, stick to the rules.

Good luck and happy trading!

Technical Analysis of AUDUSD: Weakness Ahead of Central Bank MeeIn the previous analysis, we noted the decline in this currency pair, though a temporary rebound led to a retest of the supply zone before another drop. Investor caution regarding potential retaliatory tariffs announced by U.S. President Donald Trump, scheduled for Wednesday as "Freedom Day," has added further pressure on the Australian dollar. As a result, the likelihood of a deeper decline toward the 0.60 demand zone remains intact.

AUDUSD: Long Trade with Entry/SL/TP

AUDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long AUDUSD

Entry Point - 0.6221

Stop Loss - 0.6186

Take Profit - 0.6287

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

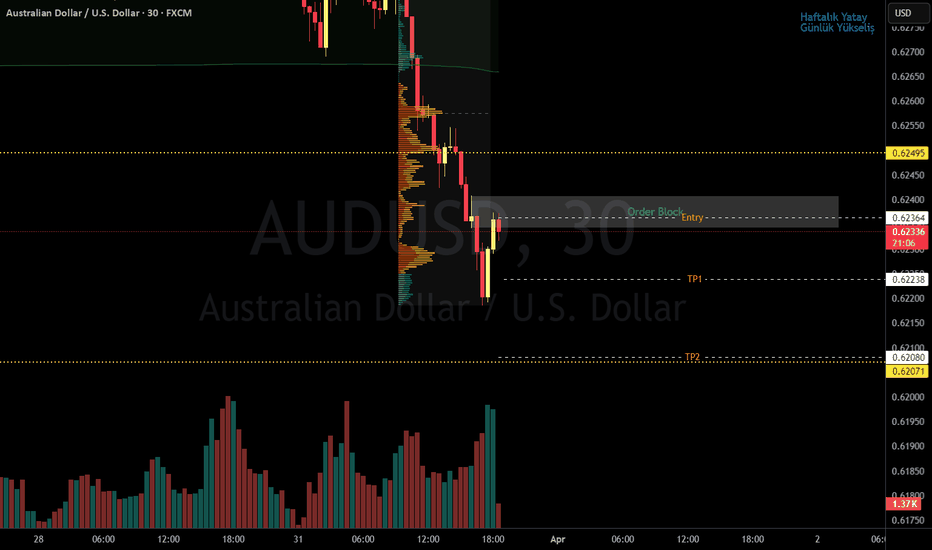

AUDUSD SELL 106 PIPS LIVE EXCAUTION AND EDUCATIONAL BREAKDOWN AUD/USD has ereased earlier gains to edge lower below 0.6300 in the Asian session on Monday. Trump's tariff concerns outweigh mixed Chinese NBS March PMI data, Australia's hot private inflation data and broad US Dollar weakness, exerting downward pressure on the pair as risk-aversion intensifies.

AUDUSD Neutral Bias with Key Support at 0.6250Trend Overview:

AUDUSD remains in a sideways trading range, indicating a neutral sentiment. Recent price action suggests a corrective pullback toward a previous consolidation zone, now acting as a key support at 0.6250.

Key Levels:

Support: 0.6250 (key level), 0.6200, 0.6140

Resistance: 0.6324, 0.6360, 0.6390

Bullish Scenario:

A bounce from 0.6250 would confirm support and may trigger an upside move. A breakout above 0.6324 could extend gains toward 0.6360 and 0.6390 over the longer term.

Bearish Scenario:

A daily close below 0.6250 would weaken the outlook, increasing the likelihood of a retracement toward 0.6200, with 0.6140 as the next downside target.

Conclusion:

AUDUSD remains neutral within a range, with a key level at 0.6250. A bullish bounce could target 0.6324, 0.6360, and 0.6390, while a break below 0.6250 may shift momentum toward 0.6200 and 0.6140. Traders should watch price action at 0.6250 for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUDUSDLast week on AUDUSD we took a 2% loss totaling 2.8% lost on phase 2 so far. Crazy part is our bias last week was completely right and we caught a good entry but price just wasn't quite ready to fall like it has been recently. We are now looking for a retracement back into the zone to then look for a entry depending on the confluences we see show itself.

Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?

AUD/USD declined below the 0.6320 and 0.6300 support levels.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar started a fresh decline from well above the 0.6320 level against the US Dollar.

- There is a connecting bearish trend line forming with resistance at 0.6300 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair struggled to clear the 0.6330 zone. The Aussie Dollar started a fresh decline below the 0.6300 support against the US Dollar, as discussed in the previous analysis.

The pair even settled below 0.6280 and the 50-hour simple moving average. There was a clear move below 0.6270. A low was formed at 0.6269 and the pair is now consolidating losses.

On the upside, an immediate resistance is near the 0.6295 level and the 61.8% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low.

There is also a connecting bearish trend line forming with resistance at 0.6300. It is close to the 76.4% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low. The next major resistance is near the 0.6310 zone, above which the price could rise toward 0.6320.

Any more gains might send the pair toward the 0.6330 resistance. A close above the 0.6330 level could start another steady increase in the near term. The next major resistance on the AUD/USD chart could be 0.6380.

On the downside, initial support is near the 0.6270 zone. The next support sits at 0.6260. If there is a downside break below 0.6260, the pair could extend its decline. The next support could be 0.6200. Any more losses might send the pair toward the 0.6165 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

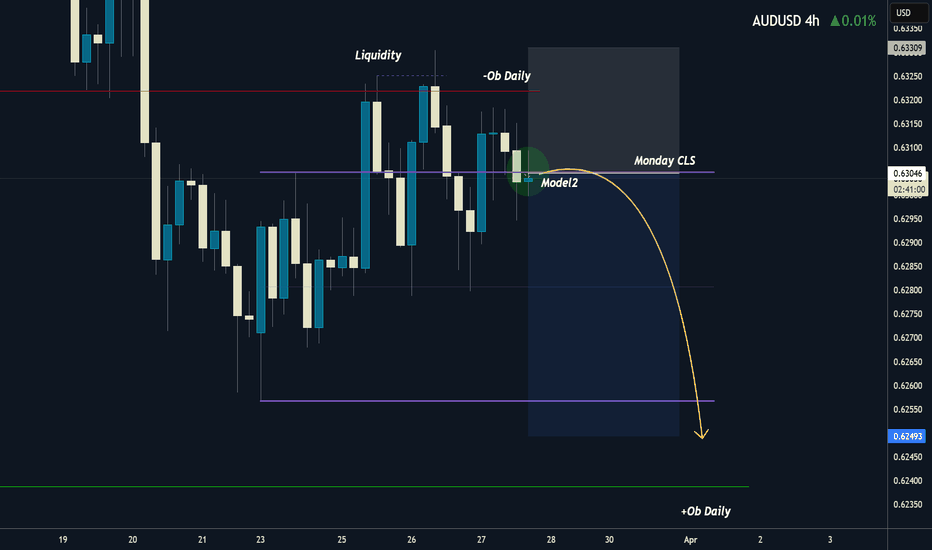

AUDUSD I Monday CLS Range I KL - OB I Model 2Hey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