INTC trade ideas

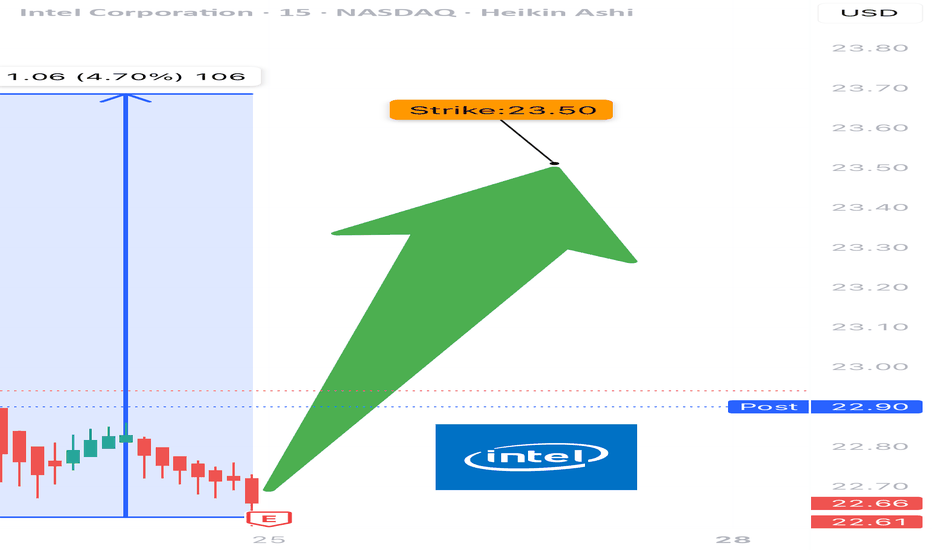

INTC EARNINGS TRADE (07/24)

🚨 INTC EARNINGS TRADE (07/24) 🚨

🎧 Earnings drop after close — here’s the high-conviction setup 📊

🧠 Key Highlights:

• 💥 Surprise Beat Rate: 88%, avg surprise = 419%

• 📉 Margins: Ugly (-36% net margin) but improving sentiment

• 📈 Volume Surge + $24 resistance test = pre-earnings drift 🚀

• 🔎 Mixed options flow → cautious bulls leaning in

• 🎯 Sector: SEMI = 🔀 rotating hard, competition vs AMD/NVDA rising

💥 TRADE SETUP

🟢 Buy INTC $23.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $1.18

🛑 Stop: $0.29

📈 Confidence: 75%

⏰ Entry: Before Earnings (Close 07/24)

📆 Earnings: Today After Market (AMC)

📊 Expected Move: 5%

⚠️ Play the earnings drift → gap up = profit. Miss = cut fast. Risk = defined. Reward = explosive.

#INTC #EarningsPlay #OptionsTrading #IntelEarnings #UnusualOptionsActivity #TechStocks #Semiconductors #TradingView #EarningsSeason #DayTrading #CallOptions

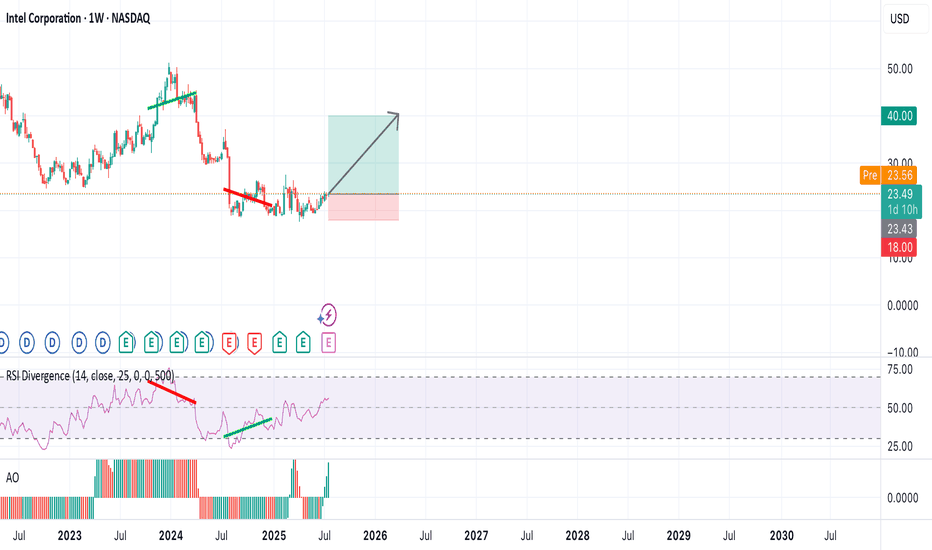

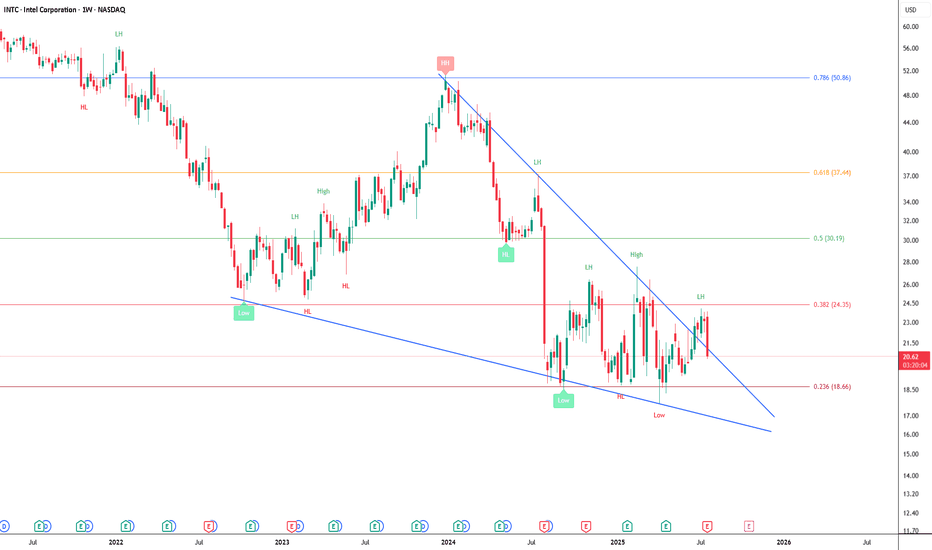

Is it a time for INTEL? 32 $ will be soon.The Intel Corporation (INTC) chart on NASDAQ illustrates the stock price dynamics from 2024 to July 2025. Initially, the price rose to a peak in the first half of 2024, followed by a significant decline, reaching its lowest point around 24 USD by the end of 2024. Since then, the price has been consolidating in the 24-26 USD range, which may signal preparation for a potential rebound.

The moving averages (MA) on the chart suggest a gradual convergence of lines, indicating a possible turning point. Oscillators at the bottom of the chart, such as RSI, may indicate oversold conditions, supporting the hypothesis of an upward move. The 26 USD level acts as a strong support, and breaking above 28-30 USD could pave the way to 34 USD, a previous resistance level.

A potential rise to 34 USD is plausible if the price maintains momentum and breaks through the resistance with sufficient volume.

Potential TP: 32 USD

Intel to 40. A bet on America's chip when the chips are downIntel is an interesting stock. I made a bet on it this week. It’s very cheap trading at book value. Lots of bad news has destroyed this stock while other chip stocks are at all time highs. With a new CEO running the show and investing in next gen chip production, I think he turns it around.

I think it's at 40 within a year, and makes new all time highs after that.

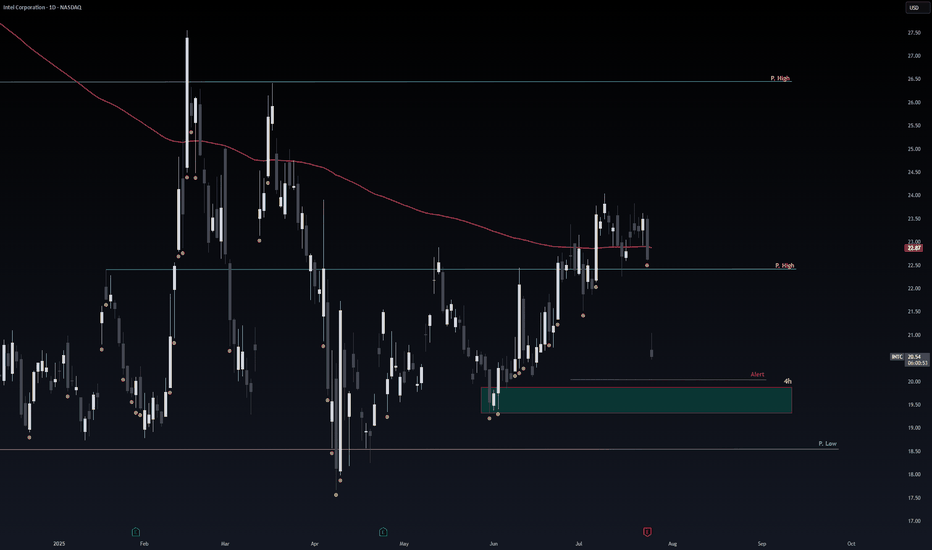

Safe Entry IntelThe 4h Green Zone is Safe & Strong Support for Intel.

If not respected the Pink Line is Second Strong support level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

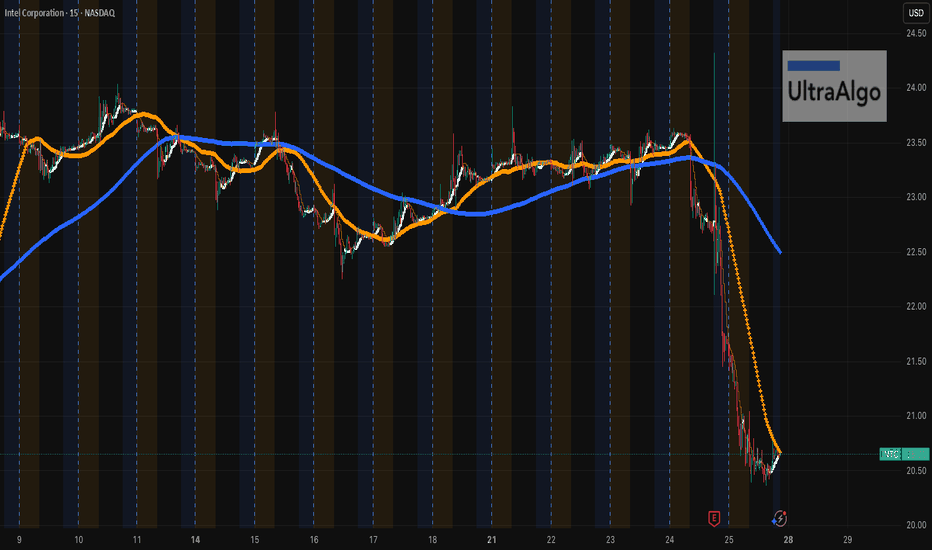

$INTC Got Smacked. Relief Bounce or Trap?Yikes. NASDAQ:INTC just faceplanted from $23.50 straight down to $20.50. It’s peeking its head up now. If you’re playing the bounce, be nimble — this thing’s still bleeding on the higher timeframes. Don't get in unless you see more pickup and buy signal.

UltraAlgo caught the drop early. If it crosses $20 could go down deeper.

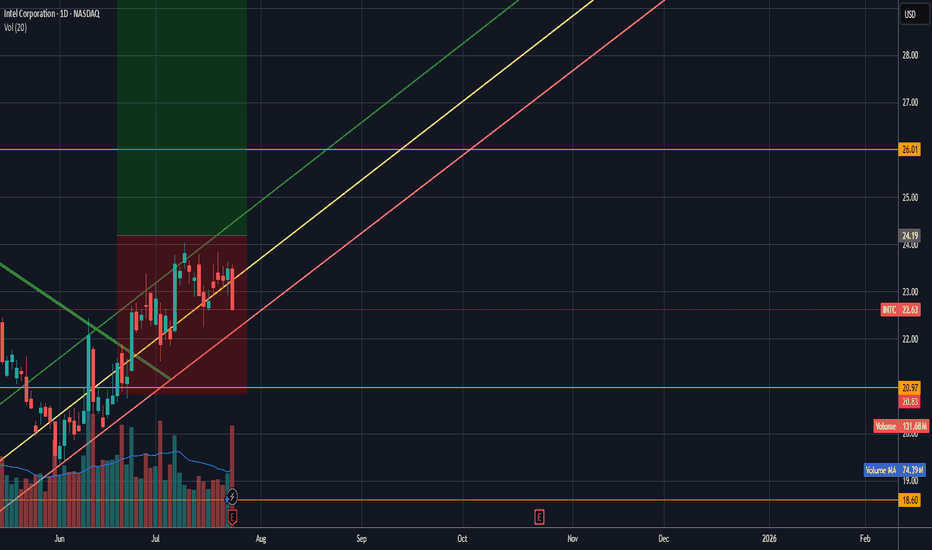

INTC – Breakout Confirmed, Bullish Continuation Inside AscendingIntel NASDAQ:INTC has broken above previous resistance and a descending trendline, confirming a bullish reversal.

