Key facts today

Lance Roberts, a financial strategist, has sold his Apple (AAPL) shares due to worries about the company's slow AI progress and high tariff exposure, particularly with China.

325 ARS

72.75 T ARS

303.50 T ARS

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

ISIN

ARDEUT116183

FIGI

BBG000S0MPB6

Apple, Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises of China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, Apple Care, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in 1976 and is headquartered in Cupertino, CA.

Related stocks

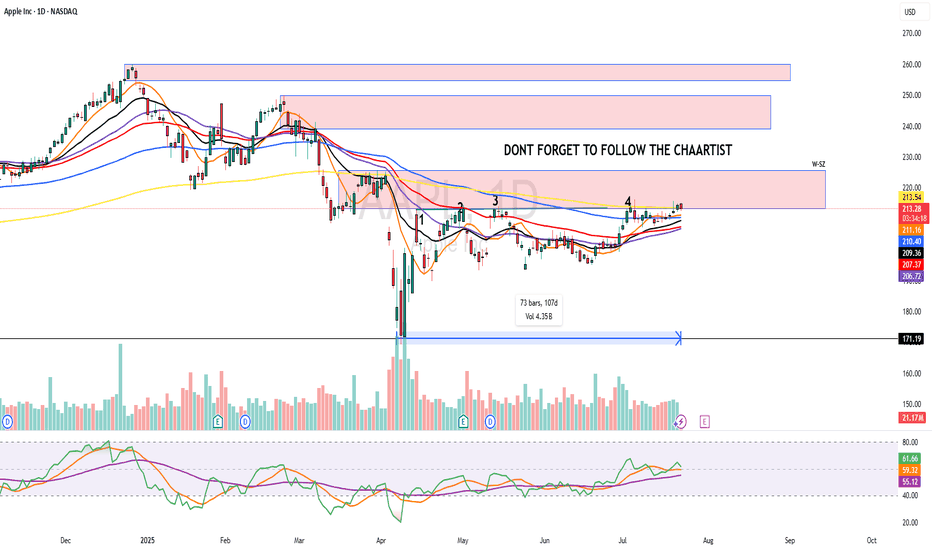

Time to buy? Too much negative press. Buy in Fear- Updated 18/7Apple has significantly underperformed compared to the other Magnificent 7 stocks, but I don’t believe it’s a company you should bet against in the current climate. With a slow rollout of AI and recent statements from Apple, they may not always be first to market, but they generally execute well. Th

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper ri

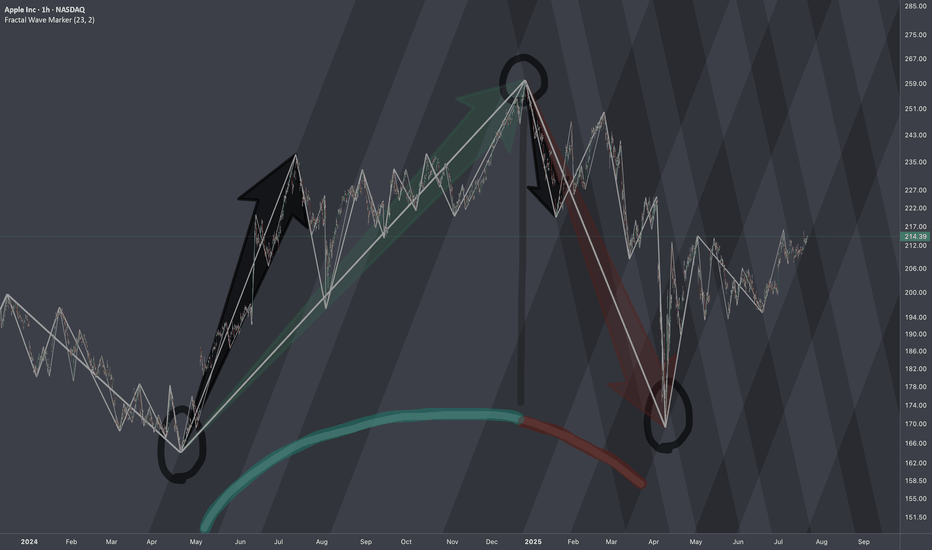

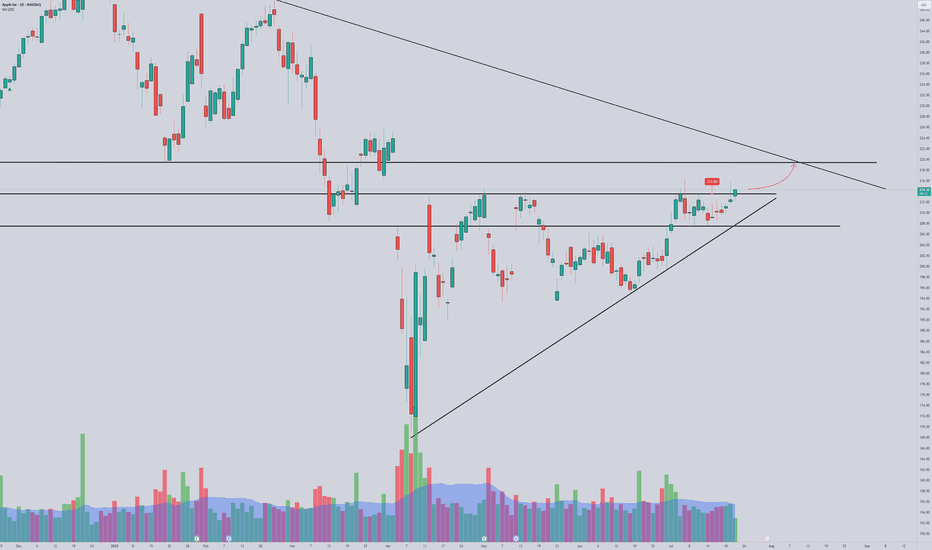

$AAPL: Structure SurgeryResearch Notes

Original Structure:

Altering structure for experimental purposes

Angle of fib channels that rises from cycle low, has been pushed into the past to the top of first major reaction. blue area resembles the change

Reason

The the angle of Fibonacci channels which cover th

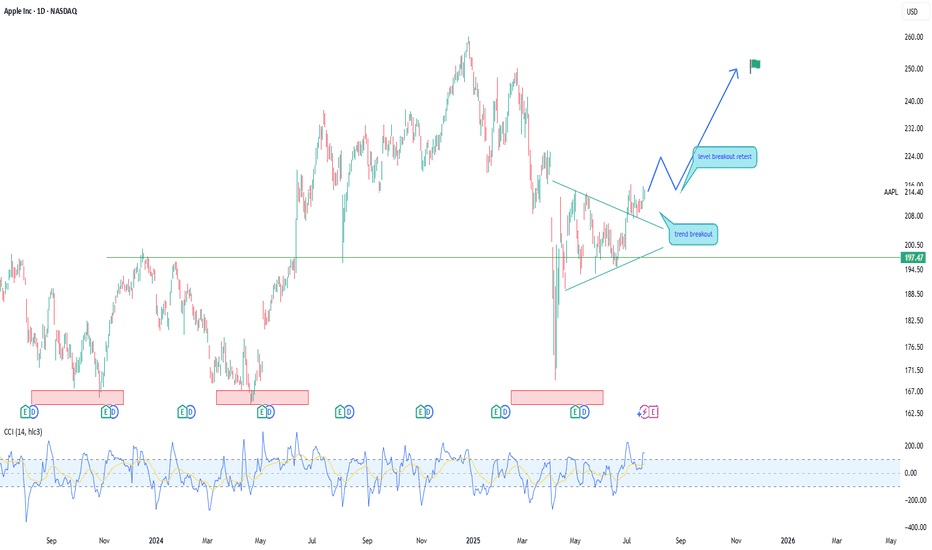

Apple (AAPL) — Expected 20% GrowthThe fundamental outlook for Apple stock remains positive: the upcoming fall presentation and anticipated AI-related announcements are driving bullish sentiment.

Technical picture:

The price has broken through a key trendline, signaling a shift in momentum toward growth.

Near-term target: a move t

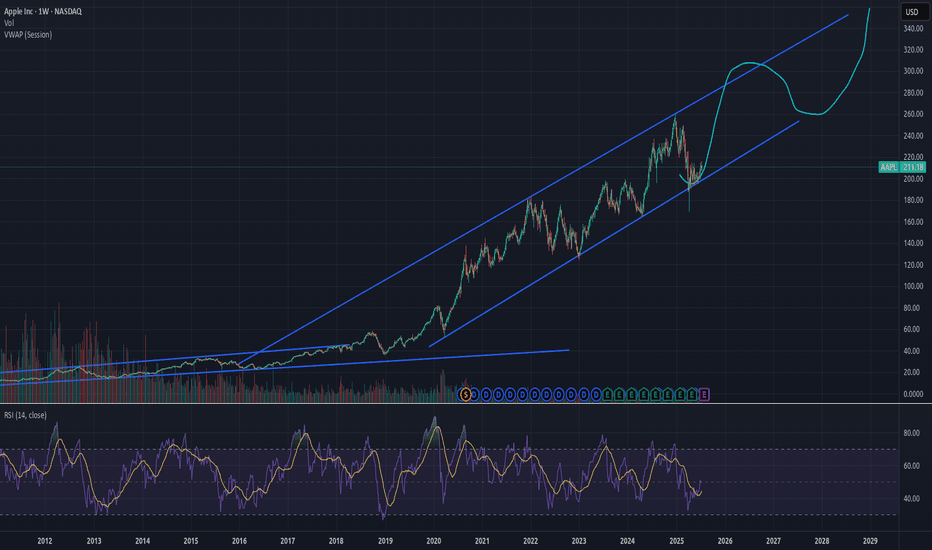

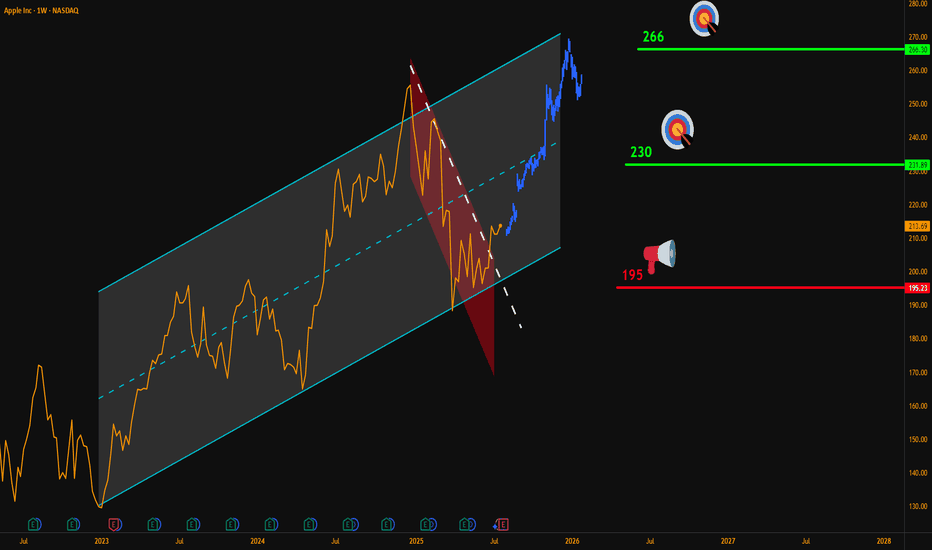

AAPL Weekly Breakout – Targeting $266Hello Traders,

Here’s my latest analysis on Apple (AAPL) based on the weekly chart.

🔍 Chart Breakdown:

Main Uptrend Channel (Blue): Price has respected this channel since 2023.

Red Downtrend Sub-Channel: Recent corrective phase is now broken.

Breakout Signal: Last week, AAPL closed above the

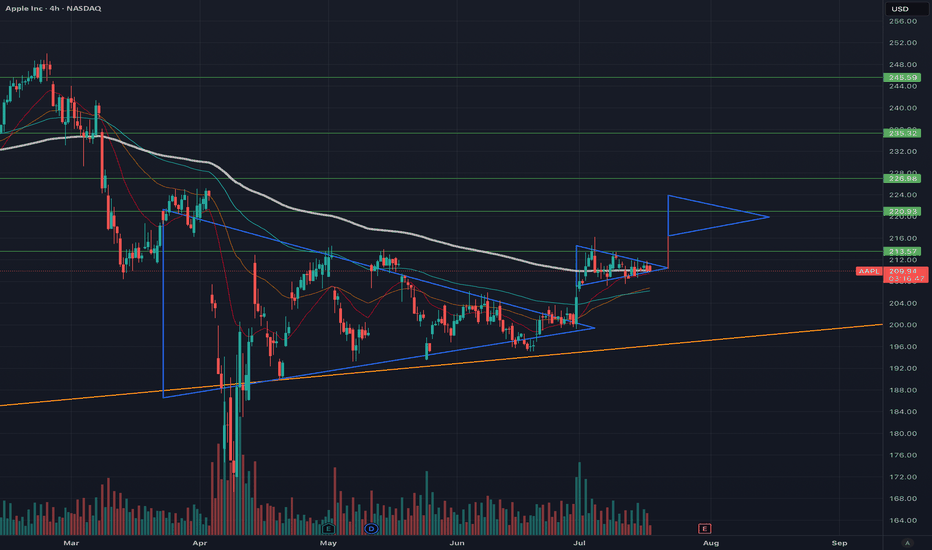

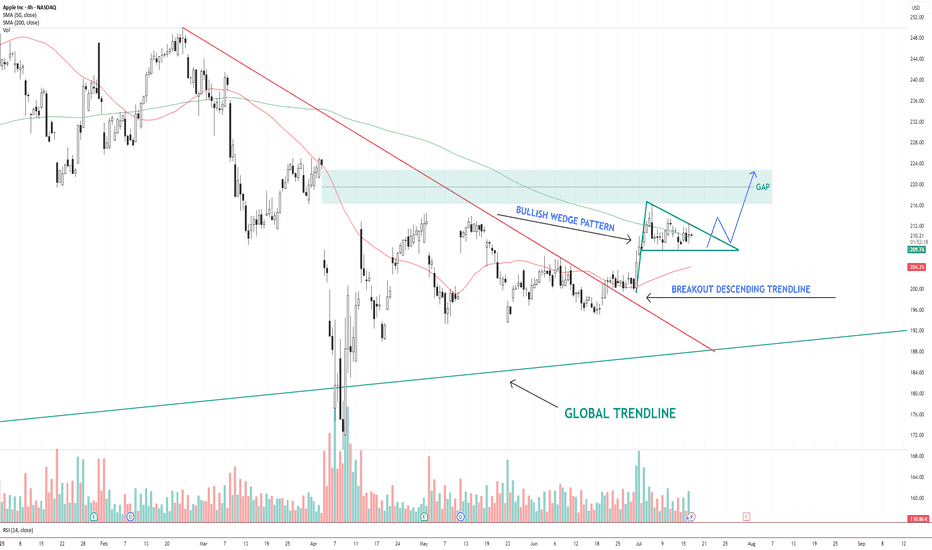

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting

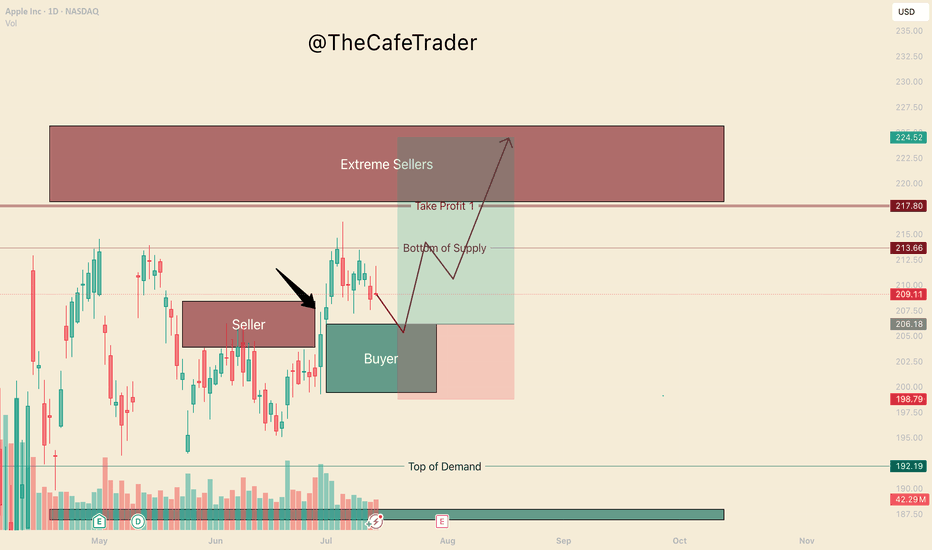

APPL. Bulls are in ControlHello, I’m TheCafeTrader.

This post is for technical traders looking to capitalize on short swings and options.

What you’re seeing here are supply and demand zones — areas where liquidity is concentrated. These levels are identified using a system built around footprint data, order flow, and marke

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833DZ0

APPLE 20/50Yield to maturity

6.99%

Maturity date

Aug 20, 2050

US37833EF3

APPLE 21/51Yield to maturity

6.85%

Maturity date

Feb 8, 2051

US37833EG1

APPLE 21/61Yield to maturity

6.81%

Maturity date

Feb 8, 2061

US37833EL0

APPLE 21/61Yield to maturity

6.81%

Maturity date

Aug 5, 2061

US37833EK2

APPLE 21/51Yield to maturity

6.81%

Maturity date

Aug 5, 2051

US37833DW7

APPLE 20/50Yield to maturity

6.80%

Maturity date

May 11, 2050

US37833EA4

APPLE 20/60Yield to maturity

6.71%

Maturity date

Aug 20, 2060

US37833DQ0

APPLE 19/49Yield to maturity

6.55%

Maturity date

Sep 11, 2049

US37833EE6

APPLE 21/41Yield to maturity

6.26%

Maturity date

Feb 8, 2041

US37833DD9

APPLE 17/47Yield to maturity

6.10%

Maturity date

Sep 12, 2047

US37833BA7

APPLE 15/45Yield to maturity

6.07%

Maturity date

Feb 9, 2045

See all AAPL bonds

Curated watchlists where AAPL is featured.