AVAXUSDT The overall trend of BINANCE:AVAXUSDT on the 4H timeframe shows signs of a potential bullish reversal, as a higher low has formed around the 20.40 support level after a strong downtrend. Currently, the price is ranging between the key support at 20.40 and the resistance at 23.10. A breakout above 23.10 could push the price toward the next major resistance at 24.40, which is a critical decision zone for the market. If buyers maintain momentum and break above 24.40, the next bullish target will be around 26.50 ✅ However, if the 20.40 support fails to hold, lower supports at 18.50 and 16.30 may come into play. The momentum currently leans slightly bullish, but price behavior between 23.10 and 24.40 will determine the next strong move. 📊

Key Support & Resistance Levels:

Supports: 20.40 – 18.50 – 16.30

Resistances: 23.10 – 24.40 – 26.50

Always remember to manage and control your risk properly. 🔒

AVAXUSDT trade ideas

Buy Trade Strategy for AVAX: Tapping into High-Speed DeFiDescription:

This trading idea highlights AVAX, the native token of the Avalanche blockchain, known for its high-speed transactions, low fees, and scalable infrastructure. AVAX powers a robust ecosystem that supports decentralized finance (DeFi), NFTs, and Web3 applications, making it a strong contender in the competitive smart contract platform space. With its unique consensus mechanism and growing list of partnerships, Avalanche has attracted developers and users seeking efficient and eco-friendly blockchain solutions. The increasing adoption of AVAX in DeFi protocols, cross-chain interoperability, and institutional interest reinforces its long-term growth potential.

Still, the cryptocurrency market remains highly volatile, with AVAX’s price influenced by market sentiment, regulatory shifts, and broader economic conditions. Proper risk management and awareness of potential downsides are essential when considering positions in AVAX.

Disclaimer:

This trading idea is for educational purposes only and should not be taken as financial advice. Trading cryptocurrencies like AVAX carries substantial risks, including the possibility of losing your entire investment. Always conduct independent research, evaluate your risk tolerance, and consult with a licensed financial advisor before investing. Past performance does not guarantee future results.

AVAX 4H – Support Retest Underway, But Will the Trendline Hold?Avalanche is approaching a high-stakes support cluster — with ascending trendline support and a previous demand zone lining up perfectly. After a sharp move down from the $26 highs, bulls are watching closely to see if this higher low structure can hold.

🔹 Key Structure & Zones

Price is consolidating between the $20–$23 range.

The mid-level supply zone around $22.80 has repeatedly rejected price — a reclaim would flip structure bullish again.

The white trendline has been respected since late June and is lining up with key support — this is a textbook decision point for trend continuation.

🔹 Momentum Check

Stoch RSI is near oversold, priming for a bounce setup.

Bullish case: higher low → reclaim $23 → push toward $26.30 and possibly $27+.

Bearish case: trendline break → revisit the lower $20 demand box.

🔹 Scenario to Watch

Entry setups may emerge on wick into the trendline with momentum curling up.

$23 is the key short-term reclaim level — above that, momentum could accelerate fast.

Will this structure hold and launch the next leg up — or is AVAX setting up for a deeper flush?

Let’s talk setups 👇

AVAX 1H – FVG Retest Lining Up, But Will 24.25 Cap the Move?Avalanche broke above a prior swing high and filled upside space before pulling back toward an unfilled Fair Value Gap (FVG) in the 22.8–23.0 range. This zone aligns closely with EMA support and prior structure, making it a key short-term decision point.

If buyers step in here, the next upside target remains the 24.25 resistance — a level that has capped price action in the past. A failure to hold the FVG zone could open the door for a deeper retrace into the 22.2–22.3 support area.

Key watchpoints:

– FVG retest at 22.8–23.0 for potential bounce

– Overhead resistance at 24.25

– Stoch RSI cooling off from overbought, allowing room for a fresh leg higher

Avalanche (avax)Avax usdt Daily analysis

Time frame daily

As you see on the chart , if decrease of avax stops on 17.5 $ the pattern (double bottom)will create.

