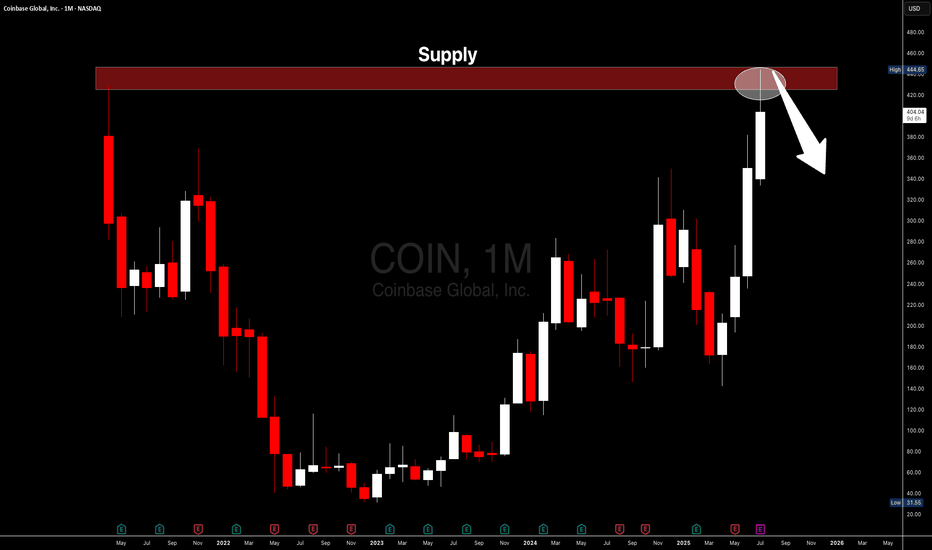

COINBASE I Strong Bearish Outlook (Take Action Now)Welcome back! Let me know your thoughts in the comments!

** COINBASE Analysis - Listen to video!

We recommend that you keep this stock on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Fol

Key facts today

Coinbase Global (COIN) shares experienced a decline of 15.2% after the company reported a decrease in Q2 adjusted profit, with the announcement made after market close on Thursday.

Coinbase Global bought 2,509 BTC in Q2 for about $222 million, increasing its total to 11,776 BTC worth $1.3 billion, now ranking among the top 10 public companies in bitcoin holdings.

Coinbase earned $332.5 million from Circle's $625 million interest income on USDC reserves, according to Mizuho Securities' analysis after Coinbase's Q2 earnings report.

0.35 USD

2.29 B USD

5.83 B USD

About Coinbase Global

Sector

Industry

CEO

Brian Armstrong

Website

Headquarters

New York

Founded

2012

ISIN

ARBCOM4603U2

FIGI

BBG01VVQT667

Coinbase Global, Inc. engages in the provision of a trusted platform that serves as a compliant on-ramp to the onchain economy and enables users to engage in a wide variety of activities with their crypto assets in both proprietary and third-party product experiences enabled by access to decentralized applications. It offers consumers primary financial account for the cryptoeconomy, institutions a full-service prime brokerage platform with access to deep pools of liquidity across the crypto marketplace, and developers a suite of products granting access to build onchain. The company was founded by Brian Armstrong and Fred Ernest Ehrsam in May 2012 and is headquartered in New York, NY.

