HL trade ideas

Hecla Mining Company Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

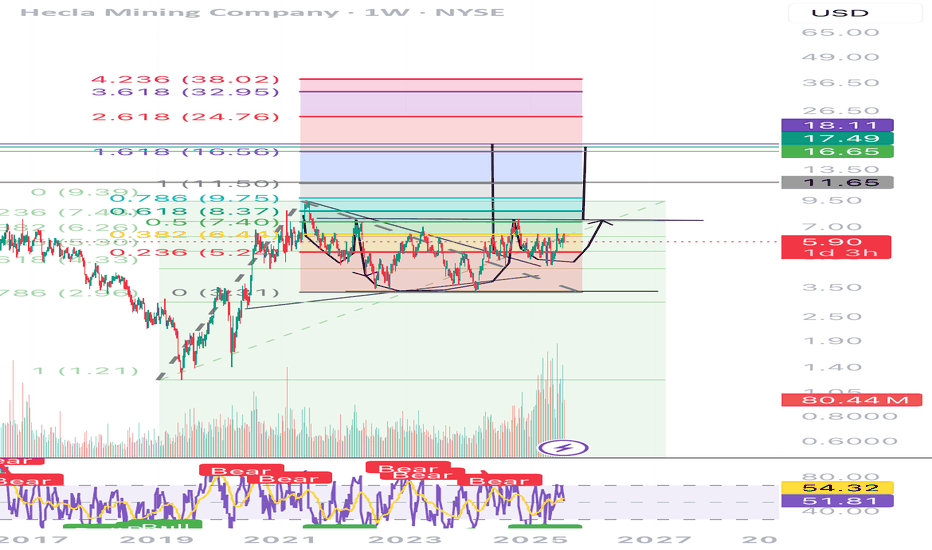

# Hecla Mining Company Stock Quote

- Double Formation

* 7.00 USD | Area Of Value

* (Neckline) At 6.50 USD | Subdivision 1

- Triple Formation

* (Reversal Argument)) | Subdivision 2

* Numbered Retracement | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Neutral

Hecla Mining Company | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

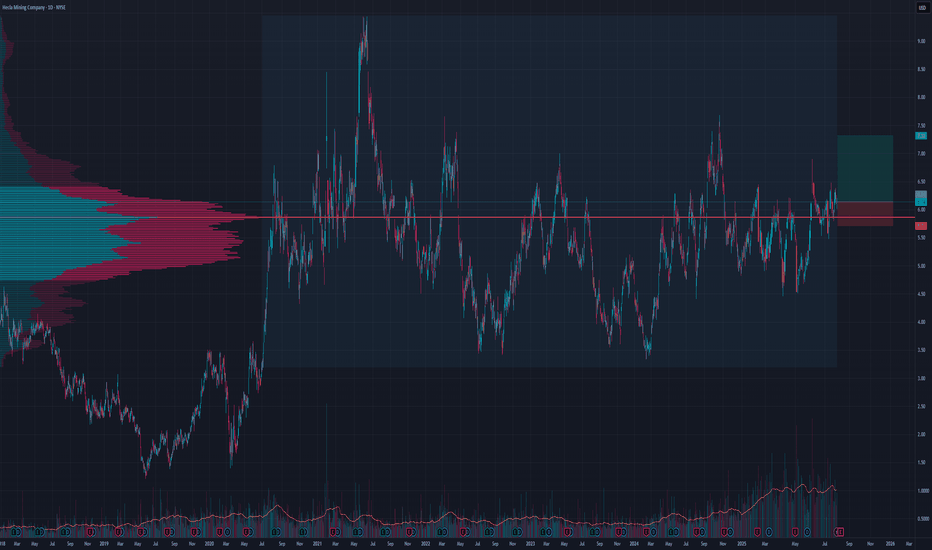

# Hecla Mining Company

- Double Formation

* Support=0 At 4.20

* Left Shoulder & 1)) | Uptrend Bias | Subdivision 1

- Triple Formation

* ((Neckline)) & Wedge Structure At 6.20 | Subdivision 2

* Retracement 50)) & 0)) | Potential Gaining Area

* 1 Hour Time | Trend Behaviour & Entry | Subdivision 3

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

HL - Hecla Mining CompanyHecla Mining Co. engages in the provision of precious and base metals. It operates through the following segments: Greens Creek, Lucky Friday, Keno Hill, Casa Berardi, Nevada Operations, and Other. The company was founded by Amasa B. Campbell, Patsy Clark, and John Finch on October 14, 1891 and is headquartered in Coeur d'Alene, ID.

Hecla Mining Co. (HL)Hecla Mining Co. (HL) witnessed a strong rebound in Friday's session violating the last major peak at 5.90$. If it remains above this peak of $5.90 by today's session, it will confirm the current uptrend in the short and medium term, leading to further rises near 6.23 - 6.36 - 6.48 - 6.68 - 7.00$ in the short term.

the indicators are heading toward the positive side, which confirms the mentioned positive scenario.

The information and publications are not intended to be or constitute any financial, investment, commercial, or other types of advice or recommendations provided.

HL potential Buy setupReasons for bullish bias:

- Price gave resistance breakout

- Price bounced from 0.5 fib level

- Positive Earnings

- TP below the next resistance

Here are the recommended trading levels:

Entry Level(CMP): 5.47

Stop Loss Level: 4.59

Take Profit Level 1: 6.07

Take Profit Level 2: Open

HL- a silver mining pennystock LONGHL shown on the reliable daiy chart while spot silver is uptrending. demonstrates multiple

bullish signs including a cross over the POC line of the volume profile and now the confluence

of a 200-50-20 triple convergence coindident with a cross of the long anchored mean VWAP

and a gaint ( "gib ass green") engulfing green price candle of 7% magnitude with volume above

the running mean. The Price Momentum Oscillator and Relative Trend Index lend further

support to a bullish bias here. I will take a long trade in HL of both shares and call options to

complement my positions in gold. Targets are 4.9, 5.4 and 6.8 yielding the potential of a very

profitable trade over in next six weeks before earnings and perhaps beyond that.

HL - LongTechnical:

Bottom of large consolidation, it looks like shorts are having a hard time pushing lower given the effort and result. looking for a 238 or 382 retrace to take some profits, 618 very probable. Looking for Low volume nodes as areas of resistance. as we cross these we can expect the stock to run until we find liquidity or less aggressive buyers.

Fundamental

In 2023, Hecla Mining Company (HL) reported a revenue increase to $720.2 million, buoyed by higher realized prices for silver and gold, marking a significant year with the second-highest silver production at 14.3 million ounces. Despite the revenue growth, the company faced a net loss of $84.8 million and navigated challenges including a decrease in gold production due to Casa Berardi's transition and negative free cash flow of $148.4 million, largely due to increased capital expenditures of $223.9 million in mine development and infrastructure. Nevertheless, HL maintained stable adjusted EBITDA at $212.6 million, reflecting resilience amid financial pressures.

Silver mining, check this outChart above shows price of HL (silver mining company) and below shows silver futures. HL price is landing on a very strong support area. And silver futures just made a nice bounce off the monthly support. Looks like silver (and gold) is forming a huge inverse HS. It may take a few more weeks to build up and break out. Also HL is trading at 4 dollars, a psychological price. If you enter now your risk is very low (SL 3.8) but the regard can be great at least to $6. I'm long here and I may add If I see buyers activity.

HL:Dip buying!Hecla Mining Company

Short Term - We look to Buy at 3.87 (stop at 3.42)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. Previous resistance at 3.90 now becomes support. Dip buying offers good risk/reward. Further upside is expected.

Our profit targets will be 4.85 and 5.00

Resistance: 4.90 / 7.50 / 9.50

Support: 3.80 / 2.90 / 2.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Hecla MiningThe 6.50$ area is a significant resistance area. The horizontal price level is also corresponding with the 200MA and the 38 Fibonacci Retracement of the march low of 2020 and the last significant high. The trade will be entered when the price closes above the 200MA in combination with a high volume.