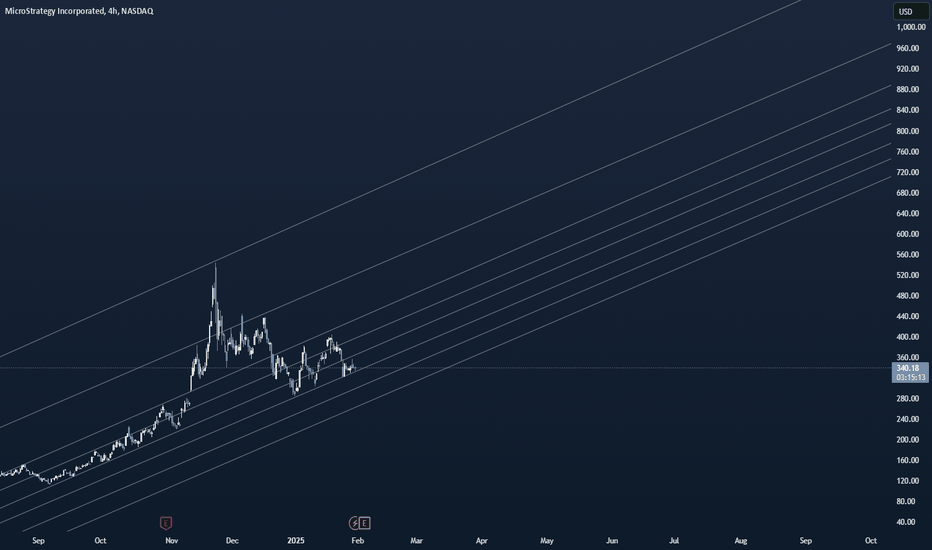

MSTR - Short again with two profit targetsP4 was a rejection at the Center-Line, the perfect short. To me the current situation commands me to add to this short.

BTC is weaker and in a scary spot. MSTR also weaker and on the way to the PTG1. This time, the add to my short is not a technical signal, but a gut feeling and a combination of the current world situation.

And hey, I maybe get slapped because I FOMO into this. But that's OK. Sometimes I need a little bit more Fun in the Game. I do such unintelligent trading when the overall performance allow me to.

Let's go Captain Ahab!!!

MSTR trade ideas

SHORT MSTRThis setup for MicroStrategy (MSTR) is based on its close correlation to Bitcoin price action and a repeating fractal pattern from its last cycle high. The stock appears to be mirroring historical movements, providing a high-confidence opportunity for a short trade as patterns tend to repeat. The trade will focus on DCA into shorts with the expectation of a significant pullback.

Trade Plan Details

1. DCA INTO SHORTS:

DCA Range: $375–$450

This zone aligns with the overhead resistance and prior rejection levels.

Approach: Gradually add to the short position if the price moves higher, staying within this range.

2. POSITION SIZING:

Initial Entry: Start small at $375 to ensure flexibility.

Scaling Strategy: Add more to the position as price approaches $400–$450.

Example:

$375: 1 unit

$400: 2 units

$425–$450: Max position

3. TARGETS:

Short-term Target: $300

Mid-term Target: $250

Long-term Target: $185

These levels correspond to key Fibonacci retracements and historical price reactions from prior cycles.

4. STOP LOSS:

Stop out above $475 (significant invalidation level).

Rationale

Fractal Pattern Repetition:

The price action is nearly identical to the previous cycle high, making it likely to follow the same trajectory.

Bitcoin Correlation:

MSTR closely mirrors Bitcoin's performance. With BTC overextended, MSTR is vulnerable to a significant pullback.

Valuation Concerns:

MSTR's valuation heavily relies on Bitcoin holdings, which are unsustainable at these levels.

Risk-Reward Ratio:

Excellent R:R potential with clear downside targets.

Diaper change for MSTR...quicklyI've been analyzing MSTR for some time and it's on a downward spiral IMHO. Buying BTC with debt, which is not only super risky and highly volatile. What could go wrong? Here it goes, let's look at the downward channel and one can see that price is only heading one way....down down!

