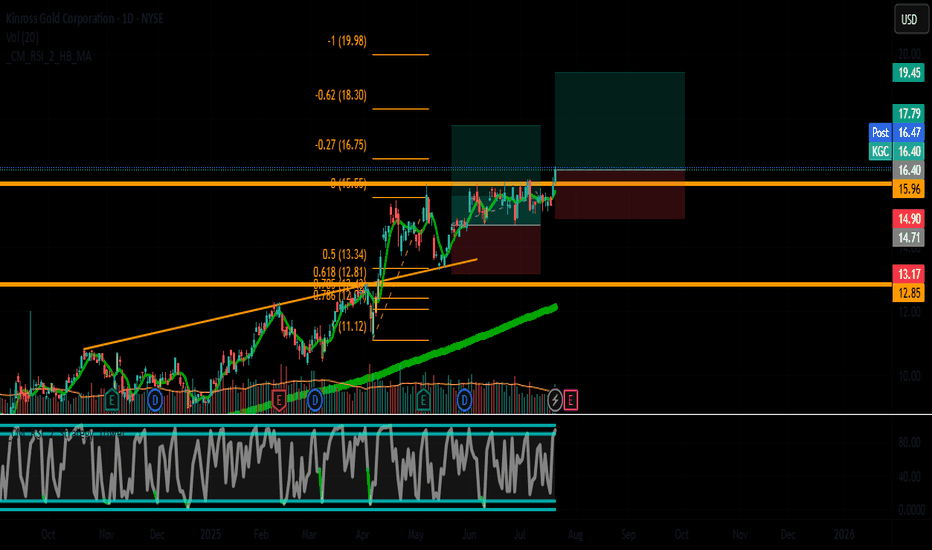

KGC (Kinross Gold Corporation) – Bullish Breakout Play🚀 Trade Idea: KGC (Kinross Gold Corporation) – Bullish Breakout Play

Entry: $16.40 | Stop Loss: $14.90 | Take Profit: $19.45

Risk/Reward Ratio: ~1:2.5

📈 Technical Setup

Trend:

Daily: Strong uptrend (higher highs & higher lows).

4H/1H: Bullish momentum confirmed with SMA(20) > SMA(50).

Key Level

975 ARS

868.79 B ARS

4.71 T ARS

About KINROSS GOLD CORP

Sector

Industry

CEO

Jonathon Paul Rollinson

Website

Headquarters

Toronto

Founded

1993

ISIN

ARDEUT115391

FIGI

BBG000C3T0D3

Kinross Gold Corp. engages in the production, acquisition, exploration, and development of gold properties. Its mining operations are in the United States, the Russian Federation, Brazil, Chile, Ghana, and Mauritania. The firm operates through the following business segments: Fort Knox, Round Mountain, Bald Mountain, Kupol, Paracatu, Tasiast, Chirano, and Corporate & Other. The Kupol segment consists of the Kupol and Dvoinoye mines. The Corporate & Other segment includes corporate, shutdown, and other non-operating assets and non-mining, and other operations. The company was founded by Robert MacKay Buchan on May 31, 1993 and is headquartered in Toronto, Canada.

Related stocks

KGC trade opportunity longHi everyone,

Just wanted to share a new trade I’ve taken on KGC.

The stock recently reacted from the weekly 10 EMA, and on the daily timeframe, it formed a descending wedge followed by a breakout. After that, it created a bullish flag which also broke out — this time with volume behind the move. T

Kinross Gold Bumping top of boxI set the box to fit the current stock situation of Kinross Gold . and yes , you can trade inside of the box. Kinross gold is bumping the top of the current 24hr box. $12.45 ish. I would probly set my stop loss at the 50 percent line or $11.53 ish. the floor is $11.59 . you can use the box to help s

Kinross Gold $KGC: Cash Flow King or Gold Risk? Kinross Gold (KGC): Cash Flow King or Gold Risk? 🏅💰

1/10

Kinross Gold NYSE:KGC surged 5.07%, hitting $10.57 per share. Revenue last quarter was $1.432 billion, driven by strong operations. 🔥 The gold sector might be glimmering again...

2/10

Earnings alert! NYSE:KGC releases its Q4 2024 results

Options overlay tools that would be awesomeThese ties in with Gann analysis of time and price and implied volitility explosion.

We get to see how far ahead of time a price moves and trade the overextensions.

Perfect to use with Bollinger bands to find stalls and consolidation and monitior the mean reversion for Gamma exposure or pinning of

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US496902AK3

KINROSS GOLD 12/41Yield to maturity

6.31%

Maturity date

Sep 1, 2041

KGC5608750

Kinross Gold Corporation 6.25% 15-JUL-2033Yield to maturity

5.31%

Maturity date

Jul 15, 2033

KGC5808439

Kinross Gold Corporation 6.25% 15-JUL-2033Yield to maturity

5.06%

Maturity date

Jul 15, 2033

KGC4514093

Kinross Gold Corporation 4.5% 15-JUL-2027Yield to maturity

4.40%

Maturity date

Jul 15, 2027

KGC.GH

Kinross Gold Corporation 6.875% 01-SEP-2041Yield to maturity

4.11%

Maturity date

Sep 1, 2041

KGC4514092

Kinross Gold Corporation 4.5% 15-JUL-2027Yield to maturity

4.05%

Maturity date

Jul 15, 2027

See all KGC bonds

Curated watchlists where KGC is featured.