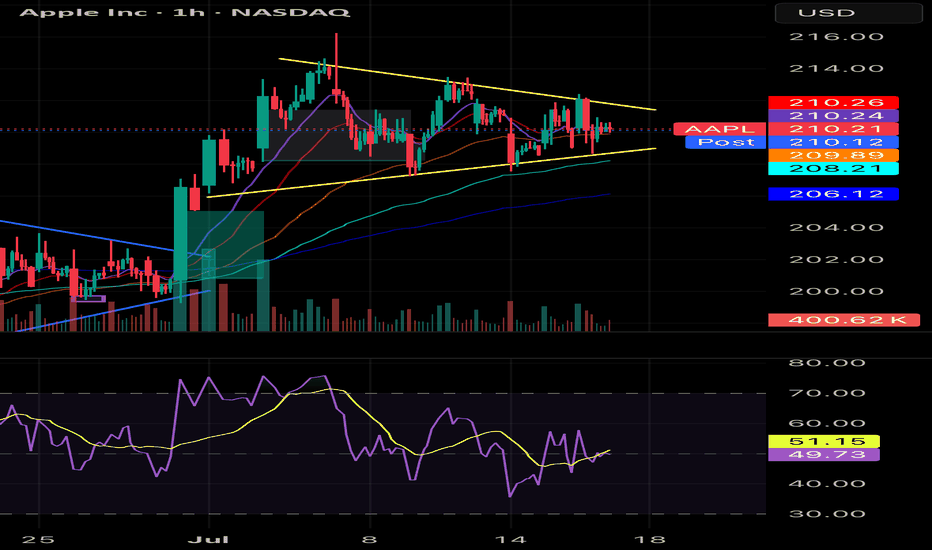

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper ri

Key facts today

Apple Inc. will report Q3 2025 earnings on July 31, with an expected EPS of $1.42, a 1.4% year-over-year rise. The company has exceeded earnings expectations for four consecutive quarters.

Morgan Stanley's Erik Woodring maintains a Buy rating on Apple (AAPL) with a $235 price target, citing strong sales in iPhones, iPads, Macs, and growth in Services.

Apple's iPhone revenue estimates rose 2% from higher shipments and prices. iPad estimates increased 9%, and Mac estimates grew 1%, indicating stronger demand across these products.

0.30 USD

75.08 B USD

313.21 B USD

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

ISIN

ARDEUT116183

FIGI

BBG000S0MSK0

Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, AppleCare, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in April 1976 and is headquartered in Cupertino, CA.

Related stocks

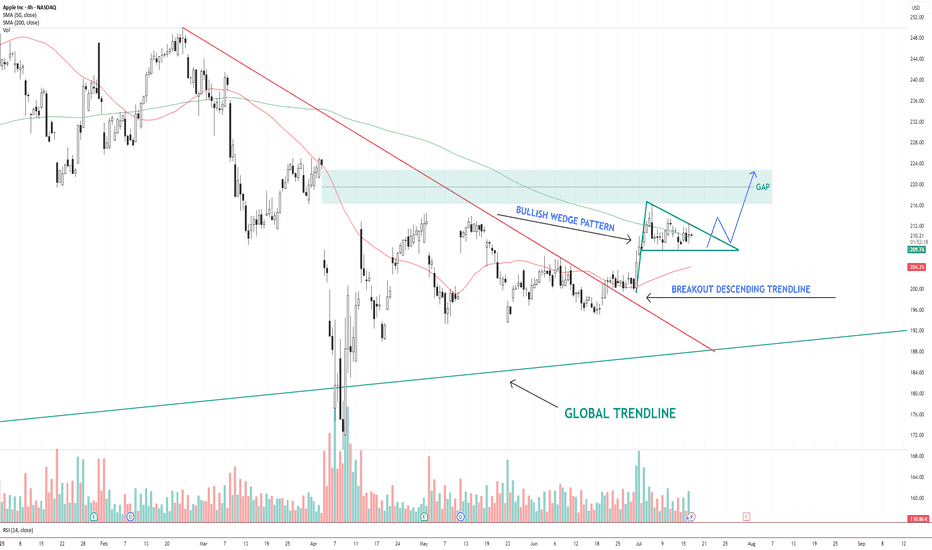

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting

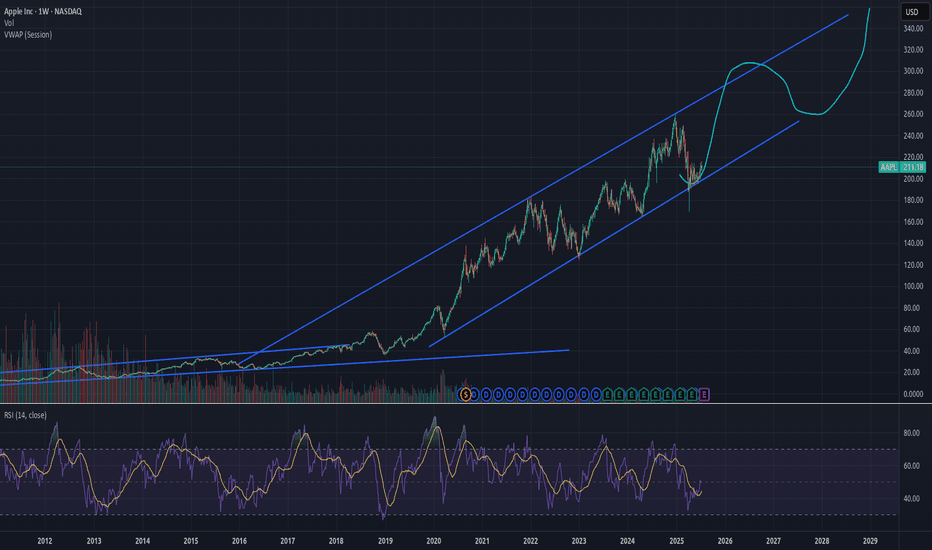

Time to buy? Too much negative press. Buy in Fear- Updated 13/7Apple has faced prolonged downward pressure from bearish investors. Despite its best efforts and some dips, the stock has steadily maintained a baseline price of 200 USD. The flag pattern required some adjustments along its path to break out, primarily due to geopolitical issues and economic variabl

Time to buy? Too much negative press. Buy in Fear- Updated 18/7Apple has significantly underperformed compared to the other Magnificent 7 stocks, but I don’t believe it’s a company you should bet against in the current climate. With a slow rollout of AI and recent statements from Apple, they may not always be first to market, but they generally execute well. Th

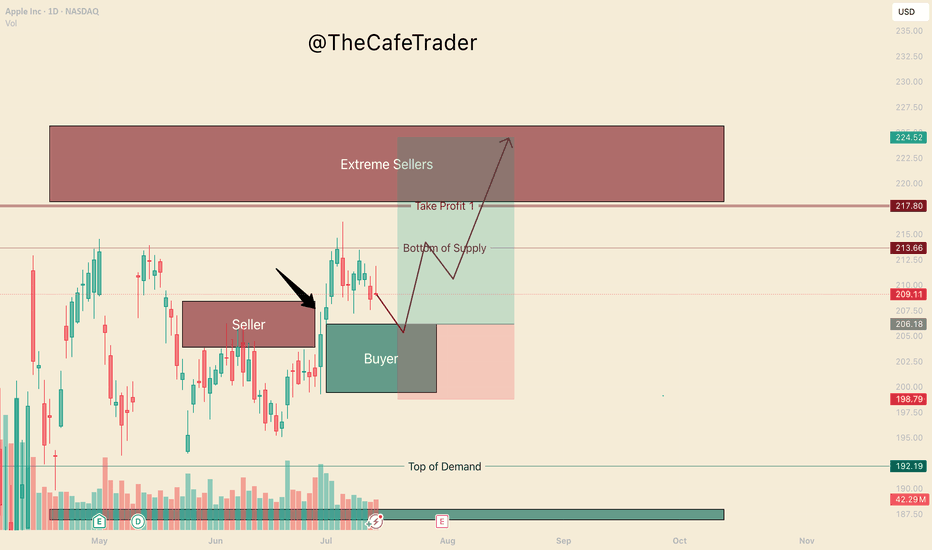

APPL. Bulls are in ControlHello, I’m TheCafeTrader.

This post is for technical traders looking to capitalize on short swings and options.

What you’re seeing here are supply and demand zones — areas where liquidity is concentrated. These levels are identified using a system built around footprint data, order flow, and marke

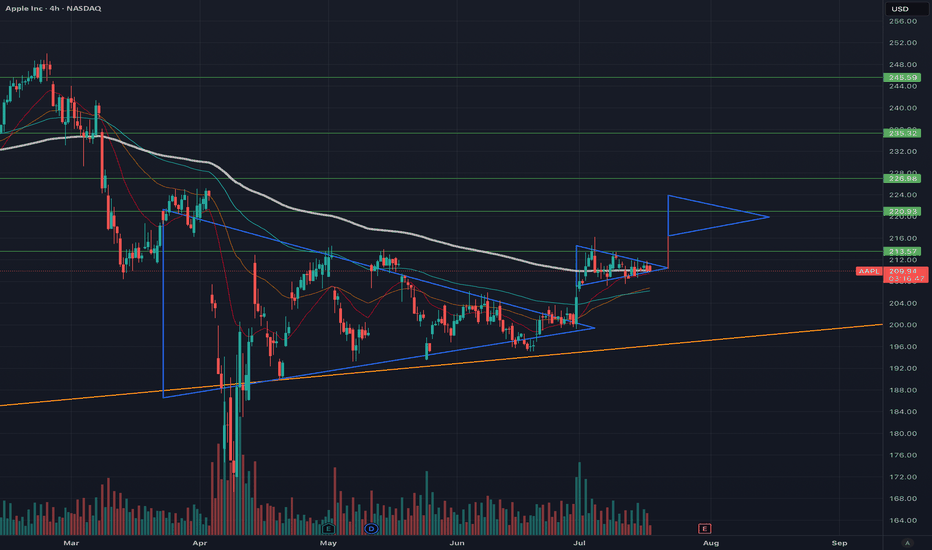

AAPL BUY 1st target $223AAPL is forming a wedge and been lagging for 2 years. I was expecting $182 but we never saw that level, after weeks of $200 range consolidation it's clear this is basing, first target of resistance is $223 then we could be off to the races. I would expect to see this as soon as next week provided

AAPL BULLISH WEDGEApple previously wedged, and broke out into the 213s. I previously tracked it but didn't enter. As of recent the volume has been thinning and the PA has been consolidating. I believe Apple has potential to breakout once again. The EMAs are also in more of a bullish stack. Hoping to hit somewhere in

AAPL Set for a Breakout? | Technical Checklist & Projections

▍Observation & Context

▪ AAPL has been moving sideways within a clearly defined range for the past three months .

▪ On July 07 , price tested the range resistance decisively, showing some interest in the upside.

→ Let's first explore the bullish breakout scenario.

▍What Makes a Goo

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833DZ0

APPLE 20/50Yield to maturity

7.04%

Maturity date

Aug 20, 2050

US37833DW7

APPLE 20/50Yield to maturity

6.85%

Maturity date

May 11, 2050

US37833EF3

APPLE 21/51Yield to maturity

6.84%

Maturity date

Feb 8, 2051

US37833EK2

APPLE 21/51Yield to maturity

6.78%

Maturity date

Aug 5, 2051

US37833EG1

APPLE 21/61Yield to maturity

6.78%

Maturity date

Feb 8, 2061

US37833EL0

APPLE 21/61Yield to maturity

6.77%

Maturity date

Aug 5, 2061

US37833EA4

APPLE 20/60Yield to maturity

6.76%

Maturity date

Aug 20, 2060

US37833DQ0

APPLE 19/49Yield to maturity

6.58%

Maturity date

Sep 11, 2049

US37833EE6

APPLE 21/41Yield to maturity

6.31%

Maturity date

Feb 8, 2041

US37833BA7

APPLE 15/45Yield to maturity

6.08%

Maturity date

Feb 9, 2045

US37833DD9

APPLE 17/47Yield to maturity

6.08%

Maturity date

Sep 12, 2047

See all AAPLD bonds

Curated watchlists where AAPLD is featured.