AAPLD trade ideas

APPLE: Expecting Bullish Continuation! Here is Why:

Looking at the chart of APPLE right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

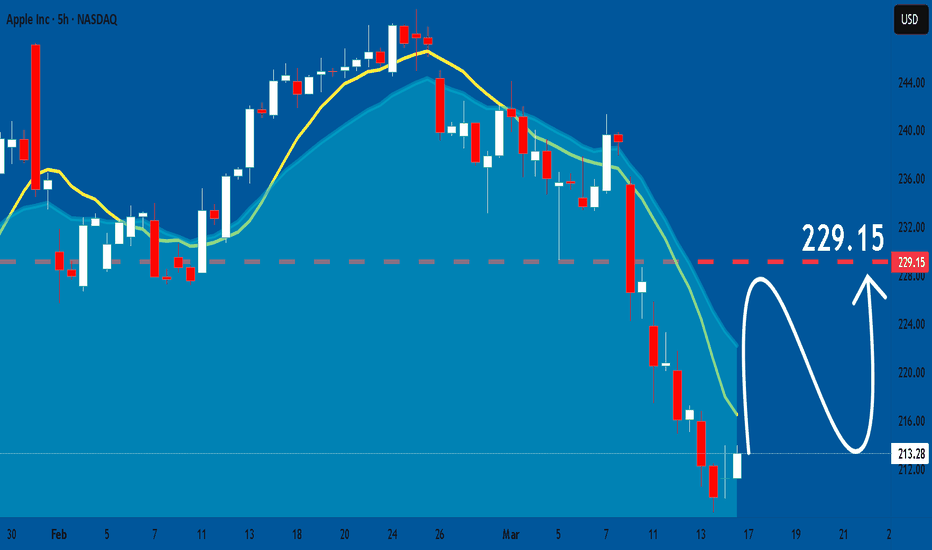

AAPL BULLS ARE GAINING STRENGTH|LONG

AAPL SIGNAL

Trade Direction: long

Entry Level: 213.28

Target Level: 232.17

Stop Loss: 200.88

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAPL: Apples Are On Sale! Buying More!Technicals:

When the chart hits just right, something are left best unexplained.

Look at this month's chart's last reddish color down price bar in Apple's stock (AAPL). Do you see a collapse in it's stock? Or does it just look like it took a brief pause and giving you a chance to buy more "apples" at a discounted price. 🙂

Monthly:

Weekly:

Equal legs + 50% fib pullback + cloud support+ uHd

Daily:

ExDiv1 at equal legs

".....accelerating growth in the money supply is historically correlated with broadening stock performance. As smaller companies have easier and less expensive access to capital, they can invest more in their own growth initiatives. That leads to stronger returns investors typically expect from smaller companies in normal economic environments and more S&P 500 constituents outperforming the overall index. One of the easiest ways to invest in that trend reversal is to buy an equal-weight index fund like the Invesco S&P 500 Equal Weight ETF. The equal-weight index balances every component of the S&P 500 equally. This means the amount you'll invest in the biggest mega-cap stocks is the same as the smallest members of the index. Each quarter, the index's managers rebalance it, and new constituents are added, while others leave." (www.fool.com)

I think that is the safest bet for where to set aside and allocate your money every month towards if you don't want to worry about being a market wizard and a savant.

However, Apple and Nvidia are still good businesses to invest in.

APPLE, will we see 200$ again ?Hello traders, Hope you're doing great. What are your thoughts about NASDAQ:AAPL ?

for upcoming weeks, I expect an upward correction at first and after that I expect a SELL OFF situation in the market that causes a huge drop in stock market, my first Target is 200$.

This post will be Updated.

Trade Safe and have a great week.

Apple Wave Analysis – 13 March 2025

- Apple broke support area

- Likely to fall to support level 200.00

Apple recently broke the support area between the strong support level 220.00 (which has been reversing the price from October) and the 61.8% Fibonacci correction of upward impulse from August.

The breakout of this support area accelerated the active impulse wave 3 of the sharp downward impulse wave (C) from February.

Apple can be expected to fall to the next round support level 200.00 – which is the target price for the completion of the active impulse wave (C).

$AAPL Ready to Explode? Harmonic Pattern and OversoldAlright, folks, it looks like Apple stock has just nailed one of those harmonic patterns, and on top of that, the RSI is screaming oversold, hitting a rock-bottom 26—the lowest it’s been in a year! With the stock chilling and holding steady at these current price levels, it’s boosting the odds of a sweet upward price reversal coming our way.

AAPL short on reboundWhile I've been putting up shorts for Nasdaq, Meta, Google, and Amzn, I just realized that I did not do it for AAPL. So here's the wave counts update. While the direction is down, it does not mean to short it now because this wave 3 down is now approximately equals to wave 1 (around $40). An extension of 1.618 will give us another $24 down move but I CANNOT be certain if there would be any corrective wave up making this current wave 3 a 5-waves movement.

So my suggestion is to wait for rebound and short.

Was AAPL overextended? Short TradeIf we look at AAPL this week, it's the most bearish asset this week. But how can we confirm that there's room for APPL to trend lower. After invalidating the weekly bisi there are no PD arrays to support price higher or to hold it. Next, indices are bearish! In Daily and H4 tf, it leaves FVGs without being retraced to while indices, especially QQQ and other tech stocks retraced to these FVGs, signaling AAPL extremely bearish and could now target daily or weekly targets from previous months.

APPLE Buy opportunity on the 1W MA50.Apple Inc. (AAPL) has been trading within a 2-year Channel Up since the January 03 2023 bottom and in the past 3 months (December 26 2024) has been forming the latest Bearish Leg. On Tuesday this Leg broke below its 1W MA50 (red trend-line) for the first time in 10 months (since May 08 2024), which is the strongest buy signal since the April 19 2024 Higher Low bottom of the Channel Up.

As you can see, even the 1D RSI pattern is similar with the one that made the October 26 2023 1W MA50 test. That was also on the 0.618 Fibonacci retracement level from the respective previous Low.

As a result, it is now highly likely to see a rebound, especially if the 1W candle closes above the 1W MA50, to test the previous High and 1.0 Fib at $260, like the December 14 2023 High did.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

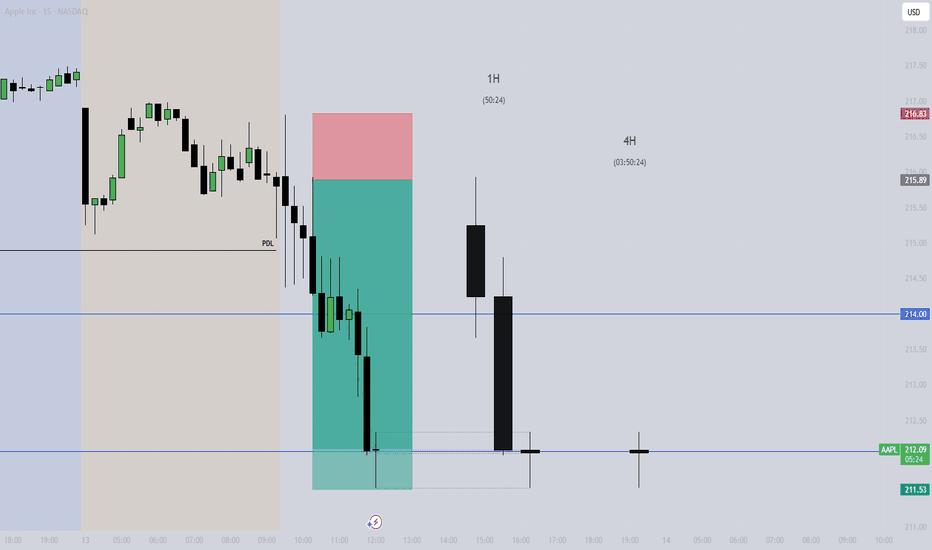

AAPL gap fill today?! Trendline reversal strategy activated!

Based on price at market open i anticipate a run up in the market as a whole and of course as we all know, AAPL is one of the main driving indicators of that!

Seems to have finally broke the down trend with a double bottom at a respected demand area, with a nice opportunity for big price movement to the up side to fill the gap.

As a Trendline reversal strategy trader, having a huge gap like that to fill in the direction of the reversal and breaking the recent short term trend… seems like a win-win I am going to enter a position in TODAY! 📈💰

AAPL - Bearish IdeaAAPL has been moving consistently up the green solid line, finding support over and over again

Will this continue? (white circle)

If not will we see a break down to a lower trend line (dotted line) This dotted trend line extends further back on the Monthly timeframe which I can't really show on this Weekly timeframe

I am bearish

Elliott Wave View: Apple (AAPL) Should See Further Downside WithApple (ticker: NASDAQ:AAPL ) shows incomplete bearish sequence from 12.26.2024 peak and looking for further downside. Down from 12.26.2024 peak, wave ((A)) ended at 218.06 and wave ((B)) ended at 250. Wave ((C)) lower is in progress as a 5 waves impulse Elliott Wave structure. Down from wave ((B)), wave (1) ended at 230.2 and wave (2) ended at 244.03 as the 30 minutes chart below shows.

Wave (3) is in progress with internal subdivision as another impulse in lesser degree. Down from wave (2), wave 1 ended at 229.23 Rally in wave 2 unfolded as a zigzag structure. Up from wave 1, wave ((a)) ended at 237.86, wave ((b)) ended at 233.33, and wave ((c)) ended at 241.36 which completed wave 2. The stock has resumed lower in wave 3 lower. Down from wave 2, wave ((i)) ended at 235.25 and wave ((ii)) ended at 238.47. Wave ((iii)) lower ended at 224.22 and wave ((iv)) rally ended at 228.66. Final leg wave ((v)) ended at 217.46 which completed wave 3 in higher degree. Rally in wave 4 ended at 223.28. Expect wave 5 to end soon which should complete wave (3) in higher degree. Then it should rally in wave (4) to correct cycle from 3.3.2025 peak before it resumes lower. Near term, as far as pivot at 241.36 high stays intact, expect rally to fail in 3, 7, or 11 swing for more downside.

APPLE Stock Chart Fibonacci Analysis 031225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 224/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

APPL I'll take your iphone at $196 As my last prediction came to be, I have at this moment 25/0 on this boxing ring so far.

2 Possible outcomes.

- Price keeps moving down from where it is to the $196 and completes the movement to the order block that created the movement to the upside.

-It bounces back to the $226 area to touch resistance, liquidate pending orders, and move down to the $196.

This is not a depression people. This is a true correction of market prices.

AAPL - heading to support at 200$ in an a-wave ?AAPL might have already completed 5 waves up as 3-wave structures and from here on a correction over many years could be seen.

Looking at the chart, it seems that price is heading to the lower trend line in the 200$ area.

That could provide support for a move up, which might turn out as a b-wave of the current a-wave correction followed by a even deeper c-wave.

Time will tell.

AAPL stock outlook: potential scenarios and key support levelsWhat does the recent price action on AAPL stock suggest?

The recent price action on AAPL stock indicates a potential topping pattern, which may signal a bearish move toward the support zone between $180 and $195. This pattern suggests that selling pressure could increase, leading to a possible decline within this range.

What is the worst-case scenario for AAPL stock in 2025?

In the worst-case scenario, AAPL stock could decline to around $180. However, if this scenario unfolds, the stock may also recover, with a potential rebound toward the $220 level.

What is the short-term support level for AAPL stock?

In the short term, AAPL stock is likely to find support around the $210 level, which could act as a key price floor for stabilization.

Apple (AAPL) Share Price Drops Over 7% in Two DaysApple (AAPL) Share Price Drops Over 7% in Two Days

As previously reported, AAPL shares had their worst January since 2008, but the challenges for investors have continued. The Apple (AAPL) stock chart shows that:

- Yesterday, the price dropped below $218 during trading—the lowest level since September last year.

- Compared to Friday’s closing price, the decline over the first two days of this week amounted to approximately 7.7%.

Why Has AAPL Stock Fallen?

Yesterday, we noted that bearish sentiment was prevailing in the stock market, leading the Nasdaq 100 index into correction territory. Market conditions were further dampened by news that Apple had delayed the release of an AI-powered update for its digital assistant, Siri 2.0, increasing selling pressure.

What Could Happen Next?

Technical Analysis of Apple (AAPL) Stock

Key price reversals, marked with red dots, outline a downward channel (shown in red). The median line, which previously acted as support (indicated by an arrow), has now been broken, suggesting that bears may expect it to act as resistance going forward.

From a bullish perspective, the lower boundary of the red channel, reinforced by the September low around $214, could serve as an area where selling pressure might ease—if AAPL continues to decline.

AAPL Share Price Forecast

According to TipRanks:

- 18 out of 33 surveyed analysts recommend buying AAPL stock.

- The average 12-month price target for AAPL is $251.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.