So we will see the end of decreasing and avax will reach to 25$

On the other hand , if price breaks down and reach 15 EURONEXT:OR less , this pattern will failed

AVAX Has Been Quiet for Too Long! Don’t Miss What Comes NextYello, Paradisers! Have you been ignoring #AVAX because of its sideways chop? That might be a costly mistake, because what’s forming now could be the foundation of a major trend reversal that catches most traders completely off guard.

💎After an extensive downtrend, AVAX has been trading sideways for nearly 184 days, signaling the market is in accumulation mode. This long consolidation is beginning to take shape as a possible reversal base, and when it breaks, it could break hard.

💎Right now, #AVAXUSDT is battling a complex resistance zone between $23.50 and $27. This region is packed with overlapping technical barriers, many of which date back to December 2024, adding to its significance. It's a make-or-break zone.

💎Once $27 is broken with strong volume confirmation, the stage will be set for a powerful breakout, with upside potential targeting the next major resistance between $36 and $39.20. This zone aligns perfectly with the 61.8% Fibonacci retracement, which is historically where larger moves tend to conclude or stall.

💎On the downside, support remains solid between $20.30 and $19.75. This band has been a reliable support/resistance flip during the range and continues to act as the primary defense zone.

💎Adding fuel to the bullish outlook is the potential golden cross formation between the EMA 50 and EMA 200. If this confirms, it would add serious momentum to any breakout and attract trend-followers back into the market.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

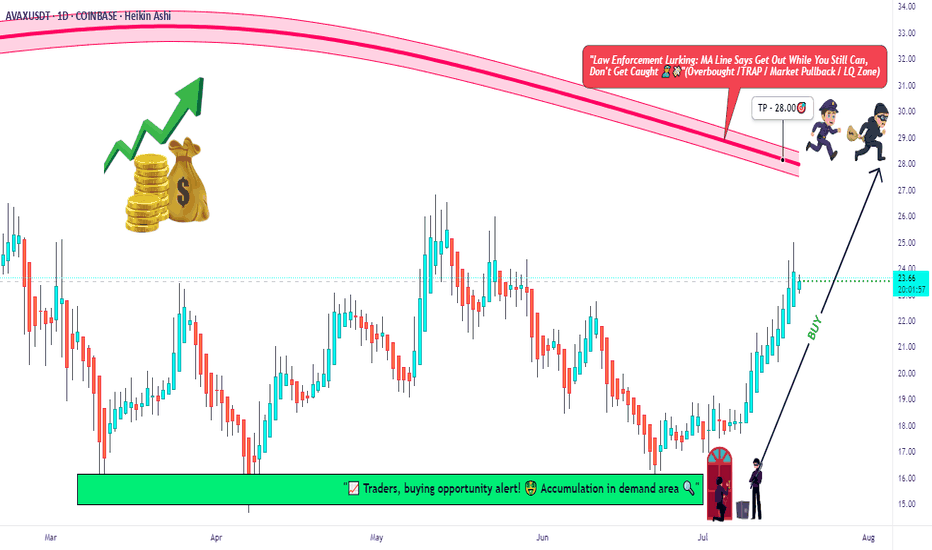

AVAX Long Only | Moving Average Trap Heist in Action🧨“Avalanche Crypto Vault Break-In 💣 | Thief Trader’s Long Playbook”⚔️💸🚀

(AVAX/USDT Crypto Heist Plan – Swing/Day Trade Blueprint)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers, Market Pirates, and Chart Snipers! 🤑💰💼✈️

This ain’t just another setup — this is a strategic crypto ambush on AVAX/USDT, cooked up with the 🔥 Thief Trading Playbook 🔥. We're planning a clean, no-fingerprint heist into the Red Moving Average Zone. That’s the liquidity vault, and yes — the police (market makers) are watching 👮♂️🚨... but so are we. Stay sharp. 💼🔦

💥 Mission Objectives:

🎯 Entry Point (The Infiltration Point)

"The vault's wide open! Swipe the Bullish loot at any decent price" 📈

Smart thieves wait for pullbacks on the 15m or 30m chart to plant their limit orders near swing lows/highs. Use layered orders (DCA style) to scale in like a pro. 💣🔁

🛑 Stop Loss (Your Getaway Exit)

Secure your trade. SL at the nearest wick low/high on the 1D timeframe (around 21:00 candle).

Your SL = your personal risk code. Choose it based on lot size & how deep you're inside the vault. 🎭🚫

🏴☠️ Take Profit Target (The Treasure Room)

🎯 Target: 28.00 USDT

...or escape early if the heat (volatility) gets too intense. Protect the bag. 💼💰

⚡ Special Note for Scalpers:

🧲Only operate on the Long Side.

If you’ve got deep pockets, smash in directly. Otherwise, ride with swing bandits. Use trailing SL to secure stolen profits. 🧨📉📈

🔍 Market Heat Map & Rationale:

The AVAX/USDT setup is flashing bullish strength, backed by:

🧠 On-Chain Metrics 📊

💡 Market Sentiment

📰 Macro Catalysts

🌐 Intermarket Synchronicity

📡 Go grab the full breakdown on:

⚠️ Red Alert: News Zones Ahead! 📰🚫

Avoid fresh trades during high-volatility news releases.

Lock in gains with trailing SL. Risk management is not optional — it’s the escape vehicle. 🚗💨

📝 Legal Talk (Don’t Skip):

This isn’t investment advice. Just a well-planned blueprint from a market thief.

You're responsible for your own loot and losses. 🎭📉📈

❤️ Boost the Brotherhood 💥

Smash the 🔥BOOST BUTTON🔥 if you found value.

Every boost powers our Thief Trading Gang’s next big score. 🚀💸

Stay tuned for the next heist plan. I’ll be back with more charts, more loot, and less mercy. 🐱👤📊💥

AVAX Technical Setup Signals 13% Upside Target $27Hello✌️

Let’s analyze Avalanche’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Avalanche’s July Octane upgrade cut C-Chain fees by 98% and boosted daily transactions 170% to 10.1M. New subnets, like FIFA NFTs and VanEck’s $100M RWA fund, could lift AVAX demand. 🚀

📊Technical analysis:

BINANCE:AVAXUSDT is holding a strong daily support and a key monthly trendline 📊. If these levels hold, a 13% upside toward $27 looks likely 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

AVAXUSDT AVAX Ready to Fly!!AVAXUSDT AVAX Ready to Fly!!

BINANCE:AVAXUSDT has broken out from resistance and found support at previous lows. This setup is looking strong and could mirror ETH’s bullish moves.

The major hurdle now is around $27. A breakout above this level could trigger a strong rally with significant upside potential.

Always manage your risk and keep a stop loss in place, the sky is the limit once $27 is cleared.

BINANCE:AVAXUSDT Currently trading at $23.5

Buy level : Above $23

Stop loss : Below $21

Target 1: $24.5

Target 2: $27

Target 3: $31

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

AVAXUSDT ( You think it’s out of mind , But you have to believe Hello dear traders.

Good days.

First of all thanks for your support and comments.

————————————————————————

Sometimes numbers are enormous and fist think which come in your mind is , oh my god it’s crazy . You could not believe crypto market will grow up this much ever .

But it’s real and you have to believe it .

AVAXUSDT on weekly Gann square could hold price above 0.5 Gann price zone which is a great signal for future .

End of Daily bearish Gann Square box exactly matched with weekly Gann reversal time zone and as you can see on longe term price form and wedge and collect spring for breaking up and experience new ATH .

Hope to analysis be helpful for you .

Good luck and safe trades.

Avalanche (AVAX): Expecting a Good Buy-side Movement | CME GAPAvax looks strong;after the break of 200 EMAs, we switched the trend and with the recent retest of that same EMA, we are seeing good buyside dominance.

What actually caught our attention here is that huge CME gap that we formed in the beginning of February, which we intend to fill very soon!