There could be some pullbacks, but I've seen this movie before.

Take advantage of this situation and use MSTZ (inverse).

Best of luck and always do your own due diligence!

MicroStrategy’s Make or Break MomentThe chart shows a breakdown from a descending wedge pattern, followed by a retest of the broken support turned resistance. A short position has been placed, anticipating further downside. The price is currently testing the retest zone, and rejection from this level could confirm continuation to the downside.

The stop-loss is strategically placed above 455.10, beyond a key resistance level, to minimize risk in case of a failed breakdown. The take-profit target is set near 224.56, aligning with a significant demand zone. The current price of 335.94 indicates minor volatility, but the structure suggests a potential bearish continuation if the price fails to reclaim the resistance zone.

If the breakdown holds, the next move could accelerate towards lower levels, making this a crucial moment for price confirmation. A reclaim of the resistance zone could invalidate the setup and trigger a short squeeze. The market’s reaction at this level will determine the next directional move.

Ripple is lobbying for a multi asset reserve and CBDC! Seems Like Ripple is lobbying aggressively to stop the BTC strategic reserve, and pushing the multi asset reserve and lobbying for private CBDC's, of course namely their own CBDC.

Ripple is a centralized protocol that is attacking the first ever free market, BTC!!

BTC is completely decentralized. Ripple is Corrupt like every centralized protocol.

MicroStrategy short opportunityEntry at D (~$405) with a target at C ($304) based on the Gartley pattern.

If it breaks SL at $420, wait for the price to reach the 1.618 Fib level at $532. Set the stop loss at $550, with target B at $378, following the Crab pattern.

Disclaimer: This is not financial advice. Always conduct your own research and consult a financial advisor before making investment decisions.

MSTR needs a new diaper! quicklyI've been saying this for a few weeks now, but MSTR will be heading to the support level of the downward channel. You can cut it up in a million different ways, but MSTR is getting smacked around like it owes its pimp some money. There is some good news, MSTZ....check it out! Let's make lemonade!

Always do your own due diligence, best of luck!

MSTR....oh my! SELLLLLLLI've been saying this for some time like a broken record. MSTR is full of hot air and it will pop. Let's see the real downward channel and it will find it's home at the support line, which means there's a lot more gravity here! No one will rescue you, all you need to do is turn this frown upside down and bet on MSTZ. She is a darling and looking for some good-old fashioned TLC! She cooks, cleans, and folds the sweaters like Macy's, what's not to like? Use SMA10 on the 30min chart so you can see what I see....nice upsde!

Safe trading and always do your own due diligence!

MSTR....pending crash (you've been warned)MSTR has had a nice ride, piggy-backing of BTC and institutional play "f&&kery." The downward channel is as clear as day light and all the buying up with debt won't help when profit takers sell!

You've been warned, and best of luck! Always do your own due diligence.

MSTR....the force of gravity is strongMSTR is in news and buying up BTC at the top again with debt from retailers, I mean what could ever go wrong? Let's dive in to the downward channel and find out.....Yes, it looks like it broke the resistance line, but I think the Champagne effect of the new crypto friendly president is still in the bottle. Let's be patient and wait to see what happens. My sense is that it will drop like a ton of bricks and MSTZ (inverse) will rise like a falcon.

If you want to make money in trading you can't think like everyone else (sheep)....

Best of luck and always do your own due diligence!

MSTR - Back to a new short levelAfter hitting Profit Target 1 (PTG1), it’s time to make a decision about the remaining position.

The fact is, MSTR tested the 1/4 level for the second time and found solid support there. Now we’ve moved higher, back to the centerline.

For me, it’s clear: if we get an Open and Close — a full bar — above the CL, I’ll close the rest of my short position.

I still think MSTR is heavily manipulated. Besides the fact that this Bitcoin catalyst isn’t following BTC’s moves the way it should, it’s cheating investors for profits.

That said — if there’s weakness, I’ll continue building the position. If I had no position, this is the place where I would open it on a Short trigger.

If there’s strength, I’ll close it.