Price is currently respecting an ascending channel and forming higher highs and higher lows. The breakout retest around $22.50 has held as new support.

If the current structure remains intact, price could continue toward the $26.00–$26.50 resistance zone. A breakout above this zone opens the door for a move toward $28+.

Key levels:

Support: $22.50 (previous resistance)

Resistance: $26.00–$26.50

Trend structure: Bullish channel

Volume supports the trend, and price is trading above both the 50 SMA and 200 SMA.

📌 Watching for a pullback and continuation move inside the channel.

This is not financial advice. Always do your own research.

To Frustration and Beyond! Welp... That Was That. And I Guess I Was Wrong.

(For now.)

Bears gonna bear, bulls gonna bull, and Intel’s still out here quietly building the Death Star while everyone’s chasing squirrel stocks hitting all-time highs. Yeah, we’re not mooning yet, but I still believe INTC will outpace most of the market on a YTD basis 2–3 years from now. Why settle for 50–100% gains when there’s a potential 200–400% monster comeback on deck? Even a smooth double to $50/share would dunk on most “safe” tech plays.

Analysis (a.k.a. my hopium-fueled thesis):

I’m still convinced this setup mirrors Pat Gelsinger’s 2023 run — but this time, without the rug-pull. Intel’s trimming the fat, locking in on its foundry moonshot, and going full Dragon Ball Z with a “laser focus” on margins and product execution. When they finally deliver a quarter with positive GAAP and non-GAAP EPS and beat expectations? That’s your ignition point for the mother of all squeezes. Until then, they’re still checking boxes and marching toward the target.

This sell-off? Overcooked.

I’m still holding, still in my leaps, and I’m not even thinking about touching that sell button until we fly past $70+.

Remember when people clowned AMD before Lisa Su pulled off the Zen-volution?

Yeah. Intel’s setting up for their own comeback tour. And I’ve got front-row seats. 🧠🚀📈

I'm still in it. Shares + Leaps....

You know the drill...

Disclaimer:

I am not a licensed financial advisor. The information provided in this content is for entertainment and informational purposes only, and should not be construed as financial or investment advice. All investments carry risk, and you should do your own research or consult with a qualified professional before making any financial decisions. Past performance is not indicative of future results. I may hold positions in the securities discussed.

I could be wrong.... but: Earnings breakout? Intel has certainly tested the patience of investors lately. That said, it’s in these moments — when sentiment turns and many walk away — that opportunity quietly builds. I’m maintaining my position, currently averaging around $24 per share alongside a sizable options exposure.

What makes this cycle feel different? It reminds me of Intel’s rally under Pat Gelsinger when the stock surged to $50, but this time the momentum seems more organic, driven by operational improvements and emerging tailwinds rather than speculative hype.

We’ll see how it plays out, but I’ve been meaning to put this out there: I’m still here, still holding, and watching this story unfold. Let’s go.

Intel Share Price Hits 3-Month High Without Clear CatalystIntel (INTC) Share Price Hits 3-Month High Without Clear Catalyst

Intel Corporation (INTC) stocks rose by over 7% yesterday, making them one of the top performers in the S&P 500 index (US SPX 500 mini on FXOpen). As a result, the stock price reached its highest level in three months.

What’s notable is the apparent lack of clear drivers behind the rally. According to Barron’s, the increase in INTC shares could have been triggered by a rating upgrade from Wall Street analysts or a corporate announcement – yet no such developments have occurred. "Nothing new or fundamental," says Mizuho managing director and technology specialist Jordan Klein.

At the same time, from a technical analysis perspective, the INTC price chart is showing significant developments. Examining these price movements may provide clues as to what’s fuelling the recent rise.

Technical analysis of INTC stocks

For many months, the share price had been confined within a downward channel. However, the psychological level of $20 acted as a strong support – repeated attempts by bears to push the price lower ultimately failed.

Bearish patterns in INTC’s chart may have led to a supply squeeze, as holders were given repeated reasons to sell (particularly against the backdrop of Nvidia’s success). Yet the bullish reversals near the $20 mark suggest that institutional interest was accumulating the stock at what was perceived to be a deeply discounted level – a characteristic sign of the Accumulation Phase in Wyckoff methodology.

It is this lack of available supply that could explain the sudden price rise in the absence of obvious news catalysts.

Since early summer, INTC shares have been making higher highs and higher lows, breaking upwards through the descending channel and beginning to form the early stages of a new bullish trend (highlighted in blue). Should fundamental catalysts emerge in the near term, they may serve as the spark to accelerate this nascent rally.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Intel - The rally starts!Intel - NASDAQ:INTC - creates a major bottom:

(click chart above to see the in depth analysis👆🏻)

For approximately a full year, Intel has not been moving anywhere. Furthermore Intel now trades at the exact same level as it was a decade ago. However price is forming a solid bottom formation at a key support level. Thus we can expect a significant move higher.

Levels to watch: $25.0

Keep your long term vision!

Philip (BasicTrading)

To 26$The price has been repeating the same pattern for months…

It drops to the $19 support level (blue line), then climbs back up to the $22 resistance (purple line).

When it breaks above $22, it rallies to $26 (light blue line), only to fall back to $19 after failed breakouts.

Last week, it closed above $22 and is now heading for a new test of the $26 level

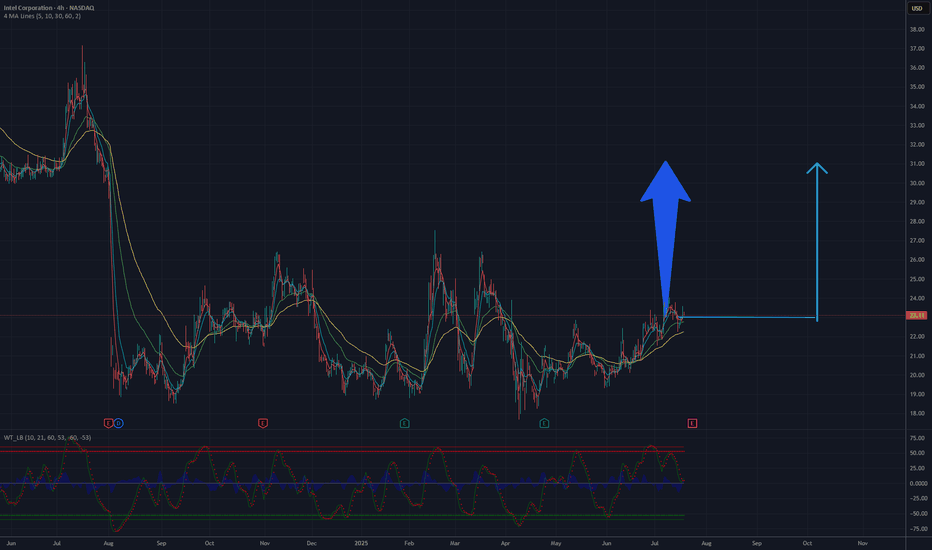

INTC getting ready to start it's upward trajectoryINTC has been ranging and coiling since July of 2024. It finally, is starting to look like bullish movement is about to break upwards.

As you can see, INTC has just broken the downward trend line as well as the triangle pattern. A break and hold above $24.40 would indicate the start of a new uptrend in the chart.

Indications that the stock is gaining bullish momentum on the weekly chart:

The Williams %R is approaching and getting ready to break the 50 line.

The MACD is bullish and approaching the zero line.

The stock has bounced off of the volume shelf on the AVP 4 times and is now breaking out of technical patterns.

Money flow on market cipher B has crossed over green.

EMA's are starting to turn upward to flip bullish.

The marked move on this triangle pattern is approximately $40.

From a fundamental standpoint, Intel is trying to fix the business on two tracks at one time:

1)Near-term – ship competitive AI-centric products now (CPUs, GPUs, Gaudi accelerators) to put revenue and margins back on a growth path.

2) Long-term – reinvent itself as a contract chip-maker (Intel Foundry) so it can win outside customers and leverage its huge fab investments.

Think of it as “sell more chips today, sell more manufacturing tomorrow.”

Let's see Intel can build enough momentum to break this range for the bigger move up. The table is set from a technical standpoint.

Not financial advice. Do your own research.

INTC may be a winner in 2025hi traders,

INTC created a strong support around 19$.

If we get another retest of this support, it may be a great opportunity to enter long position.

Eventually, we expect the price to fill the gap that was created at the beginning of August 2024 so our final target is around 29$-30$.

2 take profit levels are shown on the chart.

Stop loss: 18$

Good luck

INTC: Legacy Laggard or Coiled Spring? June 2026 $25 Calls in PlINTC: Legacy Laggard or Coiled Spring? June 2026 $25 Calls in Play

INTC is a strange bird.

A legacy tech giant that’s been trading since before I was born in 1968, it's spent the last few years struggling to keep up in a fast-moving semiconductor world. But here’s what stands out:

📉 The Stock: Brutally sold off, now hovering just above multi-year support in the $19–$20 zone.

📈 The Setup:

Descending triangle structure with multiple support tests.

Tuesday’s bounce from $20.28 to $22.08 showed real strength on volume—then came the pullback.

The 200 EMA remains overhead, but this consolidation looks more like accumulation than distribution.

The Trade:

I’ve started building a position in June 2026 $25 calls at $2.70, betting that INTC doesn’t die quietly.

With a market cap of $89B in a space that now sees $1T+ valuations, it feels like Intel is priced for irrelevance. I don’t buy that narrative.

There’s evidence of institutional support near these levels, and any progress in:

Foundry business

AI silicon

Onshoring chip production

...could light a fire under this stock.

Targets:

Target 1: $26.89

Target 2: $30.15 (stretch)

I’m open to adding on weakness—especially if it dips near $19.11 with volume support.

Sometimes the market gives up on a name right before it turns around. INTC feels like it’s coiling for something bigger.

Intel (INTC) Shares Drop Over 6% in a DayIntel (INTC) Shares Drop Over 6% in a Day

As shown on the Intel (INTC) chart, after Tuesday’s candle closed above $21, the price dropped sharply on Wednesday. INTC was the worst-performing stock of the day among the components of the S&P 500 index (US SPX 500 mini on FXOpen).

Why Did INTC Shares Fall?

The decline is linked to growing competitive pressure. According to media reports:

→ On one hand, AMD continues to rapidly expand its share of the server CPU market. A report by Mercury shows that the company already controls 40% of the segment and could match Intel as early as next year.

→ On the other hand, Nvidia is preparing to launch two accelerated processing units (APUs) for the consumer market, which will combine CPU and GPU capabilities in a single product.

Technical Analysis of the INTC Chart

In 2025, the price remains:

→ within a broad downward trend (marked in red);

→ supported by the $18.50–$20 zone.

Meanwhile, price fluctuations in May and June are forming a narrowing triangle (marked in black). Following the recent negative news, it is possible that INTC shares could fall towards the lower boundary of the triangle — or even retest the psychologically important $20 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Safe Entry Zone INTCPrice Movement Ranging.

Price Targeting 1h & 4h Green Zone.

Green Zones Are Buying Zones & Red Zones Are Selling Zones In Case Buying Zone broken down stock movement will be down and Vice Versa.

P.High(Previous High) & P.Low(Previous) Acts As significant Support and Resistance Levels.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Important Support and Resistance Zones: 23.03-28.93

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(INTC 1D chart)

It shows an upward trend above the 18.69-21.33 zone, which is a medium- to long-term buy zone.

However, you need to be relaxed because it needs to rise above 28.93 to turn into an uptrend.

The 28.93 point is the HA-Low indicator point on the 1M chart, and it is expected that a breakout trade will be possible when it breaks above this point.

Since the price is located below the M-Signal indicator on the 1M chart, you should respond quickly and briefly with short-term trading while observing the situation.

Therefore, if you were unable to purchase in the mid- to long-term purchase section,

1st: M-Signal indicator on the 1M chart

2nd: 28.93

You can proceed with a purchase when it shows support near the 1st and 2nd above.

If it falls below 18.69, you should stop trading and observe the situation.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------