AMZN trade ideas

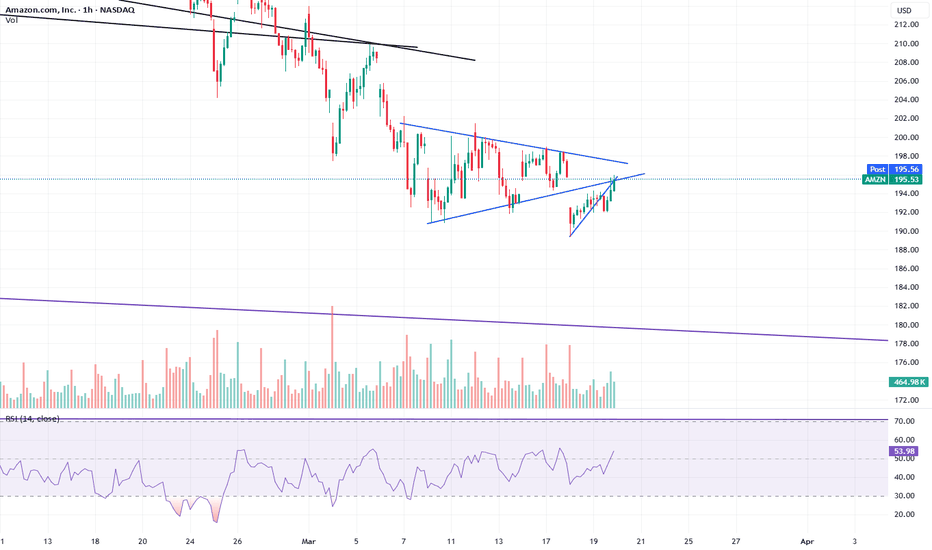

AMZN Testing Breakout Zone – Will Bulls Hold the Momentum?Technical Analysis & Options Outlook

📌 Current Price: $196.05

📌 Trend: Bullish Momentum with Key Resistance Ahead

📌 Timeframe: 1-Hour

Price Action & Market Structure

1. Bullish Reversal Confirmed – AMZN rebounded from the $190 PUT Wall, forming a higher low.

2. Breakout Attempt in Progress – Price is testing the trendline resistance, a key breakout zone.

3. Retest Possible – If rejected at $198–$200, AMZN may pull back to $195–$192 before continuing higher.

4. MACD & Stoch RSI – Both indicate strong bullish momentum, but Stoch RSI is nearing overbought territory, signaling possible short-term consolidation.

Key Levels to Watch

📍 Immediate Resistance:

🔹 $198 – Trendline Breakout Level

🔹 $200 – Major CALL Resistance (70.86%)

🔹 $202.50 – Strong CALL Wall & Potential Profit-Taking Zone

📍 Immediate Support:

🔻 $195 – Breakout Retest Zone

🔻 $190 – Highest Negative NETGEX / PUT Support

🔻 $185 – Deeper Liquidity Zone for Buyers

Options Flow & GEX Sentiment

* IVR: 40.7 (Moderate Volatility)

* IVx: 36.1 (-2.26%) (Declining Volatility)

* GEX (Gamma Exposure): Bullish Sentiment Improving

* CALL Walls: $200 & $202.50 (Upside targets)

* PUT Walls: $190 & $185 (Major support zones)

📌 Options Insight:

* Above $198, expect a gamma-driven move toward $200–$202.50 if momentum sustains.

* Below $195, risk increases for a test of $190, which has been a strong demand zone.

My Thoughts & Trade Recommendation

🚀 Bullish Case: If AMZN holds above $195, expect continuation to $200–$202.50.

⚠️ Bearish Case: If AMZN fails at $198, expect a retest of $190–$185 before another move higher.

Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Break and hold above $198

🔹 Target: $200–$202.50

🔹 Stop Loss: Below $195

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $198

🔻 Target: $190 PUT Wall

🔻 Stop Loss: Above $200

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

Final Thoughts

AMZN is in a critical breakout zone at $198. A strong move above this level could trigger a rally toward $200–$202.50, while failure to break could lead to a pullback toward $190 before attempting another move up. Watch price action carefully and wait for confirmation before entering a trade.

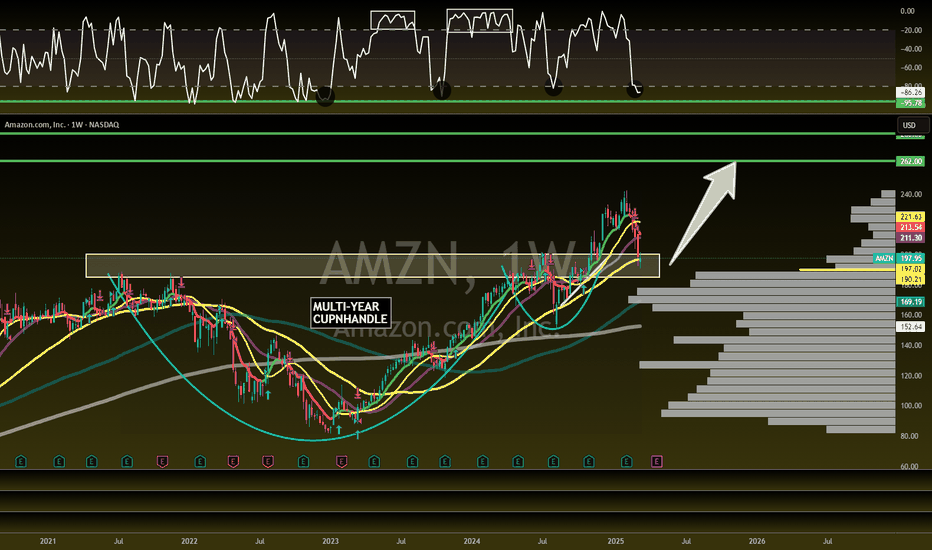

Amazon Back to 2021 Highs – A 1/6 Risk-Reward SetupYes, Amazon doesn’t look great here—but let’s put it in perspective.

Imagine holding the stock from this exact price in 2021, watching it trade 20% higher in February 2025—would you sell here?

For now, I’m watching $189—if it can’t break below, the risk reward is even better.

📌 Stop: 5 points from here

🎯 Target: $230

Let’s see if the 189 level holds. 🚀

AmznHeaded back to 180 price action and trendline support but first a push back to 208-210 (20ma) + theres a gap to close from March 5th

I don't think price makes it back over 210 before it take a turn down to 180 BUT if price can close above 211, then we are headed here

215 price action + the weekly 20ma at 217 .. that my extreme long target that will only come if Spy pushes back up to 580-585..

But we are headed back to 180 and this is perfectly normal!

The very bearish scenario is if Amzn breaks 180.. then 140 comes

So let's talk about trading this

Daily 200ma is at 199.. price action resistance is at 200.00

Long over 201.00

Target - 208-210

Stop loss below 197.00 weekly 50ma

Short only if price breaks back under 195

Target 191

Stop loss

197.50

197-199 is chop... No trade zone

AMAZON SWING LONG FROM SUPPORT|LONG|

✅AMAZON fell again to retest the support of 190.79$

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMZN Sitting at a Make-or-Break Level! Watch This Closely. Mar17Hey team! Quick AMZN update based on the 4-hour chart setup.

📈 Technical Analysis (TA):

* AMZN is flirting with the top trendline of a descending wedge pattern—could hint at a bullish breakout.

* Crucial resistance zone immediately overhead between $198–$202; breaking this zone could ignite upward momentum.

* Recent BOS (Break of Structure) at $190.85 highlights strong support—this is a key area for bulls.

* Keep an eye on the supply zone around $202.38 if the breakout continues.

📊 GEX & Options Insights:

* Highest positive NET GEX and call resistance at $210; major gamma wall that could act as a price magnet if AMZN breaks higher.

* Strongest PUT support at $190.85; crucial floor level for price.

* IV Rank at 49.6%, indicating moderate volatility and premium—consider debit spreads or strategic premium selling.

* CALL ratio at just 4% signals heavily bearish sentiment in options, implying caution on bullish trades.

💡 Trade Recommendations:

* Bullish Play: A solid break and hold above $202 could set up a bullish run targeting the $210 gamma wall. Stops just below $197.

* Bearish Play: If AMZN rejects firmly at $202, puts targeting a move back down towards $190.85 could offer a solid risk-reward.

* Neutral traders: Iron Condors or credit spreads between clear ranges ($190–$210) could be attractive.

🛑 Risk Management: Stay tight on risk management, especially in a tricky range-bound scenario like this.

Trade smart, everyone!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

AMZN Trade PlanLooking to buy AMZN at market price, with additional entries at 187 and 179 for better positioning.

🎯 Profit Target: 210 - 215

Stay disciplined, manage risk, and let the trade develop! 📈📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and trade responsibly! 💡

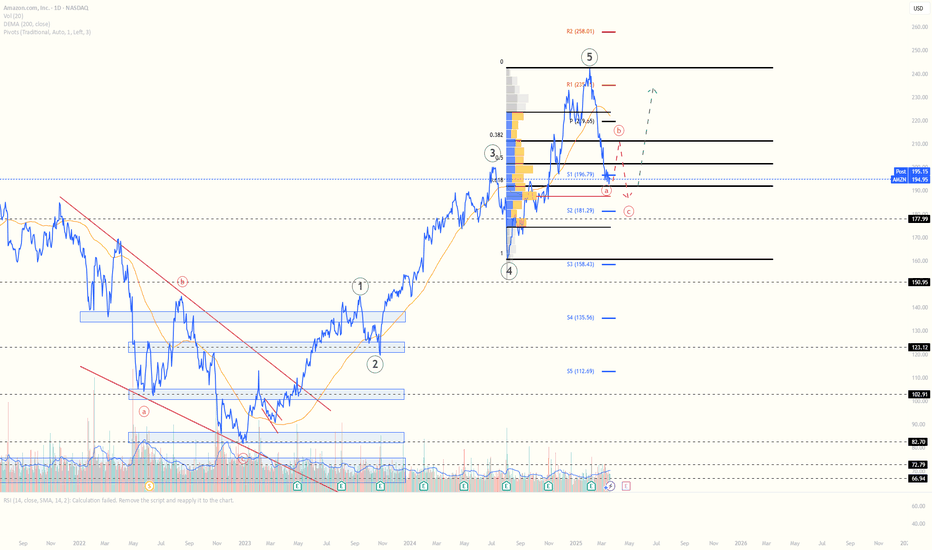

AMAZON Stock Chart Fibonacci Analysis 031125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 190/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Amazon (AMZN) in a Reversal Zone! Key Levels to Watch!📉 Price Action & Market Structure

AMZN has been in a downtrend, forming lower highs and lower lows within a descending wedge pattern. However, recent price action indicates a reversal zone, suggesting potential relief or a breakout attempt.

📊 Key Levels

* Support: $190 - $185 (Put Support & Demand Zone)

* Resistance: $200 - $212 (Call Wall & Gamma Resistance)

* Breakout Level: $220 (Major Resistance & Positive GEX Zone)

🟢 Bullish Scenario

* A breakout above $200 may push AMZN towards $209-$212, aligning with the highest call wall.

* If momentum sustains, a move toward $220 is possible.

🔴 Bearish Scenario

* Failure to hold $190 could lead to retesting $185 - $180, aligning with the negative GEX zone and put support.

* If broader weakness continues, downside targets extend toward $175 or lower.

📈 Indicators & Momentum

* MACD: Turning bullish, but needs confirmation.

* Stoch RSI: Near overbought, suggesting a pullback or sideways action before continuation.

* GEX Data: Call dominance above $200, strong Put Support at $185, showing market positioning dynamics.

📢 Trade Plan & Summary

* Bullish Above: $200

* Bearish Below: $190

* Scalping/Swing Levels:

* Buy dips near $190, targeting $200+

* Short below $190, targeting $185-$180

⚠️ Disclaimer: This analysis is for educational purposes only. Trade at your own risk.

"E-Commerce Titan on the Rise!!Amazon.com Inc. (AMZN) is exhibiting strong bullish momentum, with a notable gap forming around the $196 level. A breakout above the $216.20 resistance would confirm further strength, positioning the stock to target the $233.00 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $188.65 to manage downside risk.

Analyst sentiment remains positive, with TD Cowen analyst John Blackledge raising his price target for Amazon to $265, citing factors such as fast delivery speeds driving market-share gains and anticipated growth in Amazon Web Services (AWS) revenue due to enterprise workload migration and generative AI offerings.

Furthermore, Evercore ISI analysts have highlighted Amazon as a top large-cap stock pick for the internet sector heading into 2025, supported by cloud business revenue growth and rising e-commerce margins.

This combination of technical momentum and strong fundamentals supports a bullish push toward $233.00, making AMZN an attractive opportunity for traders and investors alike.

NASDAQ:AMZN

AMZN FOR BUYAnalyst consensus remains highly favorable for Amazon:

Strong Buy Recommendations: Of 44 analysts, 24 rate the stock as a "Strong Buy," and 19 as "Buy," reflecting strong confidence in Amazon's future performance.

STOCK ANALYSIS

Price Targets: The average 12-month price target is approximately $260.65, suggesting a potential upside of about 34%.

MARKETBEAT.COM

Several factors contribute to this positive outlook:

E-commerce Dominance: Amazon continues to lead in the e-commerce sector, benefiting from its vast logistics network and customer base.

Cloud Computing Growth: Amazon Web Services (AWS) remains a significant revenue driver, with expectations of continued growth due to increasing demand for cloud solutions.

AI Investments: Amazon's substantial investments in artificial intelligence and infrastructure are anticipated to enhance its service offerings and operational efficiency.

BARRONS.COM

However, potential investors should consider certain risks:

Competitive Landscape: Amazon faces competition from other major retailers and cloud service providers, which could impact market share.

INVESTOPEDIA.COM

Profit Margins: Ongoing investments in infrastructure and technology may pressure profit margins in the short term.

INVESTOPEDIA.COM

Market Volatility: As with any stock, Amazon's share price is subject to market fluctuations and broader economic conditions.

In summary, while Amazon's current stock price and analyst projections suggest potential for growth, it's essential to weigh these prospects against the inherent risks and align any investment decisions with your individual financial goals and risk tolerance.

AMZN butterfly & $192.The stock trend of Amazon (AMZN) in 2024 showed significant upward movement, with the price reaching a peak of $230 and a low of $145 during the year, driven by strong market performance and investor confidence.

However, In 2025 based on technical analysis, the formation of a Butterfly harmonic pattern suggests a highly probable correction toward the $190 level .

This pattern, often appearing after an extended bullish trend, indicates a potential reversal. Given the current market dynamics, the likelihood of such a drop is considerable.

Investors should closely monitor key support levels and prepare for possible downside risks while making informed decisions.

SEYED.

AMAZON Is it worth buying now?Amazon (AMZN) broke below its 1W MA50 (blue trend-line) last week for the first time since the week of August 05 2024 and opened this week below it. As you can see, the stock has been trading within a 2-year Channel Up and today's candle is as close to a technical Higher Low (bottom) as it can get.

The previous Higher Low was in fact that Aug 05 2024 candle, which despite breaking below the 1W MA50, managed to post a strong intra-week recovery and close above the it. Technically that was the 'Max pain' situation on every 1W bottom candle in those 2 years.

Every Bullish Leg that followed was around +65.24%, so that gives us an end-of-year technical Target of $300.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AMAZON at important support. Positive days coming?AMZN looking at good support. We can see positive days if it works.

Many cryptocurrency dominance charts, as well as Nasdaq and other stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli