AMD trade ideas

Trading Thesis: Silicon Whiplash – AMD Coiling for a Re-Launch🧠 Trading Thesis: “Silicon Whiplash – AMD Coiling for a Re-Launch to $164+?”

📉 Ticker: NASDAQ:AMD

🗓️ Timeframe: Daily (1D)

📍 Current Price: $144.42

📈 Fibonacci Expansion Target: $164.54 (1.236 extension), $174.98 (1.382 extension)

📉 Support Zone: $120.78

🔭 Play Duration: 2–4 weeks (event-based structure)

🔍 WaverVanir Thesis

Advanced Micro Devices ( NASDAQ:AMD ) is presenting a high-conviction pullback-to-launchpad setup.

After reaching the $147.75 resistance (1.0 Fib extension), AMD has begun carving out a potential W-pattern reaccumulation that could send it to $164.54+. This setup aligns with AI infrastructure momentum and strong GPU/CPU roadmap tailwinds into Q3.

⚡ Catalyst Radar

🚀 MI300 AI GPU Rollout: Recent guidance confirms massive momentum in AMD's data center AI segment, expected to double in Q3. MI300X is gaining traction in the hyperscaler race (vs. NVDA).

💰 AI Arms Race: AMD is aggressively capturing GPU demand in sovereign AI, defense compute, and private AI stack builders (OpenAI, Anthropic, Meta).

📅 Earnings Catalyst: Next report in early August. Expect YoY revenue growth rebound + margin guidance upgrade.

📐 Technical Blueprint

📉 Support Zone: $120.78 (Golden Pocket reversion area)

📊 Pullback Scenario: If price rejects from $147.75 again, a W-pattern retrace to $124–121 would offer a prime long entry.

📈 Upside Targets:

Target 1: $164.54 (1.236 Fib extension)

Target 2: $174.98 (1.382 extension)

🔍 WaverVanir DSS Signal

The DSS signal model confirms:

Smart Money Concepts (SMC) bullish orderblock was reclaimed at $115

Volume profile shows breakout from low-volume node — setting up for a clean sweep to higher liquidity zones

Momentum divergence on RSI and MACD supports the "cool-off before liftoff" thesis

🧠 Strategic Setup

Scenario Trigger Action

Bullish Continuation Break + close above $148 Chase breakout with $155/$165 calls

W Reversion Entry Drop to $124–121 with holding wick Long entry with call spreads into earnings

Bearish Breakdown Close below $118 Wait and reassess — structure invalidated

⚠️ Risk Management: Tighten stops below $117. Risk defined. No long if structure breaks down on high volume.

✅ Summary

AMD’s structure screams accumulation, not distribution. The convergence of technical structure, fundamental catalysts, and AI expansion cycles makes this one of the highest-risk-adjusted setups heading into earnings season. We are watching for pullbacks to enter long toward $164–175.

🧩 #Tags:

#WaverVanir #AMD #Semiconductors #AITrade #MI300 #GPUWar #FibExpansion #TradingThesis #NVDA #OptionsFlow #AIInfrastructure #SmartMoneyConcepts #VolumeProfile #WPattern #NASDAQ100

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia), but that company is getting all the attention. And, to me, this means opportunity for the future. The cashflow is likely to grow tremendously for

NASDAQ:AMD into 2027 and beyond, which may inevitably reward investors with dividends.

From a technical analysis perspective, NASDAQ:AMD just entered my historical simple moving average zone. This area (currently $108-$126) is where I will be gathering shares. Something tremendous would have to change regarding the fundamentals of this company (like a scandal) for the overall thesis to change. There may be some near-term price pains as NVidia gets all the focus, but to meet demand in the semiconductor and AI space, NASDAQ:AMD is poised to fulfill that roll in the future.

Target #1 = $158.00

Target #2 = $175.00

Target #3 = $188.00

Target #4 = $205.00

7/15 AMD short AMD just reached a major resistance level and is expected to pull back toward the $135 area. While it may not signal a full trend reversal, a retracement from today’s high is likely.

