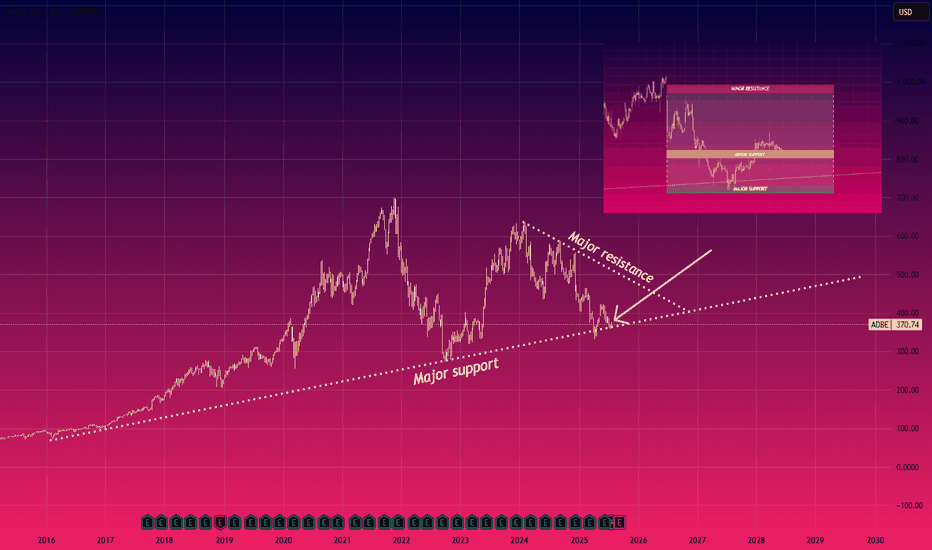

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to

Key facts today

Figma's valuation is about $70.4 billion with a price-to-sales ratio of 94, while Adobe's ratio is nearly 11. Figma's 2024 revenue growth is projected at 48%, versus Adobe's 11%.

725 ARS

4.92 T ARS

19.05 T ARS

About Adobe Inc.

Sector

Industry

CEO

Shantanu Narayen

Website

Headquarters

San Jose

Founded

1982

ISIN

ARBCOM460192

FIGI

BBG00PCC99G8

Adobe, Inc. is a global technology company, which engages in the provision of digital marketing and media solutions. It operates through the following segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products and services that enable individuals, teams, businesses, and enterprises to create, publish, and promote content anywhere and accelerate productivity by transforming view, share, engage with and collaborate on documents and creative content. The Digital Experience segment focuses on integrated platform and set of products, services, and solutions that enable businesses to create, manage, execute, measure, monetize, and optimize customer experiences that span from analytics to commerce. The Publishing and Advertising segment includes legacy products and services that address diverse market opportunities, including eLearning solutions, technical document publishing, web conferencing, document and forms platform, web app development, high-end printing, and Adobe Advertising offerings. The company was founded by Charles M. Geschke and John E. Warnock in December 1982 and is headquartered in San Jose, CA.

Related stocks

L: Quick Analysis on $NASDAQ:ADBE Support and ResistanceQuick Analysis on NASDAQ:ADBE Support and Resistance

The chart shows NASDAQ:ADBE nearing a major support level around $370, Which has held since 2016, the downward resistance line suggests continued pressure, but a breakout above $400 levels could signal a bullish reversal

Please note this

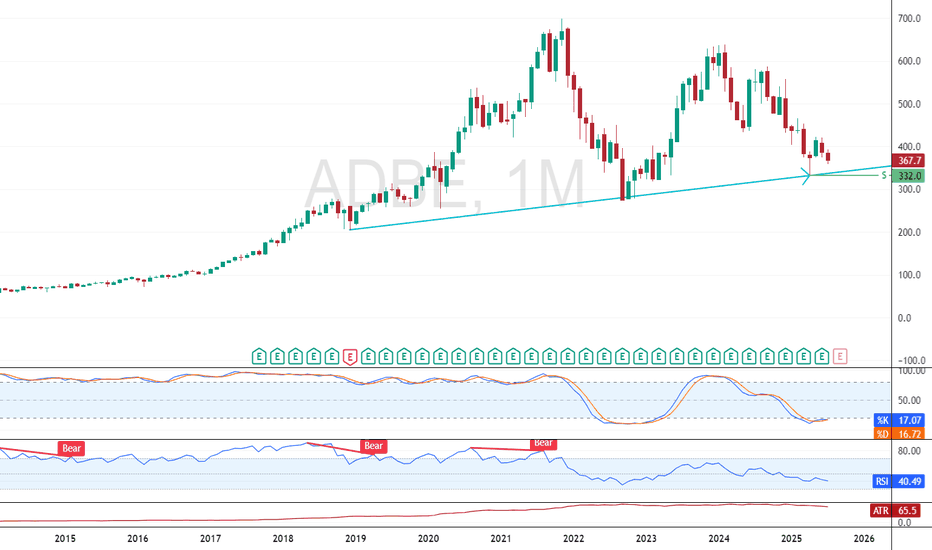

Adobe Wave Analysis – 1 August 2025- Adobe broke the key support level 360.00

- Likely to fall to support level 335.00

Adobe recently broke below the key support level 360.00 (which stopped the previous minor impulse wave i at the start of July).

The breakout of the support level 360.00 accelerated the active impulse wave C of the

Adobe - A gigantic triangle breakout! 🔋Adobe ( NASDAQ:ADBE ) will break the triangle:

🔎Analysis summary:

Yes, for the past five years Adobe has been overall consolidating. But this consolidation was governed by a strong symmetrical triangle pattern. Thus following the underlying uptrend, there is already a higher chance that we w

ADOBE MONEY SNATCH! High-Reward Long Setup (Police Trap Alert!)🚨 ADOBE HEIST ALERT: Bullish Bank Robbery Plan! (High-Risk, High-Reward Loot) 🚨

🌟 ATTENTION, MARKET PIRATES & MONEY SNATCHERS! 🌟

(Hola! Bonjour! Marhaba! Hallo!)

🔥 THIEF TRADING STRATEGY 🔥 – ADOBE INC. (ADBE) is primed for a bullish heist! Time to steal profits like a pro!

🔓 ENTRY POINT: "BREAK TH

The only way is down (Otis Clay, inverted)!NASDAQ:ADBE has been in a steady decline since Sept 24. It jumped prior to earnings in Dec 24, only to get hammered back down immediately after release. Since, it has been a sad show. The trend is down. Price has declined over time, MACD is negative, RSI has crossed negative, price is below 100 and

Adobe Wave Analysis – 18 June 2025- Adobe broke support zone

- Likely to fall to support level 364.90

Adobe recently broke through the support zone located between the support level 392.85 (which stopped wave A at the end of May) and the 61.8% Fibonacci correction of the upward impulse (1) from April.

The breakout of this support

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ADBE5981558

Adobe Inc. 5.3% 17-JAN-2035Yield to maturity

4.58%

Maturity date

Jan 17, 2035

ADBE5784629

Adobe Inc. 4.95% 04-APR-2034Yield to maturity

4.58%

Maturity date

Apr 4, 2034

US724PAD1

ADOBE 20/30Yield to maturity

4.50%

Maturity date

Feb 1, 2030

US724PAC3

ADOBE 20/27Yield to maturity

4.23%

Maturity date

Feb 1, 2027

ADBE5981252

Adobe Inc. 4.95% 17-JAN-2030Yield to maturity

4.09%

Maturity date

Jan 17, 2030

ADBE5784440

Adobe Inc. 4.8% 04-APR-2029Yield to maturity

4.01%

Maturity date

Apr 4, 2029

ADBE5784439

Adobe Inc. 4.85% 04-APR-2027Yield to maturity

3.93%

Maturity date

Apr 4, 2027

ADBE5981557

Adobe Inc. 4.75% 17-JAN-2028Yield to maturity

3.91%

Maturity date

Jan 17, 2028

See all ADBE bonds

Curated watchlists where ADBE is featured.