GE is correlating with SPY todayCorrelation trading strategy idea analysis.

Today I showed you possible correlation trading of $MSFT.

This was an example of an expensive stock.

In this idea, I will show you again possible correlation trading on the example of $GE.

$GE is a cheap stock, so it is good for correlation trading with a small deposit.

Look at the $SPY and $GE charts.

Actual corresponding support&resistance levels look so much alike.

Correlation is good enough to expect future similar moves.

Following the correlation trading strategy, it is reasonable to wait for correlated level breaking.

When $SPY and $GE simultaneously break their resistance levels, It will be possible to buy $GE.

When $SPY and $GE simultaneously break their support levels, It will be possible to short $GE.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

GE trade ideas

$GE Bullish candle with higher volume targeting 12 LONG Still showing positive long-term bullish trend , Friday candle was good enough to support up trend started on Sep-2019 with target at 12 then possible pullback to confirm support and continuous moving up . Closing above 12 for 2-3 days will lead for new high 2020 at 15.3

GE LONG 1DFor the time the company seems to recover.Last earnings were good but it is weighted down from Boeing and the General Market movement that looks like a correction.

1.breakout from mirror level

2.RSI is borderline overbought so I believe we may see some more correction to 11.5-12

3.On the 61.8 fibbo level

TP:16.8 SL:10.7 R/R is ok .

Good luck

General Electric - contrarian buy?NYSE:GE is not the stock you probably want to own given all the heat experienced by the company recently.

But from contrarian perspective, nice levels right now to attempt speculative buy. Price retraced by 61.8% of previous bounce and is holding the line of previous resistance. Today may be the third daily candle when 7.8 is held, indicating that good support zone might be formed at around current levels.

Trade: stop at 6.39 (previous low), target at ~13$

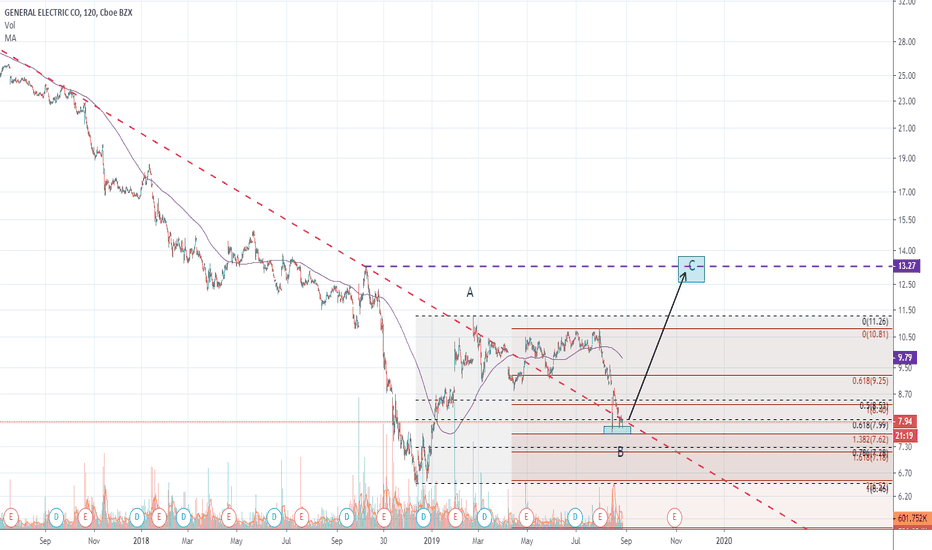

GE Elliott Wave Pattern Spotting (long)GE:

I have zoomed out to the supercycle level on a weekly and the general path is towards $25 zone (unless we completely get out of this pattern).

Some things I've noticed looking over the large patterns:

1. Large corrections lasted 2 years

2. Wave 2 and 4 alternate from the previous set meaning:

Look at: 2003 - 2007 upswing pattern (notice waves 2 and 4), Then look at the upswing pattern from 2009 - 2016, compare wave 2 and wave 4 of a larger degree to 2003-2007 then 2018 to present compare that to 2009 and 2016. Obviously realize that there are 2-year corrective patterns between them. But we have alternated the waves so if 03-07 started with Wave 2 sharp, look at the 09-16 and you'll see wave 2 went sideways. I have seen this many times on bullish moves so my point is, when people look for entry or exist points and want to predict a bit what the wave pattern might do, how far it will correct or increase...zooming out has always worked for me.

If you're good at spotting patterns, you'll be able to see opportunities.

GE is a very slow-moving stock so I swing trade it. It will fill a few gaps: $11 and $8 but there's also a gap in the 25s and between 32.40-34.73 that hasn't been filled yet so I say we'll head to 35 before massive correction.

This is just an overall analysis, I confirm direction by counting waves, using a few indicators, looking at my favorite analysts on youtube and tradingview. I'm not a financial pro and only trade for myself, it's been working well. I have learned stock trading by trading BTC as the systems run Elliott Wave pattern so it's identical only 24/7, if you want to learn fast, go trade BTC.

If you have other ideas, please share!

The waveThis is what the wave looks like for anyone interested from my last post. This will help you new traders understand the different kinds of trends a market can take on. Dont over complicate it. If your not trending nicely then go find something else to trade. This is GE and is a good example of an uptrend. We have the green bars and the wave is slanted up at a 12-2 clock angle.. This is raghee horners tool..i take no credit for making it..ive just learned how to use it.

GENERAL ELECTRIC (GE): Close To Supply Zone

General Electric is very close to a decent area of supply.

looking left at structure we can see how the underlined area was significant for the market participants in the past.

+ rsi has reached the overbought condition and we haven't seen a bearish reaction on this stock since summer 2019.

good luck!

GE - Still Chugging Along!GE is up premarket on a strong earnings report. Although guidance for this year came down a bit, cash flows are projected to be better than expected. Management is committed to turning things around and keeping the momentum going. Premarket the stock is trading around $12.50-$12.70. This is above the outlined channel and should be the push that gets the stock to $13.30. This is a name that I am adding to on any pullback. Need to monitor the situation with the 737 MAX. GE did say that their projections are based on the Max resuming flights this summer.

Future path for GE?Is a rebrand in store for GE when we start using wireless electricity? Look up Zenneck Waves and companies like VIZIV and Zenneck Power. There is already an operational tower in Milford, TX. I'm sure GE will become involved in this tech if they wish to remain an industry powerhouse for centuries to come.