If the 7/15 candle forms a red shooting star, it would provide further confirmation.

May the trend be with you.

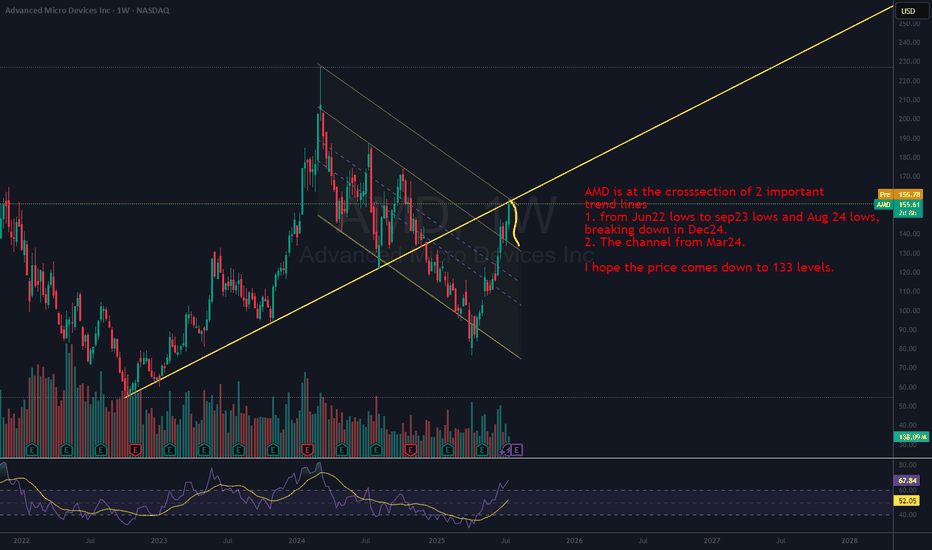

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a downtrend.

AMD new range higherAMD essentially hit my buy zone that I called months ago almost to the T. Now with renewed strength and the market realizing there is share for both NVDA and AMD, the stock rips. I believe it will push up into this zone over the next week weeks and consolidate here. I am not currently in this trade but I did short AMD on the prior pivot.

Sometime in August we likely enter this range and I may start to sell CSP in the demand zones that form.

Safe Entry Zone AMDPrice Rejected From Resistance.

Safe Entry Green Zone.

Target after that 162$ price level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

Take Care & Watch OUT !

How 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMDHow 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMD Stock

AMD stock has flashed a compelling multi-timeframe buy signal based on a weekly breakout, daily reversal, and 4H stochastic

momentum shift—all aligned with the 50 and 200 EMA and Stochastic RSI indicators.

---

Advanced Micro Devices (AMD) is showing a promising technical setup for bullish traders. An alignment across the weekly, daily,

and 4-hour charts is sending a powerful message: momentum may be shifting in favor of buyers.

This article breaks down how two key indicators—EMA (50 and

200) and the Stochastic RSI—are lining up across three timeframes to support a potential upward move.

---

Weekly Chart: Breakout in Progress

The first signal comes from the weekly chart, where AMD has broken above a recent resistance level. Price has cleared previous

consolidation highs while staying well above both the 50 EMA and 200 EMA, a classic sign of long-term strength.

This breakout is significant because weekly chart patterns carry more weight and often lead to sustained price trends. The bullish

separation of price from the 50 and 200 EMAs is a signal that long-term traders are regaining control.

---

Daily Chart: Reversal Pattern Confirmed

On the daily chart, a clear reversal has taken shape. After a recent pullback, AMD found support near the 50 EMA and bounced

higher. The 200 EMA remains below, confirming the overall bullish structure.

This bounce is further validated by the Stochastic RSI crossing

back above the oversold region, a strong signal that short-term selling pressure has been exhausted. When momentum indicators

and price structure both confirm a reversal, it often leads to an upward follow-through.

---

4-Hour Chart: Early Momentum Reversal

Drilling down into the 4-hour chart, a timely reversal is unfolding.

AMD rebounded strongly from a lower support zone while holding above the 50 and 200 EMAs. Most notably, the Stochastic

RSI has crossed bullishly, confirming the momentum shift from sellers to buyers.

This 4-hour signal adds precision to the daily and weekly bullish bias. Short-term traders may use this to fine-tune entries, while

longer-term investors may see it as confirmation to scale into positions.

---

Conclusion: Multi-Timeframe Confluence Supports a Buy Bias

When the weekly, daily, and 4-hour charts align with bullish

signals from both price action and indicators like the EMA (50 and 200) and Stochastic RSI, the odds often favor the bulls.

While no signal is guaranteed, this kind of multi-timeframe confluence is rare and valuable. It suggests momentum is building

from the ground up—starting with short-term traders and expanding into longer-term buying interest.

---

Disclaimer:

This article is for educational purposes only and not financial advice. Use a simulation trading account before you trade with

real money and learn risk management and profit-taking strategies. Trading is risky and past performance does not

guarantee future results.

---

AMD preparing to break out or fail at resistance🔍 Chart Structure & Key Levels

Horizontal Resistance:

The stock is repeatedly testing the $147.75 level, which is acting as a horizontal resistance (shown in orange). Price has stalled here for several sessions, creating a tight range just below resistance—a common precursor to breakouts.

Ascending Trendline Support:

A long-term upward trendline (dashed yellow) supports the current move. Price has respected this line multiple times, showing a strong bullish structure over the past few months.

Volume Analysis:

Volume has decreased during the recent consolidation near the highs, which is typical before a breakout. However, we want to see a volume spike on a confirmed breakout above $147.75 to validate strength.

Symmetrical Triangle / Coil:

There's a tightening pattern forming between the rising trendline and the flat resistance, indicating price compression. This type of structure is often resolved with a large directional move.

✅ Bullish Scenario

A confirmed breakout above $147.75 with volume expansion could trigger a strong upward move.

Price could quickly target the psychological level near $150, and potentially beyond to $155+, based on the height of the prior impulse wave.

⚠️ Bearish Breakdown Scenario

If price fails to break above $147.75 and breaks the ascending trendline, a pullback to $140 or $135 becomes likely.

A breakdown would invalidate the current bullish structure and signal a potential short-term reversal.

🧠 Summary

This chart is in a bullish consolidation with a coiled setup just under major resistance. A breakout above $147.75 is the critical level to watch for upside continuation. Traders should monitor volume and candlestick confirmation before entering positions.

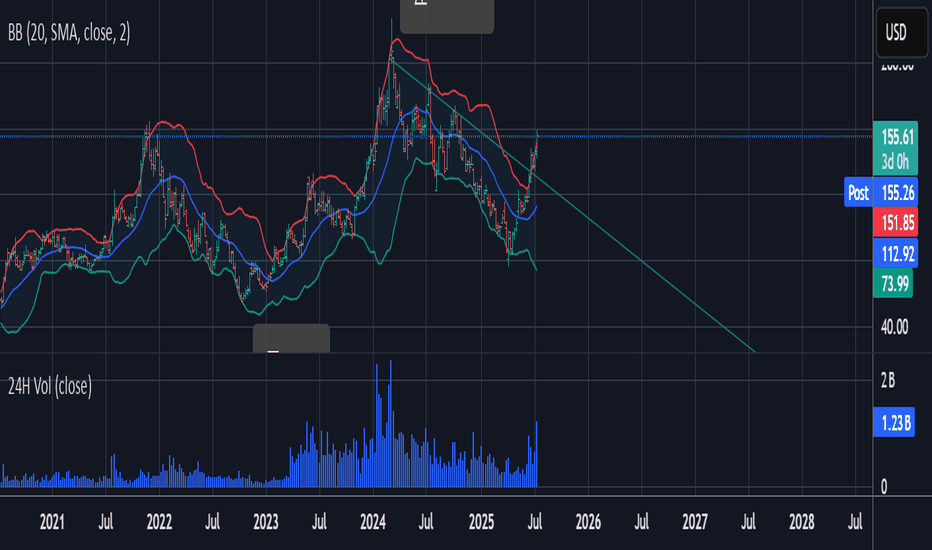

AMD UpdateAs I have mentioned, this move higher is either an extended minor A wave, or it is the beginning of another bull run. I side with the extended A wave due to not only the structure of the chart, but also the broader market as a whole. If this is the case, then price will likely drop to the $100-$110 area to complete minor B. Minor C would ideally take us back up to the $170-$190 area completing intermediate (B). I cannot say how long all of this will take us, but intermediate (A) took 13 months to complete. It would not be a stretch to say we still have 8-10+ months before (B) completes.

Let's just take this one step at a time though. That means we need to watch for price to take us to the low $100's for minor B next.

$AMD Swing Trade – Put Debit Spread Setup🔻 NASDAQ:AMD Swing Trade – Put Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025

🛠 Strategy: Buy to Open (BTO) Put Debit Spread

📉 Strikes: $31 / $30 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.21

🎯 Trade Thesis

This setup aims to capture short-term downside in NASDAQ:AMD via a low-cost, defined-risk spread. The trade fits within my broader portfolio of OTM spreads under $0.25.

Key Drivers:

🔻 Semi sector under pressure – NASDAQ:AMD showing relative weakness.

📉 Breakdown below key support near $31 and rejection at VWAP.

🧾 Weak momentum – MACD trending down, RSI near 44.

🔄 Trade enters into earnings season volatility.

📊 Technical Setup (Daily)

EMA(4) < EMA(8) < EMA(15): Bearish structure fully intact.

VWAP: Price rejected from 30-day VWAP zone.

MACD/RSI: Momentum still fading, no signs of bullish divergence.

⏳ Strategy Notes

Max loss: $0.21

Max gain: $0.79

Risk/reward structured for a drop into or below $30

Expiration: July 18

🧠 Journal Note

Most of my trades are swing-based using OTM debit spreads with tight risk control. No same-day entries — setups must have defined technical compression and short-term catalysts.

Long 4HR AND Weekly ( Finishing Wave 1)

4HR

NASDAQ:AMD is close to potentially finishing Wave 5 of a larger degree wave 1.

$154 is the calculate Fib extension of Wave 1+3 for a wave 5 however, there is plenty room for the stock to run with multiple $160+ Analyst upgrades.

From the Close Price on 6/27 to $160 there is a potential 11% upside.

I believe any negative sentiment on trade with Canada will dissipate sooner than later as we seen throughout the entirety of the year so far with all trade talks failing to hold the markets down.

WEEKLY

The MACD has finally finished above the neutral zone increasing bullish sentiment and strength on this one moving forward as this is a bullish signal.

On both time frames this is a very clear breakout against the Multi year Resistance channel from its previous ATH with price against within the channel showing tons of strength in momentum.

A further outlook for this stock shows a possible wave 3 on the weekly chart targeting the upper trendline at over $300.

If you feel you missed the opportunity to get a long term position, there is always a second chance on on micro wave 2. That would give you retracements down to $100, $110, and $120. I'm rounding up the Fib levels for simplicity.

I currently hold 100 shares at an average of $118 and look to add more beneath my average.

I also am holding multiple contracts with a $140 strike out until the end of July and $160 strike out until September. I do not plan on trimming any contracts until the $150 stock price.

Use this information for educational purposes only as this is not financial advice.

-This zone of 138 USD is really important-AMD📈 AMD Technical Analysis – Bullish Breakout in Sight?

"We are currently testing the parallel channel at $138 for a potentially very bullish confirmation afterward. If confirmed, I would set a target at $170 USD."

🔍 Let’s break it down:

- 🧭 Key Level at $138: AMD is hovering around a critical resistance level within a well-defined parallel channel. This zone is acting as a decision point—either we break out with strength or face a pullback.

- 🧠 Head and Shoulders Pattern: The chart shows a classic inverse head and shoulders formation (Left Shoulder – Head – Right Shoulder), which is typically a bullish reversal signal. If the neckline (around $138) is broken with volume, it could trigger a strong rally.

- 🚀 Bullish Confirmation: A confirmed breakout above $138, especially with strong volume and momentum indicators turning positive, could ignite a powerful uptrend. This would validate the bullish thesis.

- 🎯 Target at $170: If the breakout is confirmed, a price target of $170 is ambitious but realistic. It aligns with the upper bounds of the projected move from the head and shoulders pattern and the channel extension.

- 🛑 Risk Management: As always, keep an eye on false breakouts. A failure to hold above $138 could lead to a retest of lower support levels.

💡 Final Thoughts: AMD is at a technical crossroads. A breakout above $138 could be the spark for a major bullish run toward $170. Keep your eyes on volume, momentum, and confirmation signals. This could be a textbook setup for swing traders and long-term bulls alike. 📊🔥

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

Thank you!

Subcribe TSXGanG! 💡🎯

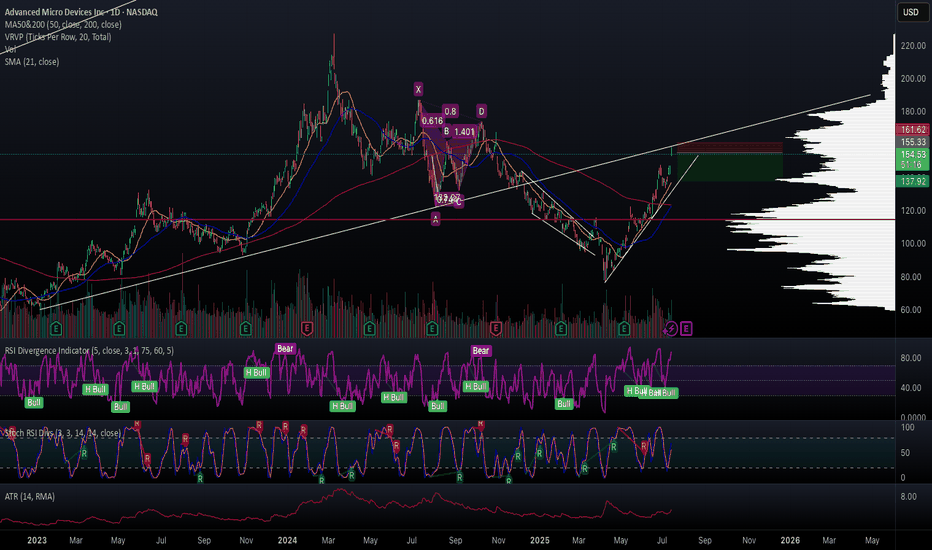

AMD: Elliott Wave Cycle Shows Impulsive RecoveryAMD has seen a deep retracement from its 2024 highs, but it now looks like the stock is trying to stabilize. However, a straight push to new highs may not be likely just yet, as we’re still tracking an ongoing running triangle—an A-B-C-D-E pattern.

Looking at the daily chart, things do look promising for more upside into wave D as we’re seeing a clean five-wave move up on the lower time frame, suggesting we may be in wave A of that D-leg. After a pullback, there could be some very interesting opportunities on the long side.

Support levels on dips to watch are around 115 and 123, while upward projections for this three-wave D-leg rally could be toward the 166 gap area and potentially 185.

Highlights:

Direction: Up after pullback

Support: 115–123

Upside projection: 166 (gap), 185

Grega

AMD: Looking a bit bearish Sort of taking a break from posting about SPY which never seems to do anything interesting.

So posting about AMD which I have been day trading more frequently recently.

Looking at AMD, expecting some upside initially to 145 region, perhaps a gap up into Monday, but overall, the impression is a pullback towards 136.55 and potentially 134.

Probability is to the downside here with the general forecasting outlook being rather bearish tilted.

Let's see what we get on Monday, but expectation is that the pullback should be starting Monday, mid-Monday.

Not advice and as always, safe trades!