AUDUSD_ZERO trade ideas

DeGRAM | AUDUSD growth in the channelAUDUSD is in an ascending channel between the trend lines.

The price is moving from the lower boundary of the channel.

The chart formed a harmonic pattern and held the 62% retracement level.

We expect the growth to continue in the channel.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

AUDUSD Analysis: Reversal Predictions Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). To increase the probability of these analysis, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

I welcome your feedback on this analysis, as it will inform and enhance my future research.

Regards,

Shunya Trade

Vertical Line time

31st March 04:30 PM

31st March 06:15 PM 07:30 PM

1st Apr 01:30 AM

1st Apr 04:30 AM 06:15 AM

1st Apr 10:30 AM

1st Apr 12:15 PM 01:30 PM

2nd Apr 01:30 AM

2nd Apr 04:30 AM 06:15 AM

2nd Apr 07:30 AM

2nd Apr 10:30 PM

3rd Apr 01:30 AM

⚠️ Disclaimer:

This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

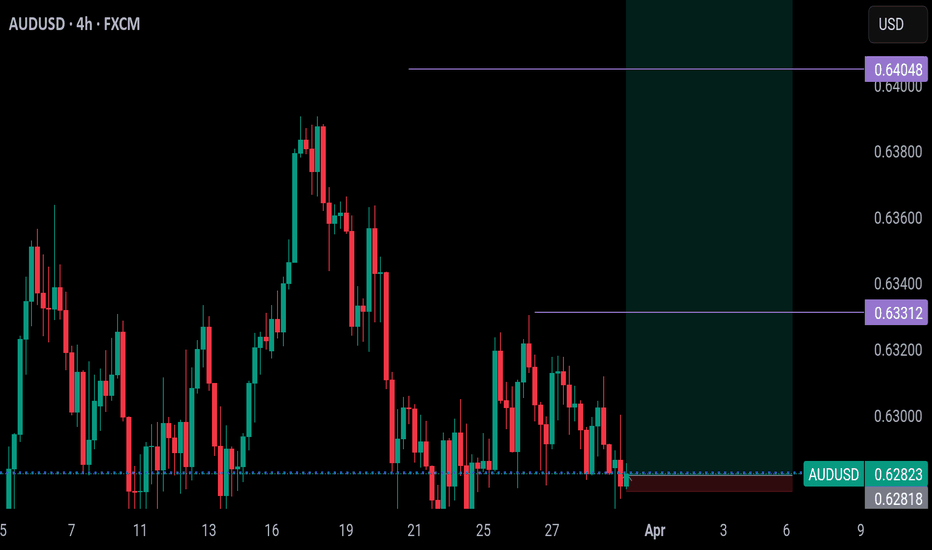

BUY AUDUSD, you wont regret it!GBPUSD has already left, you can continue adding positions to it but AUDUSD hasn't moved much yet that's why I'm picking it.

I'm makin the stops really small due to the AUD been weak now, but dont worry, it wont be hit.

My TPs are the purple line

Follow me as my trades are market order and not limit orders. You will get notification once I post if you follow so you will enter the trade on time.

Week of 3/30/25: AUDUSD Weekly AnalysisWeekly analysis this week, price has been congesting and tightening the last 2 weeks, expecting hopefully a good move this week to breakout of consolidation.

Starting the week with a bearish bias.

Major News: NFP Friday

Thanks for stopping by, have a great trading week!

AUDUSD POSSIBLE BUY When price came to our POI on the M30 it wasn't respected instead we got a sweep of liquidity of that leg, nonetheless the demand zone on the M30 was seen on the 1H which makes it invalidated. After the sweep we got a push up, well price has been ranging for awhile. On the Hourly we're seeing a clear price action so in summary since we've seen a BOS on the hourly and liquidity below before POI, my expectation is if price respects our POI I'll be looking for long.

Is This the Calm Before the Storm on AUD/USD?The AUD/USD pair is currently consolidating within a sideways range, indicating indecision in the market. Price is fluctuating between key horizontal support near 0.6150 and resistance around 0.6450.

A rising trendline is providing strong dynamic support, keeping the pair from breaking lower, while a descending resistance line continues to limit upside momentum. As long as the pair remains within this range, no clear trend is confirmed.

A breakout above resistance could signal a bullish shift, while a breakdown below the trendline may open the door for further downside.

If you find our analysis helpful, don’t forget to like and follow us.

THANK YOU

DYOR, NFA

AUD/USD 1H – Testing Demand Zone for a Potential Reversal?The pair is currently retesting a strong demand zone, with multiple rejections seen in this area. A Break of Structure (BoS) indicates bullish potential, but price needs to confirm a reversal before a strong upside move.

📊 Key Observations:

✔ Break of Structure (BoS): Bullish intent was confirmed earlier.

✔ Swing Structure Support (SSS): Holding for now, but a deeper test of demand is possible.

✔ Demand Zone Reaction: If price holds above 0.6270–0.6255, a bullish reversal is likely.

🔎 Trade Idea: Looking for bullish confirmations within the demand zone. A clean rejection could offer long opportunities toward recent highs.

AUDUSD | APRIL 2025 FORECAST| This Next Move will be Massive!AUD/USD is shaping up for a critical month, with price action hovering around a key support zone near . The pair has been reacting to , influencing both bullish and bearish momentum.

🔹 Trend Analysis: The pair remains in a on the higher timeframe, with acting as dynamic support/resistance.

🔹 Key Levels: Support at , resistance at .

🔹 Momentum & Structure: A break above could trigger bullish continuation, while failure to hold may lead to a deeper retracement.

With fundamentals aligning with technicals, this month could present solid trading opportunities. Will AUD/USD push higher, or are we in for a reversal? Drop your thoughts below! 🚀📊 #AUDUSD

AUDUSD: Bears Will Push Lower

The price of AUDUSD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Master the Market with These 5 Wave Trading RulesHello,

In any business, rules are the backbone of success, providing the structure and discipline needed to thrive. Trading and investing are no exceptions—they must be treated with the same seriousness and rigor as any entrepreneurial venture.

As a wave trader, I rely on a refined set of rules that blend technical analysis with Wave Theory to understand market behavior. Wave trading is a powerful strategy that analyzes price patterns to uncover the cyclical nature of market trends, enabling traders to predict future movements and seize profitable opportunities.

Understanding Wave Trading

Markets don’t move randomly—they ebb and flow in predictable waves. According to Elliott Wave Theory (a type of wave theory), trends unfold in a series of five waves (known as impulses) followed by three waves (corrections). Mastering this rhythm allows you to anticipate where the market is headed next, giving you a strategic edge.

Our Trading Rules

Here’s a breakdown of the essential rules I follow as a wave trader, designed to guide you through the process with clarity and precision:

Identify Impulse & Correction

Impulse: A robust, directional price surge made up of five sub-waves, signaling the dominant trend.

Correction: A smaller, counter-trend move consisting of three sub-waves, acting as a pause or pullback.

Recognizing these phases reveals the market’s underlying structure. For example, spotting a five-wave impulse upward suggests a bullish trend, while a three-wave correction might signal a temporary dip—perfect for planning your next move.

Identify the Pattern Formations

Look for patterns that can help you anticipate the next moves e.g. the expanding triangle, Bullish flag or even reversal patterns.

Identify Entry Points

Timing is everything. Pinpoint the perfect moment to enter a trade based on your wave and pattern analysis.

Wait for confirmations like a breakout above a flag pattern or a signal from indicators such as moving averages or MACD that align with your wave count.

Look for Targets

Set clear profit targets to stay disciplined and secure gains.

Wave projections, like the expected end of wave 5 in an impulse.

Look for Exits in Case the Trade Doesn’t Go Your Way

Not every trade is a winner, and that’s okay. Protect your capital with stop-losses placed at logical levels.

Where to set them: Choose points that invalidate your analysis—like below a key support level or a wave pattern’s critical threshold. If the market breaks that level, your trade idea’s likely wrong, so exit calmly.

This removes emotion from the equation, safeguarding your account for the long haul.

The Power of Discipline

These rules aren’t just guidelines—they’re your shield against the emotional rollercoaster of trading. Write them down, pin them up, or keep them handy on your trading desk. Reviewing them before every trade reinforces your commitment to a systematic, objective approach. Discipline turns good strategies into great results.

Wishing you success on your trading journey!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

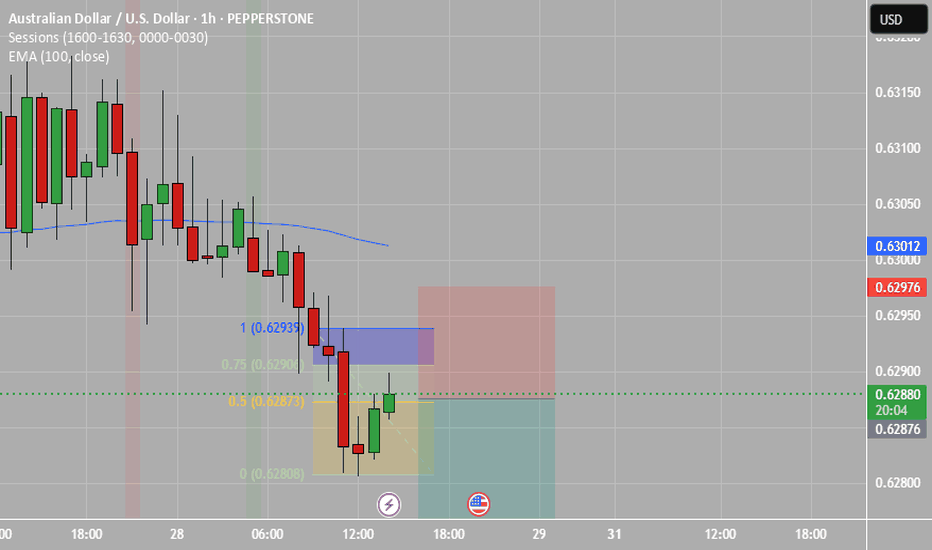

AUD/USD BULLISH BIAS RIGHT NOW| LONG

AUD/USD SIGNAL

Trade Direction: long

Entry Level: 0.629

Target Level: 0.631

Stop Loss: 0.627

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Continue to be bullish.Economic Fundamentals

Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency.

US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect.

Market & Geopolitical Factors

High risk appetite benefits the Aussie; low appetite favors the dollar. Geopolitical tensions prompt a flight to the dollar, hurting the Aussie.

💎💎💎 AUDUSD 💎💎💎

🎁 Buy@0.62500 - 0.62800

🎁 TP 0.63500 - 0.64000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates