BHP trade ideas

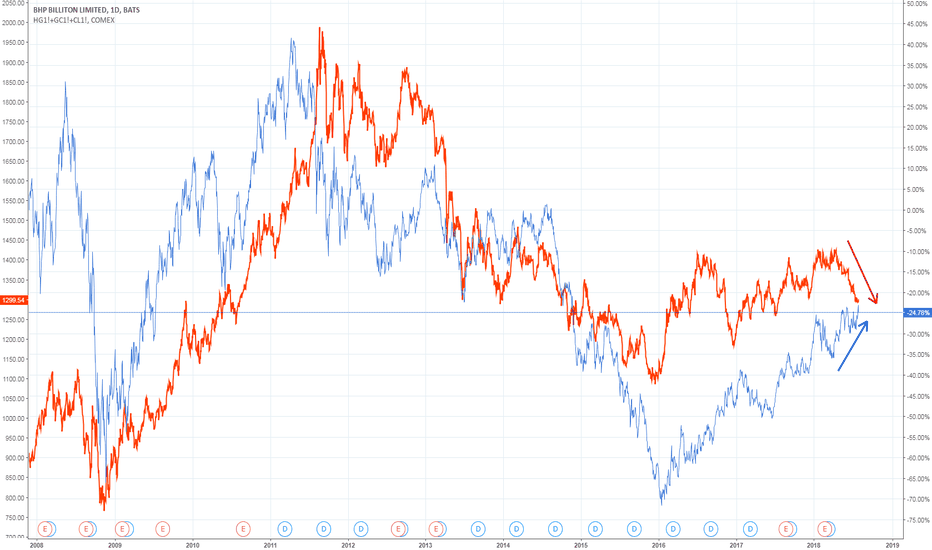

BHP BILLITON | Heading Towards 16.00 ???BHP for the last two years has been quite the bullish pick of the ASX , after it's bear run from late 2014 it was an obvious investment for the long haul trader.

-

Now into late 2018 , we can see that price is currently retesting structure at the range of DEC 201 3 and JUL 2014 . Currently ranging in the structure zone as displayed, accompanied by an RSI divergence, we have a strong reason to believe that price has completed its pullback and is headed on back down to the low of JAN 2016 .

-

A break and close over the trend-line would place us in an ideal position to short the stock.

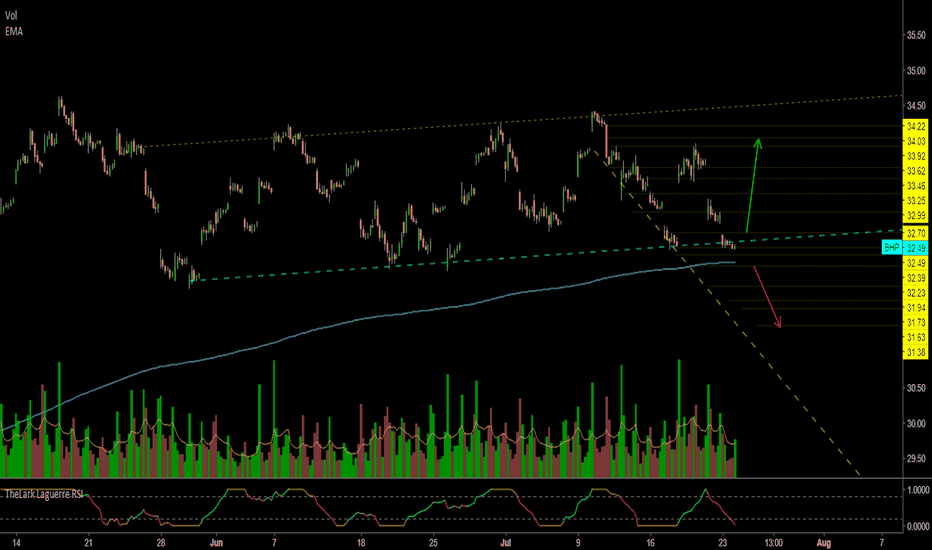

Renko Manual Back Test with BHPTesting basic Renko system.

Enter Long when:

- 2 green bricks (top of 2nd brick + 5% brick size)

- Top of 2nd brick is above 10EMA

Stop:

- bottom of 1st full brick under 10EMA -5% brick size

Exit:

- 2 red bricks (bottom of 2nd brick - 5% brick size)

- close under 10EMA

Enter Stop Exit R Profit R Mulitple

19.05 15.95 28.95 3.1 9.9 3.1935483871

27.05 24.95 35.95 2.1 8.9 4.2380952381

36.05 33.95 43.95 2.1 7.9 3.7619047619

37.05 33.95 45.95 3.1 8.9 2.8709677419

39.05 36.95 37.95 2.1 -1.1 -0.5238095238

38.05 35.95 35.95 2.1 -2.1 -1

28.05 25.95 25.95 2.1 -2.1 -1

28.05 25.95 27.95 2.1 -0.1 -0.0476190476

So far so good.