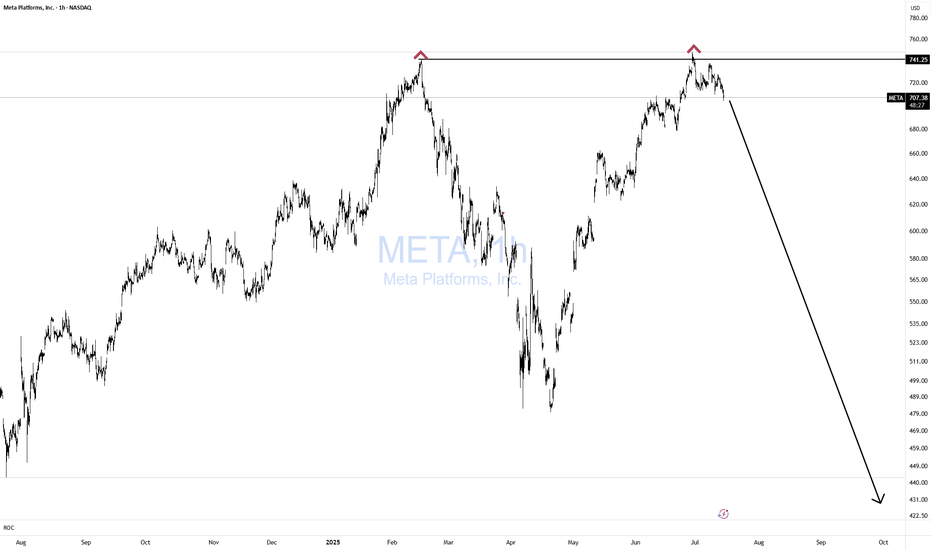

Meta .. (Where we stand)Long term, I think this stock is headed back to 300-400...

Short term I think it's a high chance we see 740-800...

Let me explain

Back in Feb we tagged our long term resistance, corrected and then we retested it with a lower high on the RSI (Bearish divergence) that you can see on the monthly

Key facts today

Meta Platforms has bought a 49% stake in Scale AI for $14 billion, boosting its AI skills with Scale's data-labeling services and leadership under Alexandr Wang.

Meta Platforms has launched the Superintelligence Lab to enhance its Llama models and strengthen its AI capabilities by hiring top talent from competitors.

Lance Roberts, a financial strategist, has sold his shares in Apple and taken a position in Meta Platforms (META), highlighting the company's growing revenues as a positive factor.

1.00 USD

55.39 B USD

146.11 B USD

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

ISIN

ARBCOM460168

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

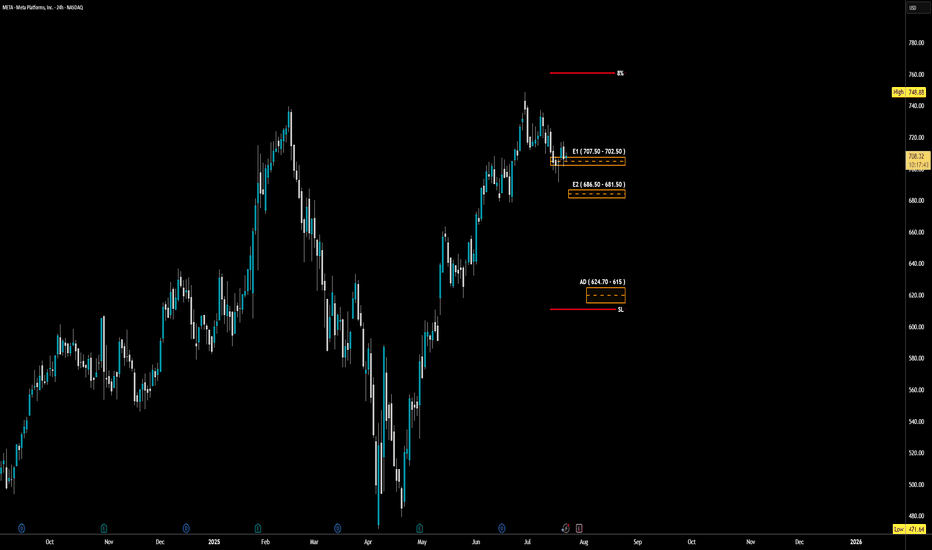

META - LONG Swing Entry PlanNASDAQ:META - LONG Swing Entry Plan

Entry Zone 1: $707.50 – $702.50

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $686.50 – $681.50

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edi

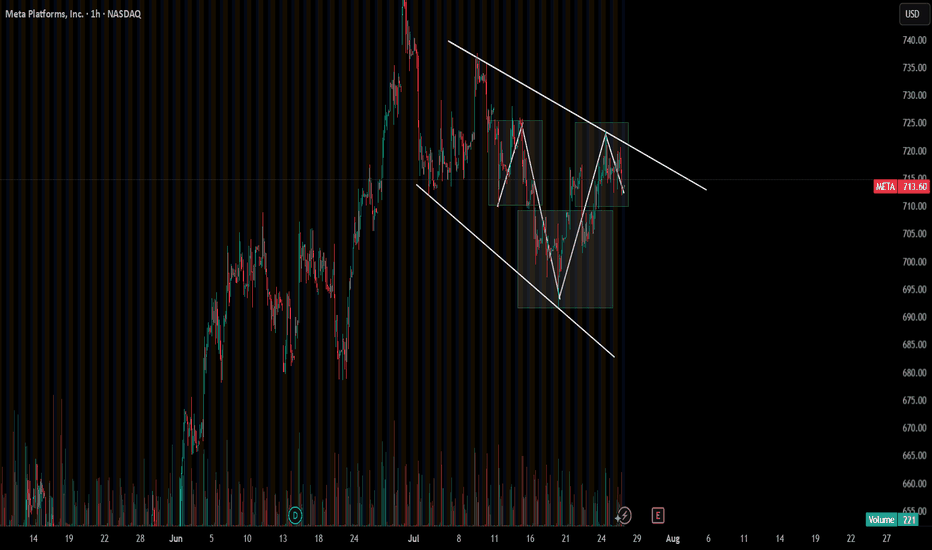

META CANT KEEP THE HULK DOWN!!!!META has been consolidating for a few weeks now, but it's still in this bull flag that looks like it might break out soon, hopefully before earnings on Wednesday, July 30. I love technical analysis on charts, and this inverse head and shoulders pattern has been effective on most semiconductor names

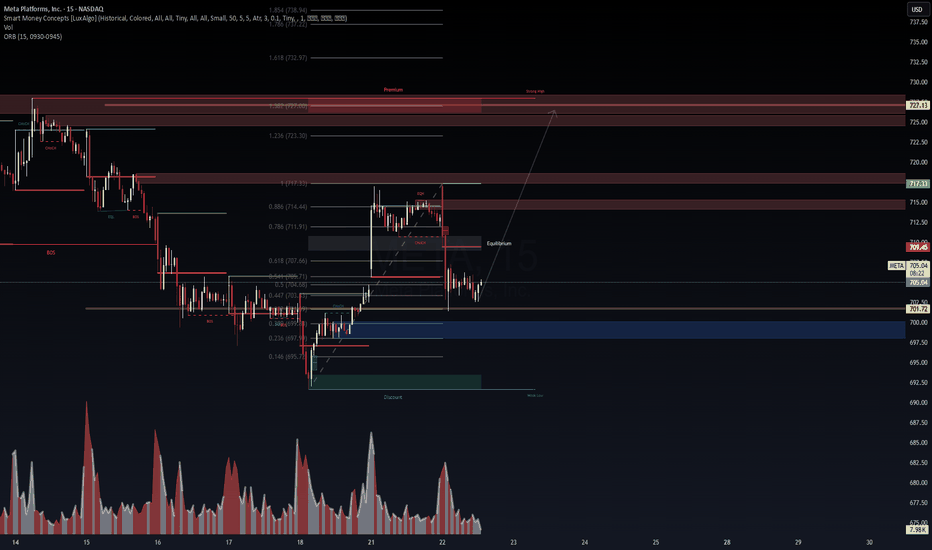

META: That weird drop looks like it was planned :P📊 META (15M) | Smart Money Concepts Setup

🔍 Powered by VolanX Protocol | WaverVanir International LLC

META is showing signs of reclaiming equilibrium after a clear CHoCH -> BOS -> EQH sweep. Price tapped into a premium inefficiency zone and is now consolidating at the equilibrium of the latest impu

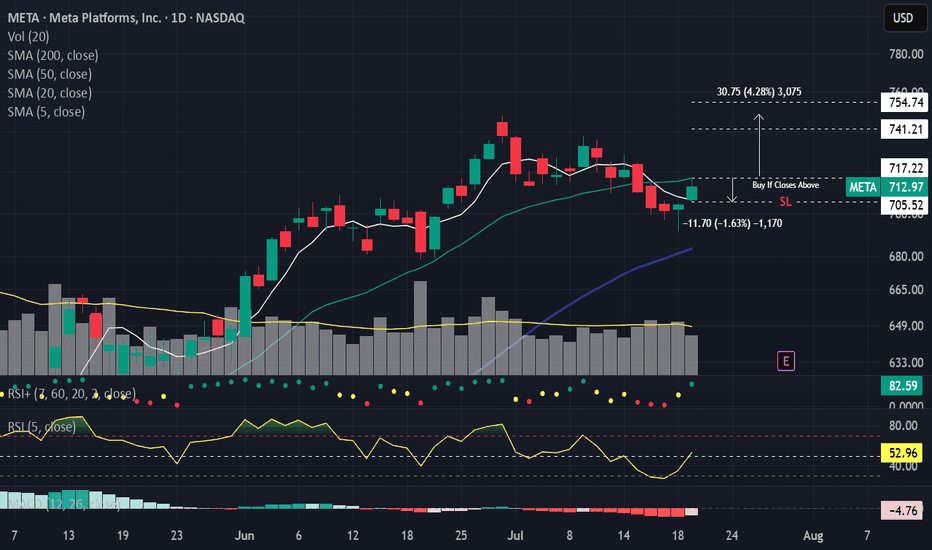

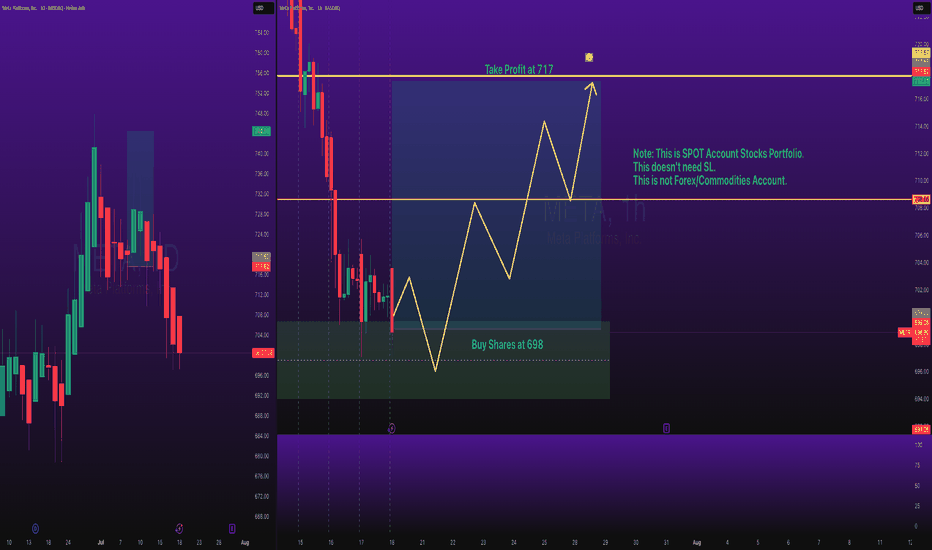

Stocks SPOT ACCOUNT: META Shares Buy Trade with Take ProfitStocks SPOT ACCOUNT:

NASDAQ:META shares: my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown B

🔻 NASDAQ:META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown Below $690 🐻

📅 Posted: July 18, 2025

💡 All models say “bearish,” but volume is the wildcard. Tight play, big potential.

⸻

🧠 AI Consensus Summary: Bearish But Not Triggered

Model Bias Key Notes

Grok 🐻 Bearish RSI 40.5, wea

7/3/25 - $meta - Still a buy sub $1k/shr7/3/25 :: VROCKSTAR :: NASDAQ:META

Still a buy sub $1k/shr

- reality is, why would you bet against zuck

- his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $50

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

16.27%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.11%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.05%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.83%

Maturity date

Aug 15, 2064

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.77%

Maturity date

May 15, 2063

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.72%

Maturity date

Aug 15, 2054

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.70%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all METAD bonds

Curated watchlists where METAD is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks