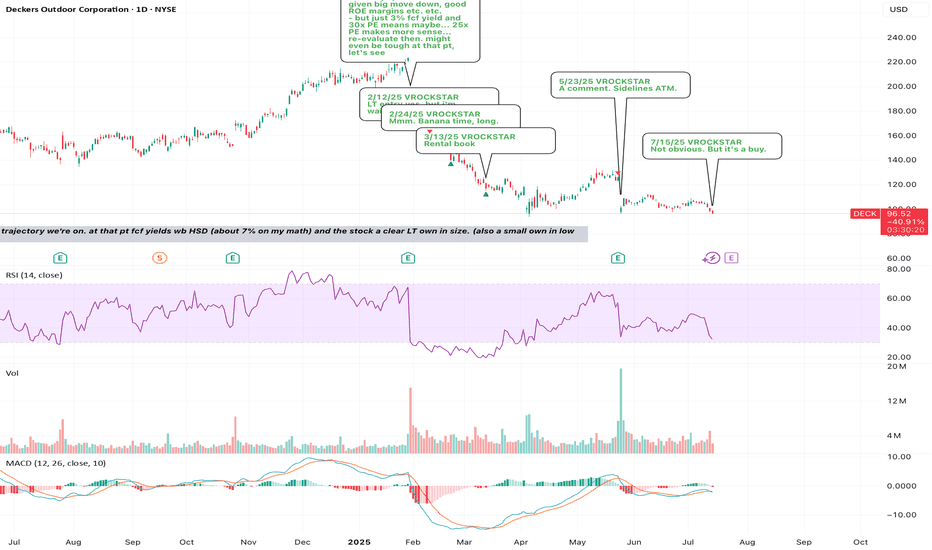

7/15/25 - $deck - Not obvious. But it's a buy.7/15/25 :: VROCKSTAR :: NYSE:DECK

Not obvious. But it's a buy.

- will reiterate that i'm not on tape so closely this week, but will revert w any comment replies by next week; nevertheless i'm checking in here on the tape

- see what T did today on NVDA/ China?

- you think it's easier or harder to

155,805 ARS

936.68 B ARS

4.84 T ARS

About Deckers Outdoor Corporation

Sector

Industry

CEO

Stefano Caroti

Website

Headquarters

Goleta

Founded

1973

ISIN

AR0571828273

FIGI

BBG01V48ZB23

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer. The UGG Brand segment offers a line of premium footwear, apparel, and accessories. The HOKA Brand segment sells footwear and apparel that offers enhanced cushioning and inherent stability with minimal weight, originally designed for ultra-runners. The Teva Brand segment focuses on the sport sandal and modern outdoor lifestyle category, such as sandals, shoes, and boots. The Sanuk Brand segment originated in Southern California surf culture and has emerged into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories. The Other Brands segment includes the Koolaburra by UGG brand. The Direct-to-Consumer segment consists of retail stores and e-commerce websites. The company was founded by Douglas B. Otto in 1973 and is headquartered in Goleta, CA.

Related stocks

BUY Deck!!!This is a good opportunity to look out for. We can see that market structure is clearly inducing early buyers to perhaps wipe them out with another bearish leg down to our major demand level.

Looking to set some buy orders at our next major zone to ride this stock up to previous all time highs.

G

Long $DECK - NYSE:DECK is the only growth story I'm comfortable buying. This was wall street darling for many years. I believe sell off was overdone.

- It has lot of room to run. It is getting traction and NYSE:NKE because of law of large number is not growing much in %age.

- However, NYSE:DECK has l

Double bottomDespite the strong quarterly results, the stock was penalized due to a lower outlook for Q2, a consequence of uncertainties surrounding tariffs, leading to a 20% decline.

The price is reaching the weekly 200-day simple moving average (blue line) for the second time, coinciding with a long-term supp

5/23/25 - $deck - A comment. Sidelines ATM.5/23/25 :: VROCKSTAR :: NYSE:DECK

A comment. Sidelines ATM.

- mgmt not providing FY guide is a problem in this environment because (serious) investors that don't own this thing will need to do more work to own it, those who own it might be forced to cut exposure (even if it's down here) and there

Deck pivot Deck has already had a nice pivot from the low and earnings are next week. After a quick analysis it looks like a buy to me. The stock has a strong history of revenue growth and decent operating cash flows. The balance sheet is very healthy as well. Deckers owns Hoka, Ugg, Teva and more popular bran

DECKERS Death Cross As they say, the trend is your friend. We are witnessing a very strong move down on Deckers, despite it's excellent growth in UGG and Hoka, sales are slowing as inventory has failed to meet demands. This a good problem as the company can fix their supply and demand equilibrium, the management are kn

3/13/25 - $deck - Rental book3/13/25 :: VROCKSTAR :: NYSE:DECK

Rental book

- ppl ditch their shoes and go homeless chic in a recession, right?

- look. of all the shoe names, this is the only one w the best growth, economics etc. etc.

- but what's probably SHTF 20% case low? 7-handle. instead of high $5s EPS, you probably en

2/24/25 - $deck - Mmm. Banana time, long.2/24/25 :: VROCKSTAR :: NYSE:DECK

Mmm. Banana time, long.

- first. let's give a thank you to mr. analyst at jefferies who's done his best and he decided "NKE was an upgrade to buy". this is what happens when you cover the elephant in the room, and your institutional bag holders keep forcing you t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where DECK is featured.