LYG trade ideas

Possible upside for Lloyds bank.I've been watching an trading LLOY for the past 2/3 years. I believe the fundamentals to be excellent. 5% dividend approx and an internal revenue of 10 (forecasted to be 8 in 2019). The bank is highly profitable even with in this low interest rate environment. With the PPI repayment deadline in August 2019, this will only improve Lloyds profitability. And if a rate hike was to occur, the same would happen for the profitability of LLOY.

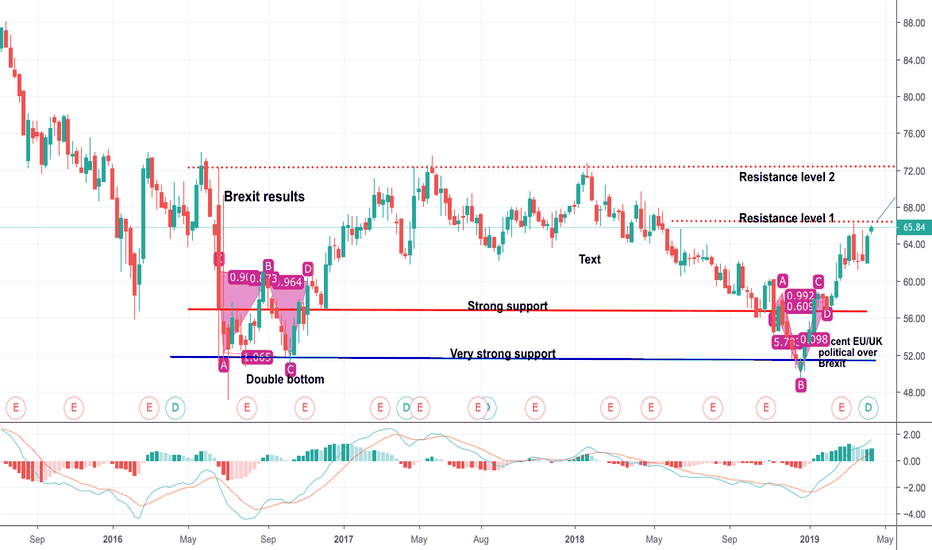

From a technical point. There has been extremely strong support at 50p. With the current price at approx 65p, there is another resistance level approaching. With the PPI repayment deadline approaching there could be further upside for LLOY.

Possible upside for Lloyds Bank (LLOY)I have been watching and trading lloyds for the past 2/3 years. The fundamentals are great. Its internal rate of return is excellent, especially considering it pays out a strong dividend (Approx 5%). It also has a P/E ratio of around 8. So fundamentally I believe it to be a sound investment. However, this is not advice.

LLOY has broken through 2 strong support levels and looks like it maybe approaching another and then another. With the August 2019 PPI cutoff point, which will only boost the banks profit, I personally can only see upside for LLOY. Also, considering how profitable Lloyds has been as of recent with rates this low, the profitability of the bank would increase if rates were hiked. HOWEVER.... Lloyds share price is seems to be correlated with BREXIT... yet, this may have changed as of late.

Please read this article for proof of profitability.

www.businessinsider.com

LLOYDS BANKING GROUP PLC ORD 10P STOCKSo this is the current situation for LLOYDS. There is huge downwards momentum at the moment and both SMA's and Elliot wave impulse (1-5) suggest this. However, the stock will look to retest the area then drop. Looking for around 120 pips bullish movement before hitting my TP.

LLOY LongI am seeing this as a double bottom reversal. Green box is my buy, and red line is stop loss. This is definietly a little more risky than usual. I will keep my stop loss tight if it decides to move upwards, as it will have to break the pink triangle, and there is also all the brexit rubbish going on. In all honesty I could have found a better trade, but meh, let's see how this plays out haha.

Lloyds Bank plc - bullish countI found this chart kind of fascinating as to how many times it has respected Elliott wave theory. Doesn't mean it's going to do what this bullish count says but interesting to me all the same. Tiny bit of divergence on the RSI too. If you take a look at the longer term chart you can see that since almost going bust in 2009 the share has been in a massive basing action since then. Time to break out......might be.

Rising interest rates = Buy Banks (#2 LYG)For the moment I only have a resistance line breakout and this idea need to wait for a pullback around the 3.80 area, apart of that this is a low volatility stock the last movement was 0.60 from the beginning of December to today but is appropriate to wait.

The other aspect here is what are the intentions of the investor, buy and hold or do quick swing trade. This is not my field I only share stocks who are going through a good time. My idea may like at to many people, but the time they want to hold a position may vary from one person to another. Some Investor want to buy and hold for one month and other for some years it depend of the future behavior of the stock in any case I only share good entry points the handle of the trade is yours

The banks I sharing so far they are reacting to the rising interest rates because other banks in my watch list have been bullish for more than a year.

I do not shared trends in progress because they are already a fact, the intention is buy low or not.

LLoyds breaks away from trendline resistance Lloyds has broken out of trendline resistance and as US 10 YR yields recover and regulation moves out I think it will continue.

I have put in the major levels on the upside to look out for but dont take them for gospel.

They may provide some stickiness but ultimately financials are on the way up as QE reduces all over the world.