BKD trade ideas

$BK Buy The DipThe market is over-reacting to $BK earnings and the stock is down over 7%. We believe this is a buy the dip opportunity. There's also the inverse head and shoulders pattern.

Bank of New York Mellon (NYSE:BK): Q4 Non-GAAP EPS of $1.01 beats by $0.01; GAAP EPS of $1.52 beats by $0.01.

Revenue of $3.99B (-0.3% Y/Y) misses by $180M.

As always, trade with caution and use protective stops.

Good luck to all!

BK may be coming under pressureI have observed that BK buyers has been struggling to prop it up from the beginning of 2019 with BK down for the year amidst broad market strength. With BK staging a modest rally from the lows, it may now be facing some serious overhead resistance as it approaches the key psychological level of 50. BK may head back to 48 then to 45 should buyers fail to hold.

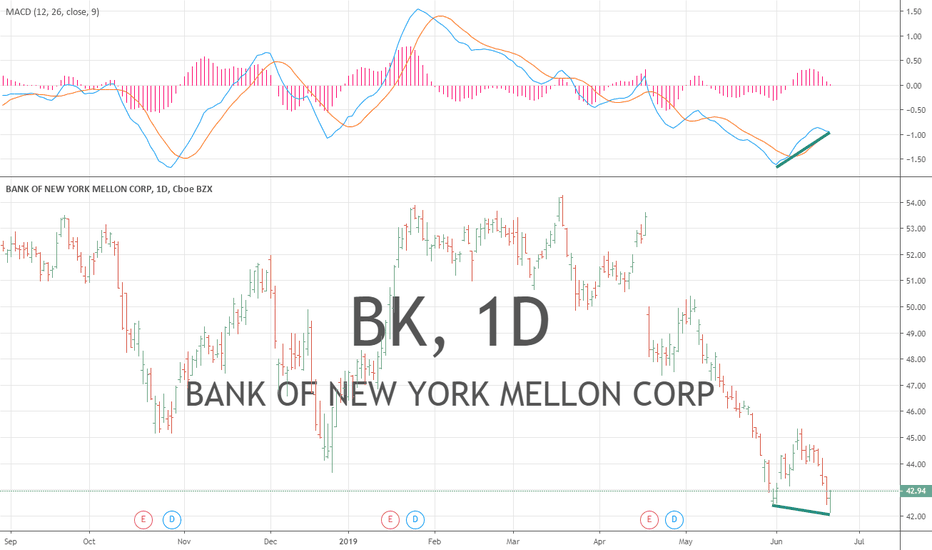

Long Bank of New York MellonOn a hourly basis, selling pressure accelarated and exceeded the regular sell of pace. Rather than technical analysis only, I also did my own fair value analysis for the stock, and at this point, there is a strong underlying value which may support the price at these levels. On given the price in june and today there is a formation of double bottom and given the resistance of the price to recent further downs, I believe an upwards break out or a moderate bounce back is very likely in the short term.

LONG Options Trading: BNK Mellon(BK) Buy Call $45.50 Exp: 7/19Understanding The trade:

As an options trader my goal is to identify trend change and utilize a breakout strategy to leverage profit off of major trend changes with minimal risk. Even though this contract does not expire till 7/19 I will be looking to take profit by early July as the rate of decay factor starts to come into play as the contract approaches expiry. This should correlate nicely with the Fib Retracement lvl.236. If you have any questions, please feel free to comment below and follow. Thank you and trade safe.

Reasons For Trade:

• Bounced off the May 31st low of 42~43 lvl

• Broken downward channel (1D chart Jan 17st -June 3rd)

• Broken RSI Channel

• RSI Overbought > 30

Trade Parameters:

• Broker: Robinhood

• Cost For Entry: Free

• Contracts: 2

• Entry Price: .44

• Risk: $88

• Reward: $88

• ROI: 100%

• Risk/Reward Ratio: 1:1