Key facts today

AMD's CEO Lisa Su announced revenue growth from record sales in server and PC processors, driven by strong demand and expected growth from the MI350 series and market share gains.

Advanced Micro Devices (AMD) stock rose nearly 50% this year, despite a recent 2.3% drop to $172.73. Analysts see potential for continued gains ahead of the earnings report.

0.15 USD

1.46 B USD

22.90 B USD

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

ISIN

ARBCOM4601M3

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

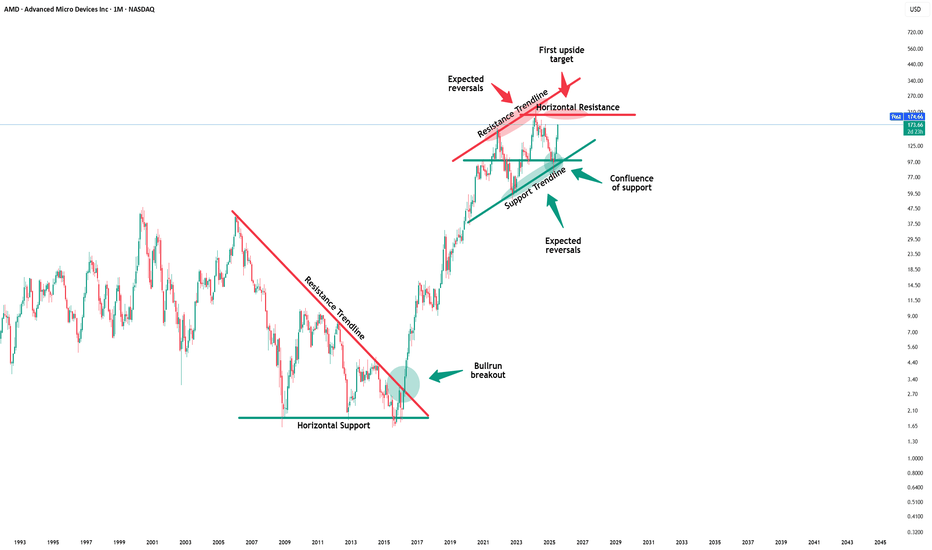

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish mo

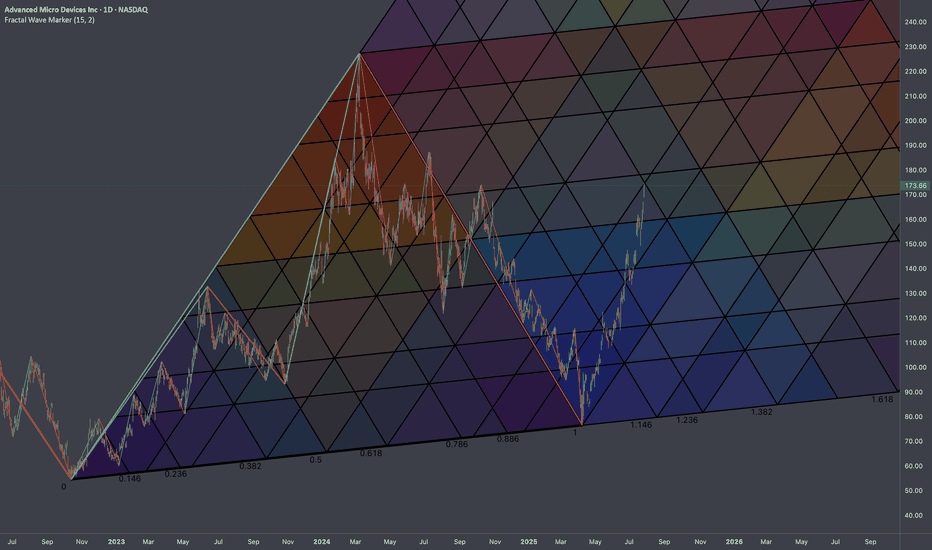

AMD Projection and Entry PointThis is speculation just like before, which played out very well so this is me having another shot at it.

Going off of the prior cycle AMD went through and comparing it to the one it's currently in, you can see a lot of similarities.

Learning from it's past and seeing how it likes to react to c

AMD Is Up 100%+ Since April. Here's What Its Chart SaysAdvanced Micro Devices NASDAQ:AMD has been on a roll recently, rising more than 100% in less than four months after losing nearly 60% of its value between a February 2024 intraday peak and an April 2025 session low. What does technical and fundamental analysis say as the chip giant prepares to rep

“AMD Breaks Out — Triangle Setup in Action”

📈 Trade Snapshot:

AMD breaks a tight triangle range with momentum. A clean move above $180.82 puts $182.48 in sight.

🎯 Plan:

→ Entry: $179.53

→ SL: ~$173.00

→ Target: $182.48

📌 Clear structure, low-risk entry, breakout confirmed. Let it run.

📋 Hashtags:

#AMD #BreakoutTrade #ChartSetup #Technica

AMD WEEKLY TRADE SIGNAL (7/31/25)

### 🚀 AMD WEEKLY TRADE SIGNAL (7/31/25)

📈 **MARKET SNAPSHOT**

🟢 Daily RSI: **86.0** 🔥

🟢 Weekly RSI: **80.4**

📊 Volume: 🔺 1.5x (Institutional surge)

💬 Call/Put Ratio: **1.90**

🌪 Gamma Risk: **HIGH (1DTE)**

🧠 Sentiment: **Extremely Bullish** across all models

---

💥 **TRADE IDEA**

📍 Ticker: **\ NAS

Quick draw upI did quick and simple T/A and in my opinion seems to be the likely outcome. EMA lines are about to cross, it has made a lower low, which has now flipped the Fibonacci and likely to get rejected at the 61.80% - 50% range. The path lines aren't placed specific to the timeframes so ignore that it stre

AMD Don't Miss Out

### 🚀 \ NASDAQ:AMD Bullish Reversal Play — Weekly Options Setup

**🔥 Institutional Flow + RSI Momentum + Volume Surge = Opportunity**

---

📊 **Model Consensus Summary (Grok, Claude, Gemini, Llama, DeepSeek):**

* **🟢 Weekly RSI:** Climbing ⬆️ — confirms trend

* **🔴 Daily RSI:** Slight dip = cauti

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

5.81%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.43%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

3.99%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

3.96%

Maturity date

Sep 24, 2026

See all AMDD bonds

Curated watchlists where AMDD is featured.