Related stocks

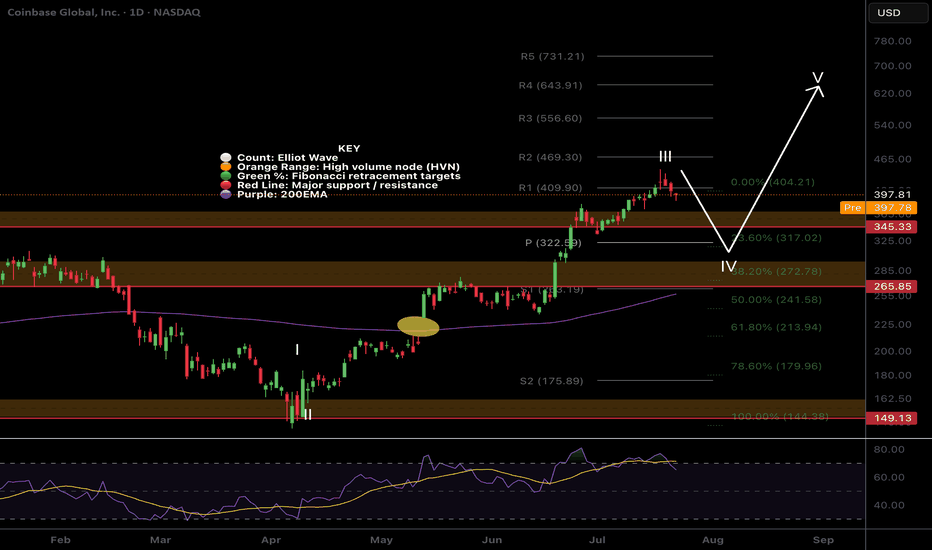

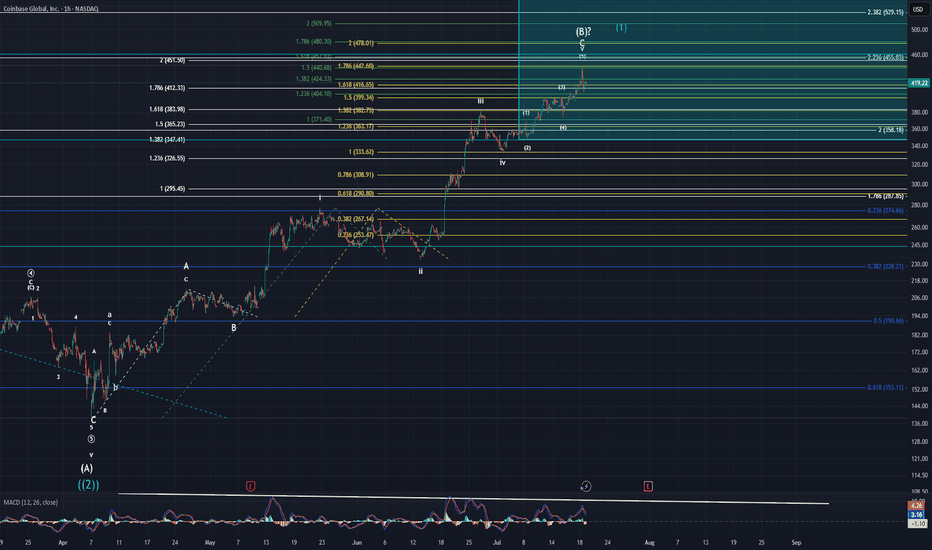

$COIN Wave 4 pullback?NASDAQ:COIN had a tremendous run, a text book Elliot wave 3 but has confirmed bearish divergence on the daily RSI.

The trend is strong so wave 4 could be shallow, only reaching the previous all time high, High Volume Node and 0.236 Fibonacci retracement and daily pivot point between $322-345

Furt

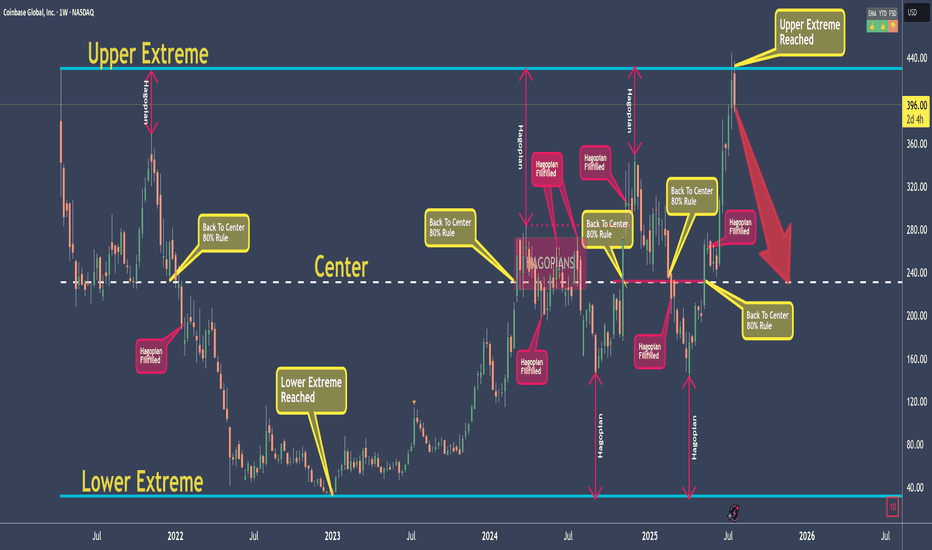

COINBASE - My rules say: Down with high probabilityI don't elaborate too much here, because I want to give you a chance to learn something!

As for the Trade, my rules say that it is a good Short.

The Short is not valid anymore, if price open and close above the Upper Extreme!

So, what are the rules?

Well, that's exactly what you will learn today ;

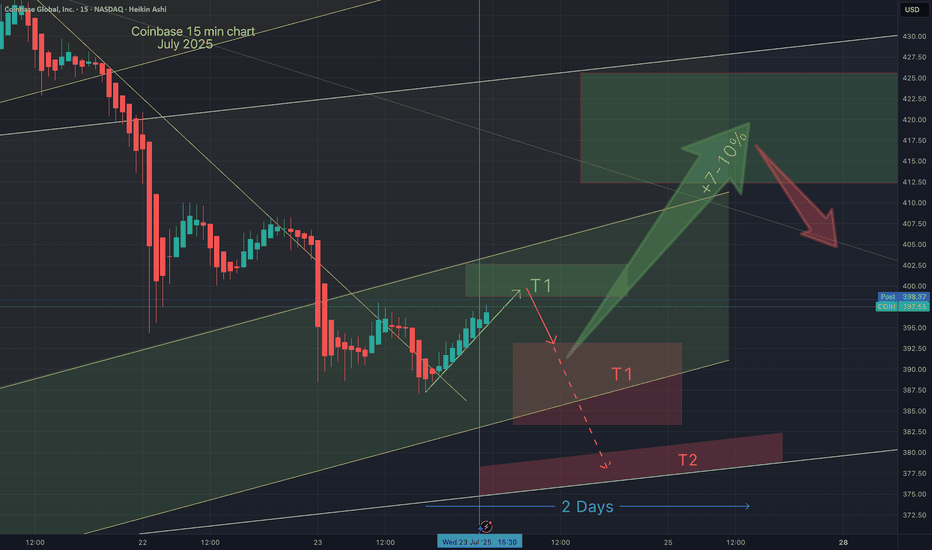

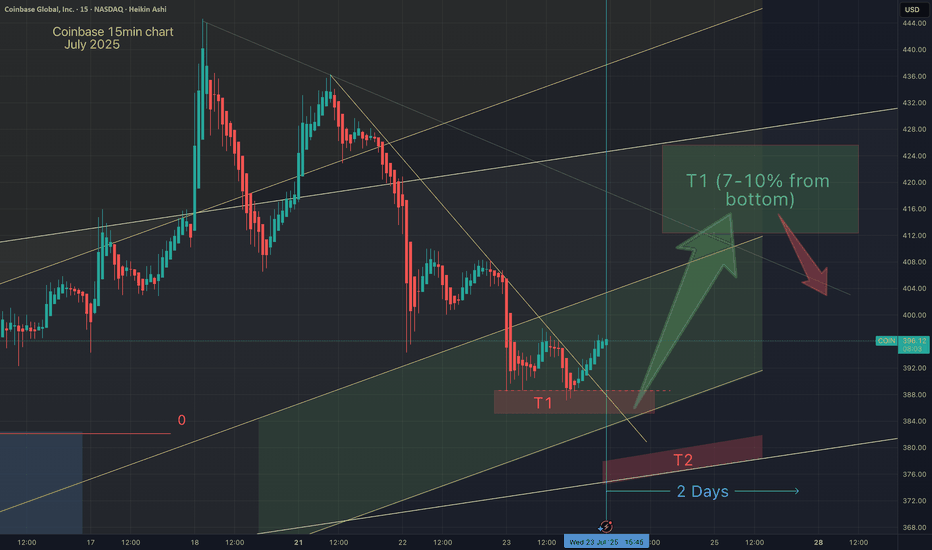

Coinbase targetsI'm confident that coinbase has more upside after this recent retracement. I have zoomed in (on 15 min timeframe), on what I believe may be the bottom of this dip. As Coinbase dips, we note that Alt coins are also retracing. I believe Alts and Coinbase will soon see a reversal to the upside. Thi

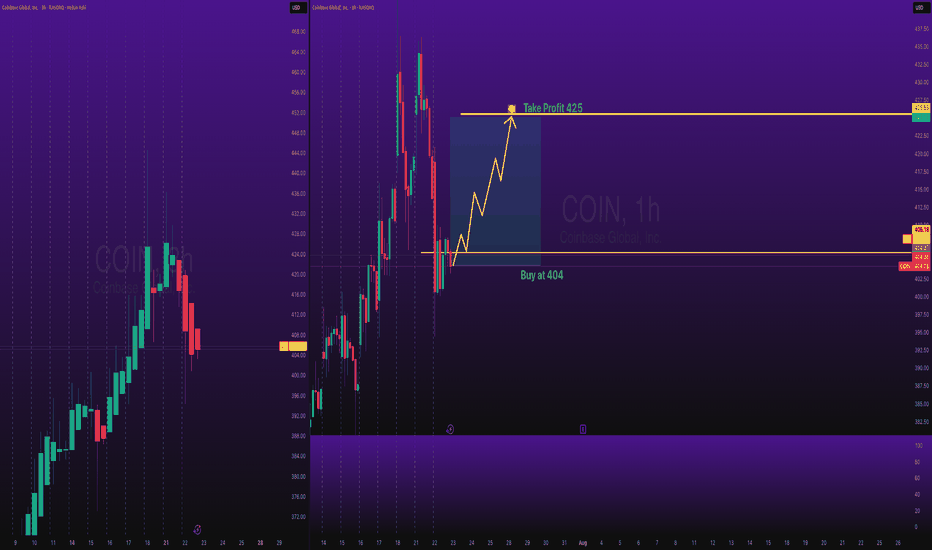

COIN Shares Buy at 404 Take Profit at 425NASDAQ:COIN Shares Buy at 404 Take Profit at 425

Stocks SPOT ACCOUNT:

NASDAQ:COIN shares: my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

COIN 0DTE Trade Breakdown – July 25, 2025

📉 COIN 0DTE Trade Breakdown – July 25, 2025

Put Play or Pass? Let’s break it down 👇

📍 Price: $392.34

🧠 Sentiment: Neutral → Bearish

📊 Call/Put Ratio: 1.08 (Balanced flow)

⚠️ Gamma Risk: HIGH

⌛ Time Decay: Accelerating (0DTE!)

⸻

🎯 TRADE IDEA: 0DTE PUT

✅ Strike: $380.00

💵 Entry Price: $0.69

🎯 Prof

Coinbase UpdateI stated that if price broke through the yellow 1.618 @ $416 with strength that I would start to very seriously doubt the corrective count that I have. Well, it broke well through that fib only to immediately fall right back down and close only $3 away from it. Now, that being said, I am still in ve

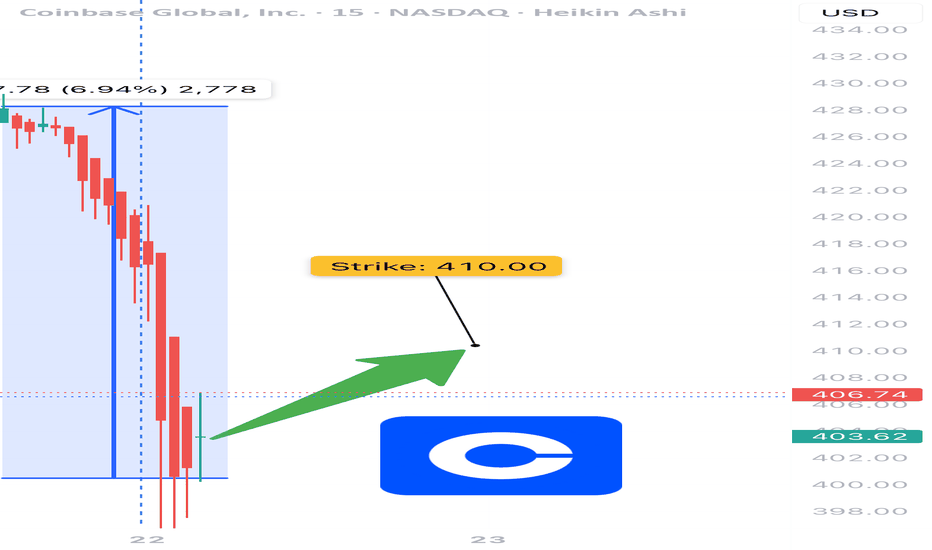

COIN Weekly Bullish Options Setup (Jul 22, 2025)

🚀 NASDAQ:COIN Weekly Bullish Options Setup (Jul 22, 2025)

Institutional call flow is heavy. Momentum is fading — but not dead. Volume confirms bulls. This is a calculated strike before earnings zone noise.

⸻

📊 Trade Setup

• 🎯 Direction: CALL

• 📍 Strike: 410

• 💰 Entry: $14.70

• 🎯 Target: $

Coinbase Stock Chart Fibonacci Analysis 080125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 310/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COIN5259272

Coinbase Global, Inc. 3.625% 01-OCT-2031Yield to maturity

5.84%

Maturity date

Oct 1, 2031

COIN5259270

Coinbase Global, Inc. 3.375% 01-OCT-2028Yield to maturity

5.33%

Maturity date

Oct 1, 2028

COIN6034335

Coinbase Global, Inc. 0.25% 01-APR-2030Yield to maturity

−3.91%

Maturity date

Apr 1, 2030

COIN5424425

Coinbase Global, Inc. 0.5% 01-JUN-2026Yield to maturity

−11.67%

Maturity date

Jun 1, 2026

See all COIND bonds

Curated watchlists where COIND is featured.

Interest-earning crypto wallets: Put your digital money to work

12 No. of Symbols

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks