Boeing to $300 - Falling wedge** The year ahead **

On the above 6 day chart price action has corrected over 50% since December 2023. A number of reasons now favour a long position, they include:

1. Price action and RSI resistance breakouts.

2. Support on past resistance.

3. Double bottom on price action (yellow arrows)

4. Falling wedge breakout confirmation with forecast to $300 area

5. The Majority of other traders are bearish. Remember, trading has a high fail rate.

www.tradingview.com

Is it possible price continues to correct as others suggest? For sure.

Is it probable? No.

Ww

Type: Trade

Risk: <= 6% of Aerospace & Defence

Return: 60% from current levels

Stop loss: Will say elsewhere

BAD trade ideas

Long Opportunity: Boeing Could Take Flight Next WeekCurrent Price: $226.84

Direction: LONG

Targets:

- T1 = $233.00

- T2 = $238.00

Stop Levels:

- S1 = $223.00

- S2 = $218.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Boeing.

**Key Insights:**

Boeing continues to be a key player in the aerospace industry. Strong demand in its commercial airplane segments, coupled with resilient defense contracts, provides the company with stability. The ongoing recovery in airline travel globally adds further momentum to growth, presenting opportunities to capitalize on this positive outlook. Boeing's concerted efforts to address operational inefficiencies and ramp up production capacity also add value, particularly as the company pivots to meet increasing demand in the commercial aviation industry.

The aerospace giant has also benefited from favorable regulatory measures and accelerated demand recovery in Asia and Europe, key regions for international travel plays. Boeing's focus on ramping up production of the 737 MAX series while maintaining strong growth in its aftermarket services positions it for sustained revenue gains.

**Recent Performance:**

Boeing has demonstrated steady upward movement over recent sessions while largely consolidating within a tight technical range. Volumes have remained consistent, signaling sustained investor confidence despite broader market uncertainties. The current price action shows a favorable risk-to-reward setup approaching key resistance levels.

**Expert Analysis:**

Market sentiment remains optimistic due to strong tailwinds in the commercial aviation sector. Analysts point to Boeing's better-than-expected execution on fulfilling delayed orders, particularly for the 737 MAX. Despite concerns over persistent supply chain disruptions, experts note that Boeing's strategic partnerships and operational agility mitigate the long-term risks. Investors are encouraged by the company's forward guidance, although higher material costs remain a watch point for margins.

Technically, Boeing is testing critical resistance at $230. Analysts view a break of this region as a trigger for additional gains, leading to breakout opportunities toward the $240 level.

**News Impact:**

Boeing recently increased its production targets for 2024 and announced strategic moves to expand global service offerings. Positive sentiment surrounding favorable regulatory measures, coupled with improving demand for replacement planes and international travel, has boosted outlooks. Continued commitments from airline giants to upgrade fleets support robust future order flow.

**Trading Recommendation:**

A long position in Boeing at the current price of $226.84 targets a movement to $233.00 (T1) and $238.00 (T2). Stops should be placed at $223.00 (S1) and $218.00 (S2) to limit downside risks. This trade benefits from near-term positive catalysts, including volume consistency, strong market sentiment, and supportive global travel demand recovery.

BA heads up into $230: Strong fib zone might cause a serious dipBA has been flying (lol) from its last crash caused crash.

About to test a signrificant resistance at $229.82-230.73

Expect at least some "orbits" or a pullback from this zone.

.

Previous analysis that caught THE BOTTOM:

==================================================

.

Quantum's BA Weekly Outlook 7/19/25🚀 G.O.D. Flow Certified Trade Blueprint – Boeing (BA)

1. 🧩 Summary Overview

Ticker: BA

Current Price: $229.34

Trade Type: Day Trade / 0–2 Day Swing

System: G.O.D. Flow (Gamma, Orderflow, Dealer Positioning)

2. 🔬 Flow Breakdown

🔵 GEX (Gamma Exposure):

Highest negative GEX at $230 = possible resistance or sticky zone.

However, +GEX2 at $235 and +GEX3 at $240 outweigh $230 → suggests dealer hedging will push price upward through gamma bands.

🟡 DEX (Delta Exposure):

+DEX peaks at $230 then fades toward $240 and reappears at $250 → bullish flow decay confirms momentum needs volume through $235–240 to continue upward push.

🟣 Vanna:

Flip zone at $232.50 → if IV rises and price pushes upward, dealers must buy, adding tailwind.

Major positive clusters at $240 & $250 = major squeeze potential if IV increases intraday.

🔴 Charm:

Flip zone at $227.50 = above this level, morning decay benefits bulls.

Negative charm at $240 & $250 = expect afternoon fade into these zones — ideal trim targets.

⚪ Volatility:

Volatility decreasing weekly = less explosive risk, more structured/predictable flow.

Dealers will likely have cleaner hedging paths without IV shocks.

🟢 Open Interest:

Stacked calls at $230, $235, $240, $250.

Aligns with GEX/Vanna targets → confirms upside skew.

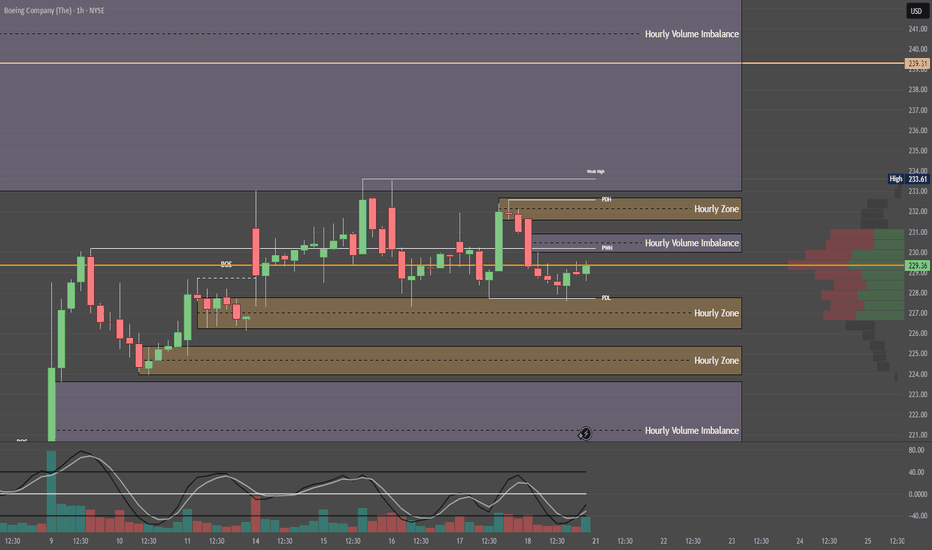

3. 🧭 Chart Structure Setup

Daily: Consolidation breakout attempt.

Hourly: Bounce off support with bullish stochastics crossover.

10M OR: Mark OR High/Low — use reclaim of OR High + VWAP as entry signal.

Resistance: $235–240 (flow + OI + chart confluence) = ideal trim zone.

4. 🎯 Trade Plan

Bias: Bullish

Trigger Entry: Break and reclaim of $232.50 (Vanna Flip)

Contract Suggestion:

235c or 240c, 0–2 DTE (Friday expiry if early week)

Stop-Loss:

VWAP loss or break below $230

Target Zones:

🎯 T1: $235 (GEX2 + OI cluster)

🎯 T2: $240 (GEX3 + Vanna/Charm confluence)

5. 🔁 Intraday Adjustment Triggers

If This Happens: Then Do This:

GEX flips positive above $232.50 Strengthen conviction

Vanna clusters weaken + IV drops Trim / De-risk

Charm flips heavily negative by 12pm Expect fade into highs

Large sweeps hit 235c/240c strikes Ride momentum with size confidence

BOEING COMPANY STOCK ENTER INTO BULLISH TREND Boeing Company Stock Enters Bullish Trend on 1-Day Time Frame

The Boeing Company (BA) stock has entered a bullish trend on the 1-day timeframe, signaling potential upward momentum. A key development in this trend is the recent breakout above the critical resistance level of $189.00, which now acts as a support zone. This breakout suggests strong buying interest and indicates that the stock may continue its upward trajectory in the near term.

Bullish Outlook and Price Targets

With the resistance level breached, Boeing's stock is expected to maintain its bullish momentum. The next major target on the upside is $265.00, which could be tested if the bullish trend sustains. This level represents a significant psychological and technical resistance point, and a successful breakout above it could lead to further gains.

Key Support Level to Watch

While the bullish scenario appears strong, traders should remain cautious of potential pullbacks. The $130.00 level serves as a crucial support zone. If the price retraces, this level will be critical in determining whether the bullish trend remains intact or if a deeper correction could occur. A break below $130.00 may signal a shift in market sentiment, but as long as the price stays above this level, the overall bullish structure remains valid.

Conclusion

Boeing’s stock has shown strength by breaking above $189.00, reinforcing a bullish outlook. Traders and investors should monitor the price action around this level for confirmation of continued upward movement. The primary target remains $265.00, while $130.00 serves as a key support in case of a downside move. If the momentum holds, Boeing’s stock could see further gains in the coming sessions.

Boeing: Potential Pullback Ahead, But Long-Term Growth IntactCurrent Price: $215.92

Direction: LONG

Targets:

- T1 = $222.00

- T2 = $227.00

Stop Levels:

- S1 = $209.00

- S2 = $193.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Boeing.

**Key Insights:**

Boeing is riding bullish momentum within the industrials sector, buoyed by global aerospace recovery post-pandemic. While the company’s fundamentals are strong, technical indicators suggest near-term overbought conditions, potentially signaling a pullback. Geopolitical risks, including trade tensions, may create volatility, but the recent U.S.-Vietnam trade deal could open new markets and drive future growth.

Investors should monitor resistance levels between $222 and $227 carefully, as breaking above these points could indicate further upside potential. Continued demand for defense aircraft and increasing global airline orders bolster Boeing’s medium to long-term prospects, making it a compelling equity in its sector.

**Recent Performance:**

Recent price movements indicate robust upside momentum in Boeing, fueled by sector-wide strength in industrials and rising demand for aerospace products. RSI and MACD have moved into cautionary territory, suggesting near-term consolidation or retracement. However, supportive factors like industrial recovery and increased government procurement have kept Boeing trending upward. The company’s stock remains closely tied to macroeconomic recovery themes, such as higher consumer airline bookings and renewed defense contracts.

**Expert Analysis:**

While overbought signals are emerging, experts widely agree on the bullish potential of Boeing’s stock in a medium to long-term timeframe. Resistance levels near $222 and $227 are critical—as they represent key inflection points for market sentiment. At the same time, some analysts have flagged short-term risks around geopolitical tensions affecting aerospace trade. A break above $227 could lead to further buying pressure, while staying above $209 ensures robust downside support.

**News Impact:**

The recent U.S.-Vietnam trade deal aligns Boeing with strategic expansion in Southeast Asia, potentially unlocking new long-term growth avenues. Despite broader geopolitical trade risks, analysts believe Boeing could leverage these relationships to drive international aerospace orders. Additionally, the industrial recovery and stronger-than-anticipated defense procurements have underscored positive near-term sentiment, providing substantial tailwinds. Investors are advised to consider this while navigating short-term fluctuations and long-term opportunities.

**Trading Recommendation:**

Given Boeing’s current trajectory and resistance levels, traders should consider taking LONG positions while monitoring stop-loss levels ($209 and $193) to manage downside risks. Breaking resistance near $222 and $227 would confirm bullish continuation. With strong fundamentals, promising international expansion opportunities, and sector-wide momentum, Boeing remains an attractive trade for medium to long-term gains. Risk management is paramount given near-term volatility concerns, but the overall outlook remains positive for growth-oriented investors.

Boeing - Eyeing a recovery soon?NYSE:BA is back to the upside and has been trending upwards since early April 2025. Price action saw the stock is back into action after filling up the bearish breakaway gap. Now it is waiting to break the key resistance above 220.00 to further confirmed the upside.

Meanwhile, Ichimoku is showing uptrend intact, just short of a three bullish golden cross. As conversion and base line is flat and leading span -A just turned flat.

Long-term MACD is rising steadily, indicating the long-term bullish momentum is sustaining well.

Stochastic saw overbought crossover but chart is showing weak correction and selling pressure was almost non-existent.

23-period ROC dips but remain positive.

Directional movement index confirms the bullish strength is still intact.

As short-term momentum and volume shows decline, there is a risk of correction hence we prefer a buy stop above 220 OR a pullback to nearest support at 189.54.

Weekly chart shows 5-wave symmetrical triangle and we expect prices to continue to have a strong bullish continuation over the longer-term period. EMA analysis shows trend is back to the upside and 14-period RSI shows steady uptrend momentum.

BOEING STOCK PRICE CONTINUING IN BULLISH TREND BOEING STOCK PRICE CONTINUING IN BULLISH TREND.

Stock is currently trading in bullish trend in 1 hour time frame.

Forming higher highs and higher lows.

Secondary trend is expected to end.

Bullish engulfing candles shows the strength of buyers in the market.

Price is expected to remain bullish for upcoming sessions.

On higher side market may hit the target price of 216$

On lower side, market may test the support level of 204$

Short-term BA Short - Gap Fill OpportunityHey y’all —

Sharing this idea a bit late, but I believe there’s still more downside to capture.

Last Friday’s massive pump on BA closed the gap on the daily timeframe. Based on the current structure, the chart suggests a likely move to close the lower gap as well. I entered around the checkered flag area last week, targeting the gap fill zone between $202–204. Given the price action, there's a high probability of a further dip to fully retrace the recent move up.

Near-term take profit target: $202–204

If that range breaks: $187–183

I’m currently holding put options with a September expiration.

Thanks for checking it out!

Boeing Company (The) (BA) Powers Global AviationBoeing Company (The) (BA) is a global aerospace leader, manufacturing commercial airplanes, defense systems, and space technology. With iconic aircraft like the 737 and major contracts with governments worldwide, Boeing plays a key role in global aviation and security. The company’s growth is driven by rising air travel demand, defense spending, and long-term investments in space exploration and next-gen aircraft.

On the chart, a confirmation bar with increasing volume shows strong buying interest. The price has entered the momentum zone by moving above the .236 Fibonacci level. A trailing stop can be placed just below that level using the Fibonacci snap tool to help manage risk while staying positioned for upside.

Boeing Stock: Is A Short-Term Rally Still In Flight?- Current Price: $214.55

- Key Insights: Boeing exhibits bullish technical momentum but risks of short-

term pullback are increasing due to overbought conditions. Support levels

around $207-$210 and resistance at $222-$225 are key. Geopolitical tailwinds

and long-term aviation demand bolster its outlook despite margin pressures

from inflation.

- Price Targets:

- Next week targets: T1 = $220, T2 = $224

- Stop levels: S1 = $210, S2 = $207

- Recent Performance: Boeing has been riding the tailwinds of broader market

positivity, benefiting from ongoing rallies in industrial and defense

stocks. However, diminishing volume during upward price moves signals

momentum risks.

- Expert Analysis: Analysts highlight Boeing's strategic importance in

commercial and defense aviation, growing demand for aerospace products, and

its resilience in an inflationary environment through a strong order

backlog. Nevertheless, technical indicators flag overbought scenarios that

could trigger consolidation or corrective price dips.

- News Impact: Progress in U.S.-China trade relations offers renewed hopes for

aircraft sales, while heightened defense spending aligns with Boeing’s

growth focus. Inflation risks, though notable, are tempered by Boeing’s

robust operational pipeline and geopolitical importance in aerospace supply

chains.

BA, Boeing1. Higher Timeframe Context

Price is currently trading within a well-defined higher timeframe supply zone between 214–218, which previously acted as a major distribution area. This zone aligns with a prior bearish impulse leg and represents unmitigated institutional sell-side interest.

2. Current Price Action

On the 15-minute chart, price has aggressively rallied into the supply zone with low retracement, suggesting an imbalance created by passive sellers.

The move into this zone has occurred without a clear internal structure shift to the downside yet, but early signs of exhaustion are evident.

There's a visible cluster of equal highs around 218, indicating resting buy-side liquidity that smart money may target.

3. Liquidity & Market Structure Outlook

We anticipate a liquidity sweep of the highs at ~218, which is typical when price revisits a premium zone filled with uncollected orders.

The projection is for a short-term rejection or distribution reaction from current levels, which could lead to a retracement into the newly formed demand zone at 208–210.

This area represents a bullish order block, which could act as a reaccumulating point before a continuation to the upside.

4. Trade Planning Framework

Short Bias (Reactive Play):

Look for signs of lower timeframe distribution, such as a break of internal structure or supply engulfing at 214+.

Potential target: 208–210 zone for partials or full exit.

Long Bias (Continuation Play):

Upon reaction from 203–205demand, anticipate bullish PA such as a CHOCH (Change of Character) or BOS (Break of Structure) on LTF.

Entry on confirmation (e.g., bullish engulfing or mitigation entry).

Target: 218+ liquidity sweep zone.

5. Risk Management Considerations

Avoid blind entries within the resistance zone; confirmation is key.

Size positions based on RR parameters (minimum 1:2) and predefine invalidation levels—especially in the short scenario, as failure to reject this zone could lead to a breakout.

Be aware of potential news catalysts or macro events that may add volatility to BA during the setup period.

Boeing (BA, 1W) Falling Wedge + H-Projection TargetOn the weekly chart, Boeing has formed a classic falling wedge — a bullish reversal pattern that typically signals the end of a correction phase. After a sharp decline from $267.97 to $138, price action began to compress within a wedge, forming lower highs and higher lows on declining volume — a textbook setup for a breakout.

The structure remains active: a confirmed breakout above the upper wedge boundary, with a retest near $181.60 (0.618 Fibonacci retracement), would validate the pattern and trigger the next upward phase.

The projected move (H) equals the height of the previous impulse — $130.02. Adding this to the base of the wedge (~$138) yields a technical target of $268.00, aligning with the previous high and completing the structural recovery.

Technical summary:

– Multiple confirmations of wedge support

– Volume declining into the apex (bullish)

– Entry zone: breakout + retest at $181.60

– Mid-level resistance: $198.09 (0.5 Fibo)

– Final target: $267.97–$268.00 (H-projection complete)

Fundamentals:

Despite operational setbacks, Boeing remains structurally positioned for recovery as demand for commercial aircraft rebounds. Additional support could come from improving supply chains, increased defense contracts, and a more dovish outlook from the Federal Reserve heading into 2025.

A breakout above $181.60 and sustained momentum would confirm the falling wedge pattern and activate the H-measured move toward $268. This is a structurally and fundamentally supported mid-term recovery setup

Boeing: Long Trade Potential Amid Defense MomentumCurrent Price: $200.32

Direction: LONG

Targets:

- T1 = $206.00

- T2 = $209.00

Stop Levels:

- S1 = $198.00

- S2 = $195.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts. Combining multiple viewpoints reduces cognitive biases and highlights consensus opportunities in Boeing.

**Key Insights:**

Boeing’s defense segment has been a stabilizing force amid geopolitical tensions that drive demand for military equipment and services. The commercial aviation sector, while showing signs of recovery, is facing challenges from global economic uncertainty and high energy costs. Traders are pinpointing technical levels where Boeing demonstrates relative strength, with support zones providing solid entry points for a continuation of the bullish trend.

Fundamentally, Boeing has established itself as a critical player in both national and international defense supply chains. This geopolitical tailwind, coupled with its reopening strategy for commercial aviation, provides balanced growth potential despite macroeconomic risks. Seasonal volatility may influence short-term price action, but the stock remains attractive based on overall sentiment.

**Recent Performance:**

Over recent weeks, Boeing’s stock has gained ground, moving consistently higher. Investors have primarily focused on the increasing government contracts for defense products, which are offsetting slow growth in the commercial sector. The stock has rallied off the $190 key support level and has positioned itself closer to its 200-day moving average — a critical level for bullish confirmation.

**Expert Analysis:**

Analysts emphasize that geopolitical developments, such as heightened global tensions and increased defense spending, position Boeing’s defense division favorably for new contracts and incremental revenue. On the technical front, the stock has shown resilience near key support levels, and recent bullish candles indicate strong buying pressure. However, energy price volatility and inflationary pressures may challenge operational margins, making efficient cost management a priority in the coming quarters.

While the defense division provides immediate upside through sustained government contracts, the commercial aviation segment is expected to take longer to recover fully. Potential catalysts, such as easing travel restrictions in key international markets, could hasten recovery and drive up demand for Boeing's large aircraft.

**News Impact:**

Recent news surrounding increased military budgets in the U.S. and allied nations underpins Boeing’s extended defense opportunities. The stock has reacted positively to these developments, especially as defense contracts reduce the company’s dependence on commercial aviation during uncertain economic times. Conversely, news about global inflation and energy price hikes may weigh on operating costs. These factors must be monitored as they could affect overall profit margins.

**Trading Recommendation:**

Boeing is well-positioned for upside due to stable defense revenues and improving sentiment in global travel recovery. Long positions are recommended for traders seeking exposure to industrial equities with balanced upside catalysts. Entering near support zones with tight stop-loss levels below $195 ensures limited risk, while targets at $206 and $209 provide a favorable reward-to-risk ratio. Boeing’s diversified offerings and critical market positioning make it a solid choice for bullish traders in the current environment.

[$BA] Boeing's black friday?NYSE:BA

Quick-Take

Unfortunately, an accident occured with a Boeing Dreamliner 787 in India.

This triggered a 'small crash' in the stock as well, due to Boeing's (ongoing) raising concerns for quality and safety.

However, we should see it as chance for a potential swing-trade of 7 days.

⭕ Risks

The analysis of the plane crash will take a couple of days and there are even rumors about an 'external factor' being the reason for the plane to fall from the sky.

Eitherway: Volatility is a two-edged sword that we should utilize to our advantage.

🟢 Pros

The Iran/Israel conflict is escalating, that led to a spike for a Defense companies such as $ NYSE:LMT XETR:RHM . But NYSE:BA takes also part of the military-industrial complex that should profit of the bad times in geopolitics.

📏 Position

We position ourselves bullish via options:

-> buy Call-Options (long-call or bull-call-spreads)

-> sell Put-Options (short-put (cc) or bull-put-spreads)

What do you guys think?

[$BA] Boeing's black friday?NYSE:BA

Quick-Take

Unfortunately, an accident occured with a Boeing Dreamliner 787 in India.

This triggered a 'small crash' in the stock as well, due to Boeing's (ongoing) raising concerns for quality and safety.

However, we should see it as chance for a potential swing-trade of 7 days.

⭕ Risks

The analysis of the plane crash will take a couple of days and there are even rumors about an 'external factor' being the reason for the plane to fall from the sky.

Eitherway: Volatility is a two-edged sword that we should utilize to our advantage.

🟢 Pros

The Iran/Israel conflict is escalating, that led to a spike for a Defense companies such as NYSE:LMT XETR:RHM . But also NYSE:BA is part of the military-industrial complex that should profit of the bad times in geopolitics.

📏 Position

We position ourselves bullish via options:

-> buy Call-Options (long-call or bull-call-spreads)

-> sell Put-Options (short-put (cc) or bull-put-spreads)

What do you guys think?

Yesterday was bad for BOEING CompanyYesterday was bad for BOEING Company.

This stock has been fighting to recover from the many challenges it has faced lately, and here comes the India news.

The stock (BA) experienced about 5% drop before its recovered a bit.

It is trading at about $203, but if it breaks the trendline on the chart and the $200 support zone, we might see it go downhill a little more.

I will be happy to buy using DCA strategy from $193 - $186 zone.

Trade with care.

Please, if it is helpful, follow me, like, comment and share

Boeing (BA): Watching for a Break Above 218.80NYSE:BA has a strong chance of breaking above the 218.80 level , with a potential move toward 221.98 .

I plan to enter 1 tick above 218.80, with a stop-loss based on the 5-minute ATR (period 10).

🔍 Technical Outlook:

BA is currently moving within an upward ABCD channel. The projected upside is capped by a strong resistance zone at 221.98 – a level derived from the daily chart and previous price action. The market may or may not react to it, but it’s a logical target within a solid risk-to-reward setup.

One aspect I particularly like about this setup is the market’s inability to close significantly below the previous pivot high at 215.80. This suggests underlying strength. If we see a confident move above resistance, the trade could be triggered with momentum.