Swallow Academy

AVAX 4H Breakout in Progress, Will Bulls Push Toward July Highs?AVAX has broken above short-term resistance around $24, with buyers showing strength off the trendline support. The setup points toward the July highs near $27 as the next major target if momentum holds. A sustained close above $24 could confirm bullish continuation, while a failure to hold would shift focus back toward the $21 demand zone. The risk-to-reward remains attractive for trend-following setups.

Avalanche will retest the $21.5 level ┆ HolderStatBINANCE:AVAXUSDT bounced sharply from the $21.50 support, confirming the level as a pivot zone. Previous breakout patterns remain intact, and the current price action indicates potential for a move toward $25.00 resistance if buyers maintain control.

AVAX 1D Trading Mid-Range, Will Bulls Push Toward Resistance?Avalanche continues to respect its long-term range, with price currently rebounding from the $16 support zone toward the mid-range near $21. The upper boundary around $26–27 has repeatedly acted as a strong rejection point, while the lower $15–16 zone has provided reliable support. A daily close above mid-range would strengthen the case for a move toward the highs, while failure to hold could see a return toward range support.

AVAX/USDT Long Opportunity – Bullish Setup Developing!AVAX is currently forming a potential bullish reversal on the 4H timeframe. Price recently bounced off the strong demand zone between $20.70 – $21.35, where previous support held and buyers stepped in aggressively.

🔍 Technical Breakdown:

Support Zone: $20.70 – $21.35 (Strong demand zone highlighted in orange)

Current Price: $22.10 (slightly above support, indicating bullish interest)

First Target (TP1): $24.01 (minor resistance and previous structure level)

Second Target (TP2): $26.25 – $27.00 (major supply zone; high probability reaction area)

✅ Confluences:

Clean bullish structure forming off demand zone

Volume profile (LuxAlgo VRVP) supports the bounce

Higher low confirmed on the 4H

Strong imbalance above, price likely to fill it

📌 Trade Idea:

If momentum continues and price stays above $21.35:

Entry Zone: $21.90 – $22.20 (current range)

SL: Below $20.70 (beneath demand zone)

TP1: $24.01

TP2: $26.25+

🧠 Notes:

Watch how price reacts at $24.01; breaking this confirms bullish strength.

The $26.25 area is a historical supply zone, so consider partial profits here.

Maintain good risk management; crypto remains volatile!

🟢 Bias: Bullish

AVAXUSDT – potential swing tradewith a risk factor of 2.59 Avax is ready to take an upward ride with a potential 50% fib retracement target at least.

Disclaimer: Not financial advice – just sharing my market outlook. Always manage risk and do your own research before taking trades.

💡 Educational Note: For sharper precision, drop to 4H or 2H charts and identify the latest ChoCH (Change of Character) and BoS (Break of Structure) before entering. This helps align with the momentum shift and avoid premature entries.

AVAX 4H – Trendline Capped Every Rally, But Can Bulls Break?AVAX continues to be suppressed by a long-standing macro downtrend line that has rejected every major rally since December. The current structure shows three critical interactions with the same horizontal zone: the original breakout, a failed reclaim, and the most recent rejection near $28.

Unless AVAX can flip the trendline with volume, the trend remains technically bearish. That said, price is still holding higher lows and has avoided a full breakdown toward major support at $14–16.

This is a textbook compression between higher timeframe resistance and major support — expect volatility ahead.

Key areas:

– $28–30 = major horizontal + trendline confluence

– ~$14 = last clean demand zone

– Flip = breakout potential to ~$33+

– Fail = sweep of support possible

Wait for the reaction — this is where bias is defined.

AVAX at the Edge: Golden Pocket Support or Breakdown Incoming?🧠 Overview:

AVAX is currently trading at a decisive support zone, aligned perfectly with the Fibonacci golden pocket (0.5–0.618) at $21.03–$19.54. This level has historically acted as a strong pivot zone, serving both as resistance during bear markets and support in bullish recoveries.

The market has compressed into this key demand zone after a prolonged sideways structure. Now, all eyes are on how price will react — this zone will likely determine AVAX's mid-to-long-term trend.

---

🔍 Key Technical Highlights:

🔸 Fibonacci Confluence Zone (Golden Pocket):

0.5 Fib Level: $21.03

0.618 Fib Level: $19.54

This area coincides with a weekly demand block — a high-probability reversal zone where buyers have historically stepped in.

🔸 Major Resistance Levels to Watch:

$28.76 – First significant supply zone.

$32.68 – Previous lower high, potential breakout confirmation zone.

$43.07 – Weekly structure resistance.

$58.30 – Mid-term bullish target.

🔸 Support Levels Below:

$15.00 – Local base during early 2023.

$8.61 – Multi-year low (critical support if demand collapses).

🔸 Structure Insight:

Price is currently forming a macro higher low, suggesting a potential accumulation phase. However, failure to hold this zone could trigger a bearish continuation.

---

🚀 Bullish Scenario:

If price sustains above $19.54–21.03 and breaks above $25.50, the following upside targets could be reached:

1. $28.76 – Local resistance

2. $32.68 – Break of bearish structure

3. $43.07 – Momentum extension

4. $58.30 – Bullish macro target

Catalyst to watch: Weekly bullish engulfing candle + volume spike + break of structure → these would confirm buyers are in control.

---

🔻 Bearish Scenario:

If the price breaks below $19.54 with strong bearish volume, then:

1. $15.00 – First zone of interest for buyers

2. $8.61 – Critical long-term support zone

This would confirm a distribution pattern and signal that the market may revisit lower accumulation zones before any major uptrend resumes.

---

🧩 Market Psychology Insight:

This current range is where smart money positions themselves — either for continuation or reversal. Retail traders often get shaken out in this kind of compression. Stay patient and wait for confirmation rather than anticipation.

---

🎯 Conclusion:

AVAX is now at a make-or-break point. With the price sitting in a high-confluence demand zone, traders should prepare for volatility and monitor weekly closes. A strong move in either direction will likely determine the next multi-week trend.

> “The bigger the base, the higher in space.” – If this is true accumulation, the upside could surprise many.

#AVAX #AVAXUSDT #CryptoTechnicalAnalysis #AltcoinWatch #FibonacciLevels #SupportResistance #BullishOrBearish #SmartMoneyZone #WeeklyChart #CryptoTrading #BreakoutOrBreakdown

AVAX Setup – Two Bullish Scenarios

🔥 AVAX Setup – Two Bullish Scenarios! 💎

♦️ Overall Market Structure ♦️

Always keep an eye on Bitcoin and its dominance.

If dominance drops while BTC starts rising again, altcoins will usually have a smoother and stronger uptrend.

Check my daily analyses for a deeper structural outlook on the market. 🔍

♦️ AVAX Setup ♦️

As long as the market structure remains bullish, I’ll keep looking for valid long triggers.

Here are the 2 bullish scenarios I’m watching on AVAX:

🟡 Scenario 1:

If we get an accumulation box on the 1H or 4H timeframe, I’ll look to enter long after a clean breakout.

Stop-loss will be placed below the box.

🟡 Scenario 2:

If price suddenly moves up with sharp bullish candles, and forms a V-pattern around the $24.00 level,

I’ll enter on the breakout of that V-pattern.

🎯 Target:

In both scenarios, the first target is $26.15,

but my goal is to hold these positions for potential moves beyond $26.15.

🚀 Hit that 🚀 if you're watching AVAX too!

And don’t forget to follow for more 🔥 daily updates!

AVAX - Trendline Break From Demand, But Can Bulls Push to $24?AVAX is showing signs of life after rebounding cleanly off a local demand zone near $21 and breaking its recent downtrend line. This structure opens the door to a possible short-term rally — with first resistance sitting near $23.80 and a secondary target at $26.60. However, Stoch RSI is already pushing into overbought, so momentum must sustain or risk another fade.

A retrace to retest the broken trendline and hold would add confluence for longs. If that fails, bulls may get trapped.

📌 Demand bounce

📌 Trendline break

📌 Eyes on follow-through to reclaim higher levels

This is early-stage structure shift — not confirmation yet, but worth watching.