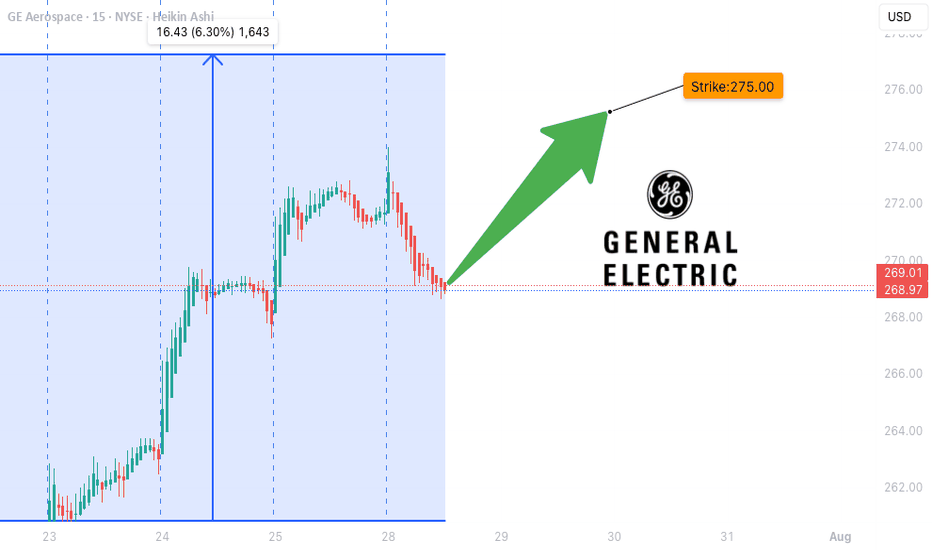

GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bull

Key facts today

GE Aerospace dominates the jet engine market with 70,000 engines in use, powering 75% of commercial flights, and is growing rapidly due to high demand for its LEAP engine.

In January 2025, GE Aerospace settled for $362.5 million with investors over misleading disclosures about its Power segment's finances from 2017, addressing legacy liabilities.

Cathay Pacific has signed an agreement with GE Aerospace for additional GE9X engines to power its Boeing 777-9S aircraft, which includes a service agreement for the maintenance of the engines.

0.80 USD

5.81 B USD

34.38 B USD

About GE Aerospace

Sector

Industry

CEO

H. Lawrence Culp

Website

Headquarters

Evendale

Founded

1878

ISIN

ARDEUT110160

FIGI

BBG000FSTYL2

GE Aerospace is an American aircraft company, which engages in the provision of jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. The firm's portfolio of brands includes Avio Aero, Unison, GE Additive, and Dowty Propellers. It operates through the Commercial Engines & Services and Defense & Propulsion Technologies segments. The Commercial Engines & Services segment is involved in the design, development, manufacturing, and servicing of jet engines for commercial airframes, as well as business aviation and aeroderivative applications. The Defense & Propulsion Technologies segment offers defense engines and critical aircraft systems. The company was founded by Thomas Alva Edison in 1878 and is headquartered in Evendale, OH.

Related stocks

GE watch $260-261: Key support to maintain strong UptrendGE has been in a strong uptrend for a couple of years now.

Earnings report dropped it to support zone at $260.00-261.05

This zone is now clearly visible to everyon, so Do-or-Die here.

Long entry here with tight stop loss just below zone.

======================================================

.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture an

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

Pullback in GE AerospaceGE Aerospace has been rallying, and now it’s pulled back.

The first pattern on today’s chart is the steady advance in April and May that established GE at its highest levels since 2001. Is an accumulation phase underway?

Second is the May 23 close of $232.79. The industrial stock tested and held

GE AERO WHERE WILL THE PRICE GOTRENDS and Price targets marked.

Price appears to be in "danger zone" or high side with not many price targets left.

There are both support and rejection trends trading down in the short term.

These both lead to a support trend.

Good luck.

Follow for more charts like this.

Taking profit on GE Aerospace stock to buy in lower after summerIt's clear NYSE:GE has hit overbought, it's the perfect time to take profits now. Less stress managing stocks over the summer too lol...

$196 is the 0.618 level I'm aiming to re-enter, there's also decent support near that level $190 to $200

GE Weekly Options Trade – Bearish Setup After Breakdown (2025-0📉 GE Weekly Options Trade – Bearish Setup After Breakdown (2025-06-12)

Ticker: NYSE:GE | Strategy: 🔻 Naked PUT (Short Bias)

Bias: Moderately to Strongly Bearish

Confidence: 75% | Entry Timing: Market Open

Expiry: June 13, 2025 (Weekly)

🔍 Technical & Options Snapshot

• Trend:

– Daily: Bearish (be

GE Daily Chart: Corrective Pullback Towards Key Support LevelOverview:

GE has experienced a significant bullish run since early April, forming a well-defined ascending channel. However, recent price action indicates a potential corrective pullback after failing to sustain above the upper boundary of this channel. The stock is currently trading below the lowe

These 2 Signals Made Members 80% Profit!NYSE:GE has had a massive rejection off of Monthly chart rejection.

We issued an alert to members om June 6th 2025. We entered a 245 Put (July 3) $5 con

We closed out our contracts today at $9 and roughly 80% gain.

This chart demonstrates the power of multiyear monthly chart resistance. Trades

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

G

GE4373445

GE Capital International Funding Co. ULC 4.418% 15-NOV-2035Yield to maturity

4.89%

Maturity date

Nov 15, 2035

G

GE4373214

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

4.57%

Maturity date

Nov 15, 2025

G

GE4297296

GE Capital International Funding Co. ULC 4.418% 15-NOV-2035Yield to maturity

3.94%

Maturity date

Nov 15, 2035

G

GE4297294

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

1.38%

Maturity date

Nov 15, 2025

See all GED bonds

Curated watchlists where GED is featured.