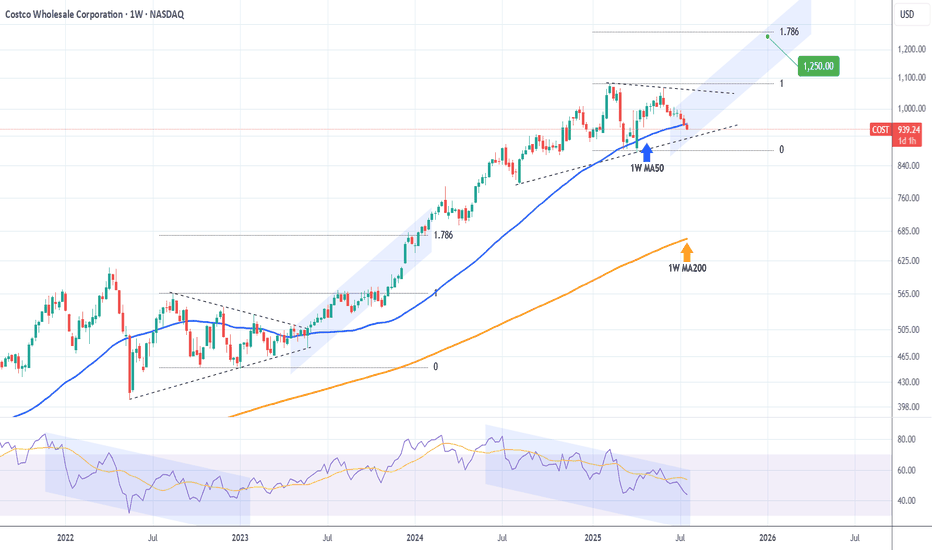

COSTCO Looking for a bottom to fuel rally to $1250.Last time we looked at Costco (COST) was 6 months ago (January 21) when we gave the most optimal buy signal exactly at the bottom of the Channel Up at the time, easily hitting our $1045 Target:

Since then, the stock has entered a new Accumulation Phase in the form of a Triangle and this week br

1,475 ARS

5.35 T ARS

184.84 T ARS

About Costco Wholesale

Sector

Industry

CEO

Roland M. Vachris

Website

Headquarters

Issaquah

Founded

1983

ISIN

ARDEUT110863

FIGI

BBG000HF59G5

Costco Wholesale Corp. engages in the provision of operation of membership warehouses through wholly owned subsidiaries. It operates through the following geographical segments: United States, Canada, and Other International Operations. The company was founded by James D. Sinegal and Jeffrey H. Brotman in 1983 and is headquartered in Issaquah, WA.

Related stocks

$COST is transiting from the Markup to the Accumulation (A)The squeezing and oversold momentum readings suggest the markdown is losing steam and "stopping action" may be occurring. We could be witnessing the area where a Selling Climax or preliminary support forms. I'm not looking for a new all-time high, but a trip to test resistance seems likely.

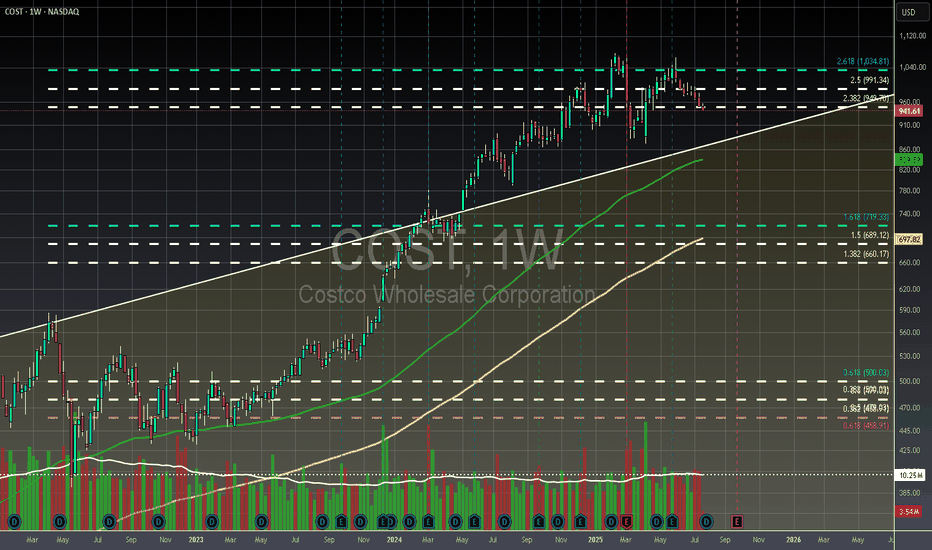

COST - Weekly - OverboughtCostco is currently trading outside a monthly channel it has been in since 1992, which could signal strong demand or overzealous traders. If Costco fails to break the $1034 Fibonacci level, considered the golden target for bulls, a reversal is likely, potentially leading to a return to the 100-perio

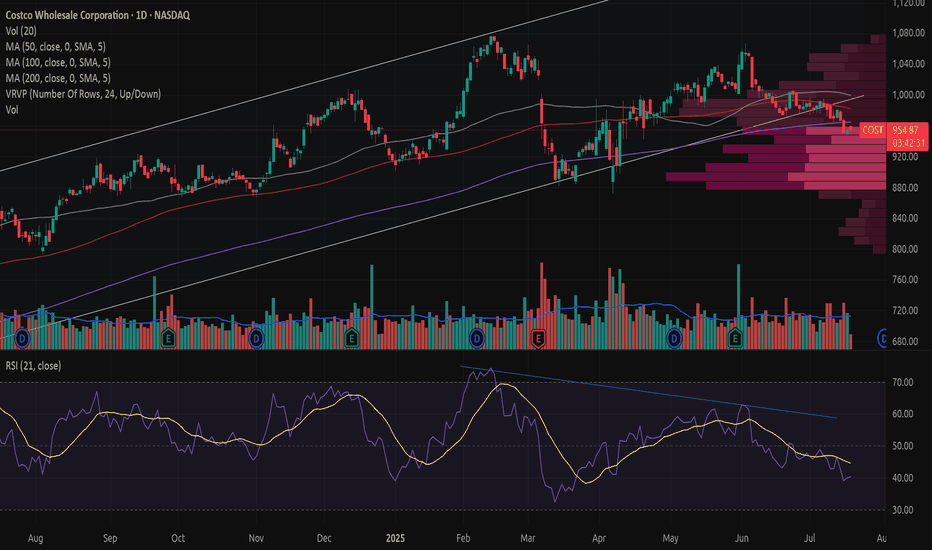

Costco has broken down from a rising trend Costco has broken down from a rising trend with increased volume and a significant price drop exceeding 3%.

The trendline has not been retested after the breakdown, but a retest is not required.

The price has support around 910 and 875.

There is a declining RSI(21) and negative volume balance over t

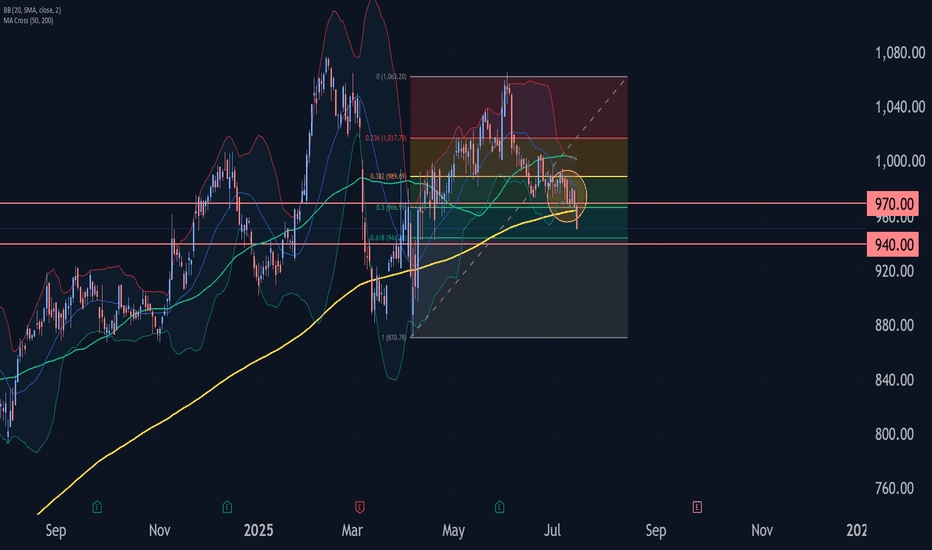

Costco Wave Analysis – 16 July 2025

- Costco broke the support area

- Likely to fall to support level 940.00

Costco recently broke the support area located between the pivotal support level 970.00 and the 50% Fibonacci correction of the upward impulse from April.

The breakout of this support area accelerated the C-wave of the activ

Potential Top in CostcoCostco Wholesale has been quietly limping, and some traders may see downside risk in the big-box retailer.

The first pattern on today’s chart is the June low of $973.90. COST made lower highs while trying to hold that level but is now sliding below it. That may be viewed as a potentially bearish tr

Costco is in the Wyckoff distribution phaseThis Week (July 8 - 11):

Support: The immediate floor is at $965. Below that, the low from the initial sell-off around $955 is critical.

Resistance: The 20-day moving average (that green line) at ~$992 is the first ceiling. If it gets frisky, look for sellers to appear at $1,030.

Next Month (July

Costco: Strong Membership Model Suggests Bullish Upside Current Price: $987.02

Direction: LONG

Targets:

- T1 = $1,016.00

- T2 = $1,032.00

Stop Levels:

- S1 = $957.00

- S2 = $940.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective i

COST Daily Chart Analysis: Key Levels, and Price StructureCostco Wholesale Corporation (COST)

Historical Context and Trend Channel:

From September 2024 through early 2025, COST was observed trading within a well-defined upward channel (indicated by the grey shaded areas). This channel represented a consistent bullish trend during that period. Howeve

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COST4977644

Costco Wholesale Corporation 1.75% 20-APR-2032Yield to maturity

4.60%

Maturity date

Apr 20, 2032

COST4977643

Costco Wholesale Corporation 1.6% 20-APR-2030Yield to maturity

4.24%

Maturity date

Apr 20, 2030

COST4495548

Costco Wholesale Corporation 3.0% 18-MAY-2027Yield to maturity

3.86%

Maturity date

May 18, 2027

COST4977642

Costco Wholesale Corporation 1.375% 20-JUN-2027Yield to maturity

3.80%

Maturity date

Jun 20, 2027

See all COST bonds

Curated watchlists where COST is featured.