MSTR trade ideas

Assortment of OTM MSTR Puts

MSTR is filling my alerts for the optimal short zone mentioned previously.

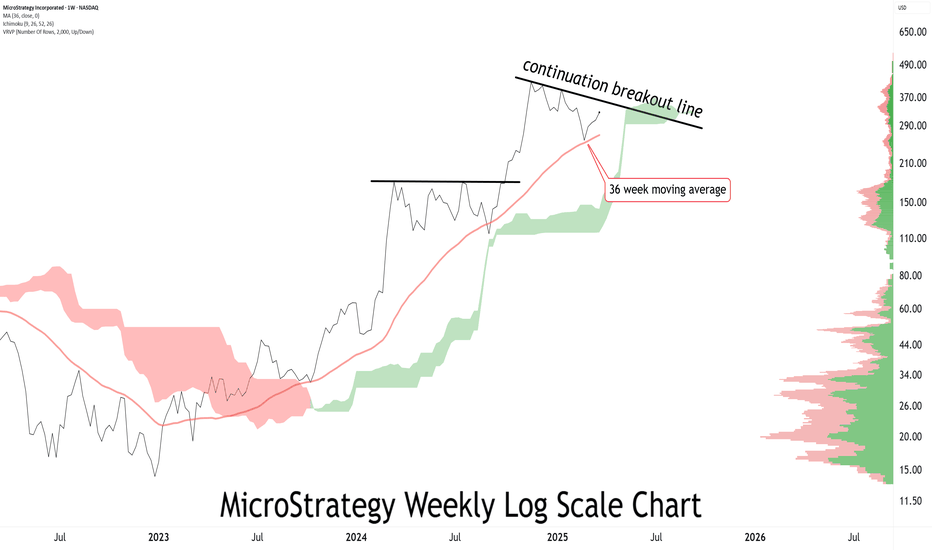

I've explained the various macro bear trend setups in MSTR previously. For some additional stuff;

Generally a correction will be two legs. When it's not, there's usually at least 4. 3 corrective legs is rarer. Breaking under might have been a bear break.

If it was, a retracement is always fair game but now we're into the zone this can be faded.

Selling calls into the rally and buying an assortment of deep OTM puts on MSTR

Put $210.00 - Last: $1.22, Bid: $1.07, Ask: $1.21, Vol: 44.0, IV: 115.0%, OTM

Put $205.00 - Last: $1.09, Bid: $0.98, Ask: $1.12, Vol: 53.0, IV: 118.4%, OTM

Put $215.00 - Last: $1.27, Bid: $1.16, Ask: $1.34, Vol: 33.0, IV: 111.9%, OTM

Put $200.00 - Last: $1.00, Bid: $0.90, Ask: $1.04, Vol: 123.0, IV: 121.8%, OTM

Put $220.00 - Last: $1.40, Bid: $1.28, Ask: $1.40, Vol: 22.0, IV: 108.3%, OTM

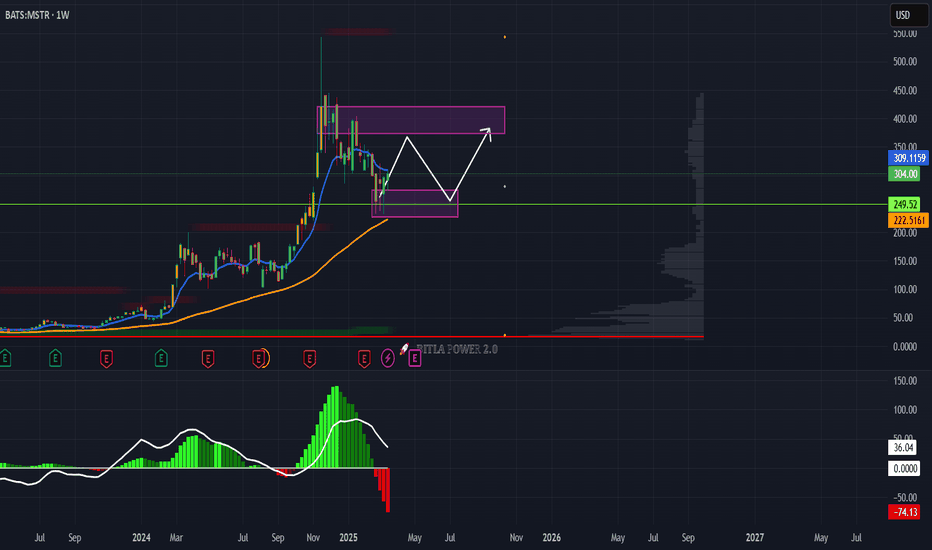

MicroStrategy To $370?Hello friends! I'm back with an analysis of MSTR. As we can see, the price had a significant drop of 57% from November 2024 to March 2025. The price is highly correlated with Bitcoin, and said cryptocurrency is in a wave 4 within an Elliott wave pattern. Therefore, Bitcoin will be returning to test $110,000. Therefore, MSTR, holding 499,096 bitcoins, will see a very significant rise in its price. In the short term, MSTR will be going to test its luck at $370 per share. However, it is highly likely that it could return to $410 per share. MSTR has many technical and fundamental indicators in its favor to be a highly profitable value asset. The best buying zones are below $300 per share.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

MSTR...to $260Downward channel, lower lows and lower highs. What else do you need to see? Oh, a ponzi model that is based on selling high volatility digital coins to unsophisticated retail investors. High chance of MSTR dipping to mid $200s esp. with this crappy economy. Leverage MSTZ (inverse) to profit from this!!

Best of luck and always do your own due diligece!

MicroStrategy, IncStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microeconomic study; consequently, more advanced stock traders will delve into macroeconomics and industry specific technical analysis to track asset or corporate performance. Other duties of a stock trader include comparison of financial analysis to current and future regulation of his or her occupation.

MSTR: Is 300 Enough?MicroStrategy is seeing tremendous strength off the lows along with the rest of the crypto space. We are eyeing this 300 level to see if it offers a proper buy zone to coincide with Bitcoin 85,000 which has also seen tremendous outperformance relative to equities. Watch the overhead trendline drawn here as well as Bitcoin 90,000 for profit takes or continuations. We will decide which if and when we get there.

Falling Wedge?The triangle correction seems mostly invalidated, but not entirely. However, it looks like a falling wedge might be forming instead.

In the short term, we should expect to see $275 – $287 as a potential target. If the falling wedge plays out, we might get a breakout to the upside. Let’s see how the price reacts! 🚀

Go Long on MSTR: Bitcoin Correlation Presents Opportunity

-Key Insights: MicroStrategy's strategy of using leveraged positions to invest

in Bitcoin provides a unique investment angle for those seeking exposure to

cryptocurrency without direct involvement. This strategy poses risks due to

Bitcoin's inherent volatility, but it also presents opportunities for gains when

Bitcoin prices rise. Investors should keep an eye on Bitcoin's market movements

as they directly affect MSTR's stock price, creating potential entry points for

informed traders.

-Price Targets: For a long position on MSTR, consider the following: Next week

targets (T1, T2): T1 at $305, T2 at $320.49. Stop levels (S1, S2): S1 at $290,

S2 at $285. These levels take into account current market support and

resistance, suggesting a strategic plan to benefit from potential upward

momentum if MSTR aligns with Bitcoin's bullish trends.

-Recent Performance: MSTR has shown a tight link to Bitcoin, with stock

performance rising and falling in tandem with Bitcoin's price swings. This

correlation has led to mixed short-term sentiment as investors evaluate the

cryptocurrency market's stability. The current price of $297.4899902 places it

between the identified support and resistance zones, making it a critical

decision point for upcoming trades.

-Expert Analysis: Experts remain divided on MSTR due to its high leverage, with

some cautioning against indirect exposure to Bitcoin through the stock. However,

proponents of the stock argue that its strategy provides a diversified approach

to participating in the cryptocurrency market without direct investment in

Bitcoin, offering potential advantages in portfolio diversification.

-News Impact: Recent market discussions highlight MSTR's strategic Bitcoin

acquisitions and their impact on stock volatility. The company's financial

maneuvers and significant shareholder interests may further influence investor

sentiment. Future Bitcoin price trends will likely dictate MSTR's performance,

making cryptocurrency developments a vital aspect to monitor in the coming weeks

for informed trading decisions.

MSTR...tik tok and BOOOM down 10-20%It's just a matter of time IMHO, most likely tomorrow / next few days, when MSTR will drop like a brick. The fact that anyone is buying this is just bonkers; they buy high volatile BTC with debt. What could ever go wrong with this Ponzi scheme? You've been warned about this house of cards. Great if you're leveraging MSTZ!

Best of luck and be careful out there....

MSTR Trading Plan - Bounce then new lows to key year 2000 levelMSTR has a lot going on. I think we're going to see the chart build structure in this low volume top and ultimately retrace to important levels made in the year 2000. Specifically, $177.

The $177 Price level has so many points of confluence it boggles the mind:

$177 is the exact 61.8 retraca from the 2023 low of $13

$177 is the very strong resistance we saw in the first half of 2024

$177 is a key level from way back in the year 2000 (yes, MSTR was this high. In fact it hit a high of $336 way back then)

$177 is also where the current lower trendline (log chart) and the 61.8 and the lower trendlien of the current wedge intersect.

What do you think?